Thermal Paper Market Synopsis:

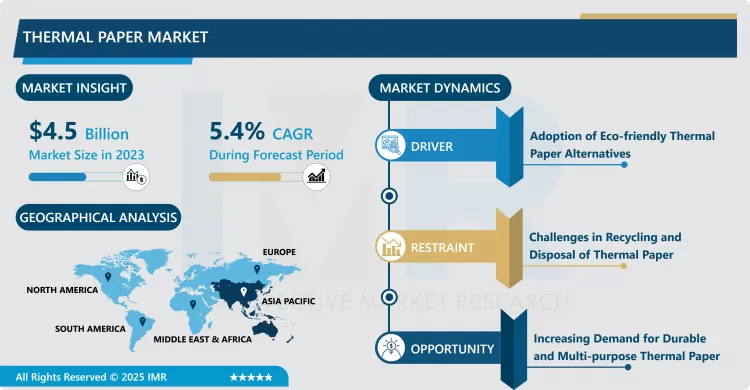

Thermal Paper Market Size Was Valued at USD 4.50 Billion in 2023, and is Projected to Reach USD 7.22 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.

The thermal paper industry relates to the industry that deals with production and sale of paper that undergoes chemical reactions in formation of images depending on heat mainly used in POS, ticketing and labeling. These papers have a unique coating that takes a heat treatment instead of ink giving a visible image or text when heat is applied on them. Receipt printers, gaming tickets, barcodes or labels, thermal papers find usage across retail, healthcare, and logistics industries.

The use of thermal paper is predominantly been propounded by the increasing demand for point of sale (POS) terminals in the retail and restaurant industry. Thermal paper has been preferred in businesses due to the rising demand for fast, cheap and high-quality prints which are not achievable in the traditional ink jet methods. As a result of a reviving retail sales, restaurants, and supermarkets, there has been a rise in the demand for thermal papers.

Other factor is the trend towards the use of online payment and self-service terminals, making use of thermo-active printing papers for receipts and tickets. Thermal paper is being increasingly demanded in such sectors as gaming, entertainment, and logistics in view of the need to introduce effective ticketing and labeling systems.

Thermal Paper Market Trend Analysis:

Production of environmentally friendly materials

- One of the observed trends in the thermal paper market is the need to reorient to the production of environmentally friendly materials. The environmental conservation practices coming into force has seen manufacturers adopt the use of safe thermal paper free from chemical components like BPA or BPS which are present in ordinary thermal papers. This is because markets have been pulled by consumers and pushed by regulations with an increased focus to environmental standards in some jurisdictions.

- Moreover, GHGRAPH developed multilayer and other technologies to upgrade and create thermal paper with higher qualities and performances are emerging as possible trends. These papers provide improved thermal and chemical stability, which allows their use in applications that are more challenging and are characteristic of a wide range of transport and storage industries.

Growing areas of e-commerce and online retail sales

- The thermal paper market’s possibility for development can be attributed to the growing areas of e-commerce and online retail sales. These sectors are at the moment expanding and since companies need shipping labels and barcode printing, thermal paper suppliers can easily penetrate into this expanding market. Moreover, with e commerce companies seeking to keep their supply chain quiet, more companies are turning to thermal printing technology as its use in inventory, order picking and product labeling increases.

- Another opportunity comes from other regions of Asia Pacific and Africa, where there is high rate of industrialization and urbanization to realize demand for thermal paper in the retail and service industries. This region has also demonstrated signs of growth most especially in the country experiencing growth in the retail and transportation networks thus opening up more opportunities for suppliers to penetrate through.

Thermal Paper Market Segment Analysis:

Thermal Paper Market is Segmented on the basis of Product Type, Application, End-use Industry, and Region

By Product Type, Plain Thermal Paper segment is expected to dominate the market during the forecast period

- On the basis of product type the thermal paper market has been divided into plain thermal paper, coated thermal paper and synthetic thermal paper. Plain thermal paper is normally used in typical applications Where ordinary printing such as receipts is required. Thermal paper with a second coating layer is used for those applications that need sharper images as well as the images which you want to appear longer. Thermal paper of synthetic material such as plastic is becoming common for attachments where the paper is likely to be used in areas such as the outdoors or industrial environment.

