Thermal Printing Market Synopsis:

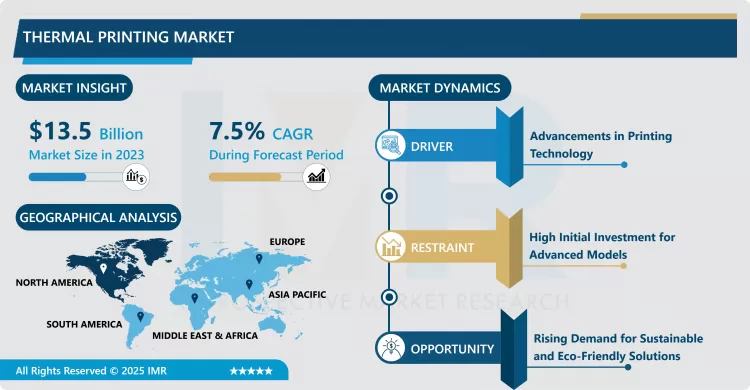

Thermal Printing Market Size Was Valued at USD 13.50 Billion in 2023, and is Projected to Reach USD 25.88 Billion by 2032, Growing at a CAGR of 7.50 % From 2024-2032.

Thermal printing is also defined as the usage of heat to either transfer ink or form images on paper, labels and other products. It involves two primary technologies: two processes which are well known in the market, namely the direct thermal printing and the thermal transfer printing. Thermal printing practices can be applied in various industries for instance retailing, supply chain sectors and most importantly the health-related sectors and even the food industry for instance printing of barcodes, receipts, and labels. Major trends influencing the market’s expansion include the development of online retail sales, and the media and printing markets, as well as an emerging customer requirement for high-quality economical labeling solutions.

Thermal print head is expected to be pushed by the increase in labels and receipts usage in the retail shops and logistics companies. This factor is expected to enhance the growth of the global market since faster and efficient labeling solutions are needed as e-commerce grows. Thermal printers are becoming popular today as they are cheaper, faster and more durable to cater for the processing needs of the new generations.

Another driver is the impending demand by the health sector in the identification of patients together with medical labeling. Reliability and accuracy in the creation of long-lasting labels to identify medication and patients’ records increases adoption of the thermal printing in this industry. At the same time, continuing developments in thermal printing technologies have led to improvements in energy efficiency and decreased operating expenses; thus, increasing application among global industries.

Thermal Printing Market Trend Analysis:

Usage of compact thermal printers have become highly required

- Wireless and mobile thermal printing solution, is on the rise is one of the trends of thermal printing industry. The usage of compact thermal printers has become highly required for mobile usage in some industries such as retail healthcare and logistics for easy portability that enables connection to mobile devices. This trend is improving operational effectiveness particularly in mobile modes of operations.

- Another constantly evolving area is the availability of the options on the ecological thermal printing. Since a number of companies around the world are trying to minimize their carbon footprint, manufacturers are coming up with printers that consume little power and those that are made of recyclable material. The climate change awareness among customers is growing, so the customers are seeking for environmentally friendly thermal printers which are also a developing category of printers.

Use of technology solutions such as IoT and artificial intelligence

- A potential to increase the demand of thermal printing is presented by the use of technology solutions such as IoT and artificial intelligence . Through IoT integration, the printer is connected to other appliances making the tracking more efficient in terms of stock among other gains. With the use of AI; areas such as predictability or maintenance to support continuous operation and minimize case of downtimes can also be supported.

- The second potential area is the constantly increasing popularity of individual and high-impact solutions of the printing service. Retail industries, food & beverage industries are in particular need of reliable thermal printing solution which can offer high resolution printing on packaging materials and labels. The need to print clear barcodes, complex designs and other related information can be easily met by thermal printing technique and therefore provides a more promising avenue for expansion in the market.

