Terpene Market Synopsis:

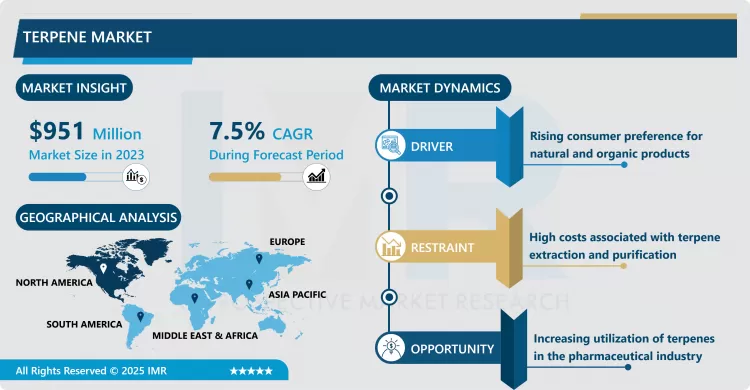

Terpene Market Size Was Valued at USD 951 Million in 2023, and is Projected to Reach USD 1,824 Million by 2032, Growing at a CAGR of 7.5% From 2024-2032.

Terpenes are a group of aliphatic hydrocarbon compounds speaking of their origin with plants, mainly with conifers and cannabis. These compounds are perceived as responsible for the hedonic quality of many plants, more specifically their smell and taste, and they inactivate important functions of the plant defence system. Terpenes are processed and used in several industries namely; pharmaceutical industries, cosmetics, in the food and beverages sector, and the agricultural industries. Used as a medicine in counseling the inflammation, fungi, and oxidation, terpenes have indeed been accorded a lot of attention from the healthcare and wellness sectors. Also, they are employed in natural solvents, fragrance components and as bio feedstocks for synthesis of other valued fine chemicals. Main consumer trends, such as the shift towards natural and organic products, have boosted the terpene market’s growth in the ongoing year worldwide.

The terpene market is gradually increasing its shares in the global economy because of the increased use of eco-friendly products and bioactive compounds in various industries. In the pharmaceutical industry, terpenes have found their application in the synthesis of modern drugs that target chronic illnesses such as cancer and nervous disorders because of their anti-inflammatory and anti microbial attributes. In the same way, terpenes are emerging in the food and beverage market as natural flavoring and fragrance compounds due to the cleaner-label claim trend. Moreover, the cosmetic and personal care industry strongly accept terpenes for their use as a raw material for environment-friendly and organic product formulation, and thus it often includes in skincare and haircare products.

This market’s also driven by the technical innovation in extraction technology to get purity from natural sources of terpenes. Together with the constantly progressing legalization and marketing of cannabis products, aromatic substances extracted from cannabis plants – the terpenes – are gaining popularity due to their therapeutic and recreational qualities. Concerns for cutting emissions trading has also contributed to the pursuit of bio-based materials and with terpenes serve suitability in a multiplicity of uses.

Terpene Market Trend Analysis:

The Growing Popularity of Cannabis-Derived Terpenes

- The other key trend noticeable in the terpene market is the growing interest in cannabis-derived terpenes. Such terpenes are not only effective in terms of their therapeutic value, but also insofar as they contribute to the top notes of cannabis products. Cannabis, for medical and recreational use, is now legal in most developed economies and its manufacturers are funding research as they too seek to harness this basket. Thus, more and more terpenes originate from cannabis and are used in the production of vape pens, edibles, and tinctures from cannabis; As well as the cannabis strains needed to meet the needs of various consumers. These factors are believed to further intensify market development in the years to come primarily in places where the legalization of cannabis is gradually advancing.

Rising Demand for Terpenes in Pharmaceuticals

- The expanding usage of natural compounds by the pharmaceutical industry in drug formulation has created a great market for terpenes. The more people learn the side effect of synthetic products, the more they shift to natural products with fewer side effects or no side at all. Because of the scientifically noted curative abilities of terpenes such as anti-cancer, anti-inflammatory, neuro-degenerative abilities it could be rightfully targeted for forming the basis of new generation of medicines. They are also working on strains that highlight effects of certain terpenes together with cannabinoids to develop new pathways of managing chronic pains, anxiety and sleep disorders. This is further supported by rising investments in clinical studies and regulatory approvals for novel terpene-based pharmaceuticals and growth of this market will be substantial.

