Wall Mounted Dental X Ray Machine Market Synopsis:

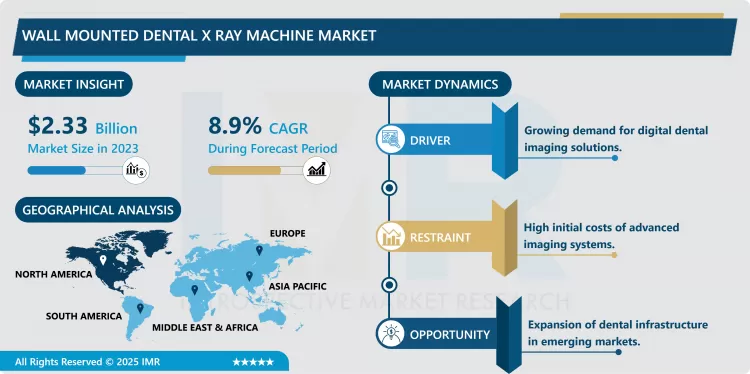

Wall Mounted Dental X Ray Machine Market Size Was Valued at USD 2.33 Billion in 2023, and is Projected to Reach USD 5.02 Billion by 2032, Growing at a CAGR of 8.9 % From 2024-2032.

The Wall Mounted Dental X-Ray Machine industry relates to the development, production, and sale of dental imaging equipment installed to walls providing variable utility, effectiveness, and usability for dentists. Alas, these devices are among the set standards today’s dentistry cannot do without because of the essentiality of high-quality diagnostic and treatment planning images for dental and oral health assessment. Stand and clamp mounted equipment is highly appreciated accordant to its size efficiency and flexibility in the dental clinics & hospitals.

The global Wall Mounted Dental X-Ray Machine Market is growing due to the growing number of dental diseases, development in the X-rays devices, and people’s awareness of dental health. Therefore, technological change characterized by minimally invasive treatment and digital dentistry has increase demand of the advanced X-ray machines that provide high quality image with low radiation dose. Clinic mounted systems are preferred over hutch mounted systems because they utilize clinic space effectively and complement clinic work flow operations.

The market is also driven via the rising populace needs for cosmetic surgery and routine dental checkups. Bearing in mind the fact that an inclusion of the ageing population has been realised in most societies, hence the enhanced spending on dental care with a corresponding rise in disposable income across the globe. Furthermore, the globalization of oral health and related governmental programs and higher investments in the expansion of healthcare infrastructure also support market growth. The digital radiography is one of the latest advancements that have impacted the market so as artificial intelligence-based imaging.

Wall Mounted Dental X Ray Machine Market Trend Analysis:

Increasing Adoption of Digital Radiography

- Another remarkable market trend based on Wall Mounted Dental X-Ray Machine is migration to digital radiography. There are many benefits that derived from digital systems as opposed to film imaging these include sharp clear image, immediate evaluation of the images, and the fact that images can be transferred electronically. Due to these benefits, leading dental practitioners especially in the developed markets consider digital solutions to be the norm. Furthermore, digitization of systems removes the requirement for the usage of chemical solutions to develop films. The manufacturers are also widening the usage of analytics AI in digital X-ray machines in order to increase the reliability of diagnosis and the treatment.

Expanding Dental Infrastructure in Emerging Markets

- The Wall Mounted Dental X-Ray Machine Market has considerable potential in the emerging countries mainly Asia-Pacific and Latin America. New technologies continually are being implemented in dental facilities, birthed by the increased urbanization and improved knowledge on oral health. In response to this situation, governments and private players are setting up new dental clinic and hospitals to offer quality dental services. This growth opens up a highly profitable niche for wall-mounted X-ray machines and especially widespread, cost-effective, and innovative technologies. The affectation level is high in these areas and local manufacturers and foreign players eyeing these markets can offer products and services unique to the regions.

Wall Mounted Dental X Ray Machine Market Segment Analysis:

Wall Mounted Dental X Ray Machine Market is Segmented on the basis of Type, Application, and Region.

