Trocars Market Synopsis:

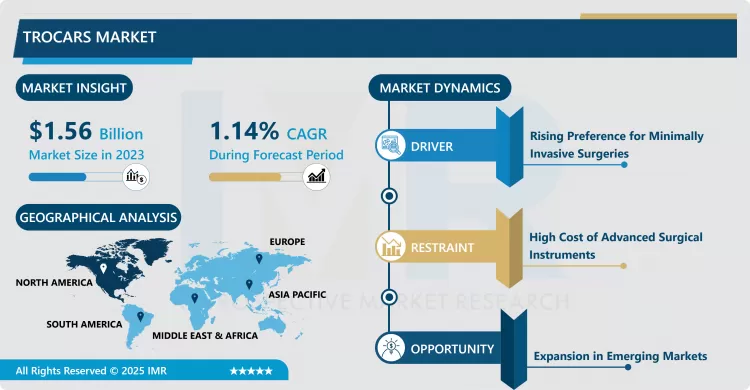

Trocars Market Size Was Valued at USD 1.56 Billion in 2023, and is Projected to Reach USD 1.73 Billion by 2032, Growing at a CAGR of 1.14% From 2024-2032.

The trocars market is the medical device market concerning the construction and sale of trocars, which are tools employed in minimally invasive procedures, including laparoscopy, urology, and gynecology. Trocars are used in surgeries to make a way to internal organs by passing through small openings then other tools such as camera and other surgical implements for operations. They generally brought a cutting edge or optical equipment that helps in the making of an access port in the organism, and it presents different models adapted to the different kinds of surgeries.

The trocars market has also grown rapidly due to the various benefits of minimally invasive surgeries which include; short hospitalization, small skin openings, and reduced susceptibility to infection compared to the normal open surgeries. Like the laparoscopic surgeries, gynecological, and urological surgeries have become essential in different medical fields raising the demand for trocars. Such factors as the progress of surgical equipment, appearance of robotic surgeries, and increasing importance of patient-safety and comfort also contribute to the development of the market. Furthermore, the transition from invasive procedures, particularly surgeries performed in hospitals, to outpatient surgeries and enhanced imaging technologies also enhance the demand for trocars for multiple uses.

The rationale common in the market include the rising healthcare expenditure, aging population across the globe, who need the surgeries, and growing rates of chronic diseases that may call for surgeries. The trocars market is very fragmented with many international and domestic companies offering a large number of trocars aimed at particular surgical procedures. It is also observed that, there are new generation trocars in to the market like bladeless trocars which causes less traumas during its insertion, and optical trocars which facilitate better vision during surgeries. Despite this, the market for trocars is said to be growing steadily, though there are some challenges facing the market such as; the high cost associated with most advanced surgical instruments which may lead to a restriction of market growth in the low income bracket. In total, the trocars market is predicted to maintain growth in the future as a result of the developments in surgical technologies and increase surgical market demands.

Trocars Market Trend Analysis:

The Shift Towards Bladeless and Optical Trocars

- When looking at the main trends that are currently characterizing the development of the trocars market, there is one that is currently gaining more attention: Bladeless and optical trocars. Such types of trocars pose minimal chances of injuring the tissue during the surgery which in effect makes operations safer and efficient. Bladeless trocars minimize contact with unintended tissues during surgery and are a safer approach better than sharp based trocars. Such trocars are useful in procedures characterized by minimal invasions in that accuracy is highly valued. This advancement is occasioned by the awareness of the patient safety, and the rising trend in the minimal invasive surgery.

- Optical trocars is another emerging trend which is being widely adopted due to ease in visualization within surgery operations. Optical trocars are designed with a camera or optical accessories, which provide surgeons with a view of the target surgical region prior to using instruments, thus the level of surgical accuracy, as well as complications that may arise are minimized. New technological trends such as laparoscopic and robotic assisted surgeries have been the biggest factor that has seen the development of optical trocars because surgeries of this nature require clear vision for the best results. Bladeless and optical trocars are expected to account for the largest share of the market since they are risk free and help surgeons offer precise and highly effective operations for the patients.

Expansion in Emerging Markets

- In effect, one of the major growth factors within the industry is the growth in the availability of medical services in the dynamically growing markets. Thus, due to the trends towards the growth of the healthcare facility in the developing states, there is identified the demand for the further development of the modern, more effective surgical instruments, such as trocars. Asia Pacific, Latin America, and the Middle East countries have the greatest increase in investment in the healthcare sector, making it mandatory to purchase superior surgical instruments. With increased adoption of MIS and especially the regions which consider the use of trocars as the next big thing, it is agreed that the overall demand drives the market forward and presents significant opportunities for industry players.

