Sports Water Bottles Market Synopsis:

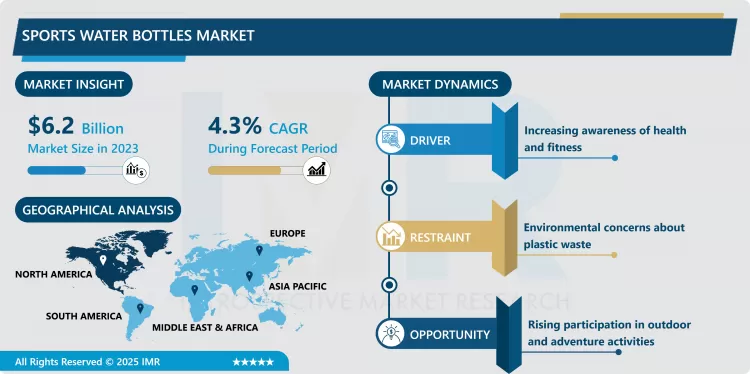

Sports Water Bottles Market Size Was Valued at USD 6.2 Billion in 2023, and is Projected to Reach USD 9.06 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.

The sports water bottles market deals with the manufacturing, marketing and sale of the bottles for holding water with features intended to help athletes, those exercising, or people engaged in sporting activities. These bottles are designed to make a perfect companion in terms of water consumption especially during exercise or training or any activity. Types of sports water bottles include; Plastic, Stainless steel, Glass and Silicone, it comes with features like; light in weight, highly durable, insulated and leak proof lids. They are used in various fitness and sports complexes, stadiums, trails and offices and they fit well into the modern consumer trend that seeks to cut on the use of plastics in disposable and single use products. Often, such bottles have additional functions as a handle, a filter or a scale, as the target customers worldwide are the conscious consumers of various healthy drinks.

Thus, the market for the sports water bottles has experienced fair share of growth in the recent past, due to the rising health consciousness as well as the growing demand for environment friendly products. For the past years, consumers are gradually shifting their preference toward reusable products due to the growing concern of global plastics pollution, and that makes sports water bottles as the perfect fit. The desire for environmentally friendly materials is now increasingly emphasized on a global scale, and thanks to this, manufacturers are developing not only environmentally friendly designs, but also optimized designs that make the product more useful, for example, a lighter product that is more durable. In addition, rising engagement in physical activities such as marathon, cycling, and yoga along with active life campaigns has increased the consumption of the sports water bottles.

Further, developments in material science have made it possible for the manufacturers bring to the market bottles that can effectively insulate and also be sturdy for all the weather conditions and uses. The replacement of traditional pottery water carriers with functional multipurpose water bottles it signifies changing consumer requirement of Functional aesthetic products. This trend is especially the case among millennial and Gen Z, as they are attracted to beautiful styled designs and simplicity of the products. Moreover, the integration of smart elements like Temperature inclusion and Bluetooth connectivity in some of the premium sports bottle has created the market for smart products.

Sports Water Bottles Market Trend Analysis:

Growing Focus on Customization

- Besides differentiation by material, customization is among the key strategies defining the further development of the sports water bottles market. From custom jewelry pieces, to choosing different colors or having logos engraved for company identification, manufacturers engage in providing many options to make the consumer’s experience better. This has particularly been embraced in fitness groups, corporate functions as well as organizations such as sports teams since the improve on their promotional bottles. Also, extra-functional productions, that means bottles with collapsible structures, one-handed openings or double wall constructions, are getting more and more popular. When sustainability is considered increasingly, brands are also focusing on options for biodegradable customs or recyclable materials.

Rising Popularity of Outdoor Activities

- A key trend stimulating demand for the sports water bottles is the continually rising concern for outdoor sports and recreation. Sight seeing tours including walking, trekking, camping, cycling, jogging and running are becoming more popular globally as people embrace social physical activities. This trend has triggered demand for water bottles that are sturdy, portable, and best of all that can retain heat or cold for many hours. Further, new markets like adventure tourism in North America, Europe and South East Asia are likely to drive the market growth in the coming years. This is why companies can use the opportunity to launch a line of local products designed to meet the needs of outdoor travelers: Schild can put forward rugged bottles for climbers or insulated bottles for winter travelers.

Sports Water Bottles Market Segment Analysis:

Sports Water Bottles Market is Segmented on the Basis of Material Type, Capacity, Distribution Channel, and Region.