By Type, Top Wall Mounted segment is expected to dominate the market during the forecast period

- The End User segment for Wall Mounted Dental X-Ray Machine Market is expected to control the Top Wall Mounted segment throughout the forecast period. These machines are very much preferred due to their design and ability to be positioned in a variety of ways making the work flow easier in dental practices. Their effectiveness in realising high quality imaging with minimum radiation dose is in line with the modern dentistry practice. Increased use of digital imaging technology with compatibility with top wall-mounted machines also favors the segment. Also, due to their compactness they can be applied in urban dental practices where spatial management is of paramount importance.

By Application, Dental Clinic segment expected to held the largest share

- It was found that the Dental Clinic segment will dominate the Wall Mounted Dental X-Ray Machine Market. Hospitals and healthcare centers are considered as the major clients of these devices considering that dental clinics mainly act as the end-users of the devices to facilitate diagnosis and treatment. The global popularity of dental clinics continues to grow due to growing awareness of the importance of oral health and expanding demand for dental tourism, which provides a foundation for this segment. Outpatient care centers are investing in modern wall-mounted X-ray systems in an effort to provide better patient care, reduce density, and increase efficiency and accuracy, as well. In addition, the market segment for cosmetic dentistry, as well as check-ups and prophylactic treatments, including in the urban population, offers a large share in the general comparison.

Wall Mounted Dental X Ray Machine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to spearhead the Wall Mounted Dental X-Ray Machine Market over the following years due to its improved healthcare facilities and greater acceptance of new dental technologies along with a focus on preventive dentistry. Most importantly, the United States is dominating the market on account of excessive number of dental clinics, strong insurance policies involved in dental surgeries and a highly civilized population prevalent with dental health problems. These factors are complemented with the active involvement of key market stakeholders and sustained capital investment on Research and Development in digital imaging technology in the region.

- Again the new market identified in Canada is good in sync with the kind of growth seen in the U S, due to the increasing elderly population an increasing governmental awareness and concern to the mouth health. Through the ongoing efforts to ensure that various regions clinch optimal value, healthcare recurrent costs, together with emphasis on patient outcomes, have boosted the use of such effective diagnostic appliances as wall-mounted X-ray devices. As technologies in dental imaging improve, along with favourable supporting policies, North America is always a strategic market that is attractive to both incumbent and new competitors.

Active Key Players in the Wall Mounted Dental X Ray Machine Market:

- cteon Group (France)

- Air Techniques, Inc. (United States)

- Carestream Dental LLC (United States)

- Cefla Group (Italy)

- Dentsply Sirona (United States)

- Envista Holdings Corporation (United States)

- Fona Dental (Slovakia)

- Genoray Co., Ltd. (South Korea)

- J. Morita Corporation (Japan)

- KaVo Dental (United States)

- Planmeca Oy (Finland)

- Prexion, Inc. (United States)

- Runyes Medical Instrument Co., Ltd. (China)

- Vatech Co., Ltd. (South Korea)

- Yoshida Dental Mfg. Co., Ltd. (Japan)

- Other Active Players

|

Global Wall Mounted Dental X Ray Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.33 Billion |

|

Forecast Period 2024-32 CAGR: |

8.9 % |

Market Size in 2032: |

USD 5.02 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wall Mounted Dental X Ray Machine Market by By Type (2018-2032)

4.1 Wall Mounted Dental X Ray Machine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Top Wall Mounted

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bottom Wall Mounted

4.5 Mobile

Chapter 5: Wall Mounted Dental X Ray Machine Market by By Application (2018-2032)

5.1 Wall Mounted Dental X Ray Machine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospital

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dental Clinic

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Wall Mounted Dental X Ray Machine Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 3M COMPANY (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 A.O. SMITH CORPORATION (UNITED STATES)

