Small Satellite Market Synopsis

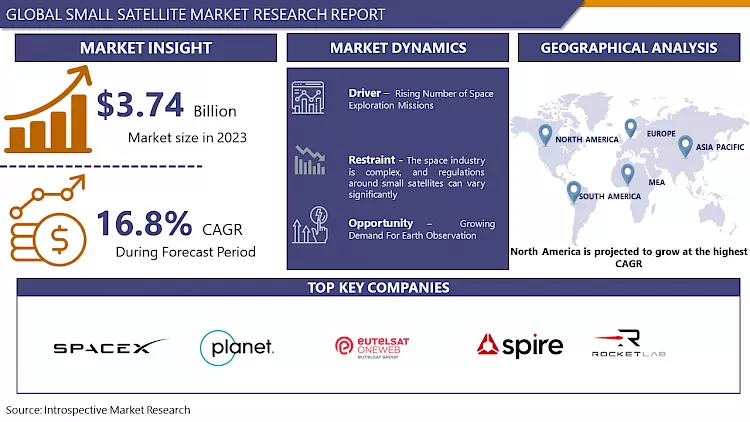

Small Satellite Market Size Was Valued at USD 3.74 Billion in 2023, and is Projected to Reach USD 15.13 Billion by 2032, Growing at a CAGR of 16.8% From 2024-2032.

The small satellite is a disruptive technology in space industries. Traditionally, space industries were dominated by satellites which have thousands of kilograms and are bulky and expensive. Small satellites denote a new generation of miniaturized satellites that, by taking advantage of modern technologies (e.g., integrated circuits, digital signal processing, MEMS, and additive manufacturing), can achieve a significant reduction in volume, mass, development time, and cost of satellites.

- The launch of the first artificial Earth “small” satellite, Sputnik 1, triggered the space race in 1957. In the decades that followed, there was the development of increasingly larger satellites to provide reliable services from space over extended periods. Since then, with the increasing demand for radio-frequency spectrum and satellite-orbit usages and sustained growth of technological breakthroughs and innovation of space communication along with the booming capabilities in satellite manufacturing, a dramatic rise in the development of small satellites and systems has been witnessed, especially over the last ten years. The small satellite industry is experiencing an era of unprecedented change.

- During recent decades, small satellites, including CubeSats, NanoSats, MiniSats, and MicroSats, have undergone rapid developments, and are playing an increasingly larger role in exploration, technology demonstration, scientific research, and education. These miniature satellites provide a low-cost platform for missions, including planetary space exploration, Earth observations, fundamental Earth and space science, and developing precursor science instruments like laser communications and millimeter-wave communications for inter-satellite and inter-satellite links, and autonomous movement capabilities.

- The small Satellite also allows educators an inexpensive means to engage students in all phases of satellite development, operation, and exploitation through real-world, hands-on research and development experience on rideshare launch opportunities. Several miniaturized satellites can form spaceborne wireless sensor networks in space, which are also going to play an important role in the Internet of Space (IoS) of the future.

Typical Characteristics of Small Satellites

|

Denomination |

Mass (kg) |

Max. bus power (W) |

Max. dimensions (m) |

Development time (years) |

Orbit |

Mission duration (years) |

|

Minisatellite |

100-500 |

1 000 |

3-10 |

3-10 |

GEO MEO LEO HEO |

5-10 |

|

Microsatellite |

10-100 |

150 |

1-5 |

2-5 |

2-6 |

|

|

Nanosatellite |

1-10 |

20 |

0.1-1 |

1-3 |

LEO (HEO) |

1-3 |

|

Picosatellite |

0.1- 1 |

5 |

0.05-0.1 |

|||

|

Femto-satellite |

< 0.1 |

1 |

0.01-0.1 |

1 |

< 1 |

Small Satellite Market Trend Analysis

Rising Number of Space Exploration Missions

- Small spacecraft have been an integral part of space study, exploration, and commercialization since humankind’s first steps into low Earth orbit with Sputnik-1 and Explorer-1. With generally lower complexity and fewer payloads, small satellites can be produced at an increased cadence than larger ones. Rapid development in small satellites provides organizations with more agility in meeting requirements and adapting to new technologies for space exploration missions, these factors drive the growth of the small satellite market.

- For instance, the Department of Defense Operationally Responsive Space (ORS) program pursues small satellites to meet its primary goal to rapidly assemble, test, and launch satellites in support of warfighters. Rapid development can also drive costs down such that use of small satellites may allow more frequent space research missions and technology demonstrations.

- Small Satellites are Affordability, lower construction, launch, and operating costs, making remote sensing and space exploration more accessible to companies and organizations of all sizes. Also, relatively short development and launch times for small satellites allow for faster deployment of space missions. these factors booming the small satellite market.

