Supplementary Cementitious Materials Market Synopsis:

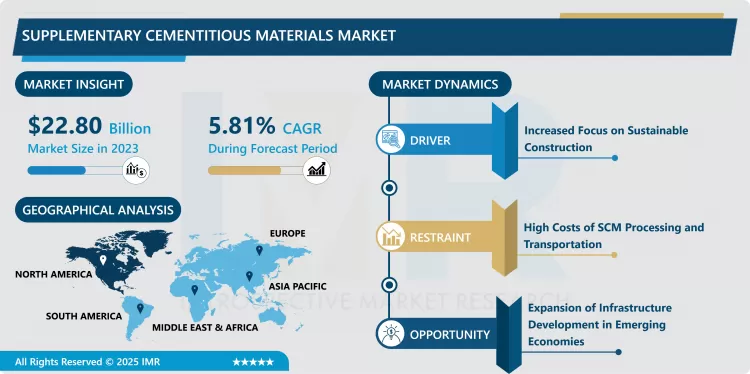

Supplementary Cementitious Materials Market Size Was Valued at USD 22.80 Billion in 2023, and is Projected to Reach USD 37.90 Billion by 2032, Growing at a CAGR of 5.81% From 2024-2032.

This market describes the global trade and use of other materials which include fly ash, silica fume, slag cement and among others that are used in partial replacement of ordinary Portland cement in concrete. These materials enhance the overall capacity, strength, durability and decrease environmental impact of construction processes by adoption of industrial waste and decrease in greenhouse gases emissions.

The SCM market continues to show growth due to the growth in consciousness of sustainable construction and high standard environmental policies that seek to limit carbon footprinting in the cementation and construction businesses. As urban development and infrastructural construction activities increase especially in the emergent economies, SCMs are being used to improve concrete performance and to satisfy extended service life demands. The market is also constrained by the developments in cement and concrete technology which have fostered the compatibility of SCMs to normal cement.

Moreover, SCMs are being encouraged through subsidy incentive, tax credit and policy initiatives across different countries of the world for environmentally sustainable building practices. This has led to adoption of fly and ash and slag cement and other industrial commodities in the different projects. The report indicates that the rising population density, improving sustainability standards for developed cities, and introducing the investment in renewable energy platforms has a positive set on for the SCM market.

Supplementary Cementitious Materials Market Trend Analysis:

Shift Toward Circular Economy

- The growing use of SCMs is one of the major trends toward the circular economy in the construction sector all over the world. SCMs also reduce waste because they often include industrial by-products like fly ash and slag, as well as silica fume which has a low carbon emission. This trend is accompanied by advancements in processing technology that increases the performance of SCMs to facilitate replacement of a higher percentage of Portland cement. Predicated on this growth in the acceptance of circular economy notions, the SCM market is anticipated to grow significantly, particularly in more sustainable-oriented regions.

Expansion of Green Building Initiatives

- The rising trend in green building certifications such as LEED BREEAM offers a clear growth opportunity for the SCM market. Many of these certifications focus on environment friendly material and green building practices and these are some of the advantages of using SCMs. Major cities across the globe continue to aspire to the implementation of near-zero energy status and the increased application of resilience-based construction processes; hence, the need for SCMs is expected to increase in the Asia-Pacific and the Middle East regions.

Supplementary Cementitious Materials Market Segment Analysis:

Supplementary Cementitious Materials Market is Segmented on the basis of Type, End-User, and Region

By Type, Fly Ash segment is expected to dominate the market during the forecast period

- The Fly Ash segment is expected to lead the growing SCM market size within the forecast period. Because fly ash has pozzolanic properties, it has found a ready market as an admixture in concretes produced from coal in thermal power plants. Owing to its ability to offer value for money and its availability it is widely used by builders and contractors. Similarly, the regulatory encouragement towards proper utilization of waste in construction has placed support to the utilization of fly ash across residential as well as commercial construction and infrastructural construction.

By End User, Infrastructure segment expected to held the largest share

- The application segment is expected to dominate the SCM market, as the largest amount of shares will be contributed by the Infrastructure segment. Major works including highways, bridges, airports, and dams can only be delivered in a cost-effective package with materials and systems that shall stand the test of time. SCMs are also essential in improving concrete performance, and decreasing porosity as well as increasing durability of concrete in harsh conditions. It’s projected that increased spending on infrastructure projects worldwide, especially in developing nations, will be strongly behind the continued prominence of this segment.

