Tidal Energy Market Synopsis

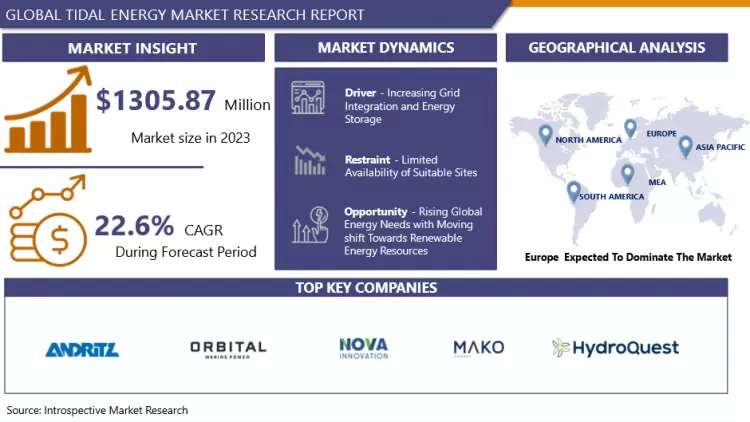

Tidal Energy Market Size Was Valued at USD 1305.87 Million in 2023, and is Projected to Reach USD 8171.73 Million by 2032, Growing at a CAGR of 22.6% From 2024-2032.

Tidal energy is harnessed by converting energy from tides into useful forms of power, mainly electricity using various methods. Although not yet widely used, tidal energy has the potential for future electricity generation. Tides are more predictable than the wind and the sun. Among sources of renewable energy, tidal energy has traditionally suffered from relatively high cost and limited availability of sites with sufficiently high tidal ranges or flow velocities, thus constricting its total availability.

- Recent technological developments and improvements, both in design (e.g. dynamic tidal power, tidal lagoons) and turbine technology (e.g. new axial turbines, cross flow turbines), indicate that the total availability of tidal power may be much higher than previously assumed and that economic and environmental costs may be brought down to competitive levels. Tidal power is the only technology that draws on energy inherent in the orbital characteristics of the Earth–Moon system, and to a lesser extent in the Earth–Sun system.

- Other natural energies exploited by human technology originate directly or indirectly from the Sun, including fossil fuel, conventional hydroelectric, wind, biofuel, wave and solar energy. Nuclear energy makes use of Earth's mineral deposits of fissionable elements, while geothermal power utilizes the Earth's internal heat, which comes from a combination of residual heat from planetary accretion and heat produced through radioactive decay. A tidal generator converts the energy of tidal flows into electricity. Greater tidal variation and higher tidal current velocities can dramatically increase the potential of a site for tidal electricity generation.

- Tidal energy has high reliability, excellent energy density, and high durability. This predictability allows for efficient planning and utilization of this renewable energy source. Tidal energy is considered environmentally friendly as it does not produce greenhouse gas emissions during power generation. It helps reduce reliance on fossil fuels, decreases air pollution, and minimizes ecological impact compared to traditional forms of energy generation. Advances in technology have improved the efficiency and reliability of tidal energy systems. Innovations in turbine design, materials, and monitoring systems have increased the viability of tidal power generation, making it more attractive to investors and developers.

Tidal Energy Market Trend Analysis

Increasing Grid Integration and Energy Storage

- Tidal energy, as a foreseeable and constant energy source, can contribute to the stability and reliability of the power grid. By integrating tidal energy into the grid, it helps meet energy demand and reduces dependence on less predictable renewable energy sources. Grid integration of tidal energy allows for better overall flexibility in managing electricity supply and demand. Tidal power generation can be combined with other renewable sources, such as solar and wind, to create a more balanced and efficient energy mix.

- Tidal energy can help stabilize the load on the grid by providing power during peak demand periods. This helps to alleviate strain on conventional power generation sources and reduces the need for backup power generation, resulting in improved grid stability. Tidal energy projects can provide ancillary services to the grid. These services include frequency regulation, voltage control, and grid synchronization, supporting the overall reliability and quality of the electrical supply.

