Vegetable Protein Market Synopsis

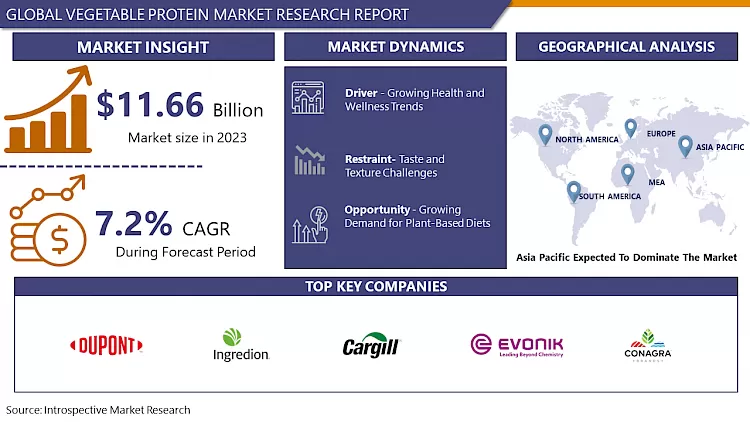

Vegetable Protein Market Size Was Valued at USD 11.66 Billion in 2023, and is Projected to Reach USD 21.8 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.

- Vegetable protein refers to proteins derived from plant sources, encompassing a diverse range of plant-based ingredients like soy, pea, wheat, rice, and more. These proteins serve as crucial nutritional components, offering an alternative to animal-based proteins for individuals following vegetarian, vegan, or flexitarian diets. Rich in essential amino acids, vegetable proteins are integral to various food and beverage applications, including plant-based meat alternatives, dairy substitutes, and nutrition supplements. Recognized for environmental sustainability, health benefits, and ethical considerations, the growing demand for vegetable proteins reflects a broader shift towards plant-centric diets and the development of sustainable food systems.

- There is an increasing awareness of the health benefits associated with plant-based diets, leading to a growing demand for vegetable proteins as alternatives to traditional animal-derived proteins. Consumers are embracing plant-based lifestyles for reasons such as weight management, heart health, and sustainability. The market is witnessing a surge in innovation and product development. Food companies are investing in research and development to enhance the taste, texture, and nutritional profile of vegetable protein products, making them more appealing to a broader consumer base. Technological advancements in extraction and processing methods are also contributing to the market's growth by improving the quality and versatility of vegetable proteins. Vegetable proteins are increasingly viewed as environmentally friendly, influencing consumer preferences and corporate strategies. As demand for plant-based protein rises, the vegetable protein market is expected to expand, catering to health-conscious consumers worldwide.

Vegetable Protein Market Trend Analysis

Growing Health and Wellness Trends

- Vegetable proteins tend to be lower in saturated fat and cholesterol while offering substantial fiber, iron, and zinc content. This correlates with a diminished risk of cardiovascular diseases, type 2 diabetes, and improved gut health. The emphasis on preventative health positions vegetable protein as an appealing option for health-conscious individuals targeting to efficiently nourish their bodies and enhance their long-term well-being.

- This trend extends beyond disease prevention, with plant-based proteins increasingly linked to improved weight management, heightened energy levels, and even enhanced athletic performance. This holistic health approach resonates with consumers seeking not only disease prevention but also overall physical and mental well-being. The vegetable protein market is fuelled by the health and wellness trend, as consumers seek a nutritious, delectable solution for their bodies, promoting a healthier future and promoting preventive health.

Growing Demand for Plant-Based Diets

- The growing demand for plant-based diets represents a significant opportunity factor in the vegetable protein market. As consumers increasingly prioritize health and sustainability, plant-based diets have gained substantial popularity. This shift is driven by various factors, including concerns about animal welfare, environmental sustainability, and the recognition of the health benefits associated with plant-centric eating.

- Consumers are becoming more conscious of their food choices and are actively seeking alternatives to animal-derived proteins. Vegetable proteins, sourced from plants such as soy, pea, and wheat, offer a viable and nutritious solution. The rise in vegetarianism and veganism, with a broader trend towards flexitarianism, has created a healthy market for vegetable proteins. Food manufacturers are responding to this demand by innovating and introducing a diverse range of plant-based products, further raising the growth of the vegetable protein market. Businesses in the vegetable protein sector are presented with a convincing opportunity to meet the escalating demand for sustainable and plant-based protein sources.

