Social Gaming Market Synopsis:

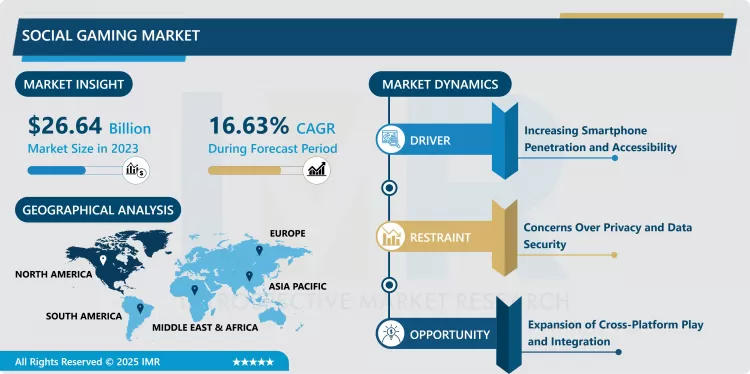

Social Gaming Market Size Was Valued at USD 26.64 Billion in 2023 and is Projected to Reach USD 106.37 Billion by 2032, Growing at a CAGR of 16.63% From 2024-2032

The social gaming industry can be defined as the segment of the gaming that is characterized by players’ possibility to play together in the social environment, usually in the context of a multiplayer on the social networks, apps, websites, etc. Such games include the use of features such as leaderboard, team work and points that are earned through online virtual means all of which prompt for interpersonal communication among players. Social gaming applies and combines casual and competitive games, and extends to various kinds of games, including strategy, puzzle, role playing, simulating games, that provide social outlets and recreational activities through the use of interaction in digital media.

The social gaming industry has experienced a steady growth especially over the last few years this, this has been due to increased usage of social networks, mobile devices as well as Internet connection. Social gaming can be defined as playing games over the internet which are supported by social networks, that enables the players to play within their friends and the rest of the players directly. This growth has been mainly facilitated by the increase in number and popularity of the use of handheld devices such as the smart phones and tablet computers in playing games. Social gaming is entertaining activity that combines aspects of games and competition with social networking, which is of interest for those who play games occasionally as well as frequent gamers. This has come to overrun the market especially with the young entrepreneurs who love internet and mobile based games.

It is necessary to number some of the possible tendencies in the social gaming market, but one of the most important tendencies is the use of multiplayer online games that connect people together worldwide and make the games even more interesting. Another outstanding trend is that of in-game purchases and virtual currencies which been integrated as one of the huge key sources of revenues for social gaming companies. Social gaming is also entering esports; multiplayer gaming has also been integrating into professional tournaments with massive popularity. Current trends still suggest that key players in the market are experimenting on ways by which conventional games can be developed to encompass latest technologies such as augmented reality and virtual reality platforms. But in the same light, the market has its challenges, such as requirement, regulation, and the continuous need for creating new products that will attract users again and again. That, however, is the general outlook, where it is generally expected that this industry will grow further as the technology advances and the usage of games increases and as the nature of games expands to become a more mainstream product.

Social Gaming Market Trend Analysis:

Trend

Blending Traditional Play with Social Interaction

- There are two types of social games; it can be played through social networks or on gaming platforms where players can play against each or with strangers and at the same time the game also has elements of social networking. This tendency has grown much popularity, especially in the post, the subject of which concerns such games as Candy Crush and FarmVille. It is conversely driven by social media platforms and the readil availability of smartphones, which made many gaming experiences more easily available to the general public, hence, inviting for social gaming. Facilities like gaming on the move and games interacting with friend or even strangers have boosted the social games market rapidly.

- Additionally, progressive development of Cloud gaming has had a significant contribution to this evolution by allowing the player to play high-end games without having the capacity and having to invest in a good graphics card plus dedicated gaming consoles. Cloud gaming platforms hence reduce the hurdles facing social gaming and increase access to these forms of games. The combination of multiplayer functions, real-time communication and virtual items gives the social aspect of the gaming even greater and more exciting view. As these trends progress forward, it opens more opportunities for the social gaming market, which they expect more development with AR and VR incorporated to the market.

Opportunity

Growing Demand for Social Gaming in Emerging Markets

- Due to advances in affordable hand-held devices like smart phones, high-speed internet availability, there is increasing and strong popularity for social entertainment games that bring in social aspect as well. Such a trend has been most evident in newly emerging markets that boast attractive large, young, and tech-savvy populations increasingly engaging in digital entertainment consumption. When these region are transforming their economy in to digital hub they have more downloading and multiplayer socialize as well as online games. Businesses especially have a golden chance to make good use of this by coming up with multiplayer games that enhance communal activity, interaction and smooth cross platform compatibility. These games can give social experiences within gameplaying activities in which communities are formed through common experiences Hence, the increase in social experiences wanted in gameplaying.

