Terpineol Market Synopsis:

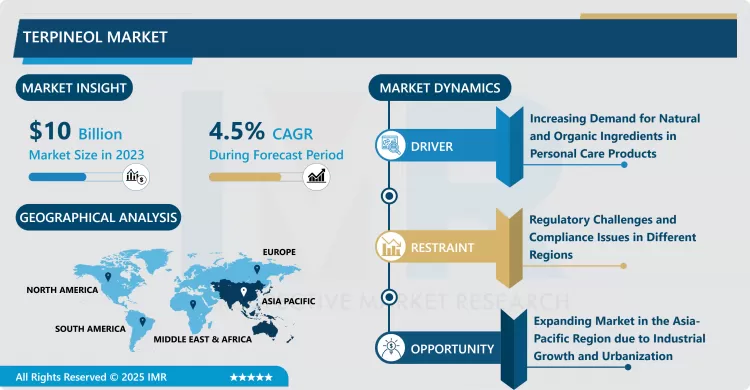

Terpineol Market Size Was Valued at USD 10.00 Billion in 2023, and is Projected to Reach USD 14.86 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032.

Terpineol is an example of naturally occurring monoterpene alcohol which possesses flower like odor and is use in fragrances, cosmetics and in cleaning solutions. It occurs from essential oils for example pine and has varieties of isomers that are alpha terpineol, beta terpineol then gamma terpineol. It has antibacterial properties that make it to be used in personal care products, pharmaceuticals and as industrial chemicals.

The expansion of Terpineol market is largely attributed to the rising need for natural products in personal care and cosmetics. Since the consumers are gradually paying more attention to the quality foods and products, producers have integrated natural terpenes like terpineol into their products. This trend can be attributed to the current developments across the global continent where the emphasis is made to sustainable and environmental conservation products.

Another reason is the increasing use of terpineol for pharmaceutical applications attributable to its antimicrobial and antioxidant characteristics. Recent studies have also pointed that Terpineol has therapeutic uses for it has properties such as anti-bacterial, anti-inflammatory and analgesic properties. This has made its use more and more incorporated into many healthcare products hence boosting the market.

Terpineol Market Trend Analysis

Natural and plant-based products

- Another factor that Terpineol market has gotten to be accustomed to is the global push to natural and plant-based products. With the demand of synthetic chemicals falling, manufacturers are looking for other alternatives, such as using terpineol, in fragrances, cosmetics and skincare products. This shift is made worse by the consumer’s inclination towards buying green and sustainable products.

- The second important concept is the trend, that has been observed over the recent years concerning the research and development activities carried out on the effectiveness of the terpineol in question on the health of individuals. As more research continue to surface on how effective it is in eradication of different ailments and fortification of immune system, the pharmacy industries are likely to extend their incorporation of terpineol in drugs and medicinal recipes.

Consumers gain more knowledge about the effects of natural compounds

- Global wellness and personal care industry has been growing steadily, and it offers a perfect opportunity for Terpineol market. As consumers gain more knowledge about the effects of natural compounds in increasing their life span and enhancing their beauty, formulations based on terpineol find their market. It is an ideal time for firms that consider themselves as market leaders to focus and build on natural products.

- Also, there is a growing scope in Asia-Pacific because personal care products, cleaning agents, and pharmaceutical are in high demand in this area. It was identified that the need for terpineol is likely to be hastened by the growing middle population and urbanization particularly in the Asian giants including China and India.

Terpineol Market Segment Analysis:

Terpineol Market is Segmented on the basis of Type, Application, End-Use Industry, and Region

By Type, Alpha-Terpineol segment is expected to dominate the market during the forecast period

- The Terpineol market is categorized into four types: Thus, the compounds to be studied includes are Alpha-Terpineol, Beta-Terpineol, Gamma-Terpineol and a Mixture of Terpineols. Of these, Alpha-Terpineol has the highest demand and market share because it has a better fragrance, compared to other terpenes, and has antimicrobial properties as well. Apparently, Beta-Terpineol and Gamma-Terpineol are employed in particular applications where attributed specific chemical characteristics are needed, for instance, in the preparation of medication compound. Terpineols blends are more commonly used especially when they solve multiple problems in cleaning agents and personal care formulations.