By Material Type, Plastic segment is expected to dominate the market during the forecast period

- New research indicates that the plastic segment leads in the sports water bottles market during the above period; the segment benefits from affordability, light weight, and endurance. Competition eatables are popular with consumers, especially athletes and children, because the packages, particularly plastic bottles, are easy to open and not breakable. Through the application of AMTs, companies undertake production of plastics bottles that meet consumer safety standards regarding BPA and recyclability. In addition, there are various colours, shapes and sizes of plastic bottles suitable for a number of uses hence making it ideal for usage.

- Besides, the relative cheapness of the plastics in contrast to such materials as stainless steel or glass make the products preferred by producers. Concerns about the effect of polythene on the environment have shot up over the years improving the segment’s position with the of easy, recyclable and environmentally friendly plastic bottles. As the consumers continue to embrace these friendly options, the plastic segment is expected to maintain a status of dominance many years to come.

By Capacity, 600ml-650ml segment expected to held the largest share

- The segment of 600ml – 650ml is also considered to be the largest in the forecast period due to the optimal and unproblematic usability of a stainer. Bottles with this capacity are portable while at the same time containing enough water, which makes them to be preferred by athletes, and business people. They are transportable in gym bags, backpacks, or car holders and dispense enough water for moderate duration tasks.

- In addition, it is, therefore, geared towards children, athletes and anyone who takes part in an outdoor activity. A good example of consumer functional appeal is where manufacturers are aiming at improving the aesthetic appeal of this segment through ergonomic design, bright colors and incorporating accessory parts like straw caps or graduations on cups. Since consumers are now trending towards convenience and functionality in product use, the 600ml-650ml will probably continue to be popular in every category by end users.

Sports Water Bottles Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2023, North America became the biggest market globally with around 35% market share of sports water bottles. The leadership of the region may also be attributed to high fitness trends and usage of reusable products available intensively from key market players. We have seen the likes of the United States and Canada increase the consumers demand of the sports water bottles due to matters concerning health and social corporate responsibility. Further, the firm’s sound distribution networks and high e-commerce values have enhanced manufacturers to meet a large customer market satisfactorily. There is a persistent trend towards innovation in production, and consumers’ willingness to pay for natural products; thus, North America remains the leader in the forecast period.

Active Key Players in the Sports Water Bottles Market:

- Adidas AG (Germany)

- CamelBak Products LLC (United States)

- Contigo (United States)

- Decathlon S.A. (France)

- Hydro Flask (United States)

- Klean Kanteen (United States)

- Milton (India)

- Nalgene Outdoor (United States)

- Nathan Sports (United States)

- Newell Brands (United States)

- Nike Inc. (United States)

- O2COOL (United States)

- S’well (United States)

- SIGG Switzerland AG (Switzerland)

- Thermos L.L.C. (United States), and Other Active Players.

|

Global Sports Water Bottles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.2 Billion |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 9.06 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By Capacity |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sports Water Bottles Market by By Material Type (2018-2032)

4.1 Sports Water Bottles Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Plastic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Stainless Steel

4.5 Silicon

4.6 Aluminium

4.7 Others

Chapter 5: Sports Water Bottles Market by By Capacity (2018-2032)

5.1 Sports Water Bottles Market Snapshot and Growth Engine

5.2 Market Overview

5.3 600ml-650ml

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 700ml-750ml

5.5 Above-750ml

Chapter 6: Sports Water Bottles Market by By Distribution Channel (2018-2032)

6.1 Sports Water Bottles Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hypermarkets/Supermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Convenience Stores

6.5 Grocery Stores

6.6 E-Commerce websites

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Sports Water Bottles Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CONTIGO (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DECATHLON S.A. (FRANCE)

7.4 HYDRO FLASK (UNITED STATES)

7.5 KLEAN KANTEEN (UNITED STATES)

7.6 MILTON (INDIA)

7.7 NALGENE OUTDOOR (UNITED STATES)

7.8 NATHAN SPORTS (UNITED STATES)

7.9 NEWELL BRANDS (UNITED STATES)

7.10 NIKE INC. (UNITED STATES)

7.11 O2COOL (UNITED STATES)

7.12 S’WELL (UNITED STATES)

7.13 SIGG SWITZERLAND AG (SWITZERLAND)

7.14 THERMOS L.L.C. (UNITED STATES)

7.15 OTHER ACTIVE PLAYERS

Chapter 8: Global Sports Water Bottles Market By Region

8.1 Overview

8.2. North America Sports Water Bottles Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Material Type

8.2.4.1 Plastic

8.2.4.2 Stainless Steel

8.2.4.3 Silicon

8.2.4.4 Aluminium

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By By Capacity

8.2.5.1 600ml-650ml

8.2.5.2 700ml-750ml

8.2.5.3 Above-750ml

8.2.6 Historic and Forecasted Market Size By By Distribution Channel

8.2.6.1 Hypermarkets/Supermarkets

8.2.6.2 Convenience Stores

8.2.6.3 Grocery Stores

8.2.6.4 E-Commerce websites

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Sports Water Bottles Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Material Type