Thermal Printing Market Segment Analysis:

Thermal Printing Market is Segmented on the basis of Technology, Application, End-User Industry, and Region

By Technology, Direct Thermal Printing segment is expected to dominate the market during the forecast period

- The thermal printing market is divided into two major technologies: They are direct thermal printing and thermal transfer printing. Direct thermal printing system work based on the use of the heat-sensitive medium that employs heat to produce image without involving ink or ribbon. This method is used heavily for applications like receipts, and labels and other uses in retail, logistics, and other industries. However thermal transfer printing uses a heated ribbon to transfer ink to the surface and is preferred for use where the labels are going to have a longer lifespan such as in health and manufacturing sectors.

By Application, Retail segment expected to held the largest share

- The global thermal printing market operates within various sectors as a segmented market. In the business world, it is mainly employed on Retails, Point of Sale (POS) machines, receipts, and Bar codes. In health care settings thermal printers are applied to patient identification, medical labels and medication management. In the real world, thermal printing finds its application when the supplies for shipping labels and bar code tracking identification for dispatches in shipping industries are pertinent. The F&B industry employs thermal printing for the packaging labels and nutritional information and consumer electronics for barcoding and product labels. Other use include tickets, tags, and receipt for different fields of uses.

Thermal Printing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is dominating the market for thermal printing due to increased and continuously growing demand for retail, heath care, logistics and other uses of labeling and printing products. The region possesses all the factors that make it dominate global markets, including well developed infrastructures, positive attitudes toward use of technology, and increased market participation by key players. Further, the current growth in the number of internet and e-commerce platforms and the consequent need for thermal printers for shipment labeling are contributing to the growth of the thermal printer market in North America.

- They include major manufacturers such as Intelligent Print and the advanced printing technologies absorption in the United States and Canada, the North American region is dominant. Ongoing investments in automation and digitalization make North America an important market for thermal printing as it has an array of opportunities for growth in the subsequent years.

Active Key Players in the Thermal Printing Market

- Bixolon Co., Ltd. (South Korea)

- Brother Industries, Ltd. (Japan)

- Epson America, Inc. (United States)

- Honeywell International Inc. (United States)

- Intermec (United States)

- Sato Holdings Corporation (Japan)

- Seiko Instruments Inc. (Japan)

- Toshiba Tec Corporation (Japan)

- TSC Auto ID Technology Co., Ltd. (Taiwan)

- Zebra Technologies (United States)

- Other Active Players

|

Thermal Printing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.50 Billion |

|

Forecast Period 2024-32 CAGR: |

7.50% |

Market Size in 2032: |

USD 25.88 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Thermal Printing Market by By Technology (2018-2032)

4.1 Thermal Printing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Direct Thermal Printing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Thermal Transfer Printing

Chapter 5: Thermal Printing Market by By Application (2018-2032)

5.1 Thermal Printing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Retail

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Healthcare

5.5 Logistics and Transportation

5.6 Food & Beverage

5.7 Consumer Electronics

5.8 Others

Chapter 6: Thermal Printing Market by By End-User Industry (2018-2032)

6.1 Thermal Printing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Thermal Printing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ZEBRA TECHNOLOGIES (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HONEYWELL INTERNATIONAL INC. (UNITED STATES)

7.4 SEIKO INSTRUMENTS INC. (JAPAN)

7.5 SATO HOLDINGS CORPORATION (JAPAN)

7.6 EPSON AMERICA INC. (UNITED STATES)

7.7 BIXOLON CO. LTD. (SOUTH KOREA)

7.8 BROTHER INDUSTRIES LTD. (JAPAN)

7.9 TOSHIBA TEC CORPORATION (JAPAN)

7.10 INTERMEC (UNITED STATES)

7.11 TSC AUTO ID TECHNOLOGY CO. LTD. (TAIWAN)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Thermal Printing Market By Region