6.4 AQUATECH INTERNATIONAL LLC (UNITED STATES)

6.5 BASF SE (GERMANY)

6.6 DOW CHEMICAL COMPANY (UNITED STATES)

6.7 ECOLAB INC. (UNITED STATES)

6.8 EVOQUA WATER TECHNOLOGIES LLC (UNITED STATES)

6.9 GE WATER & PROCESS TECHNOLOGIES (UNITED STATES)

6.10 GRUNDFOS (DENMARK)

6.11 KURITA WATER INDUSTRIES LTD. (JAPAN)

6.12 PENTAIR PLC (UNITED STATES)

6.13 SUEZ WATER TECHNOLOGIES & SOLUTIONS (FRANCE)

6.14 THERMAX LIMITED (INDIA)

6.15 VEOLIA ENVIRONMENT S.A. (FRANCE)

6.16 XYLEM INC. (UNITED STATES)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Wall Mounted Dental X Ray Machine Market By Region

7.1 Overview

7.2. North America Wall Mounted Dental X Ray Machine Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Top Wall Mounted

7.2.4.2 Bottom Wall Mounted

7.2.4.3 Mobile

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Hospital

7.2.5.2 Dental Clinic

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Wall Mounted Dental X Ray Machine Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Top Wall Mounted

7.3.4.2 Bottom Wall Mounted

7.3.4.3 Mobile

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Hospital

7.3.5.2 Dental Clinic

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Wall Mounted Dental X Ray Machine Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Top Wall Mounted

7.4.4.2 Bottom Wall Mounted

7.4.4.3 Mobile

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Hospital

7.4.5.2 Dental Clinic

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Wall Mounted Dental X Ray Machine Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Top Wall Mounted

7.5.4.2 Bottom Wall Mounted

7.5.4.3 Mobile

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Hospital

7.5.5.2 Dental Clinic

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Wall Mounted Dental X Ray Machine Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Top Wall Mounted

7.6.4.2 Bottom Wall Mounted

7.6.4.3 Mobile

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Hospital

7.6.5.2 Dental Clinic

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Wall Mounted Dental X Ray Machine Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Top Wall Mounted

7.7.4.2 Bottom Wall Mounted

7.7.4.3 Mobile

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Hospital

7.7.5.2 Dental Clinic

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Wall Mounted Dental X Ray Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.33 Billion |

|

Forecast Period 2024-32 CAGR: |

8.9 % |

Market Size in 2032: |

USD 5.02 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Wall Mounted Dental X Ray Machine Market research report is 2024-2032.

Acteon Group (France), Air Techniques, Inc. (United States), Carestream Dental LLC (United States), Cefla Group (Italy), Dentsply Sirona (United States), Envista Holdings Corporation (United States), Fona Dental (Slovakia), Genoray Co., Ltd. (South Korea), J. Morita Corporation (Japan), KaVo Dental (United States), Planmeca Oy (Finland), Prexion, Inc. (United States), Runyes Medical Instrument Co., Ltd. (China), Vatech Co., Ltd. (South Korea), Yoshida Dental Mfg. Co., Ltd. (Japan), and Other Active Players.

The Wall Mounted Dental X Ray Machine Market is segmented into Type, Application,and region. By Type, the market is categorized into Top Wall Mounted Bottom Wall Mounted Mobile. By Application, the market is categorized into Hospital and Dental Clinic. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Wall Mounted Dental X-Ray Machine industry relates to the development, production, and sale of dental imaging equipment installed to walls providing variable utility, effectiveness, and usability for dentists. Alas, these devices are among the set standards today’s dentistry cannot do without because of the essentiality of high-quality diagnostic and treatment planning images for dental and oral health assessment. Stand and clamp mounted equipment is highly appreciated accordant to its size efficiency and flexibility in the dental clinics & hospitals.

Wall Mounted Dental X Ray Machine Market Size Was Valued at USD 2.33 Billion in 2023, and is Projected to Reach USD 5.02 Billion by 2032, Growing at a CAGR of 8.9 % From 2024-2032.