Thermoformed Plastics Market Synopsis:

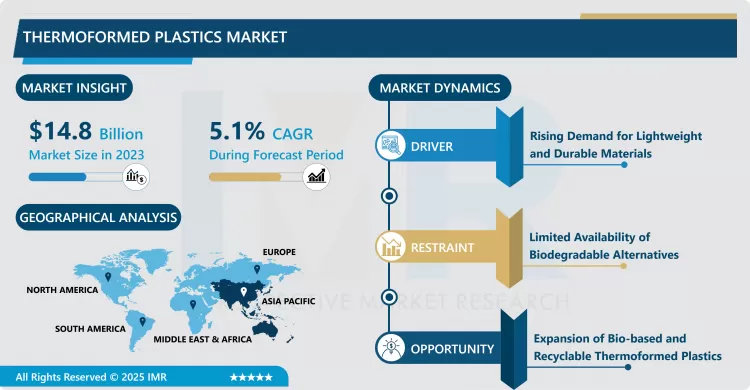

Thermoformed Plastics Market Size Was Valued at USD 14.80 Billion in 2023, and is Projected to Reach USD 23.15 Billion by 2032, Growing at a CAGR of 5.10 % From 2024-2032.

The Thermoformed Plastics Market relates to creating of products from plastics through heating of a plastic sheet to a malleable state and then forming it to a desired shape. It is applied to produce different products: from the packaging materials to the automobile components of cars, by applying different types of thermoplastic materials. These plastics are processed via methods including vacuum forming, pressure forming and twin sheet forming and primary characteristics of these plastics are that they are light in weight, economical and can be molded into a variety of shapes.

The market of thermoformed plastics is rapidly growing mainly due to the increase in demand in various industries including packaging, automotive, and healthcare. Specifically, packaging applications have grown rapidly because of increased demand for packaging materials due to e-commerce and consumer tastes towards lightweight and long-lasting packaging. Besides this, the trend within automobile industry to manufacture lightweight vehicles to enhance fuel economy has given impetus to the thermoformed plastics industry.

Another key driver is factors inclusive of the use of sustainable and recyclable products during the manufacturing process. Since thermoformed plastics are mostly derived from PET, their use has been favored in sustainability goals and directives across the world. This trend is encouraging companies to recycle and reusing of the thermoformed products through technologies investment.

Thermoformed Plastics Market Trend Analysis:

New elaborate thermoforming techniques

- The Thermoformed Plastics Market is steadily witnessing growth in new elaborate thermoforming techniques like pressure forming and plug-assisted forming for higher precision and better part profiles especially for the intricate designs. It does this while also addressing the higher demand for complex forming processes to produce precision and customizable parts for use in different sectors such as; healthcare, automotive and electronics industries among others.

- Third, there is an increased use of multi-layer thermoformed plastic where higher barrier properties are desired especially in the container industry for food and other perishable products. While these multi-layer structures provide good shelf-life and product protection that is valuable in food packaging products.

Increased focus on the use of environmentally sensitive products

- The increased focus on the use of environmentally sensitive products will offer manufacturers a niche to increase production of biodegradable and recyclable thermo-formed plastics products. Novelties in the field of bio-based plastics are believed to create new opportunities on the market, especially given the potential market for the goods that reduces the effects of climate change, like packaging and consumer products’ industries.

- In addition, new technologies across the automation and advanced production technologies offer a newly discovered chance for manufacturers. Implementation of Industry 4.0 in thermoform packaging could bring the idea of fewer costs on high outputs, which would be efficient enough to meet the increasing demand for thermoform plastics in the market

Thermoformed Plastics Market Segment Analysis:

Thermoformed Plastics Market is Segmented on the basis of Material Type, Process Type, End-User Industry, and Region

Material Type, ABS segment is expected to dominate the market during the forecast period

- The thermoformed plastics market is categorized by material type where some popular materials are ABS, PS, PVC, PET, Polycarbonate other materials. Applications of ABS are based on its high degree of impact strength and durability, whereas uses of PS include clarity of the material and ease of molding. PVC has high chemical resistance, therefore is used in packaging and automobiles industries. PET which is known for its recycle attribute and strength find its uses in food packaging and consumer products. Polycarbonate due to its high heat stability and transparency is commonly employed in manufacturing automotive and electronics applications of requisite sturdiness.

