Suboxone Market Synopsis:

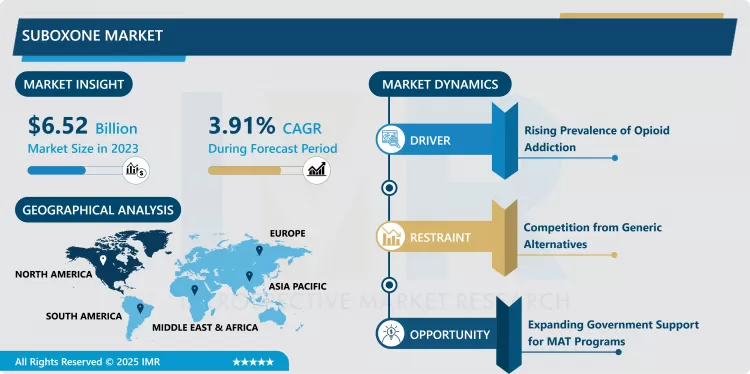

Suboxone Market Size Was Valued at USD 6.52 Billion in 2023, and is Projected to Reach USD 9.21 Billion by 2032, Growing at a CAGR of 3.91% From 2024-2032.

Suboxone market focuses on the global market of medications containing buprenorphine/naloxone combination which is applied for managing opioid dependency and dependence. Suboxone is an under-the-tongue medication build for its withdrawal symptoms and to prevent cravings, an essential tool if used in Medication-Assisted Treatment (MAT) to assist people recover from opioid dependency.

- The Suboxone market has grown quite substantially in the recent past in view of the increasing cases of opioid dependency syndrome and the growing global commendation of the use of Medication Assisted Treatment. Opioid dependence is still a prevalent problem worldwide, and although its signs are primarily observed in South Asia and Southeast Asia, newly emerging problems with such prescription opioids and heroin are noticeable in North America and Europe. Suboxone is a partial opioid agonist mixed with naloxone an opioid antagonist and it is safer and better than methadone. In its utilisation, it minimises withdrawal symptoms and lowers chances of abuse and overdose hence its popularity with medical practitioners.

- Future growth is driven by the government’s efforts towards fighting the opioid crises through enhanced funds allocation to MAT services as well as widening insurance coverage. Suboxone formulations have also received the support of regulatory agencies such as the FDA; this also creates incentives for Suboxone manufacturing companies to spend more budget on research and development. Suboxone is used in hospitals, clinics and other treatment facilities to treat people suffering from opioid dependency thus increasing patient access to the drug.

- But it indicates that barriers continue in the form of stigmatization of OUD as well as bureaucratic obstacles to opioid containing medications. Another issue by which the market has been limited is the release of generic versions of Suboxone, coupled with pressure for pricing and the market’s fragmentation. However, with awareness of the part that MAT plays in preventing opioid overdose deaths and curtailing societal costs related to opioid use, Suboxone ‘s market will likely broaden over the next year.

Suboxone Market Trend Analysis:

Telehealth Integration for Opioid Treatment

- Telehealth services integration with Suboxone treatment programs is another bright shift in the combined market. Telehealth programs are already being used with the aim of providing remote access to patients who require prescriptions and consultations for Medication-Assisted Treatment (MAT). This trend has been on the rise particularly in last year, thanks to Covid-19 pandemic which has forced or encouraged people to opt for telemedicine as a safe, convenient option for accessing healthcare.

- It shows that telehealth can also address such key challenges as geographical limited access and scarcity of healthcare providers with MAT certification in rural settings. People can now talk to doctors via video link and discuss prognosis, dose adjustments and progress check-ups. Also, since patients are able to opt for remote care through telemedicine, there is no way that addicts will be identified easily since the procedure is more personalized to their need. As codes advance with virtual MAT services, the demands for telehealth are expected to augment market growth and patients’ benefits.

Expanding Government Support for MAT Programs

- One of the trends for the Suboxone market is a growing interest in this product from governments all over the world. Worldwide, especially in countries that are struggling with the effects of opioid, such as the United States and Canada, governments are spending a lot of money in the delivery of interventions addressing opioids. Efforts to control deaths related to opioids and save health costs have seen the launch of a funding agenda to incorporate broader MAT.

- For example, grants for government subsidies are being given to addiction treatment centers and healthcare offices to make Suboxone and other related medications more available. Finally, Medicaid expansion for MAT and the integration of OTP in correctional centers, have expanded possibilities for Suboxone use even further. Such efforts present good prospects for such firms to enhance the industry engagement while responding to a critical societal demand.

Suboxone Market Segment Analysis:

Suboxone Market Segmented on The Basis of Drug Type, Formulation and Distribution Channel, and Region.

By Drug Type, Buprenorphine segment is expected to dominate the market during the forecast period

- This medication is the primary form of Suboxone and it works well for managing withdrawal signs of opioid addiction. Being a partial opioid agonist, buprenorphine produces lesser rate of respiratory deprivation and mortality than full opioid agonists. Reliable buprenorphine-based medications are being sought into in recent years because of their safety in lowering urge and important for MAT.

- NaloxoneIt help in the prevention of misuse and diversion if used in Suboxone by acting as opioid antagonist. One way by which naloxone makes Suboxone less prone to abuse is by eliminating the opioids’ feelings of euphoria which make the compound safe to patient. Introduction of naloxone into the formulation has provided Suboxone with therapeutic and safety advantages over other medications that are employed in MAT programs.