8.1 Overview

8.2. North America Thermal Printing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Technology

8.2.4.1 Direct Thermal Printing

8.2.4.2 Thermal Transfer Printing

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Retail

8.2.5.2 Healthcare

8.2.5.3 Logistics and Transportation

8.2.5.4 Food & Beverage

8.2.5.5 Consumer Electronics

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By By End-User Industry

8.2.6.1 Commercial

8.2.6.2 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Thermal Printing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Technology

8.3.4.1 Direct Thermal Printing

8.3.4.2 Thermal Transfer Printing

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Retail

8.3.5.2 Healthcare

8.3.5.3 Logistics and Transportation

8.3.5.4 Food & Beverage

8.3.5.5 Consumer Electronics

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By By End-User Industry

8.3.6.1 Commercial

8.3.6.2 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Thermal Printing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Technology

8.4.4.1 Direct Thermal Printing

8.4.4.2 Thermal Transfer Printing

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Retail

8.4.5.2 Healthcare

8.4.5.3 Logistics and Transportation

8.4.5.4 Food & Beverage

8.4.5.5 Consumer Electronics

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By By End-User Industry

8.4.6.1 Commercial

8.4.6.2 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Thermal Printing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Technology

8.5.4.1 Direct Thermal Printing

8.5.4.2 Thermal Transfer Printing

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Retail

8.5.5.2 Healthcare

8.5.5.3 Logistics and Transportation

8.5.5.4 Food & Beverage

8.5.5.5 Consumer Electronics

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By By End-User Industry

8.5.6.1 Commercial

8.5.6.2 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Thermal Printing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Technology

8.6.4.1 Direct Thermal Printing

8.6.4.2 Thermal Transfer Printing

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Retail

8.6.5.2 Healthcare

8.6.5.3 Logistics and Transportation

8.6.5.4 Food & Beverage

8.6.5.5 Consumer Electronics

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By By End-User Industry

8.6.6.1 Commercial

8.6.6.2 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Thermal Printing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Technology

8.7.4.1 Direct Thermal Printing

8.7.4.2 Thermal Transfer Printing

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Retail

8.7.5.2 Healthcare

8.7.5.3 Logistics and Transportation

8.7.5.4 Food & Beverage

8.7.5.5 Consumer Electronics

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By By End-User Industry

8.7.6.1 Commercial

8.7.6.2 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Thermal Printing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.50 Billion |

|

Forecast Period 2024-32 CAGR: |

7.50% |

Market Size in 2032: |

USD 25.88 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Thermal Printing Market research report is 2024-2032.

Zebra Technologies (United States), Honeywell International Inc. (United States), Seiko Instruments Inc. (Japan), Sato Holdings Corporation (Japan), Epson America, Inc. (United States), Bixolon Co., Ltd. (South Korea), Brother Industries, Ltd. (Japan), Toshiba Tec Corporation (Japan), Intermec (United States), TSC Auto ID Technology Co., Ltd. (Taiwan), and Other Active Players.

The Thermal Printing Market is segmented into Technology, Application, End-User Industry and Region. By Technology, the market is categorized into Direct Thermal Printing, Thermal Transfer Printing. By Application, the market is categorized into Retail, Healthcare, Logistics and Transportation, Food & Beverage, Consumer Electronics, Others. By End-User Industry, the market is categorized into Commercial, Industrial. By Region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Thermal printing is also defined as the usage of heat to either transfer ink or form images on paper, labels and other products. It involves two primary technologies: two processes which are well known in the market, namely the direct thermal printing and the thermal transfer printing. Thermal printing practices can be applied in various industries for instance retailing, supply chain sectors and most importantly the health-related sectors and even the food industry for instance printing of barcodes, receipts, and labels. Major trends influencing the market’s expansion include the development of online retail sales, and the media and printing markets, as well as an emerging customer requirement for high-quality economical labeling solutions.

Thermal Printing Market Size Was Valued at USD 13.50 Billion in 2023, and is Projected to Reach USD 25.88 Billion by 2032, Growing at a CAGR of 7.50 % From 2024-2032.