Wastewater Treatment Chemicals Market Synopsis

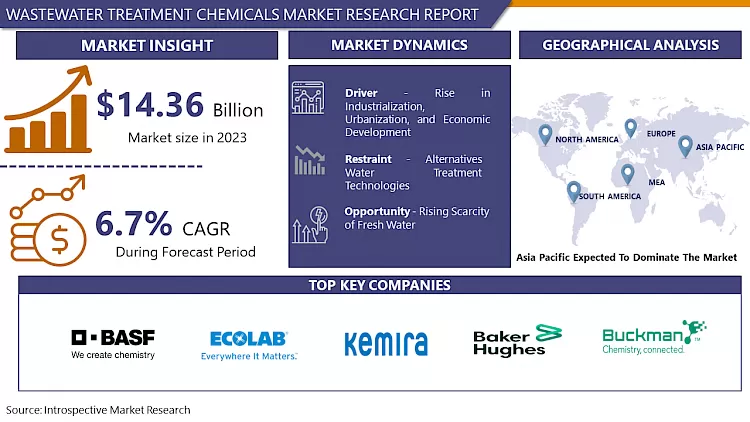

The Global Market for Wastewater Treatment Chemicals Estimated at USD 14.36 Billion In the Year 2023, Is Projected to Reach A Revised Size of USD 25.74 Billion By 2032, Growing at A CAGR of 6.7% Over the Forecast Period 2024-2030.

Wastewater Treatment Chemicals is a complex process that involves the use of different chemicals to treat used water to remove contaminants, pollutants, and other organic compounds from the water so that it can be safely reintroduced into the environment. The main purpose of wastewater treatment is to transform the pollutants or contaminants present in wastewater into secure end products by feasible processes. The end products should be disposed of through safe and reasonable techniques with minimum or no negative impact on the environment. Water treatment processes and disposal of wastes should comply with specific acts and legislation and must protect public health by continuous examination of the chemical and bacteriological composition of treated water. This treated water, after discharge to a receiving stream, is withdrawn for reuse by the downstream population.

- The four main types of chemicals used in wastewater treatment are pH neutralizers, anti-foaming agents, coagulants, and flocculants. Wastewater treatment involves a number of stages involving processes that are mechanical this is physically based, biological-based, chemical-based, as well as membrane (filtration) processes.

- There are several distinct chemical unit processes, including chemical coagulation, chemical precipitation, chemical oxidation, advanced oxidation, ion exchange, and chemical neutralization and stabilization, which can be applied to wastewater during cleaning.

- There are various types of wastewater treatment plants. Numerous process has been used to treat wastewater depending on the type and extent of the contamination. They are Sewage treatment plants, Leachate treatment plants, Agricultural wastewater treatment plants, and Industrial wastewater treatment plants.

The Wastewater Treatment Chemicals Market Trend Analysis

Rise In Industrialization, Urbanization, And Economic Development

- Growing industrialization, urbanization, and economic development are projected to be the major drivers of the wastewater chemicals market. The availability of water for the industry is limited, many industries such as manufacturing, oil and gas, and mining use water continuously in their daily operations where water is necessary. They turn sewage into usable water again and again until the usable properties of the water are lost or reduced. As water consumption increases worldwide.

- Various government bodies have taken strict rules and regulations on the total suspended solid (TSS) level in the water which helps in eliminating the impurities of the water. These are is predicted to be the major driving factors for the market.

- Stringent regulations on emission and management of industrial wastes and depletion of freshwater resources are driving the market. However, the market growth is affected by the changing demand for alternative and environmentally friendly water treatment technologies.

Rising Scarcity of Fresh Water

- The most significant role of freshwater is to be used for drinking, cooking, and bathing. This requires water to be cleaned as diluted water can cause numerous of diseases. Domestic use of water is a more important part of everyone’s life from humans to animals it plays a vital role in sustaining. Hence this water comes from any dam or river, which is more polluted. So, in this case, Wastewater treatment is used to treat water to be cleaned and accessible for domestic use.

- The scarcity of freshwater is the major concern faced by society and industries. Large production processes of industries require a large volume of water, which ultimately generates a large amount of wastewater. This has a growth opportunity for Wastewater Treatment to grow in the market. Growing Industrialization is expected to require increasing water resources Incoming years.

- Agriculture requires fresh water. Around 70 percent of freshwater goes into agriculture. The uses within the sector are very diverse and include mainly pesticide irrigation, fertilizer application, and sustaining livestock. Along the value chain, water is used for food preservation also. Hence this rise in the market of Wastewater Treatment Chemicals

Segmentation Analysis of The Wastewater Treatment Chemicals Market

Wastewater Treatment Chemicals market segments cover the Type and End-Users. By Type, the Corrosion and Scale Inhibitors Segment segment has increased demand and is Anticipated to Dominate the Market Over the Forecast period.