- The growing desire in global emerging markets for less invasive surgeries due to their shorter hospitalization and recovery time consequently promoting investment in modern surgical instruments amidst healthcare providers. Therefore, increased establishment of private healthcare networks and medical tourism in these regions will even increase demand of trocars. Consequently, firms can seize the new opportunities for the extented development of the emerging markets satisfying their needs with cheap but effective trocar solutions. This growing utilization forms the basis for expanding the market for trocar manufacturing and increased revenue generation.

Trocars Market Segment Analysis:

Trocars Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Bladeless Trocars segment is expected to dominate the market during the forecast period

- Trocar is segmented according to the type it provides which includes bladeless, optical and regular trocar that are used differently in surgeries. Bladeless trocars are most popular cause of insertion a tight blade reduce the chances of cutting during insertion. These devices apply a technique that guarantees the trocar makes an opening without causing any incisions on tissues; they are appropriate in surgeries that require high precision. The use of bladeless trocars are on the rise as patient safety concerns gain much importance in «less invasive» surgeries.

- Optical trocars on the other hand are used in procedures where the view is required to be improved in some way. These trocars usually have features of a camera through which imaging of the internal surgical area is produced providing the surgeon with accurate information. It has been seen that with the increasing use of laparoscopic surgeries, robotic surgeries and other high precision surgical procedures, has prompted the use of optical trocars in the market. Speaking of traditional operations, the basic type of trocars, used from time immemorial, maintains its popularity because of its relatively low cost price and high effectiveness. Although bladeless and optical trocars are being developed increasingly, standard trocars continue to dominate the market in terms of sales due to their relatively low cost and simplicity.

By Application, Laparoscopic Surgery segment expected to held the largest share

- Trocars is mainly used in Laparoscopic, Gynecological, Urological, Bariatric and General surgeries, hence driving the growth of the market. Laparoscopic surgery is the largest and one of the fastest-growing sectors because it is used in treatments and operations such as the removal of the gallbladder or appendix and some forms of bariatric surgery. The rising popularity of the laparoscopic procedure is a major driver for the demand of trocars because they are used for making ports for the laparoscopic tools.

- Gynecological and urological surgeries are also considered as the key drivers for the trocars market as both the areas are usually treated with minimally invasive surgeries for issues such as endometriosis, fibroids and prostate cancer among others. Obesity surgery like gastric bypass surgery and sleeve gastrectomy, similarly needed trocar to reach the abdominal region. Trocars are also used in general surgeries consisting of appendix surgeries, hernia repair surgical procedures and biopsies on internal organs. Indeed, there is a shift of these applications towards minimally invasive surgeries hence the need for trocars in the healthcare sector.

Trocars Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the largest share in the trocars market due to increased healthcare infrastructure, increased use of MISTs and increased spending in healthcare products. The American nation as an example has well-developed healthcare system and contain a great number of hospitals and surgical centers, in which often used laparoscopic and other less invasive operations. They noted the high level of implementation of the latest technologies and best practices throughout the region, including bladeless and optical trocars.

- Also, more established manufacturers of medical devices, especially in North America as well as a large obtainment of qualified surgeons and healthcare professionals contribute to the domination of this region. Other factors contributing to the growth of market include rising rate of outpatient surgeries, advanced technology being integrated in instruments used in surgeries, and cost containment. Therefore, North America accounts for the largest share of the trocars market and steady growth for trocars is recognized due to the increasing demand for high-quality, innovative surgical tools.

Active Key Players in the Trocars Market:

- Medtronic (Ireland)

- Johnson & Johnson (United States)

- Stryker Corporation (United States)

- Smith & Nephew (United Kingdom)

- Conmed Corporation (United States)

- B. Braun Melsungen AG (Germany)

- Olympus Corporation (Japan)

- Karl Storz GmbH & Co. KG (Germany)

- Richard Wolf GmbH (Germany)

- Intuitive Surgical (United States)

- Teleflex Incorporated (United States)

- Other Active Players

|

Trocars Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.56 Billion |

|

Forecast Period 2024-32 CAGR: |

1.14% |

Market Size in 2032: |

USD 1.73 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Trocars Market by By Type (2018-2032)

4.1 Trocars Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Bladeless Trocars

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Optical Trocars

4.5 Regular Trocars

Chapter 5: Trocars Market by By Application (2018-2032)