- Furthermore, using cloud technologies opens a great chance to surmount the traditionally based hard-ware boundaries in order to bring gaming to a greater mass. It is a sort of gaming which requires no high end PCs or gaming consoles and players can have an excellent experience of gaming. This democratizing effects of gaming can serve to extend the demographic of social gaming into areas of the Globe that have limited access to high end gaming devices . With cloud solutions, game developers can reach many clients and TV viewers, irrespective of their hardware compatibility, allowing millions of people to engage in social games. This shift also drops the entry barriers as the game developers add new methods to extend towards the new uncharted markets and cultivate the massive, healthier gaming populations.

Social Gaming Market Segment Analysis:

Social Gaming Market Segmented on the basis of Game Type, Monetization Mode, Platform, and Region.

By Game Type, Casual Games segment is expected to dominate the market during the forecast period

- There are significant procedures that casual games do to increase their popularity caused by easy usage and navigation. These games have simple stain bound rules and simple mechanisms, just for players to have quick and quality play time. These designs make them perfect to be played in short recreational reads or while on a bus or a train. Some of the most frequent are the puzzle games, match-3, and word games, which could be found in mobile operating systems most of the time and will integrate social aspects into gameplay in order to improve game dynamics.

- The monetization of casual games is generally done through a free-to-play model, that is, the games have limited pay features for products advertising. This approach enables the developers to create demand and have a large pool of players to whom they can sell their product as they progresses by use of microtransaction. Players who do not have time to spend hours on games appreciate casual games which are very popular with mobile gaming.

By Platform, Mobile segment expected to held the largest share

- Mobile games are developed to be played on mobile devices in most often on smart phones and tablets, they make particular convenience for the players all around the world. Social mobile gaming has become a new source of entertainment to the population although their use of smart phones has increased greatly and has provided the opportunity for gaming at any time. Mobile targets cover a wide genre range starting with simple puzzles and match-3 games and ending with strategic ones. This diversity has kept mobile gaming as one of the largest segment in overall gaming business.

- The monetization for mobile games is the most common through both ads and in-app purchases, with both F2P games and paid or Premium games. The concept of F2P enables the developers to garner a huge population of players without investing money initially by buying the game and then expecting the money back through sales of microtransactions. As mentioned earlier, the mobile games like Clash Royale and, Pokémon Go are good examples of integrating these monetization strategies. Mobile gaming also benefits a massive informal audience that does not have ambitions to build a PC or buy a console for gaming purposes, thus expanding the public appeal of the market even more.

Social Gaming Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is one of the most successful social gaming markets because of the large ownership of smart phones, easy access to high speed internet and the gaming culture inherent to the region. The United States is notable again given the fact that most of the international social gaming firms have their offices located in this country. A large number of the population own mobile devices and the increase of internet users is also very conducive to the growth of social gaming sites. This market is further strengthened by the availability of free to play mobile games so as players can socialize with their friends or strangers on real-time making the whole experience much more social.

- It also has advantages from the growth in popularity of social gaming in esports and live streaming services such as Twitch and You Tube Gaming. Esports competitions which aggregations millions of viewers also expand the social influence of gaming because users interact not only with each other but also with the viewers during tournaments. The social gaming has been further cemented in North America due to the incremental integration of gaming in mainstream entertainment with an amalgamated partnership with traditional sporting bodies and entertainment houses. Adding technological infrastructure, a strong base in gaming society, and the trend of live streaming, North America is still dominated on the major market in social games.

Active Key Players in the Social Gaming Market:

- Zynga Inc.,

- Electronic Arts (EA),

- Activision Blizzard, Inc.,

- Tencent Holdings Limited,

- Supercell,

- King Digital Entertainment,

- Niantic, Inc.,

- Roblox Corporation,

- Epic Games, Inc.,

- Playtika Holding Corp.,

- Gameloft SE,

- Bandai Namco Entertainment Inc.,

- NetEase, Inc.,

- Square Enix Holdings Co., Ltd.,

- Ubisoft Entertainment S.A.

- Other Active Players

|

Social Gaming Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.64 Billion |

|

Forecast Period 2024-32 CAGR: |

16.63% |

Market Size in 2032: |

USD 106.37 Billion |

|

|

By Game Type |

|

|

|

By Monetization Mode |

|

||

|

By Platform |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Social Gaming Market by By Game Type (2018-2032)

4.1 Social Gaming Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Casual Games

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Strategy Games

4.5 Action Games

4.6 Role-Playing Games (RPGs)

4.7 Others

Chapter 5: Social Gaming Market by By Monetization Mode (2018-2032)

5.1 Social Gaming Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Free-to-Play (F2P)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Premium

5.5 Subscription-Based

Chapter 6: Social Gaming Market by By Platform (2018-2032)

6.1 Social Gaming Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Mobile

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 PC

6.5 Console

6.6 Web-based

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Social Gaming Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ZYNGA INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ELECTRONIC ARTS (EA)

7.4 ACTIVISION BLIZZARD INC.

7.5 TENCENT HOLDINGS LIMITED

7.6 SUPERCELL

7.7 KING DIGITAL ENTERTAINMENT

7.8 NIANTIC INC.

7.9 ROBLOX CORPORATION

7.10 EPIC GAMES INC.

7.11 PLAYTIKA HOLDING CORP.

7.12 GAMELOFT SE

7.13 BANDAI NAMCO ENTERTAINMENT INC.

7.14 NETEASE INC.

7.15 SQUARE ENIX HOLDINGS CO. LTD.

7.16 AND UBISOFT ENTERTAINMENT S.A

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Social Gaming Market By Region

