Sodium Chloride Market Synopsis:

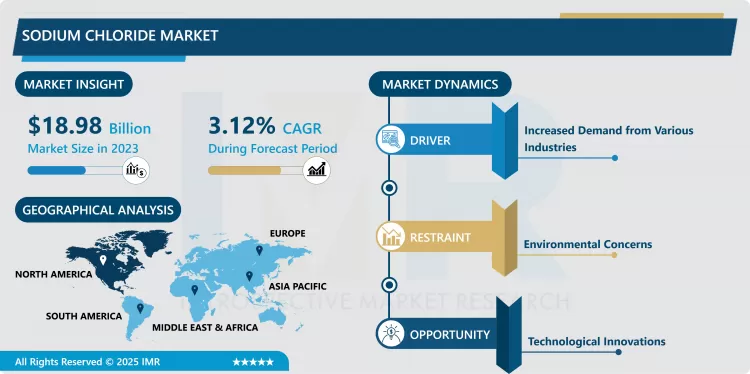

Sodium Chloride Market Size Was Valued at USD 18.98 Billion in 2023, and is Projected to Reach USD 25.03 Billion by 2032, Growing at a CAGR of 3.12% From 2024-2032

The Sodium Chloride industry involves the process of manufacturing, marketing and selling of Sodium Chloride or table salt and the scope of this report includes a global outlook. It is basic inorganic chemical widely used in more than one industry such as in the food industry for processing foods, softening of water, clearing of roads from ice, and in chemical industries. The market consists of different types including the rock salt, vacuum salt, solar salt and many more demand the industrial as well as customer requirements. Drivers of the market include; the upstream and downstream value chain, consumption from major sectors, and rules and regulations.

Particularly, the analysis of Sodium Chloride market which is also known as table salt is crucial for understanding of the companies’ activity in the sphere of chemicals industry as it is widely used in food processing, as a de-icing material, a component of medicines and water treatment. The market is fueled by factors such as; changes in consumers’ preference for processed and convenience foods, consistent rise in the global population, and more significantly by urbanization. F&B industry is by far the largest consumer of sodium chloride which is widely used in flavoring and as a preservative for most types of food and beverages. In addition, construction and maintenance agencies require sodium chloride for use in road construction and maintenance especially in the cold regions for purposes of melting ice through de-icing. The other industry, which benefits the growth of the market is the pharmaceutical industry which includes the use of sodium chloride in medicines, saline solutions and as an electrolyte.

That’s why the Sodium Chloride market has some issues, for example, negative impacts on the environment due to the problems with mining and extraction techniques, including underground mining as well as solar evaporation, which affect ecosystems. Intense regulation on environmental factors and other health factors such as high use of salt have also been a concern to market players. Nevertheless, these challenges should be controlled through innovations in the mining procedures, specifically solution mining procedure, and the superior refining procedures to obtain high-pure sodium chloride for better market improvement. Currently, based on the consumer population and industrial production, the Asia-Pacific region, led by China and India, occupies a leading position in the world market. North America and Europe are also demand markets, the demand for de-icing and industrial applications is relatively stable. In conclusion, the computations of Sodium Chloride market for future years has been moderate and has great utility in various sectors and great technological enhancements in its extraction and purification.

Sodium Chloride Market Trend Analysis:

Trend

Use in Food and Beverage Sector

- A primary force for most of the sodium chloride demand is the human consumption especially in the food and beverages industry. It is used to flavor, preserve, and provide a structure to processed and packaged food products wherein it is used. The raw material used in manufacturing convenience foods including sodium chloride is also on the rise due to the constantly expanding global population. Because the consumers’ chief concern has remained the movement towards shelf stability and ready to eat foods, demand for sodium chloride is expected to remain buoyant.

- For instance, the chemical industry plays a leading role in the sodium chloride market as well. This company utilises the compound as a raw material in the manufacture of chlorine and sodium hydroxide which are essential in manufacturing of many goods such as plastics, textiles and drugs. Increased industrial activities across the world are also contributing towards increased usage of sodium chloride. Since industries grow and become more specialized these basic chemicals remain in demand especially sodium chloride in the market.

Opportunity

Rising Demand in Food and Beverage Applications

- Currently the growth opportunity that is driving the sodium chloride market is the food and the beverage industry. More people are migrating to big cities and the world population is growing each day, coupled with increased demand for convenient foods, comes the need for salt used in processing, preservation, and flavoring. This trend is especially notable for emergent economies wherein food habits are gradually undergoing a transition towards consumer convenience and, correspondingly, processed food items. The demand for sodium chloride is promoted due to the increased consumption of processed foods by the vast middle-income population in the urban areas of these regions.

- However, sodium chloride has great future in the application in other sectors apart from the food and beverages sector. This is used in setting of chlorine that is used in the downstream processes for example in production of PVC and in water treatment. In pharmaceuticals, sodium chloride is used in formulation of drug products, the market for which is steady. Second lastly, another vent of growth is he increasing usage of salt as a de-icing agent on roads and highways especially at the winter periods in the cold countries. Exploring these uses shows that sodium chloride is a broad-spectrum product and may be adapted to penetrate emerging market niches.

