Sports Equipment Market Synopsis:

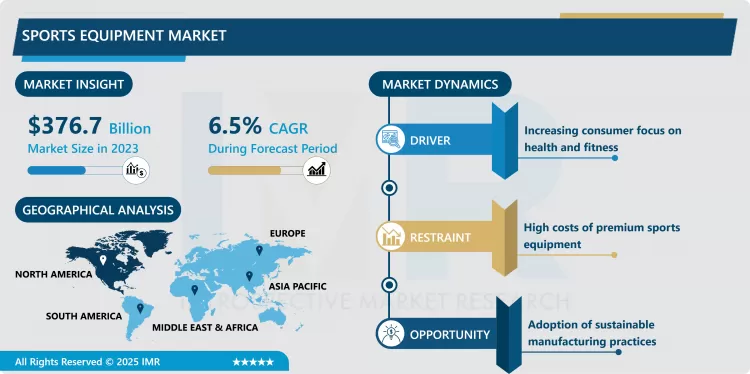

Sports Equipment Market Size Was Valued at USD 376.7 Billion in 2023, and is Projected to Reach USD 663.9 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.

The product coverage of the sports equipment market comprises items related to physical exercise, recreation, and sports that are used indoors or outdoors at professional, amateur, or casual levels. This market comprises of balls, bats, gloves, defence gears, shoes and other specific sporting equipment for specific sports such as tennis, football, basketball and golf. It also goes to wearables, home exercise equipment such as treadmills, dumbbells and gymnasium equipment like yoga mats. Due to an increasing trend of physical fitness, an elevated status of professional athletic champions, and active leisure activities, sports equipment has great demand and utility for professional athletes, amateurs, and ordinary people around the world.

The global sports equipment industry has been experiencing steady expansion over the past several years owing to rising customer interest in sports and physical exercise. As people in the emerging economies become wealthier, and the effects of social media and international sporting events have resonated with the population to make the market more appealing. New product innovations such as the use of sensors on sports equipment and related wearable devices and smart fitness and performance equipment has also compounded the market dynamics. Also, there are efforts made to improve sustainability since then, manufacturing firms are incorporating more environmental friendly material and processes needed by buyers who are now conscious on environmental issues.

Another factor favoring the growth of the market is the increased availability of equipment online through e-shops. Modern lifestyle development and demography shift through the different generation levels have contributed to the development of different sports and fitness activities. Governments and organizations around the world are also also proceeding with infrastructure construction in sports and actively encouraging physical activities as well, offering more investment space. However, fake products are a major threat to players in this industry besides other threats, such as; unpredictable prices of raw materials.

Sports Equipment Market Trend Analysis:

Technology Integration Drives Market Innovation

- An interesting trend in the market of sports equipment is associated with the use of high technologies in such products. Wearable technology including sensor-imbedded tennis racquets, basketballs with tracking bracelets, and wrist bands has grown in leaps and bounds in the recent past especially among the sporting elite and other lay consumers. These products give immediate results on performance including speed, accuracy and staminas thus improving the efficiency of the training. Also, with the use of Virtual Reality (VR) in Training and Simulation, fan enjoy immersive experiences. That is why this kind of trend is supposed to give an impact on consumers’ preferences and influence the further product development for the forecasted period.

Sustainability as a Growth Driver

- Sustainability is another key opportunity for growth in the sports equipment sector, today, people and companies are turning to be more environmentally friendly. Employment of recycled and biodegradable materials as well as energy efficient processes is increasing. For instance today there are business fashion sports shoes that are created in the plastic collected from the oceans and biodegradable soccer balls. Local and international organizations also want the reduction of pollution and emission of green house gases and are thus promoting green manufacturing through incentives. Need to accommodate environmental consciousness of consumers is achieved, while the overall value and competitiveness of brands of such manufacturers is improved.

Sports Equipment Market Segment Analysis:

Sports Equipment Market is Segmented on the Basis of Type, Distribution Channel, and Region.

By Type, Ball over net games segment is expected to dominate the market during the forecast period

- The segment, ball over net games, which is made up of volleyball, tennis, and badminton is expected to lead the growth of the sporting equipment market in the next projected period. This is mainly because these sports are world famous and there is both leisure and professional equipment for both for practicing these sports. In addition, increased frequency of international competitions including the Olympic Games, the World Cups in soccer, tennis Grand Slam events, and other tournaments international sport like soccer, tennis and other, has added interest and participation in these sports and hence, sales of the related apparatus.

- The rising number of training academies and the community sports clubs around the world has also driven growth in this segment. Moreover, such equipment does not impose a high price in comparison to other sport categories, such as golf or gym equipment. Companies are further innovating in this segment by adding lightweight, durability and performance attributes to this segment to retain market leadership.

By Distribution Channel, Online retail segment expected to held the largest share

- Based on the end-use segment, this market is expected to grow at a higher CAGR of the overall sports equipment market in the forecast period, with online retail segment being the largest segment. The advancement in e-commerce has made it possible for consumers to obtain sports equipment through retailing firms making purchases easier, cheaper and with a variety. This trend was further enriched during the COVID-19 pandemic, as the consumption migrated mainly to online channels. E-commerce technology has made sites like Amazon, Decathlon and other specialized sites leading players in distribution of sports equipment.

- Nevertheless, online channels offer an opportunity to read the customers’ feedback and read all important characteristics of the product that is going to be purchased. Adding accurate try-ons, AR features and recommendation services on these platforms makes the shopping privileges satisfactory. Closely linked to this is the continuously expanding propensity of consumers in the developed (and increasingly the developing world) to shop for goods over the internet and via their mobile phones thus signifying that the online retail segment will remain dominant in the market.