Terpene Market Segment Analysis:

Terpene Market is Segmented on the basis of Type, Source, Application, and End-User

By Type, Myrcene segment is expected to dominate the market during the forecast period

- Myrcene is expected to continue as one of the leading terpenes within the terpene market, across the forecast period, owing to the uses and medicinal properties of this particular terpene. The use of Myrcene is manifold in the pharmaceutical industry because it has the qualities of an analgesic, an anti-inflammatory and a sedative, which makes the substance a component for the treatment of diseases associated with pain and anxiety. Its easy to get aroma and taste coupled with this ‘it is widely used in the food and beverages as well as cosmetics industries.

- In addition, because of myrcene’s ability to boost the effects of cannabinoids particularly THC, the compound is used industrially in the marijuana business. Most often it is used in cannabis-infused products such as tinctures, oils, and gels to produce innovative blends that will address various consumer demands. As new uses are discovered through constant research, future development of the special myrcene segment is expected to expand which would contribute to a stronger hold of market leader position.

By Source, Natural segment expected to held the largest share

- It is predicted that the natural segment has the largest market share of terpenes due to the rising demand for natural and non-synthetic products on the market. Monterpenes of natural origin from coniferous trees, citrus fruits, and cannabis have become popular due to the absence of toxicity to humans, environment friendliness, and renewable nature. Petroleum-based industries like cosmetics and personal care are considerably dependent on natural terpenes for developing environment-friendly products.

- Further, as the material derived from plants, natural terpenes also find a wide application in the food and beverage sector as the flavoring agent with evidence for their safety and genuineness over synthetic counterparts. The pharma sector also receives a boost from terpenes, because these compounds are typically effective at a higher level than synthetic ones. This growth promise increases across various industries and guarantees the natural segment’s continued dominance in the terpene market.

Terpene Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North Americam equalled to be the largest spreading area of Terpenes in 2023 occupying approximately a third of global market demand. This growth is predominantly because cannabis has become legal and commercialized in the United States of America and Canada with people demanding terpenes from cannabis plants. Another advantage of the location is the well-developed pharmaceutical & cosmetic industry where business focus is on natural products. Moreover, the improvement of end methods for terpene separation and the shifting emphasis on environmentally friendly products have created the image of North America as the region of terpene development. In addition, existence of strategic market players and increasing investment on research and development add the strength to the regional market leadership.

Active Key Players in the Terpene Market:

- Arora Aromatics (India)

- BASF SE (Germany)

- Berjé Inc. (USA)

- Bordas Chinchurreta Distillations (Spain)

- DRT (France)

- Firmenich International SA (Switzerland)

- Hindustan Mint & Agro Products (India)

- Kuraray Co., Ltd. (Japan)

- Mentha & Allied Products (India)

- Penta Manufacturing Company (USA)

- Privi Speciality Chemicals Limited (India)

- Santa Cruz Biotechnology, Inc. (USA)

- Symrise AG (Germany)

- Takasago International Corporation (Japan)

- YASUHARA CHEMICAL Co., Ltd. (Japan)

- Other Active Players

|

Terpene Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 951 Million |

|

Forecast Period 2024-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 1,824 Million |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Terpene Market by By Type (2018-2032)

4.1 Terpene Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Myrcene

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Limonene

4.5 Pinene

4.6 Linalool

4.7 Other Product Types

Chapter 5: Terpene Market by By Source (2018-2032)

5.1 Terpene Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Natural

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Synthetic

Chapter 6: Terpene Market by By Application (2018-2032)

6.1 Terpene Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cosmetics & Personal Care

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Food & Beverage

6.5 Pharmaceuticals

6.6 Other Applications

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Terpene Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARORA AROMATICS (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BASF SE (GERMANY)

7.4 BERJÉ INC. (USA)

7.5 BORDAS CHINCHURRETA DISTILLATIONS (SPAIN)

7.6 DRT (FRANCE)

7.7 FIRMENICH INTERNATIONAL SA (SWITZERLAND)

7.8 HINDUSTAN MINT & AGRO PRODUCTS (INDIA)

7.9 KURARAY CO. LTD. (JAPAN)

7.10 MENTHA & ALLIED PRODUCTS (INDIA)

7.11 PENTA MANUFACTURING COMPANY (USA)

7.12 PRIVI SPECIALITY CHEMICALS LIMITED (INDIA)

7.13 SANTA CRUZ BIOTECHNOLOGY INC. (USA)

7.14 SYMRISE AG (GERMANY)

7.15 TAKASAGO INTERNATIONAL CORPORATION (JAPAN)

7.16 YASUHARA CHEMICAL CO. LTD. (JAPAN)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Terpene Market By Region

8.1 Overview

8.2. North America Terpene Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Myrcene

8.2.4.2 Limonene

8.2.4.3 Pinene

8.2.4.4 Linalool

8.2.4.5 Other Product Types

8.2.5 Historic and Forecasted Market Size By By Source

8.2.5.1 Natural

8.2.5.2 Synthetic

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Cosmetics & Personal Care

8.2.6.2 Food & Beverage

8.2.6.3 Pharmaceuticals

8.2.6.4 Other Applications

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Terpene Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Myrcene