- Energy storage systems can store excess tidal power produced during periods of low demand and release it during peak demand times. This enables a more efficient and optimized use of tidal energy resources, increasing the overall value of tidal energy projects. Tidal energy can experience fluctuations due to changes in tidal patterns. Energy storage systems can help smooth out these fluctuations and provide a more consistent and stable power output, which is vital for grid integration and meeting the electricity demand. Energy storage allows for time-shifted delivery of tidal energy, supplying power to the grid during periods when tidal generation is not occurring. This flexibility ensures a more reliable and continuous power supply, improving the economics and feasibility of tidal energy projects.

Opportunity

Rising Global Energy Needs with Moving shift Towards the Renewable Energy Resources

- As the global population remains to grow and industrialization progresses, there is a substantial increase in energy demand. Tidal energy, being a sustainable and reliable renewable energy source, offers an opportunity to meet this growing need for electricity while reducing dependence on fossil fuels. Countries worldwide are actively pursuing renewable energy transitions to reduce their carbon footprint and mitigate climate change. Tidal energy, as a clean and predictable source, aligns perfectly with this transition, making it an attractive option for governments, utilities, and investors.

- Tidal energy provides a unique opportunity to diversify the energy mix of countries and regions. By integrating tidal power into the existing energy infrastructure, dependence on a single energy source is reduced, enhancing energy security and resilience. Tidal energy holds immense potential for coastal regions and island communities that have abundant tidal resources. Many of these regions heavily rely on imported fossil fuels for their energy needs. Tidal energy presents an opportunity to establish local, sustainable power generation, reducing energy costs and enhancing energy independence.

- Tidal energy developments stimulate local economic growth. They create job opportunities, both during the construction phase and ongoing operation and maintenance. Furthermore, infrastructure development and associated businesses can thrive, fostering socio-economic growth in the surrounding areas. There is a growing public awareness and support for renewable energy, including tidal energy. Governments and regulatory bodies across the globe are implementing policies and incentives to foster its development. This support creates a favourable environment for investment and encourages the growth of the tidal energy market.

Tidal Energy Market Segment Analysis:

Tidal Energy Market is Segmented on the basis of Foundation Type, Capacity, Installation Type, Application, End-User and Region.

By Installation Type, Offshore Segment Is Expected to Dominate the Market During the Forecast Period

- Offshore locations typically have larger access to high-energy tidal resources compared to onshore sites. Offshore areas often experience stronger tidal currents and larger tidal ranges, providing more significant potential for power generation. This resource convenience makes offshore installations a preferred choice for harnessing tidal energy. These types of installations provide abundant space for deploying larger and more extensive arrays of tidal turbines. Unlike onshore sites that may have space limitations, offshore locations can accommodate multiple turbines in close proximity, forming large arrays or farms.

- This type of scalability enables the offshore segment to generate higher energy outputs and meet the increasing demand for renewable power. Offshore locations generally exhibit higher energy potential due to the unrestricted flow of tides. Tidal currents in deeper waters tend to be stronger and more consistent, offering a higher energy density that can be effectively harnessed by large-scale offshore installations. This enhanced energy potential attracts greater investments and supports the dominance of the offshore segment.

- Significant advancements in offshore technologies have propelled the growth of the offshore segment in the tidal energy sector. Offshore installations have witnessed improvements in turbine designs, anchoring systems, mooring techniques, and grid connection methods, enabling more efficient and reliable operations in challenging marine environments. Favourable policies, regulations, and financial incentives from governments have encouraged the development of offshore installations. These supportive measures have facilitated the growth and dominance of the offshore segment in the tidal energy market.