Vegetable Protein Market Segment Analysis:

Vegetable Protein Market Segmented based on Source, Type, Form, Application, End-User.

By Type, Protein Concentrates segment is expected to dominate the market during the forecast period

- Protein concentrates offer a cost-effective solution, catering to a broader consumer base compared to pricier isolates. Their moderate protein content packs a nutritional punch, appealing to health-conscious individuals seeking a good protein boost without breaking the bank. The Concentrates boast a richer blend of nutrients beyond just protein, including fiber, vitamins, and minerals, making them well-rounded dietary additions. Their versatility shines in various applications, excelling in food and beverage formulations, dietary supplements, and even animal feed. This ability to seamlessly integrate into diverse products fuels their widespread adoption and market dominance

By Form, the Dry segment held the largest share of 83.5% in 2022

- The dry form of vegetable protein involves the removal of moisture content through processes such as drying and dehydration. This form offers several advantages, including longer shelf life, ease of storage, and convenient transportation, making it a preferred choice for manufacturers and consumers alike. The popularity of dry vegetable protein is attributed to its versatility in various food applications. It serves as a crucial ingredient in the formulation of plant-based products such as protein bars, snacks, powdered supplements, and meat alternatives. Dry vegetable protein concentrates and isolates can be easily incorporated into a wide range of recipes, providing an efficient way to boost the protein content of food products. As consumers increasingly seek convenient and shelf-stable protein sources, the Dry segment in the Vegetable Protein market is composed for sustained growth, reflecting the demand for practical and adaptable plant-based protein solutions.

Vegetable Protein Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is optimistic to dominate the Vegetable Protein market over the forecast period, driven by a confluence of factors that emphasize the region's economic, demographic, and dietary dynamics. The increasing population, attached to rising health consciousness and awareness of sustainable food choices, has led to an increased adoption of plant-based diets across countries in the Asia Pacific. The traditional diets in many Asian cultures often incorporate plant-based protein sources, aligning with the global trend toward healthier and more sustainable eating habits.

- Furthermore, the region's economic growth has resulted in an expanding middle-class population with higher disposable incomes, enabling consumers to invest in premium and health-conscious food choices. As a response to this demand, both local and international food manufacturers are introducing a diverse range of vegetable protein products, contributing to the market's robust growth in the Asia Pacific. The region's dominance in the Vegetable Protein market reflects a combination of cultural, economic, and health-driven factors that position it as a key player in the evolving landscape of plant-based nutrition.

Vegetable Protein Market Top Key Players:

- DuPont Industrial Biosciences (USA)

- Ingredion Incorporated (USA)

- Archer Daniels Midland (ADM) (USA)

- Bunge Limited (USA)

- Cargill, Inc.(USA)

- Conagra Brands, Inc. (USA)

- Beyond Meat, Inc. (USA)

- Impossible Foods Inc. (USA)

- Hain Celestial Group, Inc. (USA)

- Mondelez International, Inc. (USA)

- Blue Diamond Growers (USA)

- SunFood Superfoods Inc. (USA)

- Axiom Foods, Inc. (USA)

- Amy's Kitchen Inc. (USA)

- Evonik Industries (Germany)

- Kerry Group plc (Ireland)

- Roquette Frères (France)

- Aarkay Foods & Proteins Ltd. (India)

- Burcon NutraScience Inc. (Canada)

- Olam International Ltd. (Singapore), AND Other Major Players.

Key Industry Developments in the Vegetable Protein Market:

- In February 2024, Roquette is pushing the frontiers of the plant protein market by launching four multi-functional pea proteins designed to improve taste, texture, and creativity in plant-based food and high-protein nutritional products. By further expanding its established NUTRALYS plant protein portfolio, the leading ingredients company is bringing a host of new and improved application opportunities to the table for food manufacturers.