By Application, POS segment expected to held the largest share

- The Thermal paper is also categorized depending on its application areas especially for business such as point of sale (POS) systems, lottery & gaming, labels & tags, tickets and others. POS systems as the most popular devices are influenced by the prevalence of thermal printers in the outlets. The lottery and gaming segment of this market depends on thermal paper for printing tickets and gaming vouchers. The labels & tags segment uses thermal paper for better durability in bar code & product label printing. Moreover, ticket segment entails thermal printing of transport tickets, event and entertainment tickets and Thermal paper is widely used due to its capability to print at an extremely high speed and high quality resolution.

Thermal Paper Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The thermal paper is most popular in the Asia-Pacific area as it takes the largest market share. This dominance is attributed to fast industrialization and increasing trends in the retail and transport industries especially in China, India and Japan. The demand for thermal printing in the Asia Pacific region specifically in the areas of retailing, logistics and transportation is also put forward as a explanation for market growth. Also, there are advantages of thermal paper products which include low costs per print and a capacity to supply the required volumes for high turnover use in the region.

- Further, the increasing proliferation of digital payments and the adoption of self-service check-in kiosks in the Asia Pacific area drives a market for thermal paper. The consumers in this region are not only diverse but are also growing which promotes the thermal printers hence confirming this region as the global leader.

Active Key Players in the Thermal Paper Market:

- Appvion (USA)

- BillerudKorsnäs (Sweden)

- Hansol Paper (South Korea)

- International Paper (USA)

- Koehler Paper Group (Germany)

- Mitsubishi Paper Mills Limited (Japan)

- Oji Holdings Corporation (Japan)

- PDI (Paper and Dispensers International) (USA)

- Ricoh Company, Ltd. (Japan)

- Sappi Lanaken Mill (Belgium)

- Other Active Players

|

Thermal Paper Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.50 Billion |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 7.22 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End-use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Thermal Paper Market by By Product Type (2018-2032)

4.1 Thermal Paper Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Plain Thermal Paper

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Coated Thermal Paper

4.5 Synthetic Thermal Paper

Chapter 5: Thermal Paper Market by By Application (2018-2032)

5.1 Thermal Paper Market Snapshot and Growth Engine

5.2 Market Overview

5.3 POS (Point of Sale) Systems

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Lottery & Gaming

5.5 Labels & Tags

5.6 Tickets

5.7 Others

Chapter 6: Thermal Paper Market by By End-use Industry (2018-2032)

6.1 Thermal Paper Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Healthcare

6.5 Transportation

6.6 Banking & Financial Services

6.7 Entertainment

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Thermal Paper Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 APPVION (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 OJI HOLDINGS CORPORATION (JAPAN)

7.4 MITSUBISHI PAPER MILLS LIMITED (JAPAN)

7.5 HANSOL PAPER (SOUTH KOREA)

7.6 KOEHLER PAPER GROUP (GERMANY)

7.7 SAPPI LANAKEN MILL (BELGIUM)

7.8 PDI (PAPER AND DISPENSERS INTERNATIONAL) (USA)

7.9 BILLERUDKORSNÄS (SWEDEN)

7.10 INTERNATIONAL PAPER (USA)

7.11 RICOH COMPANY LTD. (JAPAN)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Thermal Paper Market By Region

8.1 Overview

8.2. North America Thermal Paper Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Plain Thermal Paper

8.2.4.2 Coated Thermal Paper

8.2.4.3 Synthetic Thermal Paper

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 POS (Point of Sale) Systems

8.2.5.2 Lottery & Gaming

8.2.5.3 Labels & Tags

8.2.5.4 Tickets

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By By End-use Industry

8.2.6.1 Retail

8.2.6.2 Healthcare

8.2.6.3 Transportation

8.2.6.4 Banking & Financial Services

8.2.6.5 Entertainment

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Thermal Paper Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Plain Thermal Paper