- As per the company database, the graph shows the growth in the launch of the small satellite. In 2022, the number of small satellites launched worldwide amounted to 2,304, which represented an increase of around 32.2 percent in comparison to the small satellite launched a year earlier. Nowadays small satellites are widely used in space exploration missions due to the various advantages of small satellites like lower cost, lower weight less time to launch, etc.

Growing Demand For Earth Observation

- Small satellites offer new opportunities to address the core observational requirements of both operational and research missions for earth observation. Small satellites, in particular single-sensor platforms, provide great architectural and programmatic flexibility. They offer attractive features with respect to design, observing strategy, faster "time to science" for new sensors, rapid technology infusion, replenishment of individual failed sensors, and robustness about budget and schedule uncertainties.

- Detailed data on environmental indicators including glacier melt, deforestation, sea level rise, and changes in land use can be obtained by small satellites outfitted with sophisticated instrumentation and high-resolution imaging sensors. For scientists, decision-makers, and environmentalists tackling climate-related issues in the future, this data is precious.

- Small satellites contribute to urban planning and infrastructure development by providing detailed mapping and monitoring of urban areas. They can track urban expansion, analyze transportation networks, monitor infrastructure assets such as roads, bridges, and buildings, and assess environmental impacts of urbanization. This information aids city planners, engineers, and policymakers in making informed decisions about land use, transportation, and sustainable development.

Small Satellite Market Segment Analysis:

Small Satellite Market is Segmented into type orbit, component, application, and end-users.

By Type, Minisatellite segment held the largest share of 42.36% in 2022

- Minisatellites are generally more affordable to design, build, and launch compared to larger satellites. Their smaller size means they require fewer materials and components, which reduces manufacturing and launch costs.

- With advancements in miniaturization of electronics and components, it's now possible to pack a lot of functionality into a small satellite. This allows minisatellites to perform a wide range of tasks despite their compact size.

- Minisatellites can often be developed and deployed much more quickly than larger satellites. This rapid development cycle is attractive to organizations looking to quickly demonstrate new technologies or conduct experiments in space.

- Minisatellites can be used for a variety of applications, including Earth observation, communications, scientific research, and technology demonstration. Their versatility makes them appealing to a wide range of users and industries.

- Minisatellites remain popular among public sector and Government agencies, with ROSCOSMOS, the Italian Defense Ministry, Israel Aerospace Industries Ltd, the National Space Organization (NSPO), and the United States Air Force (USAF) among others, for launching minisatellites for various applications.

By End-User, Commercial segment is expected to dominate the market during the forecast period

- Small satellites are used in the commercial sector widely for various purposes. Due to the expanding number of internet services and mobile users in 2022, the commercial category will hold the largest market share. The growing usage of small satellites for enemy surveillance is propelling the market forward. Commercial applications for small satellites include navigation, telecommunication, weather forecasting, and others.

- The commercial sector in the small satellite market is being driven by a surge in demand for cost-efficient solutions in Earth observation, communication, and data services. Smaller satellites present advantages in terms of lower launch expenses and quicker deployment, which are appealing to businesses aiming to leverage space-based opportunities while managing financial risks.

Small Satellite Market Regional Insights:

|

Global Small Satellite Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.74 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.8% |

Market Size in 2032: |

USD 15.13 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Orbit |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By End- User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Small Satellite Market by By Type (2018-2032)

4.1 Small Satellite Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Minisatellite

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Microsatellite

4.5 Nanosatellite

4.6 Pico-Satellites

4.7 Femtosatellites

Chapter 5: Small Satellite Market by By Orbit (2018-2032)

5.1 Small Satellite Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Low Earth Orbit (LEO)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Middle Earth Orbit (MEO)

5.5 Geostationary Earth Orbit (GEO)

Chapter 6: Small Satellite Market by By Component (2018-2032)

6.1 Small Satellite Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Structures

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Payload

6.5 Electric Power System

6.6 Solar Panel and Antenna Systems

6.7 Propulsion Systems

Chapter 7: Small Satellite Market by By Application (2018-2032)

7.1 Small Satellite Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Earth Observation and Remote Sensing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Satellite Communication

7.5 Science and Exploration

7.6 Mapping and Navigation

7.7 Space Observation

Chapter 8: Small Satellite Market by By End- User (2018-2032)

8.1 Small Satellite Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Commercial

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Academic

8.5 Government

8.6 Military

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Small Satellite Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 HONEYWELL INTERNATIONAL INC. (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BOEING (U.S.)