Supplementary Cementitious Materials Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the SCM market because of the particularly developed construction industry, enhanced environment regulation, and increasing trend of sustainable construction. The region has experienced immense investments in renewable energy projects as well as in improvement of urban infrastructures, which demand high performing concrete containing SCMs. Get full access to this and 1000s of other articles with a full purchase of the Microbiology today report The use of SCMs has been further boosted by the availability of fly ash and slag cement as by products from thermal power plants and steel manufacturing units in the region.

- Also the factors like US federal has a very clear bias towards embracing green building solutions as well as sustainable infrastructure development that make the demand of SCMs stably strong. Another important segment for the regional market is Canada’s construction industry that acts as an important player to increase the building’s life span and decrease the carbon footprint. collectively, these factors put North America as one of the markets with high potential for supplementary cementitious materials consumption in the forecast period.

Active Key Players in the Supplementary Cementitious Materials Market:

- Boral Limited (Australia)

- Cemex S.A.B. de C.V. (Mexico)

- CRH Plc (Ireland)

- Elkem ASA (Norway)

- FlyAshDirect (United States)

- Hanson UK (United Kingdom)

- Holcim Ltd (Switzerland)

- LafargeHolcim (Switzerland)

- Mitsubishi Materials Corporation (Japan)

- Nippon Steel & Sumitomo Metal Corporation (Japan)

- SCB International Materials (United States)

- Salt River Materials Group (United States)

- Tata Steel (India)

- UltraTech Cement Limited (India)

- Vicem Cement (Vietnam)

- Other Active Players

|

Supplementary Cementitious Materials Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.80 Billion |

|

Forecast Period 2024-32 CAGR: |

5.81 % |

Market Size in 2032: |

USD 37.90 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Supplementary Cementitious Materials Market by By Type (2018-2032)

4.1 Supplementary Cementitious Materials Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ferrous Slag

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fly Ash

4.5 Silica Fume

4.6 Slag Cement

4.7 Calcinated Clay

4.8 Gypsum

4.9 Limestone

Chapter 5: Supplementary Cementitious Materials Market by By End User (2018-2032)

5.1 Supplementary Cementitious Materials Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Agriculture

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Residential

5.5 Commercial

5.6 Industrial

5.7 Infrastructure

5.8 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Supplementary Cementitious Materials Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ASBURY CARBONS (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CHINA CARBON GRAPHITE GROUP INC. (CHINA)

6.4 ENEOS CORPORATION (JAPAN)

6.5 FANGDA CARBON NEW MATERIAL CO. LTD. (CHINA)

6.6 GRAFTECH INTERNATIONAL LTD. (UNITED STATES)

6.7 GRAPHITE INDIA LIMITED (INDIA)

6.8 HEG LIMITED (INDIA)

6.9 IMERYS GRAPHITE & CARBON (SWITZERLAND)

6.10 JILIN CARBON CO. LTD. (CHINA)

6.11 NIPPON GRAPHITE INDUSTRIES

6.12 CO. LTD. (JAPAN)

6.13 SEC CARBON LTD. (JAPAN)

6.14 SHOWA DENKO K.K. (JAPAN)

6.15 TOKAI CARBON CO. LTD. (JAPAN)

6.16 TOYO TANSO CO. LTD. (JAPAN)

6.17 XUZHOU JIANGLONG CARBON MANUFACTURE CO. LTD. (CHINA)

6.18 OTHER ACTIVE PLAYERS

Chapter 7: Global Supplementary Cementitious Materials Market By Region

7.1 Overview

7.2. North America Supplementary Cementitious Materials Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Ferrous Slag

7.2.4.2 Fly Ash

7.2.4.3 Silica Fume

7.2.4.4 Slag Cement

7.2.4.5 Calcinated Clay

7.2.4.6 Gypsum

7.2.4.7 Limestone

7.2.5 Historic and Forecasted Market Size By By End User

7.2.5.1 Agriculture

7.2.5.2 Residential

7.2.5.3 Commercial

7.2.5.4 Industrial

7.2.5.5 Infrastructure

7.2.5.6 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Supplementary Cementitious Materials Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Ferrous Slag

