Simulation Training Systems Market Synopsis

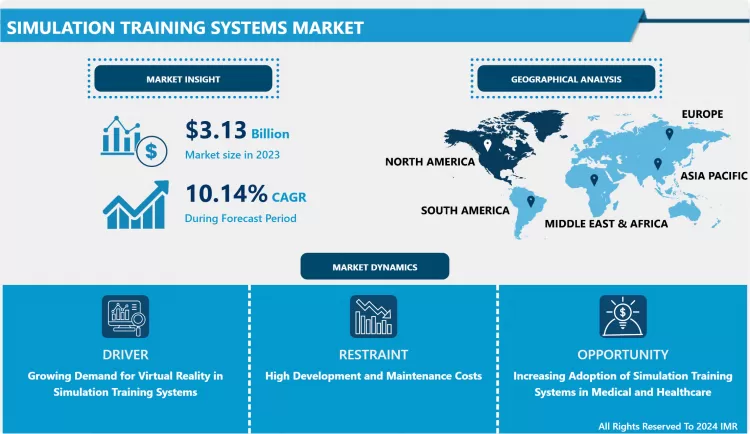

The Global Simulation Training Systems Market Size Was Valued at USD 3.13 Billion in 2023 and is Projected to Reach USD 7.47 Billion by 2032, Growing at a CAGR of 10.14. % From 2024-2032.

Simulation training systems are dynamic platforms crafted to mirror real-life situations for training objectives. They employ cutting-edge technologies like virtual reality (VR) and augmented reality (AR) to engage users in realistic environments. These systems facilitate hands-on learning and skill enhancement within a secure and supervised environment, ultimately improving learning results and performance.

- Simulation training systems are utilized across diverse industries, encompassing military, aviation, healthcare, and manufacturing. In the military domain, these systems facilitate combat training, mission rehearsals, and equipment operation simulations. Aviation employs simulation training for pilots to navigate flight scenarios, handle emergencies, and execute aircraft procedures. Healthcare professionals leverage simulation training for surgical practices, patient care, and emergency response protocols. Similarly, manufacturing firms integrate simulation systems for process enhancement, equipment familiarization, and safety procedures.

- The benefits of simulation training systems are multifaceted. they furnish a secure and monitored environment for learners to practice devoid of real-world risks. Secondly, they immerse users in lifelike scenarios, fostering the development of practical skills and decision-making acumen. Furthermore, simulation training encourages iterative practice, enabling users to hone techniques and bolster proficiency over time. Additionally, these systems are adaptable, and tailored to meet specific training objectives and evolving industry demands.

- Future demand for simulation training systems is poised for substantial growth, propelled by various factors. Advancements in technology, including artificial intelligence (AI) and virtual reality (VR), enhance the realism and efficacy of simulation systems. Industries increasingly acknowledge the cost-effectiveness and efficiency of simulation training over traditional methods. As businesses prioritize workforce training and skill development to maintain competitiveness, the demand for simulation training systems is anticipated to ascend steadily in the foreseeable future.

Simulation Training Systems Market Trend Analysis

Growing Demand for Virtual Reality in Simulation Training Systems

- The Burgeoning Demand for Virtual Reality (VR) Technology Is Emerging As A Significant driver for the growth of the simulation training systems market. VR offers immersive and interactive experiences, allowing users to engage with lifelike environments and scenarios. In simulation training systems, VR enhances realism, enabling trainees to undergo training in a highly immersive virtual setting that closely mirrors real-world situations. This heightened sense of realism facilitates more effective learning experiences, as users can practice and refine their skills in a safe and controlled environment.

- Moreover, the versatility of VR technology allows for the creation of diverse training scenarios across various industries, including military, aviation, healthcare, and manufacturing. From combat simulations and flight training to surgical procedures and equipment operation, VR-based simulation training systems cater to a wide range of training needs. As industries increasingly recognize the benefits of immersive training experiences in enhancing learning outcomes and skill development, the demand for simulation training systems incorporating VR technology continues to rise.

- Furthermore, advancements in VR technology, such as improved graphics, haptic feedback, and motion tracking, further enhance the effectiveness and realism of simulation training systems. These technological innovations not only elevate the quality of training experiences but also expand the possibilities for creating more complex and dynamic simulations. As a result, the growing adoption of VR in simulation training systems is expected to drive significant market growth in the coming years, as industries seek innovative solutions to meet their training needs and improve workforce performance.

Increasing Adoption of Simulation Training Systems in Medical and Healthcare

- The rising adoption of simulation training systems within the medical and healthcare fields presents a substantial opportunity for the expansion of the simulation training systems market. Continuous training is imperative for healthcare professionals to refine their skills and proficiency across various medical procedures and patient care practices. Simulation training systems provide a secure and monitored environment for healthcare practitioners to practice surgical techniques, emergency response protocols, and patient care scenarios. Given the increasing emphasis on patient safety and quality care, healthcare institutions are increasingly investing in simulation training systems to ensure their staff is adequately prepared to manage a diverse array of medical situations effectively.