Sports Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- During the year 2023, North America became the largest market of sports equipment and accessories by capturing the nearly 35% of the entire market. The region has control over the area due to the rigorous sporting culture, increased disposable income per effectively developed sporting facilities. Specifically the United States is one of the most important markets as professional leagues including NFL NBA and MLB produce demand for sports equipment. In addition, fitness awareness has also increased in the region and the customers are now using gym and fitness clothing items. Technologically superior products and well-developed channels of distribution make North America a dominant market for the product.

Active Key Players in the Sports Equipment Market:

- Adidas (Germany)

- Amer Sports (Finland)

- Asics Corporation (Japan)

- BRG Sports (United States)

- Callaway Golf Company (United States)

- Fila Holdings Corp. (South Korea)

- Head N.V. (Netherlands)

- Jarden Corporation (United States)

- Mizuno Corporation (Japan)

- Nike, Inc. (United States)

- PUMA SE (Germany)

- Reebok International Ltd. (United States)

- Sports Direct International (United Kingdom)

- Under Armour, Inc. (United States)

- Yonex Co., Ltd. (Japan), and Other Active Players

|

Global Sports Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 376.7 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5% |

Market Size in 2032: |

USD 663.9 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sports Equipment Market by By Type (2018-2032)

4.1 Sports Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ball over net games

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Ball games

4.5 Fitness/Strength equipment

4.6 Athletic training equipment

4.7 Others

Chapter 5: Sports Equipment Market by By Distribution Channel (2018-2032)

5.1 Sports Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Online retail

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Specialty & sports shops

5.5 Department & discount stores

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Sports Equipment Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ADIDAS (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMER SPORTS (FINLAND)

6.4 ASICS CORPORATION (JAPAN)

6.5 BRG SPORTS (UNITED STATES)

6.6 CALLAWAY GOLF COMPANY (UNITED STATES)

6.7 FILA HOLDINGS CORP. (SOUTH KOREA)

6.8 HEAD N.V. (NETHERLANDS)

6.9 JARDEN CORPORATION (UNITED STATES)

6.10 MIZUNO CORPORATION (JAPAN)

6.11 NIKE INC. (UNITED STATES)

6.12 PUMA SE (GERMANY)

6.13 REEBOK INTERNATIONAL LTD. (UNITED STATES)

6.14 SPORTS DIRECT INTERNATIONAL (UNITED KINGDOM)

6.15 UNDER ARMOUR INC. (UNITED STATES)

6.16 YONEX CO. LTD. (JAPAN)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Sports Equipment Market By Region

7.1 Overview

7.2. North America Sports Equipment Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Ball over net games

7.2.4.2 Ball games

7.2.4.3 Fitness/Strength equipment

7.2.4.4 Athletic training equipment

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size By By Distribution Channel

7.2.5.1 Online retail

7.2.5.2 Specialty & sports shops

7.2.5.3 Department & discount stores

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Sports Equipment Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Ball over net games

7.3.4.2 Ball games

7.3.4.3 Fitness/Strength equipment

7.3.4.4 Athletic training equipment

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size By By Distribution Channel

7.3.5.1 Online retail

7.3.5.2 Specialty & sports shops

7.3.5.3 Department & discount stores

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Sports Equipment Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Ball over net games

7.4.4.2 Ball games

7.4.4.3 Fitness/Strength equipment

7.4.4.4 Athletic training equipment

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size By By Distribution Channel

7.4.5.1 Online retail

7.4.5.2 Specialty & sports shops

7.4.5.3 Department & discount stores

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Sports Equipment Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Ball over net games

7.5.4.2 Ball games

7.5.4.3 Fitness/Strength equipment

7.5.4.4 Athletic training equipment

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size By By Distribution Channel

7.5.5.1 Online retail

7.5.5.2 Specialty & sports shops

7.5.5.3 Department & discount stores

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Sports Equipment Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Ball over net games

7.6.4.2 Ball games

7.6.4.3 Fitness/Strength equipment

7.6.4.4 Athletic training equipment

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size By By Distribution Channel

7.6.5.1 Online retail

7.6.5.2 Specialty & sports shops

7.6.5.3 Department & discount stores

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Sports Equipment Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Ball over net games

7.7.4.2 Ball games

7.7.4.3 Fitness/Strength equipment

7.7.4.4 Athletic training equipment

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size By By Distribution Channel

7.7.5.1 Online retail

7.7.5.2 Specialty & sports shops

7.7.5.3 Department & discount stores

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Sports Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 376.7 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5% |

Market Size in 2032: |

USD 663.9 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Sports Equipment Market research report is 2024-2032.

Adidas (Germany), Amer Sports (Finland), Asics Corporation (Japan), BRG Sports (United States), Callaway Golf Company (United States), and Other Active Players.

The Sports Equipment Market is segmented into Type, Distribution Channel, and region. By Type, the market is categorized into Ball over net games, Ball games, Fitness/Strength equipment, Athletic training equipment, Others. By Distribution Channel, the market is categorized into Online retail, Specialty & sports shops, Department & discount stores. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The product coverage of the sports equipment market comprises items related to physical exercise, recreation, and sports that are used indoors or outdoors at professional, amateur, or casual levels. This market comprises of balls, bats, gloves, defence gears, shoes and other specific sporting equipment for specific sports such as tennis, football, basketball and golf. It also goes to wearables, home exercise equipment such as treadmills, dumbbells and gymnasium equipment like yoga mats. Due to an increasing trend of physical fitness, an elevated status of professional athletic champions, and active leisure activities, sports equipment has great demand and utility for professional athletes, amateurs, and ordinary people around the world.

Sports Equipment Market Size Was Valued at USD 376.7 Billion in 2023, and is Projected to Reach USD 663.9 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.