Sterile Bottles Market Synopsis:

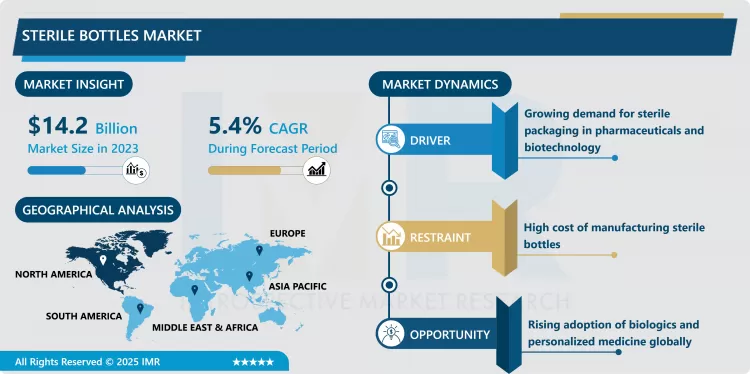

Sterile Bottles Market Size Was Valued at USD 14.2 Billion in 2023, and is Projected to Reach USD 22.8 Billion by 2032, Growing at a CAGR of 5.4% From 2024-2032.

The sterile bottles market includes a broad range of products intended for storage and manipulation of sterile liquids, pharmaceuticals and laboratory samples. These bottles are produced with clean appearance free from cracks that may contaminate the content within the bottles. Sterile bottles are mainly used in largely in pharmaceutical, biotechnology, healthcare industries and in food and beverages industries to assure safe handling of important fluids. These bottles must be made of materials like glass or plastic which will not chemically react with the contents, will withstand being washed over and over and must be easy to sterilize. The market also reflects tendencies based on material technology advances, the concentration of demand for aseptic packaging, and escalating concerns in the storage and transportation of sterile goods.

The global demand for sterile bottles is increasing steadily since the industry shows increased adoption in pharmaceutical and biotechnology industries. The global increase in the frequency of chronic diseases and development of healthcare systems create the demand for safe and sterile storage systems. This is particularly so for plastic and glass sterile bottles due to the rising marketing expenditures of pharma firms in research and development as well as the ongoing enhancement of packaging requirements. They have the important function of preserving the aseptic nature of high value biologics, vaccines, and injectable medications. Another important driver that has driven the expansion of the market is the growing tendency in laboratories where research is conducted and clinical trials are conducted in sterile bottles.

Additionally the food and beverage industries have become an evident market for sterile bottles especially when it comes to products such as juices, diary products and purified water. These bottles help to maintain product quality for a longer duration to fight counter contamination and enhance shelve life. A similar factor that is currently driving the consumption of sterilized packaging is the increased uptake of e-commerce sales of consumables and home delivery services. On account of consumer awareness and consciousness about health and safety getting incorporated with the industries, the development of advanced packaging solution is expected to aid the growth of the global sterile bottles market continuously.

Sterile Bottles Market Trend Analysis:

Focus on Sustainability

- Perhaps, one of the defining trends observed in the context of sterile bottles is the ongoing shift to sustainable Packaging. Organizations are paying attention to the biodegradable plastic and recyclability to favor consumer’s preference for eco-friendly products. This trend is promoted by elevated governmental requirements and corporation’s environmentally friendly measures to decrease the presence of plastic products in the environment. ALSO, new discoveries that involve biodegradable and reusable sterilization methods have emerged which are revolutionizing product lines by offering the industries to address the sterility issues alongside the ecological consequences.

Growth in Biologics and Personalized Medicine

- The current market development in the healthcare industry especially the production of biologics and personalized medication is rapidly on the rise thereby being a definite opportunity to the sterile bottles market. Vaccines, the cell treatments, and antibodies are examples of biologics that must be packaged in the most controlled environment to avoid compromise of their performance. In view of the fact that different diseases are on the rise and the biotechnology as well as the pharmaceutical industries are continuing to shift to the precision medicine, sterile bottles will be in high demand. The improvement of bottle shapes, using tamper evidences in seals and other sophisticated closures also acts as key boosting factor for the market.

Sterile Bottles Market Segment Analysis:

Sterile Bottles Market Segmented on The Basis of Product Type, Capacity, End User, and Region.

By Product Type, Aspirator Bottles segment is expected to dominate the market during the forecast period

- This research expects that during the forecast period aspirator bottles would lead the sterile bottles market due to their usage in laboratories and production of hospital and pharmaceutical products. These bottles contain large volumes of liquid and are suitable for sterile liquid storage and usage in clinical as well as research purpose. This segment includes aspirator bottles that are highly versatile, durable bottles which are compatible with multiple sterilization methods that meet regulatory requirements.

- The increase in the size of the aspirator bottles segment will be even more supported by the increase in demand for mass handling of sterile solutions in biopharmaceutical production. The continued use of these bottles in laboratories for sample preparation and sample testing has cemented long-term market authority. In addition, new advances in material type and fabrication technologies have improved the design and effectiveness of aspirator bottles as a must-have product in the sterile bottles market.