8.1 Overview

8.2. North America Social Gaming Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Game Type

8.2.4.1 Casual Games

8.2.4.2 Strategy Games

8.2.4.3 Action Games

8.2.4.4 Role-Playing Games (RPGs)

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By By Monetization Mode

8.2.5.1 Free-to-Play (F2P)

8.2.5.2 Premium

8.2.5.3 Subscription-Based

8.2.6 Historic and Forecasted Market Size By By Platform

8.2.6.1 Mobile

8.2.6.2 PC

8.2.6.3 Console

8.2.6.4 Web-based

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Social Gaming Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Game Type

8.3.4.1 Casual Games

8.3.4.2 Strategy Games

8.3.4.3 Action Games

8.3.4.4 Role-Playing Games (RPGs)

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By By Monetization Mode

8.3.5.1 Free-to-Play (F2P)

8.3.5.2 Premium

8.3.5.3 Subscription-Based

8.3.6 Historic and Forecasted Market Size By By Platform

8.3.6.1 Mobile

8.3.6.2 PC

8.3.6.3 Console

8.3.6.4 Web-based

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Social Gaming Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Game Type

8.4.4.1 Casual Games

8.4.4.2 Strategy Games

8.4.4.3 Action Games

8.4.4.4 Role-Playing Games (RPGs)

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By By Monetization Mode

8.4.5.1 Free-to-Play (F2P)

8.4.5.2 Premium

8.4.5.3 Subscription-Based

8.4.6 Historic and Forecasted Market Size By By Platform

8.4.6.1 Mobile

8.4.6.2 PC

8.4.6.3 Console

8.4.6.4 Web-based

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Social Gaming Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Game Type

8.5.4.1 Casual Games

8.5.4.2 Strategy Games

8.5.4.3 Action Games

8.5.4.4 Role-Playing Games (RPGs)

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By By Monetization Mode

8.5.5.1 Free-to-Play (F2P)

8.5.5.2 Premium

8.5.5.3 Subscription-Based

8.5.6 Historic and Forecasted Market Size By By Platform

8.5.6.1 Mobile

8.5.6.2 PC

8.5.6.3 Console

8.5.6.4 Web-based

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Social Gaming Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Game Type

8.6.4.1 Casual Games

8.6.4.2 Strategy Games

8.6.4.3 Action Games

8.6.4.4 Role-Playing Games (RPGs)

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By By Monetization Mode

8.6.5.1 Free-to-Play (F2P)

8.6.5.2 Premium

8.6.5.3 Subscription-Based

8.6.6 Historic and Forecasted Market Size By By Platform

8.6.6.1 Mobile

8.6.6.2 PC

8.6.6.3 Console

8.6.6.4 Web-based

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Social Gaming Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Game Type

8.7.4.1 Casual Games

8.7.4.2 Strategy Games

8.7.4.3 Action Games

8.7.4.4 Role-Playing Games (RPGs)

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By By Monetization Mode

8.7.5.1 Free-to-Play (F2P)

8.7.5.2 Premium

8.7.5.3 Subscription-Based

8.7.6 Historic and Forecasted Market Size By By Platform

8.7.6.1 Mobile

8.7.6.2 PC

8.7.6.3 Console

8.7.6.4 Web-based

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Social Gaming Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.64 Billion |

|

Forecast Period 2024-32 CAGR: |

16.63% |

Market Size in 2032: |

USD 106.37 Billion |

|

|

By Game Type |

|

|

|

By Monetization Mode |

|

||

|

By Platform |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Market research report is 2024-2032.

Zynga Inc., Electronic Arts (EA), Activision Blizzard, Inc., Tencent Holdings Limited, Supercell, King Digital Entertainment, Niantic, Inc., Roblox Corporation, Epic Games, Inc., Playtika Holding Corp., Gameloft SE, Bandai Namco Entertainment Inc., NetEase, Inc., Square Enix Holdings Co., Ltd., and Ubisoft Entertainment S.A. and Other Active Players.

The Social Gaming Market is segmented into By Game Type, By Monetization Mode, By Platform and region. By Game Type, the market is categorized into Casual Games, Strategy Games, Action Games, Role-Playing Games (RPGs), and Others. By Monetization Mode, the market is categorized into Free-to-Play (F2P), Premium, and Subscription-Based. By Platform, the market is categorized into PC, Console, and Web-based. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The social gaming market refers to the sector of online gaming that allows players to interact with each other in a social environment, typically through multiplayer games on platforms like social media networks, mobile apps, and websites. These games often feature elements like leaderboards, team-based gameplay, and virtual rewards that encourage communication, collaboration, and competition among players. Social gaming includes both casual and competitive games, with a wide range of genres such as strategy, puzzle, role-playing, and simulation games, offering players opportunities for socialization and entertainment through digital interactions.

Social Gaming Market Size Was Valued at USD 26.64 Billion in 2023 and is Projected to Reach USD 106.37 Billion by 2032, Growing at a CAGR of 16.63% From 2024-2032