By Distribution Channel, Hospital Pharmacies segment expected to held the largest share

- Hospital PharmaciesHospital pharmacies are essential in the administration of Suboxone for outpatients and others who require the drug as part of extended hospital care with an emphasis on drug rehabilitation. Hospitals are strictly controlled to provide appropriate dose of Suboxone and follow the protocols of administration. Off-Anticipated Use Of Suboxone The following are some of the reasons as to why retail pharmacies form a higher proportion of suboxone market; Convenience The retail pharmacies are preferred for outpatient services due to their ease of access. Patients need to learn about the proper use of Suboxone, including how to take it and how and where to store it: pharmacists assume this task, which is fundamental in achieving the goals of this therapy.

- Online PharmaciesAn increase in the use of online pharmacies has seen the availability of Suboxone increase due to difficulties arranging a physical appointment with the pharmacy. Patronage of online platforms as a preferred distribution channel is prevalent because it provides a convenient means of consultation, maintains the privacy, and tends to be cheaper for patients.

Suboxone Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is projected to be the largest Suboxone market because of a higher rate of addiction to opioids and increasing use of MAT programs in the area. Among all the countries, the US has the biggest share due to government programs to address the opioid epidemic and right healthcare policies concerning MAT.

- Funding, insurance and MAT certified practitioners have supported Suboxone and developed a market in North America. On the same note, growth of telemedicine platforms in the management of opioid use disorder has also expanded access to Suboxone which has consolidated the position of the region.

Active Key Players in the Suboxone Market:

- Indivior PLC (United Kingdom)

- Dr. Reddy’s Laboratories Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sandoz International GmbH (Switzerland)

- Mylan N.V. (United States)

- Hikma Pharmaceuticals PLC (United Kingdom)

- Sun Pharmaceutical Industries Ltd. (India)

- Mallinckrodt Pharmaceuticals (United States)

- Lannett Company, Inc. (United States)

- Amneal Pharmaceuticals, Inc. (United States)

- Pfizer Inc. (United States)

- Viatris Inc. (United States), and Other Active players

Suboxone Market Scope:

|

Suboxone Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.52 Billion |

|

Forecast Period 2024-32 CAGR: |

3.91% |

Market Size in 2032: |

USD 9.21 Billion |

|

Segments Covered: |

By Drug Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Suboxone Market by By Drug Type (2018-2032)

4.1 Suboxone Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Buprenorphine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Naloxone

Chapter 5: Suboxone Market by By Distribution Channel (2018-2032)

5.1 Suboxone Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospital Pharmacies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Retail Pharmacies

5.5 Online Pharmacies

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Suboxone Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 INDIVIOR PLC – (UNITED KINGDOM)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DR. REDDY’S LABORATORIES LTD. – (INDIA)

6.4 TEVA PHARMACEUTICAL INDUSTRIES LTD. – (ISRAEL)

6.5 SANDOZ INTERNATIONAL GMBH (NOVARTIS) – (SWITZERLAND)

6.6 MYLAN N.V. – (UNITED STATES)

6.7 HIKMA PHARMACEUTICALS PLC – (UNITED KINGDOM)

6.8 SUN PHARMACEUTICAL INDUSTRIES LTD. – (INDIA)

6.9 MALLINCKRODT PHARMACEUTICALS – (UNITED STATES)

6.10 LANNETT COMPANY INC. – (UNITED STATES)

6.11 AMNEAL PHARMACEUTICALS INC. – (UNITED STATES)

6.12 PFIZER INC. – (UNITED STATES)

6.13 VIATRIS INC. – (UNITED STATES)

6.14 OTHER ACTIVE PLAYERS

Chapter 7: Global Suboxone Market By Region

7.1 Overview

7.2. North America Suboxone Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Drug Type

7.2.4.1 Buprenorphine

7.2.4.2 Naloxone

7.2.5 Historic and Forecasted Market Size By By Distribution Channel

7.2.5.1 Hospital Pharmacies

7.2.5.2 Retail Pharmacies

7.2.5.3 Online Pharmacies

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Suboxone Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Drug Type

7.3.4.1 Buprenorphine

7.3.4.2 Naloxone

7.3.5 Historic and Forecasted Market Size By By Distribution Channel

7.3.5.1 Hospital Pharmacies

7.3.5.2 Retail Pharmacies

7.3.5.3 Online Pharmacies

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Suboxone Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Drug Type

7.4.4.1 Buprenorphine

7.4.4.2 Naloxone

7.4.5 Historic and Forecasted Market Size By By Distribution Channel

7.4.5.1 Hospital Pharmacies

7.4.5.2 Retail Pharmacies

7.4.5.3 Online Pharmacies

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Suboxone Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Drug Type

7.5.4.1 Buprenorphine

7.5.4.2 Naloxone

7.5.5 Historic and Forecasted Market Size By By Distribution Channel

7.5.5.1 Hospital Pharmacies

7.5.5.2 Retail Pharmacies

7.5.5.3 Online Pharmacies

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Suboxone Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Drug Type

7.6.4.1 Buprenorphine

7.6.4.2 Naloxone

7.6.5 Historic and Forecasted Market Size By By Distribution Channel

7.6.5.1 Hospital Pharmacies

7.6.5.2 Retail Pharmacies

7.6.5.3 Online Pharmacies

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Suboxone Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Drug Type

7.7.4.1 Buprenorphine

7.7.4.2 Naloxone

7.7.5 Historic and Forecasted Market Size By By Distribution Channel

7.7.5.1 Hospital Pharmacies

7.7.5.2 Retail Pharmacies

7.7.5.3 Online Pharmacies

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Suboxone Market Scope:

|

Suboxone Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.52 Billion |

|

Forecast Period 2024-32 CAGR: |

3.91% |

Market Size in 2032: |

USD 9.21 Billion |

|

Segments Covered: |

By Drug Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||