Process Type, Vacuum Forming segment expected to held the largest share

- Thermoforming processes can be classified according to the requirement of the produced products. The most identified forms of vacuum forming are vacuum forming, pressure forming, plug assisted forming, and twin sheet forming. Plastics manufacturing is a vacuum forming technique wherein a plastic sheet is heated then sucked over a mold to form the product. Pressure forming results in a higher level of accuracy and is most suited to get to regions which are more intricate in their design. Plug-assisted forming involves the use of a plug to give additional mold support to make complex shapes at a deeper level, while twin-sheet forming that permits the making of hollow multi-layered products for uses that demand more strength and heat resistance.

Thermoformed Plastics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- As of the current global standings, the Thermoformed Plastics Market in the Asia-Pacific region is steadily rising due to the factors that include increased industrialization, growth in the packaging and automotive industries, along with growing middle-class population. China, India and Japan have been identified as some of the key players in this region as the local capacity of manufacture for thermoformed plastic products continues to meet the high demand.

- Manufacturing and export activities have also been supported through government policies in the region while consideration is also given to the use of environmentally sound systems. On that note, Asia-Pacific companies continue to incorporate hi-tech technologies, including multi-layer thermoforming and automation the growing expectations of numerous industries to strengthen its market position.

Active Key Players in the Thermoformed Plastics Market:

- Berry Global (USA)

- Formech (UK)

- Greiner Packaging (Austria)

- Multivac (Germany)

- Pactiv Evergreen (USA)

- Plastipak Packaging (USA)

- RTP Company (USA)

- Sealed Air Corporation (USA)

- Sonoco Products Company (USA)

- Verstraete IML (Belgium)

- Other key Players

|

Thermoformed Plastics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.80 Billion |

|

Forecast Period 2024-32 CAGR: |

5.10 % |

Market Size in 2032: |

USD 23.15 Billion |

|

Segments Covered: |

Material Type |

|

|

|

Process Type |

|

||

|

End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Thermoformed Plastics Market by Material Type (2018-2032)

4.1 Thermoformed Plastics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 ABS (Acrylonitrile Butadiene Styrene)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 PS (Polystyrene)

4.5 PVC (Polyvinyl Chloride)

4.6 PET (Polyethylene Terephthalate

Chapter 5: Thermoformed Plastics Market by Process Type (2018-2032)

5.1 Thermoformed Plastics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Vacuum Forming

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pressure Forming

5.5 Plug-Assisted Forming

5.6 Twin Sheet Forming

5.7 Others

Chapter 6: Thermoformed Plastics Market by End-User Industry (2018-2032)

6.1 Thermoformed Plastics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Packaging

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive

6.5 Healthcare

6.6 Consumer Goods

6.7 Electronics

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Thermoformed Plastics Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PLASTIPAK PACKAGING (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SONOCO PRODUCTS COMPANY (USA)

7.4 GREINER PACKAGING (AUSTRIA)

7.5 BERRY GLOBAL (USA)

7.6 SEALED AIR CORPORATION (USA)

7.7 RTP COMPANY (USA)

7.8 PACTIV EVERGREEN (USA)

7.9 MULTIVAC (GERMANY)

7.10 FORMECH (UK)

7.11 VERSTRAETE IML (BELGIUM)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Thermoformed Plastics Market By Region

8.1 Overview

8.2. North America Thermoformed Plastics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Material Type

8.2.4.1 ABS (Acrylonitrile Butadiene Styrene)

8.2.4.2 PS (Polystyrene)

8.2.4.3 PVC (Polyvinyl Chloride)

8.2.4.4 PET (Polyethylene Terephthalate

8.2.5 Historic and Forecasted Market Size By Process Type

8.2.5.1 Vacuum Forming

8.2.5.2 Pressure Forming

8.2.5.3 Plug-Assisted Forming

8.2.5.4 Twin Sheet Forming

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By End-User Industry

8.2.6.1 Packaging

8.2.6.2 Automotive

8.2.6.3 Healthcare

8.2.6.4 Consumer Goods

8.2.6.5 Electronics

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Thermoformed Plastics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Material Type

8.3.4.1 ABS (Acrylonitrile Butadiene Styrene)

8.3.4.2 PS (Polystyrene)

8.3.4.3 PVC (Polyvinyl Chloride)

8.3.4.4 PET (Polyethylene Terephthalate

8.3.5 Historic and Forecasted Market Size By Process Type

8.3.5.1 Vacuum Forming

8.3.5.2 Pressure Forming

8.3.5.3 Plug-Assisted Forming

8.3.5.4 Twin Sheet Forming

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By End-User Industry

8.3.6.1 Packaging

8.3.6.2 Automotive

8.3.6.3 Healthcare

8.3.6.4 Consumer Goods

8.3.6.5 Electronics

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Thermoformed Plastics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Material Type