- In February 2024, Louis Dreyfus Company (LDC) announced the construction of a pea protein isolate production plant dedicated to its Plant Proteins business, at the site of its existing industrial complex in Yorkton, Saskatchewan, Canada.

|

Global Vegetable Protein Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.66 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2 % |

Market Size in 2032: |

USD 21.8 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Type |

|

||

|

By Form |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vegetable Protein Market by By Source (2018-2032)

4.1 Vegetable Protein Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Soy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Peas

4.5 Wheat

4.6 Rice

4.7 Corn

4.8 Potato

Chapter 5: Vegetable Protein Market by By Type (2018-2032)

5.1 Vegetable Protein Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Protein Concentrates

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Protein Isolates

5.5 Textured Vegetable Protein

Chapter 6: Vegetable Protein Market by By Form (2018-2032)

6.1 Vegetable Protein Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Dry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Liquid

Chapter 7: Vegetable Protein Market by By Application (2018-2032)

7.1 Vegetable Protein Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food and beverages

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Dietary Supplements

7.5 Feed

7.6 Bakery Products

Chapter 8: Vegetable Protein Market by By End-User (2018-2032)

8.1 Vegetable Protein Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Retail

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Food Service

8.5 Industrial

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Vegetable Protein Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ARCLIN INC. (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BASF SE (GERMANY)

9.4 CHEMIQUE ADHESIVES & SEALANTS LTD (U.K.)

9.5 CYTEC INDUSTRIES INC. (U.S.)

9.6 DYNEA OY (FINLAND)

9.7 ERCROS S.A. (SPAIN)

9.8 FORESA INDUSTRIAS QUIMICAS DEL NOROESTE SA (SPAIN)

9.9 GEORGIA PACIFIC LLC (U.S.)

9.10 KRONOSPAN LTD (U.K.)

9.11 MOMENTIVE SPECIALTY CHEMICALS INC. (U.S.)

9.12 QINGDAO WINLONG CHEMICAL INDUSTRIAL CO. LTD (CHINA)

9.13 TEMBEC INC. (CANADA)

9.14 OTHER KEY PLAYERS

Chapter 10: Global Vegetable Protein Market By Region

10.1 Overview

10.2. North America Vegetable Protein Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Source

10.2.4.1 Soy

10.2.4.2 Peas

10.2.4.3 Wheat

10.2.4.4 Rice

10.2.4.5 Corn

10.2.4.6 Potato

10.2.5 Historic and Forecasted Market Size By By Type

10.2.5.1 Protein Concentrates

10.2.5.2 Protein Isolates

10.2.5.3 Textured Vegetable Protein

10.2.6 Historic and Forecasted Market Size By By Form

10.2.6.1 Dry

10.2.6.2 Liquid

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Food and beverages

10.2.7.2 Dietary Supplements

10.2.7.3 Feed

10.2.7.4 Bakery Products

10.2.8 Historic and Forecasted Market Size By By End-User

10.2.8.1 Retail

10.2.8.2 Food Service

10.2.8.3 Industrial

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Vegetable Protein Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Source

10.3.4.1 Soy

10.3.4.2 Peas

10.3.4.3 Wheat

10.3.4.4 Rice

10.3.4.5 Corn

10.3.4.6 Potato

10.3.5 Historic and Forecasted Market Size By By Type

10.3.5.1 Protein Concentrates

10.3.5.2 Protein Isolates

10.3.5.3 Textured Vegetable Protein

10.3.6 Historic and Forecasted Market Size By By Form

10.3.6.1 Dry

10.3.6.2 Liquid

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Food and beverages

10.3.7.2 Dietary Supplements

10.3.7.3 Feed

10.3.7.4 Bakery Products

10.3.8 Historic and Forecasted Market Size By By End-User

10.3.8.1 Retail

10.3.8.2 Food Service

10.3.8.3 Industrial

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Vegetable Protein Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Source

10.4.4.1 Soy

10.4.4.2 Peas

10.4.4.3 Wheat

10.4.4.4 Rice

10.4.4.5 Corn

10.4.4.6 Potato

10.4.5 Historic and Forecasted Market Size By By Type

10.4.5.1 Protein Concentrates

10.4.5.2 Protein Isolates

10.4.5.3 Textured Vegetable Protein

10.4.6 Historic and Forecasted Market Size By By Form

10.4.6.1 Dry

10.4.6.2 Liquid

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Food and beverages

10.4.7.2 Dietary Supplements

10.4.7.3 Feed

10.4.7.4 Bakery Products

10.4.8 Historic and Forecasted Market Size By By End-User

10.4.8.1 Retail

10.4.8.2 Food Service

10.4.8.3 Industrial

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Vegetable Protein Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Source