By Application, Power Generation Segment Held the Largest Share In 2023

- Tidal energy offers a consistent and predictable alternative to conventional energy sources such as fossil fuels. The consistent and predictable nature of tidal currents enables the continuous, continuous generation of electricity, making tidal energy an attractive and credible alternative for power generation. The power generation sector has demonstrated commercial viability, making it an attractive investment opportunity for stakeholders. Advanced technology, cost optimization measures such as economies of scale and financing mechanisms such as project finance, have reduced the levelized cost of energy (LCOE), resulting in a more competitive and cost-effective power generation segment.

- The power generation has a vast market potential due to the growing demand for energy worldwide. Tidal energy, being a renewable energy source, aligns with the global shift towards a low-carbon future and meets the demand for energy generation while reducing greenhouse gas emissions. Tidal power generation has low environmental impacts and aligns with the global focus on sustainable energy. Tidal energy power stations do not produce greenhouse gas emissions, and minimal land use is required, minimizing the impact on the land and the ecosystem.

- The tidal power generation segment has evolved into a mature market, serving as a proof of the concept for its commercial deployment. As the market develops, opportunities for scalability, cost optimization, and technological advancements arise, further solidifying the dominance of power generation segments. Several regulations and incentives have been applied worldwide to encourage the deployment of renewable energy, including tidal energy. Feed-in-tariffs, long-term power purchase agreements, and technology-specific support schemes have been introduced, making it easier for stakeholders to invest in the tidal power generation segment.

Source: Company Database

In 2023, the global capacity of marine energy reached 527 megawatts. This ocean energy is derived from the kinetic energy of ocean waves, tides, salinity, and differences in ocean temperatures.

Tidal Energy Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

- Europe holds significant tidal energy potential due to its wide coastline along the North Atlantic Ocean, the North Sea, and the Celtic Sea. These regions experience large tidal ranges and strong tidal currents, providing ideal circumstances for tidal energy generation. These region countries have been at the lead of tidal energy research, development, and deployment. They have invested heavily in technology innovation and have gained expertise in turbine design, array configuration, resource assessment, and project management, leading to technological leadership in the sector.

- Europe has seen the successful development and operation of several pioneering tidal energy projects. For instance, the MeyGen project in Scotland, the world's first large-scale tidal energy farm, has demonstrated the viability and commercial capability of tidal energy. Such projects showcase Europe's capabilities and attract further investments and collaborations. European nations have implemented supportive policies and regulatory frameworks to promote the development of renewable energy, including tidal energy. Feed-in tariffs, long-term power purchase agreements, financial incentives, and technology-specific support schemes have facilitated the growth of the sector, making Europe an attractive market for tidal energy developers and investors.

- Europe hosts numerous research centres, technology demonstration sites, and testing facilities dedicated to tidal energy. These facilities provide a conducive environment for researchers, innovators, and industry players to advance technology, conduct feasibility studies, and gain valuable knowledge and experience. European countries actively collaborate on tidal energy projects through initiatives such as the European Marine Energy Centre (EMEC) and the Ocean Energy Europe (OEE) association. These collaborative efforts enable the sharing of expertise, resources, and best practices, fostering innovation, and accelerating the development and deployment of tidal energy technologies.

Tidal Energy Market Active Players

- Andritz AG (Austria)

- Orbital Marine Power Ltd (United Kingdom)

- Nova Innovation Ltd (United Kingdom)

- SIMEC Atlantis Energy Ltd (United Kingdom)

- MAKO Turbines Pty Ltd (Australia)

- Hydroquest SAS (France)

- CorPower Ocean AB (Sweden)

- Eco Wave Power Global AB (Sweden)

- Mocean Energy Ltd (Scotland)

- Ocean Power Technologies Inc. (USA)

- Ocean Renewable Power Co. Inc. (USA)

- Verdant Power Inc. (USA)

- Carnegie Clean Energy Ltd. (Australia)

- Blue Energy Canada Inc. (Canada)

- Minesto AB (Sweden)

- SSE Renewables (United Kingdom)

- Wello Oy (Finland)

- DP Energy (Ireland)

- Tocardo BV (Netherlands)

- Biopower Systems Pty Ltd (Australia)

- Hammerfest Strom AS (Norway)

