Toluene Market Synopsis:

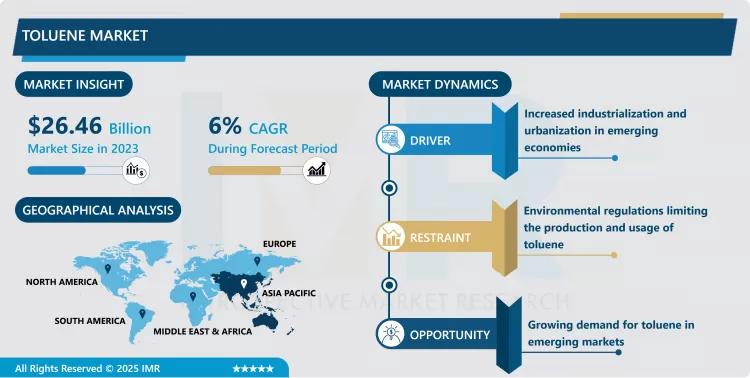

Toluene Market Size Was Valued at USD 26.46 Billion in 2023, and is Projected to Reach USD 44.32 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

Toluene is an aromatic, flammable, colourless liquid containing carbon and hydrogen and is widely used in chemical, automotive and pharmaceutical industries. There is utilized in gasoline blends and is produced from petroleum distillation. Toluene is predominantly purchased for use as a solvent in paints; coatings; adhesives; and industrial products. It is also used in synthesising chemicals such as benzene and xylene and is used in the synthesis of pharmaceuticals, resins and plastics. Due to its multipurpose characteristic, toluene serves a large market segment and hence the increased demand is base on emerging markets occasioned by industrialization and urbanization.

The toluene market has grown steadily over the years based on the fact that it is widely used in the production of so many chemicals and products. This market has been known to be sensitive to other factors such as development of automotive, construction and pharmaceutical industries among others. Because these products continue to be in high demand, the need to produce toluene also increases because it is a raw material used in production of paints, coatings, adhesives and chemical solvents. Furthermore, its use in the manufacture of gasoline has fuelled its consumption, particularly in areas endowed with growing economic activities. The market also shows relation to the crude oil prices because toluene is obtained as a product of petroleum refining and therefore its prices are influenced by the oil market prices.

The market for toluene is likely to move up from the current growth rate attributed to the rising use of the industrial products in the developing regions as well as the consumer products such as paints and coat, chemicals among others. Currently, the APAC region is expected to be a main force behind market expansion, primarily instigated by China and India due to the expanding manufacturing industries. In view of the fast pace of urbanization and increased construction activities, solvent in the paints and coatings industry is expected to drive the market. However, there are factors that may hamper its growth and development in the future including; the effects of environment on the production and application of toluene. The market players are also increasing efforts to look for other sources of raw material to meet the increased sod demand as it asserts to environmental compliance.

Toluene Market Trend Analysis:

Sustainability and Regulatory Compliance Shaping the Toluene Market

- This has been pegged on the increased concern on the environment as well as the regulation of environmental sustainability that have cropped up as one of the major trends in the toluene market. Toluene is flammable and evasive in nature; hence problems related to its impact on the atmospheric and water qualify has led many counties and their regulatory agencies set higher standards. As a result, all the participants of the market began to invest in the creation of new materials freer of toluene, in the optimization of the processes and in the improvement of the safety measures of handling of the substance. In the same manner, the governments of the global significant markets such as Europe and North America are putting into practice policies that will enforce usage environmentally friendly and biodegradable solvents, which is exerting pressure on the manufacturers of toluene based on sustainable toluene production. Thus, advances in design and manufacturing technologies and practice are likely to redesign the market in the successive years.

Rising Demand from Emerging Markets

- The driving forces in toluene market lies in the aspects of arising new markets in APAC and South American countries due to the rise in industrialization. There is rapid economic growth, urbanization and industrialization in countries such as China, India, Brazil which in term escalates the demand of industrial chemical and solvents toluene. Thus, those rising construction, automotive, and pharmaceutical industries are expected to contribute to the growth of toluene market in these regions. Also, the demand for paints, coatings, and adhesives in these countries is increasing due to the higher disposal incomes and urbanization which will be the opportunity for toluene producers. Market participants can effectively use these opportunities by entering new markets, which demonstrate higher growth rates, and adapt their products to the needs of the population.

