U.S. Degenerative Disc Disease Treatment Market Synopsis:

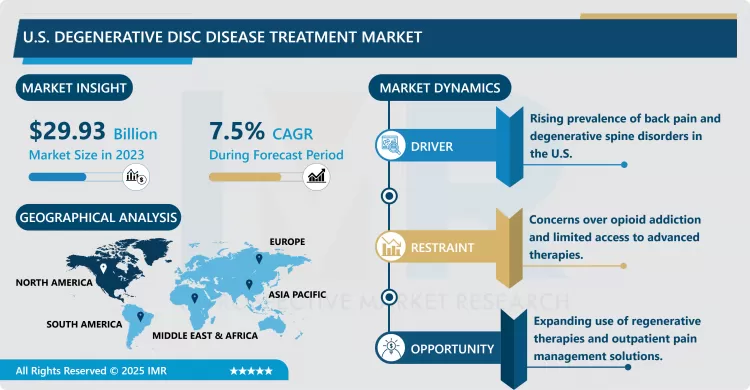

U.S. Degenerative Disc Disease Treatment Market Size Was Valued at USD 29.93 Billion in 2023, and is Projected to Reach USD 57.38 Billion by 2032, Growing at a CAGR of 7.5 % From 2024-2032.

The Degenerative Disc Disease (DDD) Treatment Market Analysis in the US includes the methods for treatment of DDD with pharmaceuticals, new treatment methodologies, surgeries, and non-surgical treatments for management and cure of the same. Intervertebral disc disorder is the condition whereby the discs between the vertebrae become damaged and may cause pain, limited mobility and many other problems. The growth of the market is primarily attributed to the innovations in the medical technologies, the rising rate of DDD occurrences and preference for the minimally invasive procedures.

The key factors influencing the U.S. DDD treatment market are thus high incidence of back pain as well as augmented disorders concerning the spine. They reasoned that sedentary lifestyle, burgeoning aging population, and increased incidences of obesity have led to the increment of the patient pool. NSAIDs, COX-II selectors, corticosteroids, and opioids are still the preferred medication solutions in meeting patients’ immediate pain and inflammation needs. However, long-term usage of opioids and related complications risks are forcing the adoption of the use of other therapies.

The new opportunities generated by regenerative medicine and new therapeutic approaches are changing the market's profile. Improvements in regenerative therapies such as Platelet-Rich Plasma (PRP) therapy and cell therapy are popular because they not only serve as supportive care for DDD but can also target the condition’s sources. Further, growth in the overall market is supported by patient and healthcare provider awareness of these new treatments, research, and published clinical trials.

U.S. Degenerative Disc Disease Treatment Market Trend Analysis:

Shift Toward Regenerative and Minimally Invasive Therapies

- One of the trends in the U.S. DDD treatment market that can be traced over the last several years is a growing focus of investors and medical professionals on developing regenerative and minimally invasive therapies. Patients and their physicians are seeking the new methods of treatment such as Platelet Rich Plasma (PRP), cell therapy and Minimal Invasive Spine Surgeries for their effectiveness in decreasing time required to recover from an ailment and possibility of side effects. Most of these therapies are not only meant to relieve symptoms but also have an impact of healing the tissues and even encourage growth of new one. In the same regard, the future improvement of imaging and diagnostic methodologies is enabling early detection and focused treatment of DDD, leading to increased use of those sophisticated methods.

Growing Demand for Non-Surgical Treatments

- The rise in the number of people opting for non-surgical liposuction treatments is one of the major factors for market development. Most patients have the belief that invasive operations can harm them or take a long time to heal. This has therefore called for PRP, corticosteroid injections and other sophisticated pain management procedures. Moreover, rising the number of outpatient departments and specialized centres providing such treatments advanced the market to grow. It has been viewed that when the health care providers and insurers start realizing the economic benefits of these non surgical-types of treatment, employment of these treatments will increase.

U.S. Degenerative Disc Disease Treatment Market Segment Analysis:

U.S. Degenerative Disc Disease Treatment Market is Segmented on the basis of Type, Novel Therapy, and Distribution Channel.

By Type, Conventional Drugs segment is expected to dominate the market during the forecast period

- The U.S. DDD treatment market by the Conventional Drugs segment is anticipated to garner the highest market share in the timeframe of the forecast period. They include NSAIDs, corticosteroids, and opioids that are still used broadly to treat pain and inflammation that is associated with DDD. These medications are easily accessible, relatively cheap and the effect are almost instant, which are why patients opt to take them. This raises controversy over dependency on opioids but the intake of traditional drugs is irresistible due to efficiency in sharp pain control. Moreover, new drug products, including extended-release NSAIDs, are also helping to build an even greater uptick.

