Start-Stop Battery Market Synopsis:

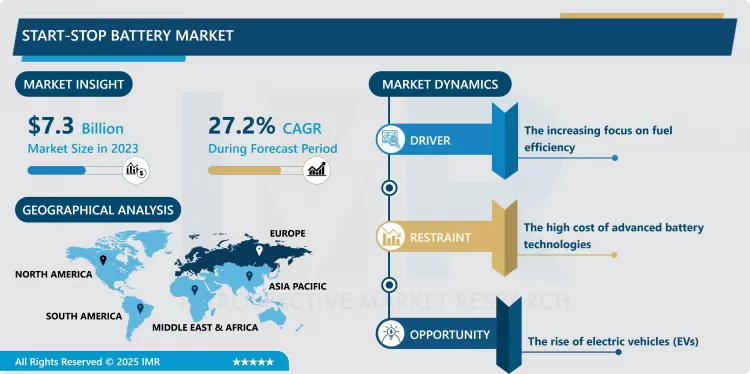

Start-Stop Battery Market Size Was Valued at USD 7.3 Billion in 2023, and is Projected to Reach USD 63.5 Billion by 2032, Growing at a CAGR of 27.2% From 2024-2032.

The Start-Stop battery market is the part of the automotive industry that deals with the manufacture of batteries specifically for use in Start-Stop technology vehicles. A Start-Stop system is a type of technology found in efficient cars today that allow the engine to shut down and turn back on to help save fuel and reduce exhaust spews. This system demands high power and efficiencies batteries particularly at low and high temperatures and cycles of charge and discharge. These batteries are mainly employed often when the engine should turnover rapidly, and are used in hybrid, electric and standard ICE motor vehicle batteries.

The Start-Stop battery market was also up in recent years because of the constant need for more energy efficient technology in automotive vehicles. With governments across the globe setting demanding fuel economy standards and environmental rules to curb emissions, car makers are moving towards Start-Stop systems in cars. All these have increased the demand of more sophisticated batteries that meet the power demands of stop start system such as high capacity and short charging time. Different technologically advanced batteries are available; however, lead acid batteries still occupy most of the market share because of their affordability, reliability and years of usage in cars. However, the market is slowly vacating the simpler battery types, and moving more towards, better performing lithium-ion batteries, which are lighter, more durable and can last considerably longer.

By application, the EV (electric vehicle) sector remains a prominent near-term growth market for the Start-Stop battery business. With the increasing global demand for electric vehicles, Start-Stop batteries, particularly high capacity and long life span of lithium iron batteries, are also being sought after. These batteries serve as an essential component to these advanced passenger cars that include electrical and hybrid vehicles in their operation: these batteries are used not only to power the motor but also in the stopping and starting mechanism. When it comes to application type, Start-Stop battery derives from EV can be rightfully considered as one of the key segments in the automotive battery market since its popularity is likely to increase as new vehicles on the market are gradually shifted towards EV. Further, with changes and constant improvement to battery technology and reduction in the cost of compact lithium-ion batteries should germinate the apply of Start-Stop systems amongst a number of vehicle classes.

Start-Stop Battery Market Trend Analysis:

Growing Adoption of Lithium-Ion Batteries

- The use of lithium-ion batteries is one of the biggest trends observe in the Start-Stop battery market in recent years. Because of superior performance lithium-ion batteries are replacing traditional batteries in car models as manufacturers are moving towards developing cars with lesser emissions. Unlike the conventional lead-acid batteries, these batteries charges faster, they are lighter in weight and have a longer life to charge ratio. Furthermore, lithium-ion batteries has one of high power-density, which is essential for the recharging and discharging rate of the concept Start-Stop system. This is magnified by the improvements on battery technologies where lithium-ion solutions become cheaper and viable to be used. Therefore, increased use of these batteries in electric and conventional vehicles has put pressure on vehicle manufacturers to incorporate Start-Stop systems.

