Vehicle Protection Service Market Synopsis:

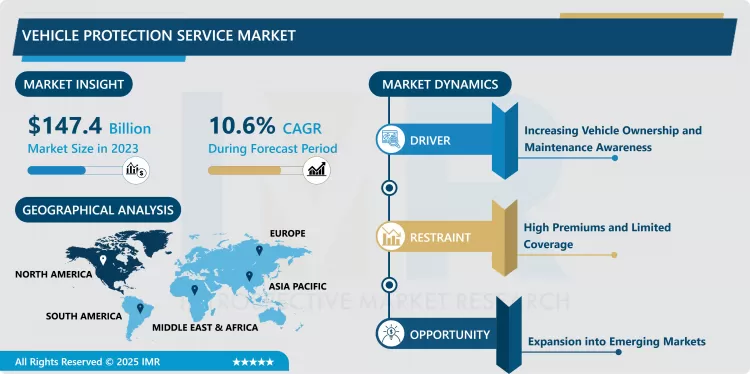

Vehicle Protection Service Market Size Was Valued at USD 147.4 Billion in 2023, and is Projected to Reach USD 365.0 Billion by 2032, Growing at a CAGR of 10.6% From 2024-2032.

The Vehicle Protection Service Market can be said to be the industry which deals with services related to the protection of vehicles with special emphasis on their durability. Such services may be, and often are, an extended warranty, road assistance, theft guard, vehicle repair, flat tire and wheel guard, scratch and dent, among others. The major customers of the market include owners of single cars as well as fleets, insurance companies, and the factors such as growing propensity to own cars, rising importance of car maintenance, and need for protection against sudden expensive repairs.

The Vehicle Protection Service Market is a major segment of the automotive business area that aims at providing protection of the car from various unpredictable financial risks most often connected with the necessity of car repair or replacement. As people gain ownership of vehicles and the usage rate of vehicles in the world increases together with the extended service life, there has been a significant increase in the ask for these services. This market offers many service choices which range from simple and straightforward towing service to elaborate service packages that encompass not only road service but also tire and wheel, vehicle repair, and theft protection services. Furthermore, service offers such as warranties are now considered worthy expenditures to avoid expensive repairs that many a time are unforeseen and costly for car owners.

One of the most important factors influencing popularity and diversity of protection plans are e-Commerce, and cooperation with automotive manufacturers by vehicle service providers. Moreover, the advancement in the area of telematics and connected vehicles technologies has facilitated more focused protection programs, this may have added values to consumers’ protection, as these engagements allow them to shift protection plans in accordance to driving behavior and vehicle data sets. Consumers know more about the protection available to them, and this has made the market call for tailored made service plans.

The market’s growth has also been due to a rising tendency of many companies owning vehicle fleets to support their operations. These companies need the best protection services in order to avoid any time wastage to achieve productive existence. Fleet management services help the owners of the fleet to safeguard their vehicles against different hazards that may cause downtime and thereby affect their operations. Likewise, more and more insurance service providers include the vehicle protection services within the policy and add extra choices for their consumers, which also further developed and extended the market.

Similarly, most of the trends shaping the global market, including the expanding middle class and the tendency towards higher disposable personal income as well as the changes in the economic world with leaning towards the service sector have already created the essential background of the vehicle protection services market. Also, the increasing rate of car stealing and mishaps, and the advanced technology that is characteristic of today’s automobiles have reinforced the need to have explicit safeguard programs. The market has created the essential foundation for growth, where existing local and international providers are developing new services while enhancing the ways in which they interact with their customers through ICT tools.

Vehicle Protection Service Market Trend Analysis:

Telematics and Connected Services

- One of the most significant trends described in the market is the merger of telematics and connected services for integrating them into the vehicle protection plans. Telematics is the recording of information by communicating with technological tools, or the remote transmission of data in a car to service providers. This data is useful in checking on the health of vehicle, correcting on how people drive and in providing proactive service to cars. Telematics can profit service providers in giving consumption-relevant offerings because consumers differ a lot and by offering consumption-flexible arrangement, they can improve the service for consumers.

