Viral Vector and Plasmid DNA Manufacturing Market Synopsis

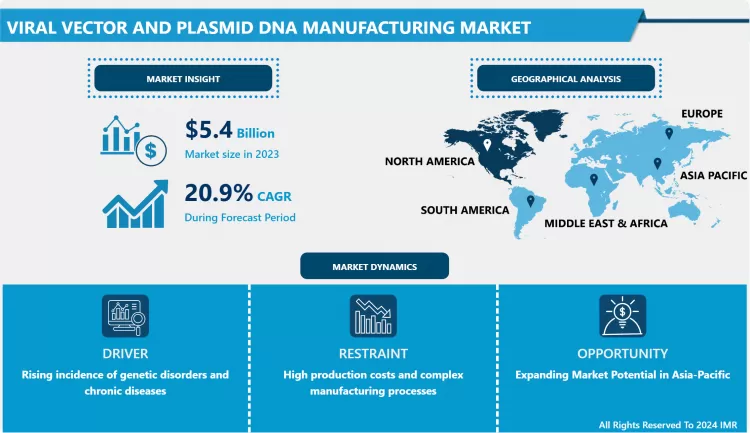

Viral Vector and Plasmid DNA Manufacturing Market Size Was Valued at USD 5.4 Billion in 2023, and is Projected to Reach USD 28.9 Billion by 2032, Growing at a CAGR of 20.9% From 2024-2032.

The Viral Vector and Plasmid DNA Manufacturing Market is that the field of the biotech industry that deals with the production of viral vectors and plasmid DNA that is regularly used for gene modification, gene therapies, and vaccines. Viral vectors refer to modified viruses that are used to transport genetic information into cells; therefore are widely applied in gene therapy; while, plasmid DNA is used a carrier of genes to deliver and is very important in preparing therapeutic proteins and vaccines. It is a complex of processes associated with the design, production, purification and quality control of these biological products. As the demand for superior treatment and specific medication increases this market has expanded.

- The Viral Vector and Plasmid DNA manufacturing market has been showing a steady and promising growth because of the growth of gene therapy and vaccines. The increasing incidence of chronic diseases and genetic disorders; and the demand for better treatments have fueled investment in biopharmaceutical research. These are very crucial in the development of gene therapies in conditions such as cancer, hemophilia and genetic diseases such as cystic fibrosis. In light of the enhancements in vector design and production technologies the success rates of those products have enhanced leading to a higher rate of pass in different clinical trials. In addition, COVID-19 has shown that the use of viral vectors in vaccines may be fast and efficient in tackling public health emergencies.

- There is also increased demand and with developing technologies to produce this market it is slowly changing. Manufacturing systems have become more automated and scalable and organizations seek to improve production processes through compliance with rigorous industry regulations. Several continuous manufacturing methodologies are slowly becoming popular to produce viral vectors and high-quality plasmid DNA cheaper and efficiently. Initiatives such as IIT Delhi and the Biotechnology industry with relevant regulatory authorities indicate that efforts are being made to bring together stakeholders in the industry to encourage innovation and coming up with new treatment options. Consequently, it has huge potential for growth over the long term, backed up by new technologies and the progress of viral vector and plasmid DNA products within the field of medicine.

Viral Vector and Plasmid DNA Manufacturing Market Trend Analysis

- A key growth driver in the Viral Vector and Plasmid DNA Manufacturing Market is seen to concern an increased growth of gene therapy uses.. As the nature of genetic diseases and the ways in which different disorders manifest come to be better understood, gene therapy has begun to advance. Currently, viral vectors are used to transfer a therapeutic gene, thus targeting the specific cells that cause genetic diseases. In particular, the availability of the approved gene therapies like Zolgensma which was developed for spinal muscular atrophy and Luxturna for inherited retinal disease has given-get more confidence into these treatments.

- In addition, what could be called vector engineering is progressing with innovations that improve the function of viral vectors as therapeutics.. Other developments such as the more molecular demanding approaches like the selective treatments done according to the genetic make up identified for individuals are also attributing to the need of the viral vectors and plasmid DNA. The growing number of gene therapies under development and awaiting entry into the clinical pipeline will further increase the demand for manufacturing processes that are both scalable and reliable; the desire for which will propel this trend.