- Marine Current Turbines Ltd (United Kingdom)

- Aquagen Technologies Inc. (Canada)

- Tenax Energy Solutions (USA)

-

Global Tidal Energy Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 1305.87 Million

Forecast Period 2024-32 CAGR:

22.6 %

Market Size in 2032:

USD 8171.73 Million

Segments Covered:

By Foundation Type

- Barrage

- Gravity Base

- Monopile

- Semi-submersible

- Lagoon

By Capacity

- Small-Scale

- Medium-Scale

- Large-Scale

By Installation Type

- Offshore

- Onshore

By Application

- Power Generation

- Desalination

- Industrial Application

By End-User

- Residential Consumers

- Commercial and Industrial

- Government and Public Institutions

- Agriculture

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Increasing Grid Integration and Energy Storage

Key Market Restraints:

- Limited Availability of Suitable Sites

Key Opportunities:

- Rising Global Energy Needs with Moving shift Towards Renewable Energy Resources

Companies Covered in the report:

- Andritz AG (Austria), Orbital Marine Power Ltd (United Kingdom), Sustainable Marine Energy Ltd (United Kingdom), Nova Innovation Ltd (United Kingdom, and Other Active Players.

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Tidal Energy Market by By Foundation Type (2018-2032)

4.1 Tidal Energy Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Barrage

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gravity Base

4.5 Monopile

4.6 Semi-submersible

4.7 Lagoon

Chapter 5: Tidal Energy Market by By Capacity (2018-2032)

5.1 Tidal Energy Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small-Scale

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium-Scale

5.5 Large-Scale

Chapter 6: Tidal Energy Market by By Installation Type (2018-2032)

6.1 Tidal Energy Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Offshore

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Onshore

Chapter 7: Tidal Energy Market by By Application (2018-2032)

7.1 Tidal Energy Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Power Generation

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Desalination

7.5 Industrial Application

Chapter 8: Tidal Energy Market by By End-User (2018-2032)

8.1 Tidal Energy Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Residential Consumers

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Commercial and Industrial

8.5 Government and Public Institutions

8.6 Agriculture

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Tidal Energy Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ANDRITZ AG (AUSTRIA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ORBITAL MARINE POWER LTD (UNITED KINGDOM)