- Corrosion inhibitors are used for general-purpose chemicals which are applied to counter the corrosion caused in boilers. Corrosion occurs due to the reaction of oxygen and metallic parts in a boiler, this forms oxides. Corrosion affects the metallic part of the boiler and also increases the cost of maintenance and energy. This acts by forming a thin layer of barrier over the exposed parts of the boiler from the water.

- In boiler water treatment, if wastewater is used in the boiler, it brings with it a number of soluble salts. These remain soluble in cold water, but with the rise in temperature inside the boiler, salts become insoluble. Carbonates as well as bicarbonates are formed from magnesium and calcium chemicals dissolved in water.

- These inhibitors are also used for cooling water treatment to prevent metal loss and ensure metal protection, which may lead to critical system failures in process cooling equipment, recirculating water piping, and heat exchangers.

Regional Analysis of The Wastewater Treatment Chemicals Market

North America is Expected to Dominate the Market Over the Forecast period.

- Technological progression in hydraulic fracturing has occasioned in augmented production output of unconventional sources including shale gas and tight oil in North Dakota and West Texas parts of North America. This resulted in increased penetration of water treatment facilities in the upstream oil and gas sector, which is expected to have a strong positive impact on the market over the forecast period.

- The US expected higher growth in the future. This increase is due to strict official regulations aimed at controlling sewage disposal and production. According to the International Trade Administration (ITA), the United States is the leader in energy production, consumption, and supply (the presence of thermal power plants). The growing demand for cleaning chemicals used in the US energy industry to treat wastewater is expected to positively influence market growth.

- Growing shift towards green chemicals is likely to provide growth opportunities for the market under study during the forecast period. Green Chemicals include a variety of chemicals and chemical processes that produce less environmentally harmful waste in North America.

- The recovery of the industry in the country is creating demand for industrial water treatment, due to the growing need for water conservation and strict environmental regulations. This, in turn, has increased the need for water purification, which has driven the market for water purification chemicals.

Covid-19 Impact Analysis on Wastewater Treatment Chemicals Market

The outbreak of COVID-19 has negatively impacted various countries and industries across the world. The adoption of lockdowns across the globe has stopped the production of electronic parts, which stops the growth of the water treatment chemicals market. Furthermore, the supply of raw materials has been delayed which is required in the manufacturing of electronic components.

This COVID-19 pandemic is affecting the supply chain due to regulations on the import and export of chemicals and raw materials. Thus, the scarcity of raw materials has led to the production of water treatment chemicals and thus affects the growth of the market. In addition, production shutdowns and strict closures due to employee infections are expected to slow the growth of the water treatment chemicals market until the second quarter of 2021.

Top Key Players Covered in The Wastewater Treatment Chemicals Market

- BASF SE (Germany)

- Ecolab (U.S.)

- Solenis (U.S.)

- Kemira Oyj (Finland)

- Baker Hughes (Germany)

- The Dow Chemical Company (U.S.)

- Cortec Corporation (U.S.)

- Buckman (U.S.)

- Solvay S.A (Belgium)

- Kurita Water Industries (Japan)

- Veolia (France)

- Somicon ME FZC (UAE)

- Toray Industries, Inc. (India)

- Daiki Axis (India), and Other Major Players

Key Industry Developments in the Wastewater Treatment Chemicals Market

- In March 2023, BASF SE has acquired the assets of Clariant AG's Catalysts and Specialties business line in order to expand its presence in the wastewater treatment chemicals market. The acquisition will add Clariant's wastewater treatment chemicals portfolio, including its coagulants, flocculants, and other specialty chemicals, to BASF's existing portfolio.

- In May 2023, Evonik Industries AG has launched a new line of wastewater treatment chemicals for the textile industry. The new chemicals are designed to help textile mills reduce their water consumption and improve the quality of their effluent.

- In June 2023, Solvay SA has acquired the water treatment business of Ashland Global Holdings Inc. for $400 million. The acquisition will add Ashland's wastewater treatment chemicals portfolio, including its polymers and flocculants, to Solvay's existing portfolio.

- In July 2023, Kemira Oyj has announced plans to invest $100 million in a new wastewater treatment chemicals plant in Jiangsu Province, China. The new plant will produce a range of wastewater treatment chemicals for the Chinese market.

- In September 2023, Kurita Water Industries Ltd. has launched a new line of wastewater treatment chemicals for the food and beverage industry. The new chemicals are designed to help food and beverage manufacturers meet the increasing demands for clean water and wastewater treatment.