Increasing Demand for Electric and Hybrid Vehicles

- The Start-Stop battery market has a great chance due to the growing popularity of electric and hybrid cars. As both governments and consumers demand vehicles that are environmentally friendly, electric vehicles popularly known as EVs are slowly taking root in the automotive market. Start-Stop systems can be particularly important in terms of fuel economy and emissions and should thus be adopted for use in EVs and hybrid vehicles. The market for start stop batteries is likely to expand massively as the pace of transition to electric cars across the world gains momentum. This poses a big challenge to battery manufacturers because it opens the door for improvement of better high performing batteries that suit the requirements of the electric vehicle market. The manufacturers, who will be able to offer batteries that prove to be cheaper while at the same time guaranteeing the capacity of handling the increasing frequency of start/stops, are likely to reap big from this trend.

Start-Stop Battery Market Segment Analysis:

Start-Stop Battery Market Segmented on The Basis of Technology, Application, And Region.

By Technology, Lead-acid battery segment is expected to dominate the market during the forecast period

- Researchers are of the opinion that lead-acid batteries is expected to hold the largest share of Start-Stop battery market within the stipulated time frame. Even now, with the constantly growing share of more progressive technologies such as lithium-ion batteries for storage, lead-acid batteries provide vehicle owners with an opportunity to benefit from Start-Stop systems without breaking the bank. These batteries have a long history adoption in automotive vehicles especially in the conventional Internal Combustion Engine (ICE) vehicles. These are suitable for Start-Stop applications due to their ruggedness and their tolerability of charging and discharging processes. Also, they are cheaper than newer technologies denoting them as efficient systems for automakers who are also interested in the performance/price ratio.

By Application, EV segment expected to held the largest share

- Start-Stop battery’s largest application segment is expected to be EV segment considering the growing use of electric and hybrid vehicles across the world. Due to awareness of the unfriendly impact of the environment on traditional vehicles and policies that encourage production of new green technologies are focusing on the development of new cars such as EVs. Starter altitude systems are incorporated in these vehicles to help in fuel consumption thereby checking on emissions. During cases of hybrid and plug-in hybrid electric vehicles (PHEVs), these systems help in the management of energy use in more efficiently especially during periods of idling. Also, due to increased uptake of electric cars, the demand for improved Start-Stop batteries that will be applied efficiently in performance-oriented EV components will reignite the market growth aggressively.

Start-Stop Battery Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- In 2023, the demand of Start-Stop battery in Europe is expected to remain the highest owing to higher automotive sector and improved environment standard norms. Forces such as a stringent policy regulation like the carbon emission policy in the European Union demanding car manufactures to reduce CO2 emission and Two Market Trends: Shift Towards Electrification of Cars and Growth in Hybrid Cars. Therefore, the market for start stop systems-across the region-is increasing significantly since consumers look at adopting new technologies that save fuel and emissions. Germany, France and the UK are amongst the most advanced countries as far as embracing of these technologies is concerned. Europe also has major automotive and battery manufacturing industries, which give more impetus to the markets growth. It is encouraging to note that devoted regional annual demand represents about 35%-40% of the international market in the upcoming 2023, embracing, both, direct currents and battery-powered electric cars.

Active Key Players in the Start-Stop Battery Market:

- A123 Systems (USA)

- BASF SE (Germany)

- Continental AG (Germany)

- Daimler AG (Germany)

- EnerSys (USA)

- Exide Technologies (USA)

- GS Yuasa Corporation (Japan)

- Johnson Controls International (USA)

- LG Chem (South Korea)

- Panasonic Corporation (Japan)

- SAFT Groupe (France)

- Samsung SDI (South Korea)

- Sanyo Electric Co., Ltd. (Japan)

- Toshiba Corporation (Japan)

- VARTA AG (Germany), and Other Active Players.

|

Global Start-Stop Battery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.3 Billion |

|

Forecast Period 2024-32 CAGR: |

27.2% |

Market Size in 2032: |

USD 63.5 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Start-Stop Battery Market by By Technology (2018-2032)