By Application, Fragrance and Cosmetics segment expected to held the largest share

- Based on its application the Terpineol market can be categorized as Fragrance and Cosmetics, Pharmaceuticals, Cleaning Products, Food and Beverages, Industrial and Manufacturing and Other. In the fragrance and cosmetics segment, terpineol is applied since it possess a floral fragrance and its antimicrobial characteristics. It is used therapeutic in the pharmaceuticals it because of its therapeutic qualities such as; anti-inflammatory and analgesic values. It is also widely used in cleaning products in light of its disinfecting nature due to its stability. In the food and beverage production facilities, the substance applies in flavoring products. Furthermore, terpineol is used in industrial purposes in manufacturing industrial product including paints, coating and solvents.

Terpineol Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region has the largest consumption owing to sound infrastructure in the automotive industry and has seen significant growth in the demand for cosmetic, pharmaceutical, and cleaning agents. The large population pool, rising disposable income and changing consumer preference towards natural and organic food are well developed in nations such as china, India and Japan. As well, there is the increasing size of the manufacturing industry in the region as Terpineol is becoming more used in production processes.

- There is a rapidly rising market for natural and sustainable products and thus this product and its derivatives are expected to see a large growth in this region as it is targeted both by the consumer and the industrial markets. The Asia-Pacific market also continues to advance due to the introduction of terpineol for various products by more manufacturers within the region contributing towards the domination of the market in the global market.

Active Key Players in the Terpineol Market:

- Arizona Chemical (USA)

- BASF (Germany)

- Borregaard (Norway)

- DSM (Netherlands)

- Kraton Polymers (USA)

- LyondellBasell Industries (USA)

- Sappi Lanaken (Belgium)

- Solvay (Belgium)

- The Good Scents Company (USA)

- Zhejiang NHU Company (China)

- Other Active Players

|

Terpineol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.00 Billion |

|

Forecast Period 2024-32 CAGR: |

4.50 % |

Market Size in 2032: |

USD 14.86 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Terpineol Market by By Type (2018-2032)

4.1 Terpineol Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Alpha-Terpineol

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Beta-Terpineol

4.5 Gamma-Terpineol

4.6 Mixture of Terpineols

Chapter 5: Terpineol Market by By Application (2018-2032)

5.1 Terpineol Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fragrance and Cosmetics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceuticals

5.5 Cleaning Products

5.6 Food and Beverages

5.7 Industrial and Manufacturing

5.8 Others

Chapter 6: Terpineol Market by By End-Use Industry (2018-2032)

6.1 Terpineol Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Personal Care

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Home Care

6.5 Pharmaceuticals

6.6 Industrial

6.7 Food and Beverage

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Terpineol Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 KRATON POLYMERS (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ZHEJIANG NHU COMPANY (CHINA)

7.4 SOLVAY (BELGIUM)

7.5 DSM (NETHERLANDS)

7.6 THE GOOD SCENTS COMPANY (USA)

7.7 LYONDELLBASELL INDUSTRIES (USA)

7.8 ARIZONA CHEMICAL (USA)

7.9 SAPPI LANAKEN (BELGIUM)

7.10 BORREGAARD (NORWAY)

7.11 BASF (GERMANY)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Terpineol Market By Region

8.1 Overview

8.2. North America Terpineol Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Alpha-Terpineol

8.2.4.2 Beta-Terpineol

8.2.4.3 Gamma-Terpineol

8.2.4.4 Mixture of Terpineols

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Fragrance and Cosmetics

8.2.5.2 Pharmaceuticals

8.2.5.3 Cleaning Products

8.2.5.4 Food and Beverages

8.2.5.5 Industrial and Manufacturing

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By By End-Use Industry

8.2.6.1 Personal Care

8.2.6.2 Home Care

8.2.6.3 Pharmaceuticals

8.2.6.4 Industrial

8.2.6.5 Food and Beverage

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Terpineol Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Alpha-Terpineol

8.3.4.2 Beta-Terpineol

8.3.4.3 Gamma-Terpineol

8.3.4.4 Mixture of Terpineols

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Fragrance and Cosmetics

8.3.5.2 Pharmaceuticals

8.3.5.3 Cleaning Products

8.3.5.4 Food and Beverages

8.3.5.5 Industrial and Manufacturing

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By By End-Use Industry

8.3.6.1 Personal Care

8.3.6.2 Home Care

8.3.6.3 Pharmaceuticals

8.3.6.4 Industrial

8.3.6.5 Food and Beverage

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Terpineol Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Alpha-Terpineol