5.1 Trocars Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Laparoscopic Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gynecological Surgery

5.5 Urological Surgery

5.6 Bariatric Surgery

5.7 General Surgery

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Trocars Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MEDTRONIC (IRELAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 JOHNSON & JOHNSON (UNITED STATES)

6.4 STRYKER CORPORATION (UNITED STATES)

6.5 SMITH & NEPHEW (UNITED KINGDOM)

6.6 CONMED CORPORATION (UNITED STATES)

6.7 B. BRAUN MELSUNGEN AG (GERMANY)

6.8 OLYMPUS CORPORATION (JAPAN)

6.9 KARL STORZ GMBH & CO. KG (GERMANY)

6.10 RICHARD WOLF GMBH (GERMANY)

6.11 INTUITIVE SURGICAL (UNITED STATES)

6.12 TELEFLEX INCORPORATED (UNITED STATES)

6.13 MAXER ENDOSCOPY (GERMANY)

6.14 OTHER ACTIVE PLAYERS

Chapter 7: Global Trocars Market By Region

7.1 Overview

7.2. North America Trocars Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Bladeless Trocars

7.2.4.2 Optical Trocars

7.2.4.3 Regular Trocars

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Laparoscopic Surgery

7.2.5.2 Gynecological Surgery

7.2.5.3 Urological Surgery

7.2.5.4 Bariatric Surgery

7.2.5.5 General Surgery

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Trocars Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Bladeless Trocars

7.3.4.2 Optical Trocars

7.3.4.3 Regular Trocars

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Laparoscopic Surgery

7.3.5.2 Gynecological Surgery

7.3.5.3 Urological Surgery

7.3.5.4 Bariatric Surgery

7.3.5.5 General Surgery

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Trocars Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Bladeless Trocars

7.4.4.2 Optical Trocars

7.4.4.3 Regular Trocars

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Laparoscopic Surgery

7.4.5.2 Gynecological Surgery

7.4.5.3 Urological Surgery

7.4.5.4 Bariatric Surgery

7.4.5.5 General Surgery

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Trocars Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Bladeless Trocars

7.5.4.2 Optical Trocars

7.5.4.3 Regular Trocars

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Laparoscopic Surgery

7.5.5.2 Gynecological Surgery

7.5.5.3 Urological Surgery

7.5.5.4 Bariatric Surgery

7.5.5.5 General Surgery

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Trocars Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Bladeless Trocars

7.6.4.2 Optical Trocars

7.6.4.3 Regular Trocars

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Laparoscopic Surgery

7.6.5.2 Gynecological Surgery

7.6.5.3 Urological Surgery

7.6.5.4 Bariatric Surgery

7.6.5.5 General Surgery

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Trocars Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Bladeless Trocars

7.7.4.2 Optical Trocars

7.7.4.3 Regular Trocars

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Laparoscopic Surgery

7.7.5.2 Gynecological Surgery

7.7.5.3 Urological Surgery

7.7.5.4 Bariatric Surgery

7.7.5.5 General Surgery

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Trocars Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.56 Billion |

|

Forecast Period 2024-32 CAGR: |

1.14% |

Market Size in 2032: |

USD 1.73 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Trocars Market research report is 2024-2032.

Medtronic (Ireland), Johnson & Johnson (United States), Stryker Corporation (United States), Smith & Nephew (United Kingdom), Conmed Corporation (United States), B. Braun Melsungen AG (Germany), Olympus Corporation (Japan), Karl Storz GmbH & Co. KG (Germany), Richard Wolf GmbH (Germany), Intuitive Surgical (United States), Teleflex Incorporated (United States), Other Active Players.

The Trocars Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Bladeless Trocars, Optical Trocars, Regular Trocars. By Application, the market is categorized into Laparoscopic Surgery, Gynecological Surgery, Urological Surgery, Bariatric Surgery, General Surgery. By End User, the market is categorized into Hospitals, Ambulatory Surgical Centers, Clinics. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The trocars market is the medical device market concerning the construction and sale of trocars, which are tools employed in minimally invasive procedures, including laparoscopy, urology, and gynecology. Trocars are used in surgeries to make a way to internal organs by passing through small openings then other tools such as camera and other surgical implements for operations. They generally brought a cutting edge or optical equipment that helps in the making of an access port in the organism, and it presents different models adapted to the different kinds of surgeries.

Trocars Market Size Was Valued at USD 1.56 Billion in 2023, and is Projected to Reach USD 1.73 Billion by 2032, Growing at a CAGR of 1.14% From 2024-2032.