9.4 L3HARRIS TECHNOLOGIES INC. (U.S.)

9.5 LOCKHEED MARTIN CORPORATION (U.S.)

9.6 MAXAR TECHNOLOGIES (U.S)

9.7 NORTHROP GRUMMAN (U.S.)

9.8 BLUE CANYON TECHNOLOGIES (U.S.)

9.9 OHB SE (GERMANY)

9.10 BERLIN SPACE TECHNOLOGIES GMBH (GERMANY)

9.11 AIRBUS (NETHERLANDS)

9.12 OHB SE (GERMANY)

9.13 C3S ELECTRONICS DEVELOPMENT LLC (HUNGARY)

9.14 AAC CLYDE SPACE (SWEDEN)

9.15 ALÉN SPACE (SPAIN)

9.16 GLAVKOSMOS (RUSSIA)

9.17 THALES GROUP (FRANCE)

9.18 DRAGONFLY AEROSPACE (SOUTH AFRICA)

9.19 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

9.20 CENTUM (INDIA)

9.21 DHRUVA SPACE (INDIA)

9.22 IAI (ISRAEL)

9.23

Chapter 10: Global Small Satellite Market By Region

10.1 Overview

10.2. North America Small Satellite Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Minisatellite

10.2.4.2 Microsatellite

10.2.4.3 Nanosatellite

10.2.4.4 Pico-Satellites

10.2.4.5 Femtosatellites

10.2.5 Historic and Forecasted Market Size By By Orbit

10.2.5.1 Low Earth Orbit (LEO)

10.2.5.2 Middle Earth Orbit (MEO)

10.2.5.3 Geostationary Earth Orbit (GEO)

10.2.6 Historic and Forecasted Market Size By By Component

10.2.6.1 Structures

10.2.6.2 Payload

10.2.6.3 Electric Power System

10.2.6.4 Solar Panel and Antenna Systems

10.2.6.5 Propulsion Systems

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Earth Observation and Remote Sensing

10.2.7.2 Satellite Communication

10.2.7.3 Science and Exploration

10.2.7.4 Mapping and Navigation

10.2.7.5 Space Observation

10.2.8 Historic and Forecasted Market Size By By End- User

10.2.8.1 Commercial

10.2.8.2 Academic

10.2.8.3 Government

10.2.8.4 Military

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Small Satellite Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Minisatellite

10.3.4.2 Microsatellite

10.3.4.3 Nanosatellite

10.3.4.4 Pico-Satellites

10.3.4.5 Femtosatellites

10.3.5 Historic and Forecasted Market Size By By Orbit

10.3.5.1 Low Earth Orbit (LEO)

10.3.5.2 Middle Earth Orbit (MEO)

10.3.5.3 Geostationary Earth Orbit (GEO)

10.3.6 Historic and Forecasted Market Size By By Component

10.3.6.1 Structures

10.3.6.2 Payload

10.3.6.3 Electric Power System

10.3.6.4 Solar Panel and Antenna Systems

10.3.6.5 Propulsion Systems

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Earth Observation and Remote Sensing

10.3.7.2 Satellite Communication

10.3.7.3 Science and Exploration

10.3.7.4 Mapping and Navigation

10.3.7.5 Space Observation

10.3.8 Historic and Forecasted Market Size By By End- User

10.3.8.1 Commercial

10.3.8.2 Academic

10.3.8.3 Government

10.3.8.4 Military

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Small Satellite Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Minisatellite

10.4.4.2 Microsatellite

10.4.4.3 Nanosatellite

10.4.4.4 Pico-Satellites

10.4.4.5 Femtosatellites

10.4.5 Historic and Forecasted Market Size By By Orbit

10.4.5.1 Low Earth Orbit (LEO)

10.4.5.2 Middle Earth Orbit (MEO)

10.4.5.3 Geostationary Earth Orbit (GEO)

10.4.6 Historic and Forecasted Market Size By By Component

10.4.6.1 Structures

10.4.6.2 Payload

10.4.6.3 Electric Power System

10.4.6.4 Solar Panel and Antenna Systems

10.4.6.5 Propulsion Systems

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Earth Observation and Remote Sensing

10.4.7.2 Satellite Communication

10.4.7.3 Science and Exploration

10.4.7.4 Mapping and Navigation

10.4.7.5 Space Observation

10.4.8 Historic and Forecasted Market Size By By End- User

10.4.8.1 Commercial

10.4.8.2 Academic

10.4.8.3 Government

10.4.8.4 Military

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Small Satellite Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Minisatellite

10.5.4.2 Microsatellite

10.5.4.3 Nanosatellite

10.5.4.4 Pico-Satellites

10.5.4.5 Femtosatellites

10.5.5 Historic and Forecasted Market Size By By Orbit

10.5.5.1 Low Earth Orbit (LEO)

10.5.5.2 Middle Earth Orbit (MEO)

10.5.5.3 Geostationary Earth Orbit (GEO)

10.5.6 Historic and Forecasted Market Size By By Component

10.5.6.1 Structures

10.5.6.2 Payload

10.5.6.3 Electric Power System

10.5.6.4 Solar Panel and Antenna Systems

10.5.6.5 Propulsion Systems

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Earth Observation and Remote Sensing