10.5.4.1 Soy

10.5.4.2 Peas

10.5.4.3 Wheat

10.5.4.4 Rice

10.5.4.5 Corn

10.5.4.6 Potato

10.5.5 Historic and Forecasted Market Size By By Type

10.5.5.1 Protein Concentrates

10.5.5.2 Protein Isolates

10.5.5.3 Textured Vegetable Protein

10.5.6 Historic and Forecasted Market Size By By Form

10.5.6.1 Dry

10.5.6.2 Liquid

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Food and beverages

10.5.7.2 Dietary Supplements

10.5.7.3 Feed

10.5.7.4 Bakery Products

10.5.8 Historic and Forecasted Market Size By By End-User

10.5.8.1 Retail

10.5.8.2 Food Service

10.5.8.3 Industrial

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Vegetable Protein Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Source

10.6.4.1 Soy

10.6.4.2 Peas

10.6.4.3 Wheat

10.6.4.4 Rice

10.6.4.5 Corn

10.6.4.6 Potato

10.6.5 Historic and Forecasted Market Size By By Type

10.6.5.1 Protein Concentrates

10.6.5.2 Protein Isolates

10.6.5.3 Textured Vegetable Protein

10.6.6 Historic and Forecasted Market Size By By Form

10.6.6.1 Dry

10.6.6.2 Liquid

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Food and beverages

10.6.7.2 Dietary Supplements

10.6.7.3 Feed

10.6.7.4 Bakery Products

10.6.8 Historic and Forecasted Market Size By By End-User

10.6.8.1 Retail

10.6.8.2 Food Service

10.6.8.3 Industrial

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Vegetable Protein Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Source

10.7.4.1 Soy

10.7.4.2 Peas

10.7.4.3 Wheat

10.7.4.4 Rice

10.7.4.5 Corn

10.7.4.6 Potato

10.7.5 Historic and Forecasted Market Size By By Type

10.7.5.1 Protein Concentrates

10.7.5.2 Protein Isolates

10.7.5.3 Textured Vegetable Protein

10.7.6 Historic and Forecasted Market Size By By Form

10.7.6.1 Dry

10.7.6.2 Liquid

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Food and beverages

10.7.7.2 Dietary Supplements

10.7.7.3 Feed

10.7.7.4 Bakery Products

10.7.8 Historic and Forecasted Market Size By By End-User

10.7.8.1 Retail

10.7.8.2 Food Service

10.7.8.3 Industrial

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Vegetable Protein Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.66 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2 % |

Market Size in 2032: |

USD 21.8 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Type |

|

||

|

By Form |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Vegetable Protein Market research report is 2024-2032.

DuPont Industrial Biosciences (USA), Ingredion Incorporated (USA), Archer Daniels Midland (ADM) (USA), Bunge Limited (USA), Cargill, Inc. (USA), Conagra Brands, Inc. (USA), Beyond Meat, Inc. (USA), Impossible Foods Inc. (USA), Hain Celestial Group, Inc. (USA), Mondelez International, Inc. (USA), Blue Diamond Growers (USA), SunFood Superfoods Inc. (USA), Axiom Foods, Inc. (USA), Amy's Kitchen Inc. (USA), Evonik Industries (Germany), Kerry Group plc (Ireland), Roquette Frères (France), Aarkay Foods & Proteins Ltd. (India), Burcon NutraScience Inc. (Canada), Olam International Ltd. (Singapore), and Other Major Players.

The Vegetable Protein Market is segmented into Source, Type, Form, Application, End-User, and region. By Source, the market is categorized into Soy, Peas, Wheat, Rice, Corn, and Potato. By Type, the market is categorized into Protein Concentrates, Protein Isolates, and Textured Vegetable Protein. By Form, the market is categorized into Dry and Liquid. By Application, the market is categorized into Food and beverages, Dietary Supplements, Feed, and Bakery Products. By End-User, the market is categorized into Retail, Food Service, and Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Vegetable protein refers to proteins derived from plant sources, encompassing a diverse range of plant-based ingredients like soy, pea, wheat, rice, and more. These proteins serve as crucial nutritional components, offering an alternative to animal-based proteins for individuals following vegetarian, vegan, or flexitarian diets. Rich in essential amino acids, vegetable proteins are integral to various food and beverage applications, including plant-based meat alternatives, dairy substitutes, and nutrition supplements. Recognized for environmental sustainability, health benefits, and ethical considerations, the growing demand for vegetable proteins reflects a broader shift towards plant-centric diets and the development of sustainable food systems.

Vegetable Protein Market Size Was Valued at USD 11.66 Billion in 2023, and is Projected to Reach USD 21.8 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.