8.4.4.2 Beta-Terpineol

8.4.4.3 Gamma-Terpineol

8.4.4.4 Mixture of Terpineols

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Fragrance and Cosmetics

8.4.5.2 Pharmaceuticals

8.4.5.3 Cleaning Products

8.4.5.4 Food and Beverages

8.4.5.5 Industrial and Manufacturing

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By By End-Use Industry

8.4.6.1 Personal Care

8.4.6.2 Home Care

8.4.6.3 Pharmaceuticals

8.4.6.4 Industrial

8.4.6.5 Food and Beverage

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Terpineol Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Alpha-Terpineol

8.5.4.2 Beta-Terpineol

8.5.4.3 Gamma-Terpineol

8.5.4.4 Mixture of Terpineols

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Fragrance and Cosmetics

8.5.5.2 Pharmaceuticals

8.5.5.3 Cleaning Products

8.5.5.4 Food and Beverages

8.5.5.5 Industrial and Manufacturing

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By By End-Use Industry

8.5.6.1 Personal Care

8.5.6.2 Home Care

8.5.6.3 Pharmaceuticals

8.5.6.4 Industrial

8.5.6.5 Food and Beverage

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Terpineol Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Alpha-Terpineol

8.6.4.2 Beta-Terpineol

8.6.4.3 Gamma-Terpineol

8.6.4.4 Mixture of Terpineols

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Fragrance and Cosmetics

8.6.5.2 Pharmaceuticals

8.6.5.3 Cleaning Products

8.6.5.4 Food and Beverages

8.6.5.5 Industrial and Manufacturing

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By By End-Use Industry

8.6.6.1 Personal Care

8.6.6.2 Home Care

8.6.6.3 Pharmaceuticals

8.6.6.4 Industrial

8.6.6.5 Food and Beverage

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Terpineol Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Alpha-Terpineol

8.7.4.2 Beta-Terpineol

8.7.4.3 Gamma-Terpineol

8.7.4.4 Mixture of Terpineols

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Fragrance and Cosmetics

8.7.5.2 Pharmaceuticals

8.7.5.3 Cleaning Products

8.7.5.4 Food and Beverages

8.7.5.5 Industrial and Manufacturing

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By By End-Use Industry

8.7.6.1 Personal Care

8.7.6.2 Home Care

8.7.6.3 Pharmaceuticals

8.7.6.4 Industrial

8.7.6.5 Food and Beverage

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Terpineol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.00 Billion |

|

Forecast Period 2024-32 CAGR: |

4.50 % |

Market Size in 2032: |

USD 14.86 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Terpineol Market research report is 2024-2032.

Arizona Chemical (USA),BASF (Germany),Borregaard (Norway),DSM (Netherlands),Kraton Polymers (USA),LyondellBasell Industries (USA),Sappi Lanaken (Belgium),Solvay (Belgium),The Good Scents Company (USA),Zhejiang NHU Company (China), and Other Active Players.

The Terpineol Market is segmented into By Type, By Application, By End-Use Industry and region. By Type, the market is categorized into Alpha-Terpineol, Beta-Terpineol, Gamma-Terpineol, Mixture of Terpineols. By Application, the market is categorized into Fragrance and Cosmetics, Pharmaceuticals, Cleaning Products, Food and Beverages, Industrial and Manufacturing, Others. By End-Use Industry, the market is categorized into Personal Care, Home Care, Pharmaceuticals, Industrial, Food and Beverage. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Terpineol is an example of naturally occurring monoterpene alcohol which possesses flower like odor and is use in fragrances, cosmetics and in cleaning solutions. It occurs from essential oils for example pine and has varieties of isomers that are alpha terpineol, beta terpineol then gamma terpineol. It has antibacterial properties that make it to be used in personal care products, pharmaceuticals and as industrial chemicals.

Terpineol Market Size Was Valued at USD 10.00 Billion in 2023, and is Projected to Reach USD 14.86 Billion by 2032, Growing at a CAGR of 4.50 % From 2024-2032.