Toluene Market Segment Analysis:

Toluene Market Segmented on the basis of Derivation Type, application, and Region.

By Derivation Type, Benzene & Xylene segment is expected to dominate the market during the forecast period

- The benzene and xylene segments are expected to contribute the most to the global toluene market during the forecast period because toluene is produced as a byproduct in refining to benzene and xylene proportions. Benzene and xylene as the major feedstock chemicals for petrochemical industry are closely related to the demand for toluene. Benzene and xylene are two of the most demanded chemical commodities worldwide even more so in plastics, fibers, and resins manufacturing industries, and hence toluene production from these feedstocks is expected to rise in the future. This kind of growth of benzene and xylene production will help the expanding supply of toluene making the segment dominant in the market.The aforementioned effect of benzene and xylene on the toluene market is expected to prevail along theforecast period.

By Application, Drugs segment expected to held the largest share

- The application segment, which will dominate the toluene market, is likely to be the drugs segment because toluene is essential in the production of pharmaceuticals. Toluene finds application mainly as a solvent in the formulation of drugs and contributes substantially to the synthesis of API’s. Thus, an advancement in the use of toluene in drug manufacturing due to demand from a growing global population, and the growth of the healthcare sector through increased cases of chronic diseases is anticipated to increase the demand for pharmaceuticals, hence toluene. In addition, the solubility properties of toluene, accompanied by the possibility of dissolving a large number of reagents, are unique for formulation of preparations for pharmaceuticals and vaccines, including injections, which forms a significant demand for the market in this segment.

Toluene Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- In 2023, Asia-Pacific is anticipated to take the largest share of toluene market owing to considerably higher production requirement from the countries including China, India, and Japan. The demand rise mainly owes to the growth of automotive, construction and pharmaceutical industries which use toluene in the production of many products. With a large population as its consumer base, China remains the largest consumer of toluene in the Asia Pacific and an exceptionally dominating player in the worldwide market considering how much the market has expanded due to the country. It is expected that the Asia Pacific region will capture almost half of the market share which makes it the largest market for toluene around the world. It is forecasted that the usage of these materials will continuously grow in the following years owing to the development of manufacturing industry and more industrial productions in the region.

Active Key Players in the Toluene Market:

- BASF (Germany)

- BP (UK)

- China National Petroleum Corporation (China)

- ExxonMobil (USA)

- Formosa Chemicals & Fibre Corporation (Taiwan)

- GS Caltex Corporation (South Korea)

- Haldia Petrochemicals Ltd. (India)

- Honeywell International Inc. (USA)

- Indian Oil Corporation Ltd. (India)

- LyondellBasell Industries (Netherlands)

- Mitsubishi Chemical Corporation (Japan)

- Reliance Industries Ltd. (India)

- Royal Dutch Shell (Netherlands)

- Saudi Aramco (Saudi Arabia)

- Sinopec (China)

- Other Active Players

|

Toluene Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.46 Billion |

|

Forecast Period 2024-32 CAGR: |

6% |

Market Size in 2032: |

USD 44.32 Billion |

|

Segments Covered: |

By Derivation Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Toluene Market by By Derivation Type (2018-2032)

4.1 Toluene Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Benzene & Xylene

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Toluene Diisocyanatos

4.5 Gasoline Additives

4.6 Others

Chapter 5: Toluene Market by By Application (2018-2032)

5.1 Toluene Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Drugs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dyes

5.5 Blending

5.6 Cosmetic Nail Products

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Toluene Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BASF (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BP (UK)