Expanding Market Potential in Asia-Pacific

- The Viral Vector and Plasmid DNA Manufacturing Market medical facilities and companies in the Asia-Pacific region can spur the Market growth.. As the industry for biotechnology continues to grow at an alarming rate and more capital is invested in healthcare departments major players of the global market comprise countries such as China, India and Japan. The increase in genetic diseases and the cumulative interest for new solutions in these nations are the contributing factors for the call for versatile manufacturing.

- Besides, the availability of supportive policies in the regulatory arena and government support extended towards Biotechnology research and development is further providing the market a better opportunity.. Local companies’ partnerships with key international participants are also encouraging the acquisition of learning and technology, which will advance the enterprise within this market. With the global interest in gene therapies growing steadily in the future, Asia-Pacific is expected to establish itself as another important segment in the Viral Vector and Plasmid DNA Manufacturing Market.

Viral Vector and Plasmid DNA Manufacturing Market Segment Analysis:

Viral Vector and Plasmid DNA Manufacturing Market Segmented on the basis of Vector Type, application and Disease.

By Vector Type, Adenovirus segment is expected to dominate the market during the forecast period

- The segment of Adenovirus is expected to have the largest market share in the Viral Vector and Plasmid DNA Manufacturing Market during the aforementioned period due to numerous proven and off-the-shelf applications of idenitified viruses in gene therapies.. Adenoviruses are known and well established vectors capable of delivering genetic material into target cells of virtually all mammalian species and therefore are versatile vectors that are being used for several therapeutic uses like cancer therapy and genetic disorders therapy. This ability to mobilise robust immune responses also makes them even more desirable in vaccine development as shown by their incorporation in the current COVID-19 vaccines.

- Further, the growth of adenoviral vector technology as more refined and targeted holds increasing potential for therapeutic use.. Clinical trial application of adenovirus vectors is increasing and strapping partnerships between biotechnology firms with research facilities will a propel the market for Adenoviridae vectors in near future. As the researchers are still working on adenoviral vectors regarding innovative therapies, they will remain featured in the market and become the ongoing foundation of the Viral Vector and Plasmid DNA Manufacturing Market growth.

By Application, Antisense & RNAi Therapy segment expected to held the largest share

- The Antisense & RNAi Therapy segment is expected to contribute the largest market share to the Viral Vector and Plasmid DNA Manufacturing Market throughout the forecast period due to the rising incidence of genetic disorders and the rising trend of targeted treatment modalities.. RNA targeted therapies such as antisense oligonucleotides and RNA interference (RNAi) are innovational technologies useful in creating solutions for diseases that were considered incurable before. These therapies function with certain genes that are related to disease progression and by inhibiting those genes, there is a better way of treatment making positive impacts on patients’ results. Substantial successes achieved in the approval of several antisense and RNAi-based products has enhanced investors confidence and further investment in this type of solutions.

- Moreover, with technological enhancements in the delivery systems such as the formulation of viral vectors specific to the delivery of antisense and RNAi that are in the process of causing therapeutic effect, the market is boosted even more.. The demand for high precision medicine is expected to increase and the segment for Antisense & RNAi Therapy is set to grow, strengthening the Viral Vector and Plasmid DNA Manufacturing Market.

Viral Vector and Plasmid DNA Manufacturing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the analysis, North America is expected to remain the largest market in the Viral Vector and Plasmid DNA Manufacturing Market throughout 2023, capturing more than 45% of the global market.. The leadership is attributed to a number of factors which include well-established biopharmaceutical companies, sophisticated research institutes and sound regulatory environment for gene therapy and vaccine development. Biotechnological sophistication is nearly ad hoc to the United States, with major commitment being given to research and development channeled towards genetic diseases and cancers. In addition to this, the rise in clinical trials and approval of specific gene therapies within the region is enough to cordon its supremacy. With more and more players adopting the latest technologies as well as engaging university partnerships, North America is set to remain the market leader.