8.3.4.2 Limonene

8.3.4.3 Pinene

8.3.4.4 Linalool

8.3.4.5 Other Product Types

8.3.5 Historic and Forecasted Market Size By By Source

8.3.5.1 Natural

8.3.5.2 Synthetic

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Cosmetics & Personal Care

8.3.6.2 Food & Beverage

8.3.6.3 Pharmaceuticals

8.3.6.4 Other Applications

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Terpene Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Myrcene

8.4.4.2 Limonene

8.4.4.3 Pinene

8.4.4.4 Linalool

8.4.4.5 Other Product Types

8.4.5 Historic and Forecasted Market Size By By Source

8.4.5.1 Natural

8.4.5.2 Synthetic

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Cosmetics & Personal Care

8.4.6.2 Food & Beverage

8.4.6.3 Pharmaceuticals

8.4.6.4 Other Applications

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Terpene Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Myrcene

8.5.4.2 Limonene

8.5.4.3 Pinene

8.5.4.4 Linalool

8.5.4.5 Other Product Types

8.5.5 Historic and Forecasted Market Size By By Source

8.5.5.1 Natural

8.5.5.2 Synthetic

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Cosmetics & Personal Care

8.5.6.2 Food & Beverage

8.5.6.3 Pharmaceuticals

8.5.6.4 Other Applications

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Terpene Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Myrcene

8.6.4.2 Limonene

8.6.4.3 Pinene

8.6.4.4 Linalool

8.6.4.5 Other Product Types

8.6.5 Historic and Forecasted Market Size By By Source

8.6.5.1 Natural

8.6.5.2 Synthetic

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Cosmetics & Personal Care

8.6.6.2 Food & Beverage

8.6.6.3 Pharmaceuticals

8.6.6.4 Other Applications

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Terpene Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Myrcene

8.7.4.2 Limonene

8.7.4.3 Pinene

8.7.4.4 Linalool

8.7.4.5 Other Product Types

8.7.5 Historic and Forecasted Market Size By By Source

8.7.5.1 Natural

8.7.5.2 Synthetic

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Cosmetics & Personal Care

8.7.6.2 Food & Beverage

8.7.6.3 Pharmaceuticals

8.7.6.4 Other Applications

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Terpene Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 951 Million |

|

Forecast Period 2024-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 1,824 Million |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Terpene Market research report is 2024-2032.

Arora Aromatics (India),BASF SE (Germany),Berjé Inc. (USA),Bordas Chinchurreta Distillations (Spain),DRT (France),Firmenich International SA (Switzerland),Hindustan Mint & Agro Products (India),Kuraray Co., Ltd. (Japan),Mentha & Allied Products (India),Penta Manufacturing Company (USA),Privi Speciality Chemicals Limited (India),Santa Cruz Biotechnology, Inc. (USA),Symrise AG (Germany),Takasago International Corporation (Japan),YASUHARA CHEMICAL Co., Ltd. (Japan), and Other Active Players.

The Terpene Market is segmented into Type, Source, Application and region. By Type, the market is categorized into Myrcene, Limonene, Pinene, Linalool, Other Product Types. By Source, the market is categorized into Natural, Synthetic. By Application, the market is categorized into Cosmetics & Personal Care, Food & Beverage, Pharmaceuticals, Other Applications. By region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe),Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC),Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa),South America (Brazil, Argentina, Rest of SA).

Terpenes are a group of aliphatic hydrocarbon compounds speaking of their origin with plants, mainly with conifers and cannabis. These compounds are perceived as responsible for the hedonic quality of many plants, more specifically their smell and taste, and they inactivate important functions of the plant defence system. Terpenes are processed and used in several industries namely; pharmaceutical industries, cosmetics, in the food and beverages sector, and the agricultural industries. Used as a medicine in counseling the inflammation, fungi, and oxidation, terpenes have indeed been accorded a lot of attention from the healthcare and wellness sectors. Also, they are employed in natural solvents, fragrance components and as bio feedstocks for synthesis of other valued fine chemicals. Main consumer trends, such as the shift towards natural and organic products, have boosted the terpene market’s growth in the ongoing year worldwide.

Terpene Market Size Was Valued at USD 951 Million in 2023, and is Projected to Reach USD 1,824 Million by 2032, Growing at a CAGR of 7.5% From 2024-2032.