By Novel Therapy, Platelet-Rich Plasma (PRP) segment expected to held the largest share

- Platelet-Rich Plasma (PRP) segment appears to have the largest market share in the forecast period of the U.S DDD treatment market. Hence there is an increasing interest in using PRP for treatment because it is invasive and the treatment encourages the body’s own repair mechanism by using the patient’s platelets to repair damaged tissues. Due to increased understanding of its advantages such as killing of pain and enhanced mobility, PRP has gained popularity among the patients as well as healthcare providers. Besides, increasing popularity of regenerative medicine and other ongoing clinical trials that confirm effectiveness of PRP is set to fuel this growth more further in the future.

Active Key Players in the U.S. Degenerative Disc Disease Treatment Market:

- Abbott (United States)

- Amgen Inc. (United States)

- Bioventus LLC (United States)

- Boston Scientific Corporation (United States)

- DePuy Synthes (United States)

- Eli Lilly and Company (United States)

- Globus Medical Inc. (United States)

- Integra LifeSciences Holdings Corporation (United States)

- Johnson & Johnson (United States)

- Medtronic PLC (Ireland)

- Novartis International AG (Switzerland)

- Orthofix Medical Inc. (United States)

- Pfizer Inc. (United States)

- Smith & Nephew PLC (United Kingdom)

- Stryker Corporation (United States)

- Other Active Players

|

U.S. Degenerative Disc Disease Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 29.93 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5 % |

Market Size in 2032: |

USD 57.38 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Novel Therapy |

|

||

|

|

By Distribution Channel |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: U.S. Degenerative Disc Disease Treatment Market by By Type (2018-2032)

4.1 U.S. Degenerative Disc Disease Treatment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Conventional Drugs (Non-steroidal Anti-inflammatory Drugs (NSAIDs)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Corticosteroids

4.5 Opioids

4.6 Others

Chapter 5: U.S. Degenerative Disc Disease Treatment Market by By Novel Therapy (2018-2032)

5.1 U.S. Degenerative Disc Disease Treatment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cell Therapy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Platelet Rich Plasma (PRP)

5.5 and Others

Chapter 6: U.S. Degenerative Disc Disease Treatment Market by By Distribution Channel (2018-2032)

6.1 U.S. Degenerative Disc Disease Treatment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.5 Online Pharmacies

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 U.S. Degenerative Disc Disease Treatment Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAIC GROUP (CHINA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BMW GROUP (GERMANY)

7.4 BYD AUTO CO. LTD. (CHINA)

7.5 CHANGAN AUTOMOBILE (CHINA)

7.6 CHERY AUTOMOBILE CO. LTD. (CHINA)

7.7 DAIMLER AG (GERMANY)

7.8 GEELY AUTOMOBILE HOLDINGS LTD. (CHINA)

7.9 GENERAL MOTORS COMPANY (USA)

7.10 GREAT WALL MOTORS (CHINA)

7.11 HYUNDAI MOTOR COMPANY (SOUTH KOREA)

7.12 NIO INC. (CHINA)

7.13 SAIC MOTOR CORPORATION LIMITED (CHINA)

7.14 TESLA INC. (USA)

7.15 TOYOTA MOTOR CORPORATION (JAPAN)

7.16 VOLKSWAGEN AG (GERMANY)

7.17 OTHER ACTIVE PLAYERS

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

U.S. Degenerative Disc Disease Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 29.93 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5 % |

Market Size in 2032: |

USD 57.38 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Novel Therapy |

|

||

|

|

By Distribution Channel |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the U.S. Degenerative Disc Disease Treatment Market research report is 2024-2032.

Abbott (United States), Amgen Inc. (United States), Bioventus LLC (United States), Boston Scientific Corporation (United States), DePuy Synthes (United States), Eli Lilly and Company (United States), Globus Medical Inc. (United States), Integra LifeSciences Holdings Corporation (United States), Johnson & Johnson (United States), Medtronic PLC (Ireland), Novartis International AG (Switzerland), Orthofix Medical Inc. (United States), Pfizer Inc. (United States), Smith & Nephew PLC (United Kingdom), Stryker Corporation (United States), and Other Active Players.

The U.S. Degenerative Disc Disease Treatment Market is segmented into Type, Novel Therapy, Distribution Channel and region. By Type, the market is categorized into Conventional Drugs (Non-steroidal Anti-inflammatory Drugs (NSAIDs), Corticosteroids, Opioids, and Others. By Novel Therapy, the market is categorized into Cell Therapy, Platelet Rich Plasma (PRP), and Others. By Distribution Channel, the market is categorized into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies.

The Degenerative Disc Disease (DDD) Treatment Market Analysis in the US includes the methods for treatment of DDD with pharmaceuticals, new treatment methodologies, surgeries, and non-surgical treatments for management and cure of the same. Intervertebral disc disorder is the condition whereby the discs between the vertebrae become damaged and may cause pain, limited mobility and many other problems. The growth of the market is primarily attributed to the innovations in the medical technologies, the rising rate of DDD occurrences and preference for the minimally invasive procedures.

U.S. Degenerative Disc Disease Treatment Market Size Was Valued at USD 29.93 Billion in 2023, and is Projected to Reach USD 57.38 Billion by 2032, Growing at a CAGR of 7.5 % From 2024-2032.