9.4 NOVA INNOVATION LTD (UNITED KINGDOM)

9.5 SIMEC ATLANTIS ENERGY LTD (UNITED KINGDOM)

9.6 MAKO TURBINES PTY LTD (AUSTRALIA)

9.7 HYDROQUEST SAS (FRANCE)

9.8 CORPOWER OCEAN AB (SWEDEN)

9.9 ECO WAVE POWER GLOBAL AB (SWEDEN)

9.10 MOCEAN ENERGY LTD (SCOTLAND)

9.11 OCEAN POWER TECHNOLOGIES INC. (USA)

9.12 OCEAN RENEWABLE POWER CO. INC. (USA)

9.13 VERDANT POWER INC. (USA)

9.14 CARNEGIE CLEAN ENERGY LTD. (AUSTRALIA)

9.15 BLUE ENERGY CANADA INC. (CANADA)

9.16 MINESTO AB (SWEDEN)

9.17 SSE RENEWABLES (UNITED KINGDOM)

9.18 WELLO OY (FINLAND)

9.19 DP ENERGY (IRELAND)

9.20 TOCARDO BV (NETHERLANDS)

9.21 BIOPOWER SYSTEMS PTY LTD (AUSTRALIA)

9.22 HAMMERFEST STROM AS (NORWAY)

9.23 MARINE CURRENT TURBINES LTD (UNITED KINGDOM)

9.24 AQUAGEN TECHNOLOGIES INC. (CANADA)

9.25 TENAX ENERGY SOLUTIONS (USA)

9.26 LOCKHEED MARTIN CORPORATION (USA)

9.27 EUROPEAN MARINE ENERGY CENTRE (EMEC) (UNITED KINGDOM)

Chapter 10: Global Tidal Energy Market By Region

10.1 Overview

10.2. North America Tidal Energy Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Foundation Type

10.2.4.1 Barrage

10.2.4.2 Gravity Base

10.2.4.3 Monopile

10.2.4.4 Semi-submersible

10.2.4.5 Lagoon

10.2.5 Historic and Forecasted Market Size By By Capacity

10.2.5.1 Small-Scale

10.2.5.2 Medium-Scale

10.2.5.3 Large-Scale

10.2.6 Historic and Forecasted Market Size By By Installation Type

10.2.6.1 Offshore

10.2.6.2 Onshore

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Power Generation

10.2.7.2 Desalination

10.2.7.3 Industrial Application

10.2.8 Historic and Forecasted Market Size By By End-User

10.2.8.1 Residential Consumers

10.2.8.2 Commercial and Industrial

10.2.8.3 Government and Public Institutions

10.2.8.4 Agriculture

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Tidal Energy Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Foundation Type

10.3.4.1 Barrage

10.3.4.2 Gravity Base

10.3.4.3 Monopile

10.3.4.4 Semi-submersible

10.3.4.5 Lagoon

10.3.5 Historic and Forecasted Market Size By By Capacity

10.3.5.1 Small-Scale

10.3.5.2 Medium-Scale

10.3.5.3 Large-Scale

10.3.6 Historic and Forecasted Market Size By By Installation Type

10.3.6.1 Offshore

10.3.6.2 Onshore

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Power Generation

10.3.7.2 Desalination

10.3.7.3 Industrial Application

10.3.8 Historic and Forecasted Market Size By By End-User

10.3.8.1 Residential Consumers

10.3.8.2 Commercial and Industrial

10.3.8.3 Government and Public Institutions

10.3.8.4 Agriculture

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Tidal Energy Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Foundation Type

10.4.4.1 Barrage

10.4.4.2 Gravity Base

10.4.4.3 Monopile

10.4.4.4 Semi-submersible

10.4.4.5 Lagoon

10.4.5 Historic and Forecasted Market Size By By Capacity

10.4.5.1 Small-Scale

10.4.5.2 Medium-Scale

10.4.5.3 Large-Scale

10.4.6 Historic and Forecasted Market Size By By Installation Type

10.4.6.1 Offshore

10.4.6.2 Onshore

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Power Generation

10.4.7.2 Desalination

10.4.7.3 Industrial Application

10.4.8 Historic and Forecasted Market Size By By End-User

10.4.8.1 Residential Consumers

10.4.8.2 Commercial and Industrial

10.4.8.3 Government and Public Institutions

10.4.8.4 Agriculture

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Tidal Energy Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Foundation Type

10.5.4.1 Barrage

10.5.4.2 Gravity Base

10.5.4.3 Monopile

10.5.4.4 Semi-submersible

10.5.4.5 Lagoon

10.5.5 Historic and Forecasted Market Size By By Capacity

10.5.5.1 Small-Scale

10.5.5.2 Medium-Scale

10.5.5.3 Large-Scale

10.5.6 Historic and Forecasted Market Size By By Installation Type

10.5.6.1 Offshore

10.5.6.2 Onshore

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Power Generation

10.5.7.2 Desalination

10.5.7.3 Industrial Application

10.5.8 Historic and Forecasted Market Size By By End-User

10.5.8.1 Residential Consumers

10.5.8.2 Commercial and Industrial

10.5.8.3 Government and Public Institutions

10.5.8.4 Agriculture

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Tidal Energy Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Foundation Type

10.6.4.1 Barrage

10.6.4.2 Gravity Base

10.6.4.3 Monopile

10.6.4.4 Semi-submersible

10.6.4.5 Lagoon

10.6.5 Historic and Forecasted Market Size By By Capacity

10.6.5.1 Small-Scale

10.6.5.2 Medium-Scale

10.6.5.3 Large-Scale

10.6.6 Historic and Forecasted Market Size By By Installation Type

10.6.6.1 Offshore

10.6.6.2 Onshore

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Power Generation

10.6.7.2 Desalination

10.6.7.3 Industrial Application

10.6.8 Historic and Forecasted Market Size By By End-User

10.6.8.1 Residential Consumers

10.6.8.2 Commercial and Industrial

10.6.8.3 Government and Public Institutions

10.6.8.4 Agriculture

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Tidal Energy Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Foundation Type