8.3.4.1 Plastic

8.3.4.2 Stainless Steel

8.3.4.3 Silicon

8.3.4.4 Aluminium

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By By Capacity

8.3.5.1 600ml-650ml

8.3.5.2 700ml-750ml

8.3.5.3 Above-750ml

8.3.6 Historic and Forecasted Market Size By By Distribution Channel

8.3.6.1 Hypermarkets/Supermarkets

8.3.6.2 Convenience Stores

8.3.6.3 Grocery Stores

8.3.6.4 E-Commerce websites

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Sports Water Bottles Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Material Type

8.4.4.1 Plastic

8.4.4.2 Stainless Steel

8.4.4.3 Silicon

8.4.4.4 Aluminium

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By By Capacity

8.4.5.1 600ml-650ml

8.4.5.2 700ml-750ml

8.4.5.3 Above-750ml

8.4.6 Historic and Forecasted Market Size By By Distribution Channel

8.4.6.1 Hypermarkets/Supermarkets

8.4.6.2 Convenience Stores

8.4.6.3 Grocery Stores

8.4.6.4 E-Commerce websites

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Sports Water Bottles Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Material Type

8.5.4.1 Plastic

8.5.4.2 Stainless Steel

8.5.4.3 Silicon

8.5.4.4 Aluminium

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By By Capacity

8.5.5.1 600ml-650ml

8.5.5.2 700ml-750ml

8.5.5.3 Above-750ml

8.5.6 Historic and Forecasted Market Size By By Distribution Channel

8.5.6.1 Hypermarkets/Supermarkets

8.5.6.2 Convenience Stores

8.5.6.3 Grocery Stores

8.5.6.4 E-Commerce websites

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Sports Water Bottles Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Material Type

8.6.4.1 Plastic

8.6.4.2 Stainless Steel

8.6.4.3 Silicon

8.6.4.4 Aluminium

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By By Capacity

8.6.5.1 600ml-650ml

8.6.5.2 700ml-750ml

8.6.5.3 Above-750ml

8.6.6 Historic and Forecasted Market Size By By Distribution Channel

8.6.6.1 Hypermarkets/Supermarkets

8.6.6.2 Convenience Stores

8.6.6.3 Grocery Stores

8.6.6.4 E-Commerce websites

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Sports Water Bottles Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Material Type

8.7.4.1 Plastic

8.7.4.2 Stainless Steel

8.7.4.3 Silicon

8.7.4.4 Aluminium

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By By Capacity

8.7.5.1 600ml-650ml

8.7.5.2 700ml-750ml

8.7.5.3 Above-750ml

8.7.6 Historic and Forecasted Market Size By By Distribution Channel

8.7.6.1 Hypermarkets/Supermarkets

8.7.6.2 Convenience Stores

8.7.6.3 Grocery Stores

8.7.6.4 E-Commerce websites

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Sports Water Bottles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.2 Billion |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 9.06 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By Capacity |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Sports Water Bottles Market research report is 2024-2032.

Contigo (United States), Decathlon S.A. (France), Hydro Flask (United States), Klean Kanteen (United States), Milton (India), Nalgene Outdoor (United States), Nathan Sports (United States), and Other Active Players.

The Sports Water Bottles Market is segmented into Material Type, Capacity, Distribution Channel and region. By Material Type, the market is categorized into Plastic, Stainless Steel, Silicon, Aluminium, Others. By Capacity, the market is categorized into 600ml-650ml, 700ml-750ml, Above-750ml. By Distribution Channel, the market is categorized into Hypermarkets/Supermarkets, Convenience Stores, Grocery Stores, E-Commerce websites, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The sports water bottles market deals with the manufacturing, marketing and sale of the bottles for holding water with features intended to help athletes, those exercising, or people engaged in sporting activities. These bottles are designed to make a perfect companion in terms of water consumption especially during exercise or training or any activity. Types of sports water bottles include; Plastic, Stainless steel, Glass and Silicone, it comes with features like; light in weight, highly durable, insulated and leak proof lids. They are used in various fitness and sports complexes, stadiums, trails and offices and they fit well into the modern consumer trend that seeks to cut on the use of plastics in disposable and single use products. Often, such bottles have additional functions as a handle, a filter or a scale, as the target customers worldwide are the conscious consumers of various healthy drinks.

Sports Water Bottles Market Size Was Valued at USD 6.2 Billion in 2023, and is Projected to Reach USD 9.06 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.