Active Key Players in the Viral Vector and Plasmid DNA Manufacturing Market

- Aldevron (USA)

- Aptuit (USA)

- Boehringer Ingelheim (Germany)

- Catalent, Inc. (USA)

- Cobra Biologics (UK)

- Fujifilm Diosynth Biotechnologies (Japan)

- Genomatix Software GmbH (Germany)

- Lonza Group AG (Switzerland)

- Merck KGaA (Germany)

- Oxford Biomedica (UK)

- Samsung Biologics (South Korea)

- Sartorius AG (Germany)

- Takara Bio (Japan)

- ViraTherapeutics (Austria)

- WuXi AppTec (China)

- Other key Players

Global Viral Vector and Plasmid DNA Manufacturing Market Scope:

|

Global Viral Vector and Plasmid DNA Manufacturing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.9% |

Market Size in 2032: |

USD 28.9 Bn. |

|

Segments Covered: |

By Vector Type |

|

|

|

By Application |

|

||

|

By Disease |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Viral Vector and Plasmid DNA Manufacturing Market by By Vector Type (2018-2032)

4.1 Viral Vector and Plasmid DNA Manufacturing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Adenovirus

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Retrovirus

4.5 Adeno-Associated Virus (AAV)

4.6 Lentivirus

4.7 Plasmids

4.8 Others

Chapter 5: Viral Vector and Plasmid DNA Manufacturing Market by By Application (2018-2032)

5.1 Viral Vector and Plasmid DNA Manufacturing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Antisense & RNAi Therapy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gene Therapy

5.5 Cell Therapy

5.6 Vaccinology

5.7 Research Applications

Chapter 6: Viral Vector and Plasmid DNA Manufacturing Market by By Disease (2018-2032)

6.1 Viral Vector and Plasmid DNA Manufacturing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cancer

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Genetic Disorders

6.5 Infectious Diseases

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Viral Vector and Plasmid DNA Manufacturing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALDEVRON (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 APTUIT (USA)

7.4 BOEHRINGER INGELHEIM (GERMANY)

7.5 CATALENT INC. (USA)

7.6 COBRA BIOLOGICS (UK)

7.7 FUJIFILM DIOSYNTH BIOTECHNOLOGIES (JAPAN)

7.8 GENOMATIX SOFTWARE GMBH (GERMANY)

7.9 LONZA GROUP AG (SWITZERLAND)

7.10 MERCK KGAA (GERMANY)

7.11 OXFORD BIOMEDICA (UK)

7.12 SAMSUNG BIOLOGICS (SOUTH KOREA)

7.13 SARTORIUS AG (GERMANY)

7.14 TAKARA BIO (JAPAN)

7.15 VIRATHERAPEUTICS (AUSTRIA)

7.16 WUXI APPTEC (CHINA)

7.17 OTHER KEY PLAYERS

Chapter 8: Global Viral Vector and Plasmid DNA Manufacturing Market By Region

8.1 Overview

8.2. North America Viral Vector and Plasmid DNA Manufacturing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Vector Type

8.2.4.1 Adenovirus

8.2.4.2 Retrovirus

8.2.4.3 Adeno-Associated Virus (AAV)

8.2.4.4 Lentivirus

8.2.4.5 Plasmids

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Antisense & RNAi Therapy

8.2.5.2 Gene Therapy

8.2.5.3 Cell Therapy

8.2.5.4 Vaccinology

8.2.5.5 Research Applications

8.2.6 Historic and Forecasted Market Size By By Disease

8.2.6.1 Cancer

8.2.6.2 Genetic Disorders

8.2.6.3 Infectious Diseases

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Viral Vector and Plasmid DNA Manufacturing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Vector Type

8.3.4.1 Adenovirus

8.3.4.2 Retrovirus

8.3.4.3 Adeno-Associated Virus (AAV)

8.3.4.4 Lentivirus

8.3.4.5 Plasmids

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Antisense & RNAi Therapy

8.3.5.2 Gene Therapy

8.3.5.3 Cell Therapy

8.3.5.4 Vaccinology

8.3.5.5 Research Applications

8.3.6 Historic and Forecasted Market Size By By Disease

8.3.6.1 Cancer

8.3.6.2 Genetic Disorders

8.3.6.3 Infectious Diseases

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Viral Vector and Plasmid DNA Manufacturing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Vector Type