10.7.4.1 Barrage

10.7.4.2 Gravity Base

10.7.4.3 Monopile

10.7.4.4 Semi-submersible

10.7.4.5 Lagoon

10.7.5 Historic and Forecasted Market Size By By Capacity

10.7.5.1 Small-Scale

10.7.5.2 Medium-Scale

10.7.5.3 Large-Scale

10.7.6 Historic and Forecasted Market Size By By Installation Type

10.7.6.1 Offshore

10.7.6.2 Onshore

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Power Generation

10.7.7.2 Desalination

10.7.7.3 Industrial Application

10.7.8 Historic and Forecasted Market Size By By End-User

10.7.8.1 Residential Consumers

10.7.8.2 Commercial and Industrial

10.7.8.3 Government and Public Institutions

10.7.8.4 Agriculture

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Tidal Energy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1305.87 Million |

|

Forecast Period 2024-32 CAGR: |

22.6 % |

Market Size in 2032: |

USD 8171.73 Million |

|

Segments Covered: |

By Foundation Type |

|

|

|

By Capacity |

|

||

|

By Installation Type |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Tidal Energy Market research report is 2024-2032.

Andritz AG (Austria), Orbital Marine Power Ltd (United Kingdom), Sustainable Marine Energy Ltd (United Kingdom), Nova Innovation Ltd (United Kingdom), SIMEC Atlantis Energy Ltd (United Kingdom), MAKO Turbines Pty Ltd (Australia), Hydroquest SAS (France), CorPower Ocean AB (Sweden), Eco Wave Power Global AB (Sweden), Mocean Energy Ltd (Scotland), Ocean Power Technologies Inc. (USA), Ocean Renewable Power Co. Inc. (USA), Verdant Power Inc. (USA), Carnegie Clean Energy Ltd. (Australia), Blue Energy Canada Inc. (Canada), Minesto AB (Sweden), SSE Renewables (United Kingdom), Wello Oy (Finland), DP Energy (Ireland), Tocardo BV (Netherlands), Biopower Systems Pty Ltd (Australia), Hammerfest Strom AS (Norway), Marine Current Turbines Ltd (United Kingdom), Aquagen Technologies Inc. (Canada), Tenax Energy Solutions (USA), Lockheed Martin Corporation (USA), European Marine Energy Centre (EMEC) (United Kingdom) and Other Active Players.

The Tidal Energy Market is segmented into Foundation Type, Capacity, Installation Type, Application, End-User, Segment6, and region. By Foundation Type, the market is categorized into Barrage, Gravity Base, Monopile, Semi-submersible, Lagoon, And Foundation. By Capacity, the market is categorized into Small-Scale, Medium-Scale, Large-Scale. By Installation Type, the market is categorized into Offshore, Onshore. By Application, the market is categorized into Power Generation, Desalination, Industrial Application. By End-User, The Market Is Categorized into Residential Consumers, Commercial and Industrial, Government and Public Institutions, Agriculture. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Tidal energy is harnessed by converting energy from tides into useful forms of power, mainly electricity using various methods. Although not yet widely used, tidal energy has the potential for future electricity generation. Tides are more predictable than the wind and the sun. Among sources of renewable energy, tidal energy has traditionally suffered from relatively high cost and limited availability of sites with sufficiently high tidal ranges or flow velocities, thus constricting its total availability.

Tidal Energy Market Size Was Valued at USD 1305.87 Million in 2023, and is Projected to Reach USD 8171.73 Million by 2032, Growing at a CAGR of 22.6% From 2024-2032.