6.4 CHINA NATIONAL PETROLEUM CORPORATION (CHINA)

6.5 EXXONMOBIL (USA)

6.6 FORMOSA CHEMICALS & FIBRE CORPORATION (TAIWAN)

6.7 GS CALTEX CORPORATION (SOUTH KOREA)

6.8 HALDIA PETROCHEMICALS LTD. (INDIA)

6.9 HONEYWELL INTERNATIONAL INC. (USA)

6.10 INDIAN OIL CORPORATION LTD. (INDIA)

6.11 LYONDELLBASELL INDUSTRIES (NETHERLANDS)

6.12 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

6.13 RELIANCE INDUSTRIES LTD. (INDIA)

6.14 ROYAL DUTCH SHELL (NETHERLANDS)

6.15 SAUDI ARAMCO (SAUDI ARABIA)

6.16 SINOPEC (CHINA)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Toluene Market By Region

7.1 Overview

7.2. North America Toluene Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Derivation Type

7.2.4.1 Benzene & Xylene

7.2.4.2 Toluene Diisocyanatos

7.2.4.3 Gasoline Additives

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Drugs

7.2.5.2 Dyes

7.2.5.3 Blending

7.2.5.4 Cosmetic Nail Products

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Toluene Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Derivation Type

7.3.4.1 Benzene & Xylene

7.3.4.2 Toluene Diisocyanatos

7.3.4.3 Gasoline Additives

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Drugs

7.3.5.2 Dyes

7.3.5.3 Blending

7.3.5.4 Cosmetic Nail Products

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Toluene Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Derivation Type

7.4.4.1 Benzene & Xylene

7.4.4.2 Toluene Diisocyanatos

7.4.4.3 Gasoline Additives

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Drugs

7.4.5.2 Dyes

7.4.5.3 Blending

7.4.5.4 Cosmetic Nail Products

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Toluene Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Derivation Type

7.5.4.1 Benzene & Xylene

7.5.4.2 Toluene Diisocyanatos

7.5.4.3 Gasoline Additives

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Drugs

7.5.5.2 Dyes

7.5.5.3 Blending

7.5.5.4 Cosmetic Nail Products

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Toluene Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Derivation Type

7.6.4.1 Benzene & Xylene

7.6.4.2 Toluene Diisocyanatos

7.6.4.3 Gasoline Additives

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Drugs

7.6.5.2 Dyes

7.6.5.3 Blending

7.6.5.4 Cosmetic Nail Products

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Toluene Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Derivation Type

7.7.4.1 Benzene & Xylene

7.7.4.2 Toluene Diisocyanatos

7.7.4.3 Gasoline Additives

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Drugs

7.7.5.2 Dyes

7.7.5.3 Blending

7.7.5.4 Cosmetic Nail Products

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Toluene Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.46 Billion |

|

Forecast Period 2024-32 CAGR: |

6% |

Market Size in 2032: |

USD 44.32 Billion |

|

Segments Covered: |

By Derivation Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Toluene Market research report is 2024-2032.

BASF (Germany), BP (UK), China National Petroleum Corporation (China), ExxonMobil (USA), Formosa Chemicals & Fibre Corporation (Taiwan), GS Caltex Corporation (South Korea), Haldia Petrochemicals Ltd. (India), Honeywell International Inc. (USA), Indian Oil Corporation Ltd. (India), LyondellBasell Industries (Netherlands), Mitsubishi Chemical Corporation (Japan), Reliance Industries Ltd. (India), Royal Dutch Shell (Netherlands), Saudi Aramco (Saudi Arabia), Sinopec (China), and Other Active Players.

The Toluene Market is segmented into Derivation Type, Application, and region. By Derivation Type, the market is categorized into Benzene & Xylene, Toluene Diisocyanatos, Gasoline Additives, Others. By Application, the market is categorized into Drugs, Dyes, Blending, Cosmetic Nail Products, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC),Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Toluene is an aromatic, flammable, colourless liquid containing carbon and hydrogen and is widely used in chemical, automotive and pharmaceutical industries. There is utilized in gasoline blends and is produced from petroleum distillation. Toluene is predominantly purchased for use as a solvent in paints; coatings; adhesives; and industrial products. It is also used in synthesising chemicals such as benzene and xylene and is used in the synthesis of pharmaceuticals, resins and plastics. Due to its multipurpose characteristic, toluene serves a large market segment and hence the increased demand is base on emerging markets occasioned by industrialization and urbanization.

Toluene Market Size Was Valued at USD 26.46 Billion in 2023, and is Projected to Reach USD 44.32 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.