8.4.4.1 Adenovirus

8.4.4.2 Retrovirus

8.4.4.3 Adeno-Associated Virus (AAV)

8.4.4.4 Lentivirus

8.4.4.5 Plasmids

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Antisense & RNAi Therapy

8.4.5.2 Gene Therapy

8.4.5.3 Cell Therapy

8.4.5.4 Vaccinology

8.4.5.5 Research Applications

8.4.6 Historic and Forecasted Market Size By By Disease

8.4.6.1 Cancer

8.4.6.2 Genetic Disorders

8.4.6.3 Infectious Diseases

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Vector Type

8.5.4.1 Adenovirus

8.5.4.2 Retrovirus

8.5.4.3 Adeno-Associated Virus (AAV)

8.5.4.4 Lentivirus

8.5.4.5 Plasmids

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Antisense & RNAi Therapy

8.5.5.2 Gene Therapy

8.5.5.3 Cell Therapy

8.5.5.4 Vaccinology

8.5.5.5 Research Applications

8.5.6 Historic and Forecasted Market Size By By Disease

8.5.6.1 Cancer

8.5.6.2 Genetic Disorders

8.5.6.3 Infectious Diseases

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Viral Vector and Plasmid DNA Manufacturing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Vector Type

8.6.4.1 Adenovirus

8.6.4.2 Retrovirus

8.6.4.3 Adeno-Associated Virus (AAV)

8.6.4.4 Lentivirus

8.6.4.5 Plasmids

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Antisense & RNAi Therapy

8.6.5.2 Gene Therapy

8.6.5.3 Cell Therapy

8.6.5.4 Vaccinology

8.6.5.5 Research Applications

8.6.6 Historic and Forecasted Market Size By By Disease

8.6.6.1 Cancer

8.6.6.2 Genetic Disorders

8.6.6.3 Infectious Diseases

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Viral Vector and Plasmid DNA Manufacturing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Vector Type

8.7.4.1 Adenovirus

8.7.4.2 Retrovirus

8.7.4.3 Adeno-Associated Virus (AAV)

8.7.4.4 Lentivirus

8.7.4.5 Plasmids

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Antisense & RNAi Therapy

8.7.5.2 Gene Therapy

8.7.5.3 Cell Therapy

8.7.5.4 Vaccinology

8.7.5.5 Research Applications

8.7.6 Historic and Forecasted Market Size By By Disease

8.7.6.1 Cancer

8.7.6.2 Genetic Disorders

8.7.6.3 Infectious Diseases

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Global Viral Vector and Plasmid DNA Manufacturing Market Scope:

|

Global Viral Vector and Plasmid DNA Manufacturing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.9% |

Market Size in 2032: |

USD 28.9 Bn. |

|

Segments Covered: |

By Vector Type |

|

|

|

By Application |

|

||

|

By Disease |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Viral Vector and Plasmid DNA Manufacturing Market research report is 2024-2032.

Aldevron (USA), Aptuit (USA), Boehringer Ingelheim (Germany), Catalent, Inc. (USA), Cobra Biologics (UK) and Other Major Players.

The Viral Vector and Plasmid DNA Manufacturing Market is segmented into Vector Type, Application, Disease and region. By Vector Type, the market is categorized into Adenovirus, Retrovirus, Adeno-Associated Virus (AAV), Lentivirus, Plasmids, Others. By Application, the market is categorized into Antisense & RNAi Therapy, Gene Therapy, Cell Therapy, Vaccinology, Research Applications. By Disease, the market is categorized into Cancer, Genetic Disorders, Infectious Diseases, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Viral Vector and Plasmid DNA Manufacturing Market is that the field of the biotech industry that deals with the production of viral vectors and plasmid DNA that is regularly used for gene modification, gene therapies, and vaccines. Viral vectors refer to modified viruses that are used to transport genetic information into cells; therefore are widely applied in gene therapy; while, plasmid DNA is used a carrier of genes to deliver and is very important in preparing therapeutic proteins and vaccines. It is a complex of processes associated with the design, production, purification and quality control of these biological products. As the demand for superior treatment and specific medication increases this market has expanded.

Viral Vector and Plasmid DNA Manufacturing Market Size Was Valued at USD 5.4 Billion in 2023 and is Projected to Reach USD 28.9 Billion by 2032, Growing at a CAGR of 20.9% From 2024-2032.