10.5.7.2 Satellite Communication

10.5.7.3 Science and Exploration

10.5.7.4 Mapping and Navigation

10.5.7.5 Space Observation

10.5.8 Historic and Forecasted Market Size By By End- User

10.5.8.1 Commercial

10.5.8.2 Academic

10.5.8.3 Government

10.5.8.4 Military

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Small Satellite Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Minisatellite

10.6.4.2 Microsatellite

10.6.4.3 Nanosatellite

10.6.4.4 Pico-Satellites

10.6.4.5 Femtosatellites

10.6.5 Historic and Forecasted Market Size By By Orbit

10.6.5.1 Low Earth Orbit (LEO)

10.6.5.2 Middle Earth Orbit (MEO)

10.6.5.3 Geostationary Earth Orbit (GEO)

10.6.6 Historic and Forecasted Market Size By By Component

10.6.6.1 Structures

10.6.6.2 Payload

10.6.6.3 Electric Power System

10.6.6.4 Solar Panel and Antenna Systems

10.6.6.5 Propulsion Systems

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Earth Observation and Remote Sensing

10.6.7.2 Satellite Communication

10.6.7.3 Science and Exploration

10.6.7.4 Mapping and Navigation

10.6.7.5 Space Observation

10.6.8 Historic and Forecasted Market Size By By End- User

10.6.8.1 Commercial

10.6.8.2 Academic

10.6.8.3 Government

10.6.8.4 Military

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Small Satellite Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Minisatellite

10.7.4.2 Microsatellite

10.7.4.3 Nanosatellite

10.7.4.4 Pico-Satellites

10.7.4.5 Femtosatellites

10.7.5 Historic and Forecasted Market Size By By Orbit

10.7.5.1 Low Earth Orbit (LEO)

10.7.5.2 Middle Earth Orbit (MEO)

10.7.5.3 Geostationary Earth Orbit (GEO)

10.7.6 Historic and Forecasted Market Size By By Component

10.7.6.1 Structures

10.7.6.2 Payload

10.7.6.3 Electric Power System

10.7.6.4 Solar Panel and Antenna Systems

10.7.6.5 Propulsion Systems

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Earth Observation and Remote Sensing

10.7.7.2 Satellite Communication

10.7.7.3 Science and Exploration

10.7.7.4 Mapping and Navigation

10.7.7.5 Space Observation

10.7.8 Historic and Forecasted Market Size By By End- User

10.7.8.1 Commercial

10.7.8.2 Academic

10.7.8.3 Government

10.7.8.4 Military

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Small Satellite Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.74 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.8% |

Market Size in 2032: |

USD 15.13 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Orbit |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By End- User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Small Satellite Market research report is 2024-2032.

SpaceX (USA), Planet Labs (USA), Blue Origin (USA), OneWeb (UK), Spire Global (USA), Rocket Lab (USA/New Zealand), BlackSky (USA), Airbus Defense and Space (France), Lockheed Martin (USA), Northrop Grumman (USA), Boeing (USA), Surrey Satellite Technology Ltd (UK), ISRO (Indian Space Research Organisation) (India), Thales Alenia Space (France/Italy), Mitsubishi Electric Corporation (Japan), Ball Aerospace (USA), NanoRacks (USA), Axelspace Corporation (Japan), Virgin Orbit (USA), Terran Orbital (USA), AAC Clyde Space (Sweden), China Aerospace Science and Technology Corporation (China), GomSpace (Denmark), Clyde Space (UK), Tyvak Nano-Satellite Systems (USA) and Other Major Players.

The Small Satellite Market is segmented into Type, Orbit, Component, Application, End-User, and region. By Type, the market is categorized into Minisatellite, Microsatellite, Nanosatellite, Pico-Satellites, and Femtosatellites. By Orbit, the market is categorized into Low Earth Orbit (LEO), Middle Earth Orbit (MEO), Geostationary Earth Orbit (GEO). By Component, the market is categorized into Structures, Payload, Electric Power Systems, Solar Panel and Antenna Systems, and Propulsion Systems. By Application, the market is categorized into Earth Observation and Remote Sensing, Satellite Communication, Science and Exploration, Mapping and Navigation, and Space Observation. By End-User, the market is categorized into Commercial, Academic, Government, and Military. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The small satellite is a disruptive technology in space industries. Traditionally, space industries were dominated by satellites which have thousands of kilograms and are bulky and expensive. Small satellites denote a new generation of miniaturized satellites that, by taking advantage of modern technologies (e.g., integrated circuits, digital signal processing, MEMS, and additive manufacturing), can achieve a significant reduction in volume, mass, development time, and cost of satellites.

Small Satellite Market Size Was Valued at USD 3.74 Billion in 2023, and is Projected to Reach USD 15.13 Billion by 2032, Growing at a CAGR of 16.8% From 2024-2032.