8.3.4.2 Coated Thermal Paper

8.3.4.3 Synthetic Thermal Paper

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 POS (Point of Sale) Systems

8.3.5.2 Lottery & Gaming

8.3.5.3 Labels & Tags

8.3.5.4 Tickets

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By By End-use Industry

8.3.6.1 Retail

8.3.6.2 Healthcare

8.3.6.3 Transportation

8.3.6.4 Banking & Financial Services

8.3.6.5 Entertainment

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Thermal Paper Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Plain Thermal Paper

8.4.4.2 Coated Thermal Paper

8.4.4.3 Synthetic Thermal Paper

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 POS (Point of Sale) Systems

8.4.5.2 Lottery & Gaming

8.4.5.3 Labels & Tags

8.4.5.4 Tickets

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By By End-use Industry

8.4.6.1 Retail

8.4.6.2 Healthcare

8.4.6.3 Transportation

8.4.6.4 Banking & Financial Services

8.4.6.5 Entertainment

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Thermal Paper Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Plain Thermal Paper

8.5.4.2 Coated Thermal Paper

8.5.4.3 Synthetic Thermal Paper

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 POS (Point of Sale) Systems

8.5.5.2 Lottery & Gaming

8.5.5.3 Labels & Tags

8.5.5.4 Tickets

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By By End-use Industry

8.5.6.1 Retail

8.5.6.2 Healthcare

8.5.6.3 Transportation

8.5.6.4 Banking & Financial Services

8.5.6.5 Entertainment

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Thermal Paper Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Plain Thermal Paper

8.6.4.2 Coated Thermal Paper

8.6.4.3 Synthetic Thermal Paper

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 POS (Point of Sale) Systems

8.6.5.2 Lottery & Gaming

8.6.5.3 Labels & Tags

8.6.5.4 Tickets

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By By End-use Industry

8.6.6.1 Retail

8.6.6.2 Healthcare

8.6.6.3 Transportation

8.6.6.4 Banking & Financial Services

8.6.6.5 Entertainment

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Thermal Paper Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Plain Thermal Paper

8.7.4.2 Coated Thermal Paper

8.7.4.3 Synthetic Thermal Paper

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 POS (Point of Sale) Systems

8.7.5.2 Lottery & Gaming

8.7.5.3 Labels & Tags

8.7.5.4 Tickets

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By By End-use Industry

8.7.6.1 Retail

8.7.6.2 Healthcare

8.7.6.3 Transportation

8.7.6.4 Banking & Financial Services

8.7.6.5 Entertainment

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Thermal Paper Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.50 Billion |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 7.22 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End-use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Thermal Paper Market research report is 2024-2032.

Appvion (USA), Oji Holdings Corporation (Japan), Mitsubishi Paper Mills Limited (Japan), Hansol Paper (South Korea), Koehler Paper Group (Germany), Sappi Lanaken Mill (Belgium), PDI (Paper and Dispensers International) (USA), BillerudKorsnäs (Sweden), International Paper (USA), Ricoh Company, Ltd. (Japan). and Other Active Players.

The Thermal Paper Market is segmented into By Product Type, By Application, By End-use Industry and region. By Product Type, the market is categorized into Plain Thermal Paper, Coated Thermal Paper, Synthetic Thermal Paper. By Application, the market is categorized into POS (Point of Sale) Systems, Lottery & Gaming, Labels & Tags, Tickets, Others. By End-use Industry, the market is categorized into Retail, Healthcare, Transportation, Banking & Financial Services, Entertainment, Others. By region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe),Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC),Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa),South America (Brazil, Argentina, Rest of SA).

The thermal paper industry relates to the industry that deals with production and sale of paper that undergoes chemical reactions in formation of images depending on heat mainly used in POS, ticketing and labeling. These papers have a unique coating that takes a heat treatment instead of ink giving a visible image or text when heat is applied on them. Receipt printers, gaming tickets, barcodes or labels, thermal papers find usage across retail, healthcare, and logistics industries.

Thermal Paper Market Size Was Valued at USD 4.50 Billion in 2023, and is Projected to Reach USD 7.22 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.