- Moreover, simulation training systems offer healthcare professionals the chance to acquaint themselves with emerging medical technologies and equipment in a controlled setting. Whether it involves mastering the operation of cutting-edge medical devices or honing complex medical procedures, simulation training empowers healthcare workers to gain practical experience and confidence before applying their skills in real-world clinical settings. This not only enhances patient outcomes but also mitigates the risk of medical errors and adverse events, thereby enhancing overall healthcare delivery standards.

- Furthermore, the growing acknowledgment of the efficacy of simulation training in augmenting clinical skills and patient care outcomes is propelling the integration of simulation technology into medical education curricula and professional development initiatives. As medical institutions, hospitals, and healthcare entities increasingly prioritize the incorporation of simulation training systems, the market for these solutions is poised for substantial expansion. With ongoing advancements in simulation technology and the emergence of more immersive and authentic training experiences, the prospects for innovation and growth in the simulation training systems market within the medical and healthcare sectors appear promising.

Simulation Training Systems Market Segment Analysis:

Simulation Training Systems Market Segmented on the basis of Type, Technology, Training Methodology, Application, and End-User.

By Technology, Virtual Reality segment is expected to dominate the market during the forecast period

- The VR segment is positioned to lead the expansion of the simulation training systems market. VR technology delivers immersive and interactive experiences mirroring real-world scenarios, rendering it a prime selection for simulation training across diverse industries. In fields like military, aviation, healthcare, and manufacturing, VR-driven simulation training systems afford trainees lifelike settings to hone skills, tackle intricate tasks, and bolster decision-making proficiencies.

- Various factors contribute to the growing adoption of VR in simulation training systems. Advancements in VR technology have resulted in more cost-effective and accessible VR devices, spurring widespread integration across industries. Furthermore, VR offers advantages such as scalability, adaptability, and cost efficiency, making it an appealing option for organizations seeking to modernize their training initiatives. With businesses increasingly prioritizing immersive and captivating training experiences to enhance learning outcomes and workforce efficiency, the VR segment is anticipated to experience substantial growth within the simulation training systems market in the foreseeable future.

By Application, Military & Defense segment held the largest share of 45.10% in 2022

- The Military & Defense segment has maintained the largest share in the growth of the simulation training systems market. Military and defense entities extensively employ simulation training systems for various purposes, including combat training, mission rehearsals, and equipment operation simulations. These systems allow military personnel to train in realistic environments, thereby enhancing their combat readiness and operational efficiency while mitigating risks associated with live training exercises.

- The dominance of the Military & Defense segment stems from the paramount importance of training in ensuring mission success and personnel safety. Simulation training systems provide a cost-effective and scalable means of delivering lifelike training scenarios, enabling military forces to undergo training across diverse environments and scenarios. Furthermore, advancements in simulation technology, such as virtual reality and augmented reality, have amplified the capabilities of simulation training systems, driving their widespread adoption throughout military and defense organizations worldwide. As defense budgets continue to allocate resources towards training and preparedness endeavors, the Military & Defense segment is poised to sustain its leading position in the simulation training systems market.

Simulation Training Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to lead the region in the growth of the simulation training systems market. With a strong presence of top simulation training system providers and pioneers in technology, North America has emerged as a leader in adopting cutting-edge training solutions across various sectors. The region benefits from a well-developed infrastructure, a robust focus on technological advancements, and substantial investments in defense, healthcare, aviation, and other crucial industries, which are key drivers of the demand for simulation training systems.

- Furthermore, North America's military and defense sector significantly contributes to the expansion of the simulation training systems market. The United States, with its substantial defense budget and advanced defense capabilities, heavily invests in simulation training systems for its military personnel. Additionally, industries such as aviation, healthcare, and manufacturing in North America prioritize employee training and skill enhancement, further propelling the demand for simulation training systems. As North American businesses continue to prioritize efficiency, safety, and innovative training methods, the region is expected to maintain its dominant stance in the simulation training systems market in the foreseeable future.

Simulation Training Systems Market Top Key Players:

- L3Harris Technologies (U.S.)

- FlightSafety International (U.S.)

- Lockheed Martin (U.S.)

- Boeing (U.S.)

- MTS (U.S.)

- Instron (U.S.)

- Moog Inc. (U.S.)