- Further, through the application of the connected services feature, there is instant help in case of a breakdown or an accident. For instance, cars that have a breakdown have quick access to roadside assistance services, and service providers track down the car. In the same manner, theft protection services have now enhanced and have an option for real time tracking for a faster recovery of stolen cars. It is envisaged that the overall pattern will continue as auto makers and service companies enhance the use of technology to deliver enhanced form and efficiency of protection services for consumers.

Expansion into Emerging Markets

- Among the growth factors that are seen in the Vehicle Protection Service Market, the development of the markets involves the global markets, including Asia-Pacific, Latin America, and some countries in Africa. These markets are defined by an increasing number of vehicles on the road owing to increased income per capita and increased middle class populations. Since more and more people and companies invest in cars, there is more demand for vehicle protection services and the corresponding market prospects for service providers who are ready to enter the underdeveloped regions.

- Furthermore, the increasing trend of people adopting a car-oriented life in emerging urbanization areas is another factor that enjoys the development of low-cost protection programs by companies. The availability of technology such as e-commerce sites or even mobile applications makes it easier for the service providers to extend the market reach, sell their services cheaper than their competitors and thus make people demand for their services. The opportunity does not only exist in the ability to sell established protection services but also in the ability to devise competitive, value-added propositions that meet the needs and manage the threats facing drivers in those markets.

Vehicle Protection Service Market Segment Analysis:

Vehicle Protection Service Market Segmented on the basis of Service Type, Vehicle Type, Provider Type, Distribution Channel, End User, and Region.

By Service Type, Extended Warranty segment is expected to dominate the market during the forecast period

- Based on service differentiation, the Vehicle Protection Service Market has several service types for customer requirements. Of these, the highly sought-after services include the Extended Warranty services that give customers shield against expensive service needs after the manufacturer’s warranty lapse. Such service is especially relevant for people who do not change their cars often or use their vehicles heavily. Another popular add-on is Roadside Assistance which is very important as operation in large surfaced areas or areas with unstable climate. Services and conveniences, customers get assistance when their cars break down, have a flat tire, or need some sort of attention.

- Besides these, programs such as Theft Protection and Vehicle Repair Coverage are also finding increased popularity because of the upgraded theft worry and the increasing cost of major repairs. As car theft increases in some parts of the world, consumers are in search of protection services that offer security and prompt response to help with regards to stolen cars. Another rising type of service is Tire and Wheel Protection due to the escalating cost in replacing tires and wheels especially for luxury vehicles. Furthermore, Paint and Dent Protection is, gradually gaining consumers acceptance and demand due to the high rate of car damages in the market areas.

By End User, Individual Consumers segment expected to held the largest share

- The targets of Vehicle Protection Service Market are many and may differ from one client to another. The largest segment is individual Consumers for whom protection plans pave their personal vehicles against hasty repairs, theft, and maintenance. Most of these consumers seek convenience and worry-free services, and will prefer to have a solution where their vehicles are covered in various ways. This segment is expected to be a strong driver of the market’s growth as the global ownership of vehicles persists to surge.

- Fleet Owners is also among one of the major end-users because large organization that owns vehicle fleets need more coverage in order to reduce downtime. For fleet owners, it is crucial to be able to obtain insurance that addresses as many kinds of services as possible and keep their fleets moving and functional. Pursuant to this, Insurance Companies are expanding coverage by joining cooperation agreements with vehicle protection service to provide added value for their customers and extend the coverages under insurance policies for their policy holders.

Vehicle Protection Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the analysis, the Vehicle Protection Service Market is led by North America, predominantly due to the region’s drastically high per capita car ownership and customer potential for care and service. Both the United States and Canada boast of having many car owners many consumers prefer to buy additional services like longer warranty coverage, road side assistance among other related services. It is also substantiated by existing service providers, insurance companies, and, most importantly, high customer concern regarding vehicle protection.