Sodium Chloride Market Segment Analysis:

Sodium Chloride Market is Segmented on the basis of By Application, End-use, and Region.

By Application, Disinfectant segment is expected to dominate the market during the forecast period

- The disinfectant segment in the formic acid market mostly focuses on the use of the acid in exclusion or neutralization of the pathogenic organisms. This unique 3 ^{rd} generation organic acid is troubled-free of microbes and thus, perfectly suitable for disinfecting various surfaces, equipment and even water for many industries. Many pharmaceuticals are used and others such as chlorine CrO2 are used in water treatment to help control bacterial growth making water safe for human consumption. It can be applied where one might need it for sterilization as in medical facilities for example in order to keep clean. The segment is eased by strict regulatory requirement of high standards of cleanliness and disclaimers, which makes formic acid a necessity to industries that are keen on safety and clean environments.

- That is why formic acid also performs an antimicrobial activity, in other words, it retards bacteria, fungal and other parasitic formation. Therefore the properties make it unique suitable for use in food processing because it acts as an anti microbial agent, helps to prevent the spoilt of food products. In textile and paper conversion, formic acid it used to eliminate microbes that may contaminate products when in the process of being processed to their final form. The segment is increasing due to the rising consumer awareness of hygiene and safety issues along with the higher demand of effective antimicrobial solutions in different application areas. Current studies and development finally proceed to discover various types of uses of fornic acid, increasing its efficiency and applying it in various sectors in the finishing industries.

By End-use, Water treatment segment expected to held the largest share

- Another major end-use sector for formic acid is in water treatment; this product is used to regulate pH, as a coagulant and also for disinfection. Due to its efficiency in minimizing contaminant and impurities in water from drinking water to industrial wastewaters, formic acid is very effective. It is extremely useful in its ability to act as an antimicrobial for bacteria that impacts the preservation of water quality and the preventation of formations of scales. Also, because of its biodegradable nature, formic acid is safer to the environment than other chemical solutions reducing their effects on the environment. In light of growing concerns for sustainability as well as strained regulatory tolerances of effluents; there will be a growing interest in the use of formic acid in water treatment in industries.

- Water treatment is becoming the center of attention as the world focuses on clean water solutions and formic acid will become a more important part of this process in the future. Tight regulatory requirements for water reuse to preserve water quality are making industries utilize the efficient and green formic acid. The ever increasing global concern for the accepted practice of sustainable practices and the clamor for the greener option is therefore responsible for the high demand for for formic acid as preferred option in water treatment. For these reasons, its biodegradability and low application impact when used for these purposes are desirable in helping it achieve the necessary water quality goals. While these trends advance, the demand for formic acid in water treatment should increase, fueled by both regulation and proactive environmentalism.

Sodium Chloride Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The consumption trend can be attributed to the huge demand of sodium chloride in North America as it can be widely used in number of industries. The United States remains an influential country in this process, which is mainly caused by the growing need for processed products that suffice their taste by the use of salt as a conditioner and preservative agent. Furthermore, there are more needs for road safety in cold regions, the demand for road de-icing products where sodium chloride is widely used in the removal of ice and snow on the roads increases. The American market is also driven by Water treatment applications, since salt is an important ingredient in softening both domestic and industrial water.

- Sodium chloride also has a particularly important place in the North American market and Canada is a large consumer in this market. High demand for de-icing applications is due to long winter in the country and because it has well-developed facilities for road construction. Heating and conservation of ice and snow on roads is a major factor that causes high usage of salt which is an input to production. Also, the market of Canada adds a lot of food-grade salt as it has a constant increment ordinates in the food processing industry for enhancing the flavor and prolonging the shelf life of the food products. Having gone through the factors up above it can easily be deduced that indeed sodium chloride has a solid market in Canada.

Active Key Players in the Sodium Chloride Market:

- Alfa Aesar

- Nanjing Kaimubo Pharmatech Company Limited

- Shree Chlorates

- Dongying Shengya Chemical Co., Ltd.

- Airedale Chemical Company Limited

- Shandong Gaomi Gaoyuan Chemical Industry Co., Ltd.

- Debyesci

- DuPont

- ERCO Worldwide

- Finetech Industry Limited

- Sigma-Aldrich Co. LLC.

- Occidental Petroleum Corporation

- Tractus Company Limited

- American Elements

- ABI Chem Germany

- Other Active Players

|

Sodium Chloride Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.98 Billion |

|

Forecast Period 2024-32 CAGR: |

3.12% |

Market Size in 2032: |

USD 25.03 Billion |

|

|

By Application |

|

|

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sodium Chloride Market by By Application (2018-2032)

4.1 Sodium Chloride Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Disinfectant

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Antimicrobial Agent

4.5 Bleaching Agent

4.6 Other Applications

Chapter 5: Sodium Chloride Market by By End-use (2018-2032)

5.1 Sodium Chloride Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Water treatment

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Paper

5.5 Textile

5.6 Medical

5.7 Other End Uses

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Sodium Chloride Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ALFA AESAR