7.3.4.2 Fly Ash

7.3.4.3 Silica Fume

7.3.4.4 Slag Cement

7.3.4.5 Calcinated Clay

7.3.4.6 Gypsum

7.3.4.7 Limestone

7.3.5 Historic and Forecasted Market Size By By End User

7.3.5.1 Agriculture

7.3.5.2 Residential

7.3.5.3 Commercial

7.3.5.4 Industrial

7.3.5.5 Infrastructure

7.3.5.6 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Supplementary Cementitious Materials Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Ferrous Slag

7.4.4.2 Fly Ash

7.4.4.3 Silica Fume

7.4.4.4 Slag Cement

7.4.4.5 Calcinated Clay

7.4.4.6 Gypsum

7.4.4.7 Limestone

7.4.5 Historic and Forecasted Market Size By By End User

7.4.5.1 Agriculture

7.4.5.2 Residential

7.4.5.3 Commercial

7.4.5.4 Industrial

7.4.5.5 Infrastructure

7.4.5.6 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Supplementary Cementitious Materials Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Ferrous Slag

7.5.4.2 Fly Ash

7.5.4.3 Silica Fume

7.5.4.4 Slag Cement

7.5.4.5 Calcinated Clay

7.5.4.6 Gypsum

7.5.4.7 Limestone

7.5.5 Historic and Forecasted Market Size By By End User

7.5.5.1 Agriculture

7.5.5.2 Residential

7.5.5.3 Commercial

7.5.5.4 Industrial

7.5.5.5 Infrastructure

7.5.5.6 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Supplementary Cementitious Materials Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Ferrous Slag

7.6.4.2 Fly Ash

7.6.4.3 Silica Fume

7.6.4.4 Slag Cement

7.6.4.5 Calcinated Clay

7.6.4.6 Gypsum

7.6.4.7 Limestone

7.6.5 Historic and Forecasted Market Size By By End User

7.6.5.1 Agriculture

7.6.5.2 Residential

7.6.5.3 Commercial

7.6.5.4 Industrial

7.6.5.5 Infrastructure

7.6.5.6 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Supplementary Cementitious Materials Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Ferrous Slag

7.7.4.2 Fly Ash

7.7.4.3 Silica Fume

7.7.4.4 Slag Cement

7.7.4.5 Calcinated Clay

7.7.4.6 Gypsum

7.7.4.7 Limestone

7.7.5 Historic and Forecasted Market Size By By End User

7.7.5.1 Agriculture

7.7.5.2 Residential

7.7.5.3 Commercial

7.7.5.4 Industrial

7.7.5.5 Infrastructure

7.7.5.6 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Supplementary Cementitious Materials Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.80 Billion |

|

Forecast Period 2024-32 CAGR: |

5.81 % |

Market Size in 2032: |

USD 37.90 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Supplementary Cementitious Materials Market research report is 2024-2032.

Boral Limited (Australia), Cemex S.A.B. de C.V. (Mexico), CRH Plc (Ireland), Elkem ASA (Norway), FlyAshDirect (United States), Hanson UK (United Kingdom), Holcim Ltd (Switzerland), LafargeHolcim (Switzerland), Mitsubishi Materials Corporation (Japan), Nippon Steel & Sumitomo Metal Corporation (Japan), SCB International Materials (United States), Salt River Materials Group (United States), Tata Steel (India), UltraTech Cement Limited (India), Vicem Cement (Vietnam), and Other Active Players.

The Supplementary Cementitious Materials Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Ferrous Slag, Fly Ash, Silica Fume, Slag Cement, Calcinated Clay, Gypsum, and Limestone. By End User, the market is categorized into Agriculture, Residential, Commercial, Industrial, Infrastructure, and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

This market describes the global trade and use of other materials which include fly ash, silica fume, slag cement and among others that are used in partial replacement of ordinary Portland cement in concrete. These materials enhance the overall capacity, strength, durability and decrease environmental impact of construction processes by adoption of industrial waste and decrease in greenhouse gases emissions.

Supplementary Cementitious Materials Market Size Was Valued at USD 22.80 Billion in 2023, and is Projected to Reach USD 37.90 Billion by 2032, Growing at a CAGR of 5.81% From 2024-2032.