4.1 Start-Stop Battery Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lead-acid battery

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Lithium-ion battery

4.5 Others

Chapter 5: Start-Stop Battery Market by By Application (2018-2032)

5.1 Start-Stop Battery Market Snapshot and Growth Engine

5.2 Market Overview

5.3 EV

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Conventional vehicles

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Start-Stop Battery Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 A123 SYSTEMS (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BASF SE (GERMANY)

6.4 CONTINENTAL AG (GERMANY)

6.5 DAIMLER AG (GERMANY)

6.6 ENERSYS (USA)

6.7 EXIDE TECHNOLOGIES (USA)

6.8 GS YUASA CORPORATION (JAPAN)

6.9 JOHNSON CONTROLS INTERNATIONAL (USA)

6.10 LG CHEM (SOUTH KOREA)

6.11 PANASONIC CORPORATION (JAPAN)

6.12 SAFT GROUPE (FRANCE)

6.13 SAMSUNG SDI (SOUTH KOREA)

6.14 SANYO ELECTRIC CO. LTD. (JAPAN)

6.15 TOSHIBA CORPORATION (JAPAN)

6.16 VARTA AG (GERMANY)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Start-Stop Battery Market By Region

7.1 Overview

7.2. North America Start-Stop Battery Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Technology

7.2.4.1 Lead-acid battery

7.2.4.2 Lithium-ion battery

7.2.4.3 Others

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 EV

7.2.5.2 Conventional vehicles

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Start-Stop Battery Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Technology

7.3.4.1 Lead-acid battery

7.3.4.2 Lithium-ion battery

7.3.4.3 Others

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 EV

7.3.5.2 Conventional vehicles

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Start-Stop Battery Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Technology

7.4.4.1 Lead-acid battery

7.4.4.2 Lithium-ion battery

7.4.4.3 Others

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 EV

7.4.5.2 Conventional vehicles

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Start-Stop Battery Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Technology

7.5.4.1 Lead-acid battery

7.5.4.2 Lithium-ion battery

7.5.4.3 Others

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 EV

7.5.5.2 Conventional vehicles

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Start-Stop Battery Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Technology

7.6.4.1 Lead-acid battery

7.6.4.2 Lithium-ion battery

7.6.4.3 Others

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 EV

7.6.5.2 Conventional vehicles

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Start-Stop Battery Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Technology

7.7.4.1 Lead-acid battery

7.7.4.2 Lithium-ion battery

7.7.4.3 Others

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 EV

7.7.5.2 Conventional vehicles

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Start-Stop Battery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.3 Billion |

|

Forecast Period 2024-32 CAGR: |

27.2% |

Market Size in 2032: |

USD 63.5 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Start-Stop Battery Market research report is 2024-2032.

A123 Systems (USA), BASF SE (Germany), Continental AG (Germany), Daimler AG (Germany), EnerSys (USA), Exide Technologies (USA), and Other Active Players.

The Start-Stop Battery Market is segmented into Technology, Application, and region. By Technology, the market is categorized into Lead-acid battery, Lithium-ion battery, Others. By Application, the market is categorized into EV, Conventional vehicles. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Start-Stop battery market is the part of the automotive industry that deals with the manufacture of batteries specifically for use in Start-Stop technology vehicles. A Start-Stop system is a type of technology found in efficient cars today that allow the engine to shut down and turn back on to help save fuel and reduce exhaust spews. This system demands high power and efficiencies batteries particularly at low and high temperatures and cycles of charge and discharge. These batteries are mainly employed often when the engine should turnover rapidly, and are used in hybrid, electric and standard ICE motor vehicle batteries.

Start-Stop Battery Market Size Was Valued at USD 7.3 Billion in 2023, and is Projected to Reach USD 63.5 Billion by 2032, Growing at a CAGR of 27.2% From 2024-2032.