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NANJING KAIMUBO PHARMATECH COMPANY LIMITED

6.4 SHREE CHLORATES

6.5 DONGYING SHENGYA CHEMICAL CO. LTD.

6.6 AIREDALE CHEMICAL COMPANY LIMITED

6.7 SHANDONG GAOMI GAOYUAN CHEMICAL INDUSTRY CO. LTD.DEBYESCI

6.8 ERCO WORLDWIDE

6.9 FINETECH INDUSTRY LIMITED

6.10 SIGMA-ALDRICH CO. LLC.

6.11 OCCIDENTAL PETROLEUM CORPORATION

6.12 TRACTUS COMPANY LIMITED

6.13 AMERICAN ELEMENTS

6.14 ABI CHEM GERMANY

6.15 OTHER ACTIVE PLAYERS

Chapter 7: Global Sodium Chloride Market By Region

7.1 Overview

7.2. North America Sodium Chloride Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Application

7.2.4.1 Disinfectant

7.2.4.2 Antimicrobial Agent

7.2.4.3 Bleaching Agent

7.2.4.4 Other Applications

7.2.5 Historic and Forecasted Market Size By By End-use

7.2.5.1 Water treatment

7.2.5.2 Paper

7.2.5.3 Textile

7.2.5.4 Medical

7.2.5.5 Other End Uses

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Sodium Chloride Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Application

7.3.4.1 Disinfectant

7.3.4.2 Antimicrobial Agent

7.3.4.3 Bleaching Agent

7.3.4.4 Other Applications

7.3.5 Historic and Forecasted Market Size By By End-use

7.3.5.1 Water treatment

7.3.5.2 Paper

7.3.5.3 Textile

7.3.5.4 Medical

7.3.5.5 Other End Uses

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Sodium Chloride Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Application

7.4.4.1 Disinfectant

7.4.4.2 Antimicrobial Agent

7.4.4.3 Bleaching Agent

7.4.4.4 Other Applications

7.4.5 Historic and Forecasted Market Size By By End-use

7.4.5.1 Water treatment

7.4.5.2 Paper

7.4.5.3 Textile

7.4.5.4 Medical

7.4.5.5 Other End Uses

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Sodium Chloride Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Application

7.5.4.1 Disinfectant

7.5.4.2 Antimicrobial Agent

7.5.4.3 Bleaching Agent

7.5.4.4 Other Applications

7.5.5 Historic and Forecasted Market Size By By End-use

7.5.5.1 Water treatment

7.5.5.2 Paper

7.5.5.3 Textile

7.5.5.4 Medical

7.5.5.5 Other End Uses

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Sodium Chloride Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Application

7.6.4.1 Disinfectant

7.6.4.2 Antimicrobial Agent

7.6.4.3 Bleaching Agent

7.6.4.4 Other Applications

7.6.5 Historic and Forecasted Market Size By By End-use

7.6.5.1 Water treatment

7.6.5.2 Paper

7.6.5.3 Textile

7.6.5.4 Medical

7.6.5.5 Other End Uses

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Sodium Chloride Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Application

7.7.4.1 Disinfectant

7.7.4.2 Antimicrobial Agent

7.7.4.3 Bleaching Agent

7.7.4.4 Other Applications

7.7.5 Historic and Forecasted Market Size By By End-use

7.7.5.1 Water treatment

7.7.5.2 Paper

7.7.5.3 Textile

7.7.5.4 Medical

7.7.5.5 Other End Uses

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Sodium Chloride Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.98 Billion |

|

Forecast Period 2024-32 CAGR: |

3.12% |

Market Size in 2032: |

USD 25.03 Billion |

|

|

By Application |

|

|

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Market research report is 2024-2032.

Alfa Aesar, Nanjing Kaimubo Pharmatech Company Limited, Shree Chlorates, Dongying Shengya Chemical Co., Ltd., Airedale Chemical Company Limited, Shandong Gaomi Gaoyuan Chemical Industry Co., Ltd.Debyesci, ERCO Worldwide, Finetech Industry Limited, Sigma-Aldrich Co. LLC., Occidental Petroleum Corporation, Tractus Company Limited, American Elements, ABI Chem Germany and Other Active Players.

The Sodium Chloride Market is segmented into By Application, By End-use and region. By Application, the market is categorized into Disinfectant, Antimicrobial Agent, Bleaching Agent and Other Applications. By End-use, the market is categorized into Water treatment, Paper, Textile, Medical and Other End Uses. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Sodium Chloride market refers to the global industry involved in the production, distribution, and sale of sodium chloride, commonly known as table salt. It is a vital chemical compound used in a wide range of applications including food processing, water softening, de-icing roads, and chemical manufacturing. The market encompasses various forms such as rock salt, vacuum salt, solar salt, and others, catering to different industrial and consumer needs. Factors influencing the market include supply chain dynamics, demand from key end-use industries, and regulatory guidelines.

Sodium Chloride Market Size Was Valued at USD 18.98 Billion in 2023, and is Projected to Reach USD 25.03 Billion by 2032, Growing at a CAGR of 3.12% From 2024-2032