By Capacity, More than 4,000 mL segment expected to held the largest share

- Among the segments, the ‘More than 4000 mL’ segment will be the largest regional market, which is expected to use sterile bottles for direct industrial and pharma bulk package. These bottles are used in transporting and preservation of relatively huge quantities of sterile fluids especially in biopharmaceutical processing industries. The segment must benefit from the constant demand for large-capacity bottles in manufacturing processes, similar to the medical industries in generating vaccines, where sterilization and large volumes are critical factors.

- Moreover, increasingly great demand for the large-capacity bottles is observed not only in the food and beverage sector, because manufacturers seek for the mass storage volumes when transporting the products without affecting its quality. Of all the segments for packaging that contains more than 4,000 mL, the worldwide growth in pharmaceutical production and the push for cost-conscious solutions to packaging indicate that this segment will experience significant growth.

Sterile Bottles Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the study, North America has been a leading consuming region for sterile bottles in the year 2023 with contribution to nearly 35% of the total market share around the globe. The leadership is said to be as a result of the numerous pharmaceutical and biotechnology industries, well developed healthcare system as well as the high investment made in research. Of particular importance is the United States, specifically, major pharma companies and research firms rely on sophisticated sterile packaging products. Emerging growth in the sectors of biologics and personalized medicines along with the availability of strict regulatory norms concerning sterile packaging makes North America a stronghold market.

Active Key Players in the Sterile Bottles Market

- Amcor PLC (Australia)

- AptarGroup, Inc. (USA)

- Berry Global, Inc. (USA)

- Corning Incorporated (USA)

- DWK Life Sciences (Germany)

- Gerresheimer AG (Germany)

- Nipro Corporation (Japan)

- O-I Glass, Inc. (USA)

- Parekhplast India Ltd (India)

- Qorpak (USA)

- SCHOTT AG (Germany)

- SiO2 Medical Products (USA)

- SM Pack (Italy)

- Thermo Fisher Scientific (USA)

- WHEATON Industries (USA), and Other Active Players.

|

Global Sterile Bottles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.2 Billion |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 22.8 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Capacity |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sterile Bottles Market by By Product Type (2018-2032)

4.1 Sterile Bottles Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aspirator Bottles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Dilution Bottles

4.5 Dispensing/Dropping Bottles

4.6 Sampling/Serum Bottles

4.7 Solution Bottles

4.8 Reagent bottles

4.9 Others

Chapter 5: Sterile Bottles Market by By Capacity (2018-2032)

5.1 Sterile Bottles Market Snapshot and Growth Engine

5.2 Market Overview

5.3 More than 4

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 000 mL

5.5 4

5.6 000 mL to 1

5.7 000 mL

5.8 1

5.9 000 mL to 250 mL

5.10 Less than 250 mL

Chapter 6: Sterile Bottles Market by By End User (2018-2032)

6.1 Sterile Bottles Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmaceuticals & Biological

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Medical & Surgical

6.5 Food & Beverage

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Sterile Bottles Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMCOR PLC (AUSTRALIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 APTARGROUP INC. (USA)

7.4 BERRY GLOBAL INC. (USA)

7.5 CORNING INCORPORATED (USA)

7.6 DWK LIFE SCIENCES (GERMANY)

7.7 GERRESHEIMER AG (GERMANY)

7.8 NIPRO CORPORATION (JAPAN)

7.9 O-I GLASS INC. (USA)

7.10 PAREKHPLAST INDIA LTD (INDIA)

7.11 QORPAK (USA)

7.12 SCHOTT AG (GERMANY)

7.13 SIO2 MEDICAL PRODUCTS (USA)

7.14 SM PACK (ITALY)

7.15 THERMO FISHER SCIENTIFIC (USA)

7.16 WHEATON INDUSTRIES (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Sterile Bottles Market By Region

8.1 Overview

8.2. North America Sterile Bottles Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Aspirator Bottles

8.2.4.2 Dilution Bottles

8.2.4.3 Dispensing/Dropping Bottles

8.2.4.4 Sampling/Serum Bottles

8.2.4.5 Solution Bottles

8.2.4.6 Reagent bottles

8.2.4.7 Others

8.2.5 Historic and Forecasted Market Size By By Capacity

8.2.5.1 More than 4

8.2.5.2 000 mL

8.2.5.3 4

8.2.5.4 000 mL to 1

8.2.5.5 000 mL

8.2.5.6 1

8.2.5.7 000 mL to 250 mL

8.2.5.8 Less than 250 mL

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Pharmaceuticals & Biological

8.2.6.2 Medical & Surgical

8.2.6.3 Food & Beverage

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Sterile Bottles Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Aspirator Bottles

8.3.4.2 Dilution Bottles

8.3.4.3 Dispensing/Dropping Bottles

8.3.4.4 Sampling/Serum Bottles

8.3.4.5 Solution Bottles

8.3.4.6 Reagent bottles

8.3.4.7 Others

8.3.5 Historic and Forecasted Market Size By By Capacity

8.3.5.1 More than 4

8.3.5.2 000 mL

8.3.5.3 4

8.3.5.4 000 mL to 1

8.3.5.5 000 mL

8.3.5.6 1

8.3.5.7 000 mL to 250 mL

8.3.5.8 Less than 250 mL

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Pharmaceuticals & Biological