- Furthermore, there is also well-developed automotive market in the region, as well as highly developed e-commerce market that can facilitate consumers and providers to reach out for customized protective services. Telematics and connected services, which have recently come into use in North America also acted in favor of the demand for personalized protection plans opening new essential solutions for the market participants. The trend of using personal vehicles for commuting and business purposes also plays an active role in making North America the most significant player in the global vehicle protection services market.

Active Key Players in the Vehicle Protection Service Market

- Allianz SE (Germany)

- Assurant, Inc. (USA)

- AIG (USA)

- The Warranty Group (USA)

- CNA National (USA)

- Endurance Warranty Services, LLC (USA)

- CarShield (USA)

- Automobile Protection Corporation (USA)

- Mapfre (Spain)

- Zurich Insurance Group (Switzerland)

- AXA (France)

- Nationwide Insurance (USA)

- Other Active Players

|

Vehicle Protection Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 147.4 Billion |

|

Forecast Period 2024-32 CAGR: |

10.6% |

Market Size in 2032: |

USD 365.0 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vehicle Protection Service Market by By Service Type (2018-2032)

4.1 Vehicle Protection Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Extended Warranty

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Roadside Assistance

4.5 Theft Protection

4.6 Vehicle Repair Coverage

4.7 Tire and Wheel Protection

4.8 Paint and Dent Protection

Chapter 5: Vehicle Protection Service Market by By End User (2018-2032)

5.1 Vehicle Protection Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Individual Consumers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fleet Owners

5.5 Insurance Companies

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Vehicle Protection Service Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ALLIANZ SE (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ASSURANT INC. (USA)

6.4 AIG (USA)

6.5 THE WARRANTY GROUP (USA)

6.6 CNA NATIONAL (USA)

6.7 ENDURANCE WARRANTY SERVICES LLC (USA)

6.8 CARSHIELD (USA)

6.9 AUTOMOBILE PROTECTION CORPORATION (USA)

6.10 MAPFRE (SPAIN)

6.11 ZURICH INSURANCE GROUP (SWITZERLAND)

6.12 AXA (FRANCE)

6.13 NATIONWIDE INSURANCE (USA)

6.14 OTHER ACTIVE PLAYERS

Chapter 7: Global Vehicle Protection Service Market By Region

7.1 Overview

7.2. North America Vehicle Protection Service Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Service Type

7.2.4.1 Extended Warranty

7.2.4.2 Roadside Assistance

7.2.4.3 Theft Protection

7.2.4.4 Vehicle Repair Coverage

7.2.4.5 Tire and Wheel Protection

7.2.4.6 Paint and Dent Protection

7.2.5 Historic and Forecasted Market Size By By End User

7.2.5.1 Individual Consumers

7.2.5.2 Fleet Owners

7.2.5.3 Insurance Companies

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Vehicle Protection Service Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Service Type

7.3.4.1 Extended Warranty

7.3.4.2 Roadside Assistance

7.3.4.3 Theft Protection

7.3.4.4 Vehicle Repair Coverage

7.3.4.5 Tire and Wheel Protection

7.3.4.6 Paint and Dent Protection

7.3.5 Historic and Forecasted Market Size By By End User

7.3.5.1 Individual Consumers

7.3.5.2 Fleet Owners

7.3.5.3 Insurance Companies

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Vehicle Protection Service Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Service Type

7.4.4.1 Extended Warranty

7.4.4.2 Roadside Assistance

7.4.4.3 Theft Protection

7.4.4.4 Vehicle Repair Coverage

7.4.4.5 Tire and Wheel Protection

7.4.4.6 Paint and Dent Protection

7.4.5 Historic and Forecasted Market Size By By End User

7.4.5.1 Individual Consumers

7.4.5.2 Fleet Owners

7.4.5.3 Insurance Companies

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Vehicle Protection Service Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Service Type