- CAE, Inc. (Canada)

- AIP GmbH & Co. KG (Germany)

- Bohemia Interactive Simulations (Germany)

- Servotest (UK)

- Thales (France)

- ECA Group (France)

- FAAC (Italy)

- ECA (France)

- RUAG (Switzerland)

- SAGINOMIYA SEISAKUSHO, INC (Japan)

- Elbit Systems (Israel), and Other Major Players

Key Industry Developments in the Simulation Training Systems Market:

-

In July 2024, L3Harris is pleased to announce that it has secured a contract with Air Astana JSC to provide an Airbus A320neo Full Flight Simulator (FFS) for its Flight Training Centre. The advanced simulator will be operational by the second half of 2025 at Astana International Airport, supporting Air Astana and its subsidiary FlyArystan’s growing Airbus pilot training needs. With both EASA and local Level D regulatory approvals, the A320neo FFS will meet the highest safety standards, enhancing training capacity for Central Asia’s largest airline.

-

In April 2023, L3Harris Technologies announced an expanded contract with OEMServices to improve the availability of simulation training systems. This partnership ensures airlines and pilot training centers have faster access to L3Harris' full-flight and flat-panel simulators, along with other pilot-training equipment. Leveraging OEMServices' global logistics expertise, the agreement offers year-round access to crucial inventory, reducing procurement costs and improving responsiveness. The expanded contract also covers commercial surveillance, avionics, and flight recorder products, providing regional inventory and cost-effective solutions for the aviation industry’s training and simulation needs.

|

Global Simulation Training Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.13 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.14% |

Market Size in 2032: |

USD 7.47 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Training Methodology |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Simulation Training Systems Market by By Type (2018-2032)

4.1 Simulation Training Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Virtual Reality

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Augmented Reality

4.5 Mixed Reality

4.6 Live Simulation Training Systems

Chapter 5: Simulation Training Systems Market by By Technology (2018-2032)

5.1 Simulation Training Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Software

Chapter 6: Simulation Training Systems Market by By Training Methodology (2018-2032)

6.1 Simulation Training Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Instructor-Led Training

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Self-Paced Training

6.5 Blended Training

Chapter 7: Simulation Training Systems Market by By Application (2018-2032)

7.1 Simulation Training Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Military & Defense

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Civilian

7.5 Industrial

7.6 Educational

Chapter 8: Simulation Training Systems Market by By End-User (2018-2032)

8.1 Simulation Training Systems Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Government

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Commercial

8.5 Academic

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Simulation Training Systems Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 CISCO SYSTEMS INC (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 POLYCOM (U.S.)

9.4 MICROSOFT CORPORATION (U.S.)

9.5 ZTE CORPORATION (U.S.)

9.6 AVAYA INC. (U.S.)

9.7 ADOBE INC. (U.S.)

9.8 FUZE INC (U.S.)

9.9 VIDYO INC (U.S.)

9.10 OBLONG INDUSTRIES INC. (U.S.)

9.11 SPIRE GLOBAL INC (U.S.)

9.12 VGO COMMUNICATIONS INC (U.S)

9.13 STARLEAF (UK)

9.14 LOOPUP GROUP PLC (UK)

9.15 PEXIP AS (NORWAY)

9.16 HUAWEI TECHNOLOGIES COLTD (CHINA)

Chapter 10: Global Simulation Training Systems Market By Region

10.1 Overview

10.2. North America Simulation Training Systems Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Virtual Reality

10.2.4.2 Augmented Reality

10.2.4.3 Mixed Reality

10.2.4.4 Live Simulation Training Systems

10.2.5 Historic and Forecasted Market Size By By Technology

10.2.5.1 Hardware

10.2.5.2 Software

10.2.6 Historic and Forecasted Market Size By By Training Methodology

10.2.6.1 Instructor-Led Training

10.2.6.2 Self-Paced Training

10.2.6.3 Blended Training

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Military & Defense

10.2.7.2 Civilian

10.2.7.3 Industrial

10.2.7.4 Educational

10.2.8 Historic and Forecasted Market Size By By End-User

10.2.8.1 Government

10.2.8.2 Commercial

10.2.8.3 Academic

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Simulation Training Systems Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Virtual Reality

10.3.4.2 Augmented Reality

10.3.4.3 Mixed Reality

10.3.4.4 Live Simulation Training Systems

10.3.5 Historic and Forecasted Market Size By By Technology

10.3.5.1 Hardware

10.3.5.2 Software

10.3.6 Historic and Forecasted Market Size By By Training Methodology

10.3.6.1 Instructor-Led Training

10.3.6.2 Self-Paced Training

10.3.6.3 Blended Training

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Military & Defense

10.3.7.2 Civilian

10.3.7.3 Industrial

10.3.7.4 Educational

10.3.8 Historic and Forecasted Market Size By By End-User

10.3.8.1 Government

10.3.8.2 Commercial

10.3.8.3 Academic

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Simulation Training Systems Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Virtual Reality