8.3.6.2 Medical & Surgical

8.3.6.3 Food & Beverage

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Sterile Bottles Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Aspirator Bottles

8.4.4.2 Dilution Bottles

8.4.4.3 Dispensing/Dropping Bottles

8.4.4.4 Sampling/Serum Bottles

8.4.4.5 Solution Bottles

8.4.4.6 Reagent bottles

8.4.4.7 Others

8.4.5 Historic and Forecasted Market Size By By Capacity

8.4.5.1 More than 4

8.4.5.2 000 mL

8.4.5.3 4

8.4.5.4 000 mL to 1

8.4.5.5 000 mL

8.4.5.6 1

8.4.5.7 000 mL to 250 mL

8.4.5.8 Less than 250 mL

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Pharmaceuticals & Biological

8.4.6.2 Medical & Surgical

8.4.6.3 Food & Beverage

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Sterile Bottles Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Aspirator Bottles

8.5.4.2 Dilution Bottles

8.5.4.3 Dispensing/Dropping Bottles

8.5.4.4 Sampling/Serum Bottles

8.5.4.5 Solution Bottles

8.5.4.6 Reagent bottles

8.5.4.7 Others

8.5.5 Historic and Forecasted Market Size By By Capacity

8.5.5.1 More than 4

8.5.5.2 000 mL

8.5.5.3 4

8.5.5.4 000 mL to 1

8.5.5.5 000 mL

8.5.5.6 1

8.5.5.7 000 mL to 250 mL

8.5.5.8 Less than 250 mL

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Pharmaceuticals & Biological

8.5.6.2 Medical & Surgical

8.5.6.3 Food & Beverage

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Sterile Bottles Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Aspirator Bottles

8.6.4.2 Dilution Bottles

8.6.4.3 Dispensing/Dropping Bottles

8.6.4.4 Sampling/Serum Bottles

8.6.4.5 Solution Bottles

8.6.4.6 Reagent bottles

8.6.4.7 Others

8.6.5 Historic and Forecasted Market Size By By Capacity

8.6.5.1 More than 4

8.6.5.2 000 mL

8.6.5.3 4

8.6.5.4 000 mL to 1

8.6.5.5 000 mL

8.6.5.6 1

8.6.5.7 000 mL to 250 mL

8.6.5.8 Less than 250 mL

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Pharmaceuticals & Biological

8.6.6.2 Medical & Surgical

8.6.6.3 Food & Beverage

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Sterile Bottles Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Aspirator Bottles

8.7.4.2 Dilution Bottles

8.7.4.3 Dispensing/Dropping Bottles

8.7.4.4 Sampling/Serum Bottles

8.7.4.5 Solution Bottles

8.7.4.6 Reagent bottles

8.7.4.7 Others

8.7.5 Historic and Forecasted Market Size By By Capacity

8.7.5.1 More than 4

8.7.5.2 000 mL

8.7.5.3 4

8.7.5.4 000 mL to 1

8.7.5.5 000 mL

8.7.5.6 1

8.7.5.7 000 mL to 250 mL

8.7.5.8 Less than 250 mL

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Pharmaceuticals & Biological

8.7.6.2 Medical & Surgical

8.7.6.3 Food & Beverage

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Sterile Bottles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.2 Billion |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 22.8 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Capacity |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Sterile Bottles Market research report is 2024-2032.

Amcor PLC (Australia), AptarGroup, Inc. (USA), Berry Global, Inc. (USA), Corning Incorporated (USA), DWK Life Sciences (Germany), Gerresheimer AG (Germany), and Other Active Players.

The Sterile Bottles Market is segmented into Product Type, Capacity, End User and region. By Product Type, the market is categorized into Aspirator Bottles, Dilution Bottles, Dispensing/Dropping Bottles, Sampling/Serum Bottles, Solution Bottles, Reagent bottles, Others. By Capacity, the market is categorized into More than 4,000 mL, 4,000 mL to 1,000 mL, 1,000 mL to 250 mL, Less than 250 mL. By End User, the market is categorized into Pharmaceuticals & Biological, Medical & Surgical, Food & Beverage, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The sterile bottles market includes a broad range of products intended for storage and manipulation of sterile liquids, pharmaceuticals and laboratory samples. These bottles are produced with clean appearance free from cracks that may contaminate the content within the bottles. Sterile bottles are mainly used in largely in pharmaceutical, biotechnology, healthcare industries and in food and beverages industries to assure safe handling of important fluids. These bottles must be made of materials like glass or plastic which will not chemically react with the contents, will withstand being washed over and over and must be easy to sterilize. The market also reflects tendencies based on material technology advances, the concentration of demand for aseptic packaging, and escalating concerns in the storage and transportation of sterile goods.

Sterile Bottles Market Size Was Valued at USD 14.2 Billion in 2023, and is Projected to Reach USD 22.8 Billion by 2032, Growing at a CAGR of 5.4% From 2024-2032.