7.5.4.1 Extended Warranty

7.5.4.2 Roadside Assistance

7.5.4.3 Theft Protection

7.5.4.4 Vehicle Repair Coverage

7.5.4.5 Tire and Wheel Protection

7.5.4.6 Paint and Dent Protection

7.5.5 Historic and Forecasted Market Size By By End User

7.5.5.1 Individual Consumers

7.5.5.2 Fleet Owners

7.5.5.3 Insurance Companies

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Vehicle Protection Service Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Service Type

7.6.4.1 Extended Warranty

7.6.4.2 Roadside Assistance

7.6.4.3 Theft Protection

7.6.4.4 Vehicle Repair Coverage

7.6.4.5 Tire and Wheel Protection

7.6.4.6 Paint and Dent Protection

7.6.5 Historic and Forecasted Market Size By By End User

7.6.5.1 Individual Consumers

7.6.5.2 Fleet Owners

7.6.5.3 Insurance Companies

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Vehicle Protection Service Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Service Type

7.7.4.1 Extended Warranty

7.7.4.2 Roadside Assistance

7.7.4.3 Theft Protection

7.7.4.4 Vehicle Repair Coverage

7.7.4.5 Tire and Wheel Protection

7.7.4.6 Paint and Dent Protection

7.7.5 Historic and Forecasted Market Size By By End User

7.7.5.1 Individual Consumers

7.7.5.2 Fleet Owners

7.7.5.3 Insurance Companies

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Vehicle Protection Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 147.4 Billion |

|

Forecast Period 2024-32 CAGR: |

10.6% |

Market Size in 2032: |

USD 365.0 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Vehicle Protection Service Market research report is 2024-2032.

Allianz SE (Germany), Assurant, Inc. (USA), AIG (USA), The Warranty Group (USA), CNA National (USA), Endurance Warranty Services, LLC (USA), CarShield (USA), Automobile Protection Corporation (USA), Mapfre (Spain), Zurich Insurance Group (Switzerland), AXA (France), Nationwide Insurance (USA), and Other Active Players.Allianz SE (Germany), Assurant, Inc. (USA), AIG (USA), The Warranty Group (USA), CNA National (USA), Endurance Warranty Services, LLC (USA), CarShield (USA), Automobile Protection Corporation (USA), Mapfre (Spain), Zurich Insurance Group (Switzerland), AXA (France), Nationwide Insurance (USA), and Other Active Players.

The Vehicle Protection Service Market is segmented into Service Type, Vehicle Type, Provider Type, Distribution Channel, End User and region. By Service Type, the market is categorized into Extended Warranty, Roadside Assistance, Theft Protection, Vehicle Repair Coverage, Tire and Wheel Protection, Paint and Dent Protection. By Vehicle Type, the market is categorized into Passenger Cars, Commercial Vehicles, Electric Vehicles, Two-Wheelers. By Provider Type, the market is categorized into OEM (Original Equipment Manufacturer) Providers, Third-Party Providers. By End-User, the market is categorized into Individual Consumers, Fleet Owners, Insurance Companies. By Distribution Channel, the market is categorized into Online, Offline (Dealerships, Service Centers, etc.). By region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe),Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC),Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa),South America (Brazil, Argentina, Rest of SA).

The Vehicle Protection Service Market can be said to be the industry which deals with services related to the protection of vehicles with special emphasis on their durability. Such services may be, and often are, an extended warranty, road assistance, theft guard, vehicle repair, flat tire and wheel guard, scratch and dent, among others. The major customers of the market include owners of single cars as well as fleets, insurance companies, and the factors such as growing propensity to own cars, rising importance of car maintenance, and need for protection against sudden expensive repairs.

Vehicle Protection Service Market Size Was Valued at USD 147.4 Billion in 2023, and is Projected to Reach USD 365.0 Billion by 2032, Growing at a CAGR of 10.6% From 2024-2032.