10.4.4.2 Augmented Reality

10.4.4.3 Mixed Reality

10.4.4.4 Live Simulation Training Systems

10.4.5 Historic and Forecasted Market Size By By Technology

10.4.5.1 Hardware

10.4.5.2 Software

10.4.6 Historic and Forecasted Market Size By By Training Methodology

10.4.6.1 Instructor-Led Training

10.4.6.2 Self-Paced Training

10.4.6.3 Blended Training

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Military & Defense

10.4.7.2 Civilian

10.4.7.3 Industrial

10.4.7.4 Educational

10.4.8 Historic and Forecasted Market Size By By End-User

10.4.8.1 Government

10.4.8.2 Commercial

10.4.8.3 Academic

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Simulation Training Systems Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Virtual Reality

10.5.4.2 Augmented Reality

10.5.4.3 Mixed Reality

10.5.4.4 Live Simulation Training Systems

10.5.5 Historic and Forecasted Market Size By By Technology

10.5.5.1 Hardware

10.5.5.2 Software

10.5.6 Historic and Forecasted Market Size By By Training Methodology

10.5.6.1 Instructor-Led Training

10.5.6.2 Self-Paced Training

10.5.6.3 Blended Training

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Military & Defense

10.5.7.2 Civilian

10.5.7.3 Industrial

10.5.7.4 Educational

10.5.8 Historic and Forecasted Market Size By By End-User

10.5.8.1 Government

10.5.8.2 Commercial

10.5.8.3 Academic

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Simulation Training Systems Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Virtual Reality

10.6.4.2 Augmented Reality

10.6.4.3 Mixed Reality

10.6.4.4 Live Simulation Training Systems

10.6.5 Historic and Forecasted Market Size By By Technology

10.6.5.1 Hardware

10.6.5.2 Software

10.6.6 Historic and Forecasted Market Size By By Training Methodology

10.6.6.1 Instructor-Led Training

10.6.6.2 Self-Paced Training

10.6.6.3 Blended Training

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Military & Defense

10.6.7.2 Civilian

10.6.7.3 Industrial

10.6.7.4 Educational

10.6.8 Historic and Forecasted Market Size By By End-User

10.6.8.1 Government

10.6.8.2 Commercial

10.6.8.3 Academic

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Simulation Training Systems Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Virtual Reality

10.7.4.2 Augmented Reality

10.7.4.3 Mixed Reality

10.7.4.4 Live Simulation Training Systems

10.7.5 Historic and Forecasted Market Size By By Technology

10.7.5.1 Hardware

10.7.5.2 Software

10.7.6 Historic and Forecasted Market Size By By Training Methodology

10.7.6.1 Instructor-Led Training

10.7.6.2 Self-Paced Training

10.7.6.3 Blended Training

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Military & Defense

10.7.7.2 Civilian

10.7.7.3 Industrial

10.7.7.4 Educational

10.7.8 Historic and Forecasted Market Size By By End-User

10.7.8.1 Government

10.7.8.2 Commercial

10.7.8.3 Academic

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Simulation Training Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.13 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.14% |

Market Size in 2032: |

USD 7.47 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Training Methodology |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Simulation Training Systems Market research report is 2024-2032.

L3Harris Technologies (U.S.), FlightSafety International (U.S.), Lockheed Martin (U.S.), Boeing (U.S.), MTS (U.S.), Instron (U.S.), Moog Inc. (U.S.), CAE, Inc. (Canada), AIP GmbH & Co. KG (Germany), Bohemia Interactive Simulations (Germany), Servotest (UK), Thales (France), ECA Group (France), FAAC (Italy), ECA (France), RUAG (Switzerland), Saginomiya Seisakusho, INC (Japan), Elbit Systems (Israel), and Other Major Players.

The Simulation Training Systems Market is segmented into Type, Technology, Training Methodology, Application, End-User, and Region. By Type, the market is categorized into Virtual Reality, Augmented Reality, Mixed Reality, and Live Simulation Training Systems. By Technology, the market is categorized into Hardware and software. By Training Methodology, the market is categorized into Instructor-Led Training, Self-Paced Training, and Blended Training. By Application, the market is categorized into Military & Defense, Civilian, Industrial, and Educational. By End-User, the market is categorized into Government, Commercial, and Academic. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Simulation training systems are dynamic platforms crafted to mirror real-life situations for training objectives. They employ cutting-edge technologies like virtual reality (VR) and augmented reality (AR) to engage users in realistic environments. These systems facilitate hands-on learning and skill enhancement within a secure and supervised environment, ultimately improving learning results and performance.

The Global Simulation Training Systems Market Size Was Valued at USD 3.13 Billion in 2023 and is Projected to Reach USD 7.47 Billion by 2032, Growing at a CAGR of 10.14. % From 2024-2032.