- In November 2023, Chemtex International Inc. has acquired the wastewater treatment chemicals business of Ecolab Inc. for $250 million. The acquisition will add Ecolab's wastewater treatment chemicals portfolio, including its biocides and other specialty chemicals, to Chemtex's existing portfolio.

|

Global Wastewater Treatment Chemicals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 25.74 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wastewater Treatment Chemicals Market by By Type (2018-2032)

4.1 Wastewater Treatment Chemicals Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Coagulants & Flocculants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Corrosion & Scale Inhibitors

4.5 Chelating Agents

4.6 Biocides & Disinfects

Chapter 5: Wastewater Treatment Chemicals Market by By End-User (2018-2032)

5.1 Wastewater Treatment Chemicals Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

5.5 Industrial

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Wastewater Treatment Chemicals Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CORRADI S.P.AAIRBOSS AIR TOOLS CO. LTDANDREAS STIHL AG & CO. KG

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMERICAN LAWN MOWER COMPANY

6.4 APEX TOOL GROUP LLC

6.5 BEFCO INCBLOUNT INTERNATIONAL INCCUB CADET

6.6 DRAPER TOOLS LTDBRIGGS & STRATTON CORPORATION

6.7 CRAFTSMAN

6.8 BIGGER BOYZ TOYZ AUSTRALIA PTY LTD

6.9 COMIFER SRL

6.10 CAO HUNG TECHNICAL SERVICE TRADING COMPANY LIMITED

6.11 ARBORICULTURE CANADA TRAINING AND EDUCATION LTD.

Chapter 7: Global Wastewater Treatment Chemicals Market By Region

7.1 Overview

7.2. North America Wastewater Treatment Chemicals Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Coagulants & Flocculants

7.2.4.2 Corrosion & Scale Inhibitors

7.2.4.3 Chelating Agents

7.2.4.4 Biocides & Disinfects

7.2.5 Historic and Forecasted Market Size By By End-User

7.2.5.1 Residential

7.2.5.2 Commercial

7.2.5.3 Industrial

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Wastewater Treatment Chemicals Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Coagulants & Flocculants

7.3.4.2 Corrosion & Scale Inhibitors

7.3.4.3 Chelating Agents

7.3.4.4 Biocides & Disinfects

7.3.5 Historic and Forecasted Market Size By By End-User

7.3.5.1 Residential

7.3.5.2 Commercial

7.3.5.3 Industrial

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Wastewater Treatment Chemicals Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Coagulants & Flocculants

7.4.4.2 Corrosion & Scale Inhibitors

7.4.4.3 Chelating Agents

7.4.4.4 Biocides & Disinfects

7.4.5 Historic and Forecasted Market Size By By End-User

7.4.5.1 Residential

7.4.5.2 Commercial

7.4.5.3 Industrial

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Wastewater Treatment Chemicals Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Coagulants & Flocculants

7.5.4.2 Corrosion & Scale Inhibitors

7.5.4.3 Chelating Agents

7.5.4.4 Biocides & Disinfects

7.5.5 Historic and Forecasted Market Size By By End-User

7.5.5.1 Residential

7.5.5.2 Commercial

7.5.5.3 Industrial

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Wastewater Treatment Chemicals Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Coagulants & Flocculants

7.6.4.2 Corrosion & Scale Inhibitors

7.6.4.3 Chelating Agents

7.6.4.4 Biocides & Disinfects

7.6.5 Historic and Forecasted Market Size By By End-User

7.6.5.1 Residential

7.6.5.2 Commercial

7.6.5.3 Industrial

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Wastewater Treatment Chemicals Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Coagulants & Flocculants

7.7.4.2 Corrosion & Scale Inhibitors

7.7.4.3 Chelating Agents

7.7.4.4 Biocides & Disinfects

7.7.5 Historic and Forecasted Market Size By By End-User

7.7.5.1 Residential

7.7.5.2 Commercial

7.7.5.3 Industrial

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Wastewater Treatment Chemicals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 25.74 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Wastewater Treatment Chemicals Market research report is 2024-2032.

BASF SE (Germany), Ecolab (U.S.), Solenis (U.S.), Kemira Oyj (Finland), Baker Hughes (Germany), The Dow Chemical Company (U.S.), Cortec Corporation (U.S.), Buckman (U.S.), Solvay S.A (Belgium), Kurita Water Industries (Japan), Veolia (France), Somicon ME FZC (UAE), Toray Industries, Inc. (India), Daiki Axis (India) and other major players.

The Wastewater Treatment Chemicals Market is segmented into Type, End Users, and region. By Type, the market is categorized into Coagulants and Flocculants, Corrosion and Scale Inhibitors, Chelating Agents, Biocides and Disinfects. By End Users, the market is categorized into Residential, Commercial, Industrial. By region, it is analyzed across North America (US, Canada, Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Wastewater Treatment Chemicals is a complex process that involve the use of different chemicals to treat used water to remove contaminants, pollutants, and other organic compounds from the water so that it can be safely reintroduced into the environment.

The Global Market for Wastewater Treatment Chemicals Estimated at USD 14.36 Billion In the Year 2023, Is Projected to Reach A Revised Size of USD 25.74 Billion By 2032, Growing at A CAGR of 6.7% Over the Forecast Period 2024-2030.