8.4.4.1 ABS (Acrylonitrile Butadiene Styrene)

8.4.4.2 PS (Polystyrene)

8.4.4.3 PVC (Polyvinyl Chloride)

8.4.4.4 PET (Polyethylene Terephthalate

8.4.5 Historic and Forecasted Market Size By Process Type

8.4.5.1 Vacuum Forming

8.4.5.2 Pressure Forming

8.4.5.3 Plug-Assisted Forming

8.4.5.4 Twin Sheet Forming

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By End-User Industry

8.4.6.1 Packaging

8.4.6.2 Automotive

8.4.6.3 Healthcare

8.4.6.4 Consumer Goods

8.4.6.5 Electronics

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Thermoformed Plastics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Material Type

8.5.4.1 ABS (Acrylonitrile Butadiene Styrene)

8.5.4.2 PS (Polystyrene)

8.5.4.3 PVC (Polyvinyl Chloride)

8.5.4.4 PET (Polyethylene Terephthalate

8.5.5 Historic and Forecasted Market Size By Process Type

8.5.5.1 Vacuum Forming

8.5.5.2 Pressure Forming

8.5.5.3 Plug-Assisted Forming

8.5.5.4 Twin Sheet Forming

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By End-User Industry

8.5.6.1 Packaging

8.5.6.2 Automotive

8.5.6.3 Healthcare

8.5.6.4 Consumer Goods

8.5.6.5 Electronics

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Thermoformed Plastics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Material Type

8.6.4.1 ABS (Acrylonitrile Butadiene Styrene)

8.6.4.2 PS (Polystyrene)

8.6.4.3 PVC (Polyvinyl Chloride)

8.6.4.4 PET (Polyethylene Terephthalate

8.6.5 Historic and Forecasted Market Size By Process Type

8.6.5.1 Vacuum Forming

8.6.5.2 Pressure Forming

8.6.5.3 Plug-Assisted Forming

8.6.5.4 Twin Sheet Forming

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By End-User Industry

8.6.6.1 Packaging

8.6.6.2 Automotive

8.6.6.3 Healthcare

8.6.6.4 Consumer Goods

8.6.6.5 Electronics

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Thermoformed Plastics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Material Type

8.7.4.1 ABS (Acrylonitrile Butadiene Styrene)

8.7.4.2 PS (Polystyrene)

8.7.4.3 PVC (Polyvinyl Chloride)

8.7.4.4 PET (Polyethylene Terephthalate

8.7.5 Historic and Forecasted Market Size By Process Type

8.7.5.1 Vacuum Forming

8.7.5.2 Pressure Forming

8.7.5.3 Plug-Assisted Forming

8.7.5.4 Twin Sheet Forming

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By End-User Industry

8.7.6.1 Packaging

8.7.6.2 Automotive

8.7.6.3 Healthcare

8.7.6.4 Consumer Goods

8.7.6.5 Electronics

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Thermoformed Plastics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.80 Billion |

|

Forecast Period 2024-32 CAGR: |

5.10 % |

Market Size in 2032: |

USD 23.15 Billion |

|

Segments Covered: |

Material Type |

|

|

|

Process Type |

|

||

|

End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Thermoformed Plastics Market research report is 2024-2032.

Berry Global (USA),Formech (UK),Greiner Packaging (Austria),Multivac (Germany),Pactiv Evergreen (USA),Plastipak Packaging (USA),RTP Company (USA),Sealed Air Corporation (USA),Sonoco Products Company (USA),Verstraete IML (Belgium), and Other Active Players.

The Thermoformed Plastics Market is segmented into Material Type, Process Type, End-User Industry and Region. Material Type, the market is categorized into ABS (Acrylonitrile Butadiene Styrene), PS (Polystyrene), PVC (Polyvinyl Chloride), PET (Polyethylene Terephthalate), Polycarbonate, Others. Process Type, the market is categorized into Vacuum Forming, Pressure Forming, Plug-Assisted Forming, Twin Sheet Forming, Others. End-User Industry, the market is categorized into Packaging, Automotive, Healthcare, Consumer Goods, Electronics, Others. By Region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe),Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC),Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa),South America (Brazil, Argentina, Rest of SA).

The Thermoformed Plastics Market relates to creating of products from plastics through heating of a plastic sheet to a malleable state and then forming it to a desired shape. It is applied to produce different products: from the packaging materials to the automobile components of cars, by applying different types of thermoplastic materials. These plastics are processed via methods including vacuum forming, pressure forming and twin sheet forming and primary characteristics of these plastics are that they are light in weight, economical and can be molded into a variety of shapes.

Thermoformed Plastics Market Size Was Valued at USD 14.80 Billion in 2023, and is Projected to Reach USD 23.15 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.