Water Heater Market Synopsis

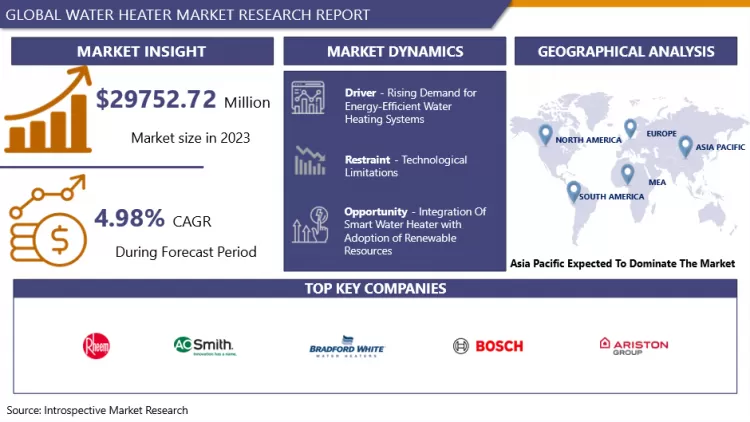

Water Heater Market Size Was Valued at USD 29752.72 Million in 2023, and is Projected to Reach USD 46077.17 Million by 2032, Growing at a CAGR of 4.98% From 2024-2032.

The water heater market involves manufacturing, distributing, and selling devices that heat water for residential, commercial, and industrial purposes. These appliances are vital for providing hot water for bathing, cleaning, cooking, and space heating, utilizing various technologies and energy sources like tank-based, tankless, electric, gas, and solar-powered units.

- Increasing residential building projects drive up the need for water heaters. The increasing urbanization and population growth increase the demand for dependable hot water solutions. Tankless and solar heaters, equipped with smart controls and energy-saving features, are gaining popularity for their effectiveness and environmentally friendly nature in satisfying the needs of city residents living in multi-family buildings.

- Government rules and regulations regarding energy efficiency and carbon emissions play a significant role in shaping the market. Smart technologies and IoT integration in water heaters are transforming how they are used due to technological advancements. The increasing popularity of environmentally friendly water heaters, fueled by a growing emphasis on energy efficiency and sustainability, is boosting market demand.

- Manufacturers have integrated smart technology, allowing users to remotely control water heaters using smartphone applications. This technology is capable of identifying leaks and stopping potential system damage. Rigorous regulations worldwide are resulting in strict criteria for product safety, performance, and environmental impact. The market is being influenced by consumer choices for water heaters that are energy-efficient, affordable, and available for purchase online.

Water Heater Market Trend Analysis

Rising Demand for Energy-Efficient Water Heating Systems

- The emphasis on reducing greenhouse gas emissions has been spurred by environmental issues such as global warming and climate change. Energy-saving water heaters assist by using less energy, decreasing carbon footprints. Efficient water heating systems also help save resources and support wider sustainability objectives held by individuals, organizations, and governments. Progress in technology has increased the effectiveness of heating systems by introducing advancements such as condensing technology, heat pumps, and solar thermal systems.

- Water heaters that are energy-efficient can help reduce energy costs, leading to long-term savings. Even though they may be more expensive initially, the potential for long-term savings makes them an appealing choice for customers. Reduced energy costs can drive demand for such systems, leading to recovery of the initial investment. Governments worldwide are implementing rules on energy efficiency for appliances such as water heaters, leading manufacturers to create models that are more efficient. Incentives and rebates are given to incentivize consumers to select energy-efficient choices, making them more cost-effective and attractive.

- Incorporating smart technology features such as smart thermostats and timers enables more efficient management and optimization of energy usage in water heating systems. Consumers are becoming more conscious of the environmental effects of their decisions and are learning about the advantages of using energy-efficient appliances. Educational initiatives by governments, NGOs, and manufacturers play a crucial role in increasing awareness. Environmentally conscious consumers are increasingly seeking out green products, such as energy-efficient water heaters. Energy-saving systems provide enhanced characteristics and superior parts, boosting longevity and dependability, attracting customers seeking lasting advantages.

Opportunity

Integration Of Smart Water Heater with Adoption of Renewable Resources

- Smart water heaters can reduce waste by learning usage habits and heating water efficiently based on actual needs. They have the ability to modify settings according to high and low electricity rates, leading to cost savings. Hybrid systems alternate between solar energy and traditional power sources to improve efficiency and save money. Intelligent water heaters take part in demand response initiatives by modifying energy consumption during peak hours. Users can utilize real-time monitoring to make informed choices that can lead to additional reductions in energy consumption and expenses. In general, these characteristics improve energy efficiency and result in cost savings for consumers.

- Solar energy water heaters decrease dependence on fossil fuels, leading to a reduction in greenhouse gas emissions and carbon footprint. They function without producing emissions, promoting cleaner air and a more healthful environment. Incorporating sustainable energy sources can assist in meeting environmental guidelines and rules, possibly leading to receiving eco-friendly certifications. Individuals can take advantage of government incentives, subsidies, and tax credits that encourage the affordability of smart solar water heaters.

- The integration of IoT and AI into water heaters enables enhanced capabilities such as predictive maintenance and automatically adapting to weather conditions, which in turn decreases reliance on the grid. Combining battery storage with solar water heaters guarantees a steady supply of hot water even when the sun is not shining. Manufacturers have the opportunity to set their products apart by incorporating advanced features and linking with renewable energy sources, attracting customers who are tech-savvy and care about the environment. Consistent innovation may result in improved systems and a competitive edge.

Water Heater Market Segment Analysis:

Water Heater Market is segmented on the basis of Type, Technology, Application, Capacity, Distribution Channel, and Region.

By Type, Electric Segment is Expected to Dominate the Market During the Forecast Period

- Electric water heaters are easily accessible worldwide, readily obtained from retailers, online stores, or manufacturers. Their widespread availability and easy access through multiple distribution channels make them convenient for consumers in developed and developing countries alike. Electric water heaters are simple to install and operate compared to gas or solar heaters. They don't need fuel storage, making installation easier and safer. They are suitable for various residential and commercial settings due to their easy installation process and lack of complex venting systems or gas lines.

- Electric water heaters can be used indoors without the need for venting due to their versatility. They are available in small, compact designs that are perfect for limited spaces such as underneath sinks or within cabinets. This versatility permits installation in different indoor settings. Modern electric water heaters are equipped with highly developed heating components and insulation in order to improve energy efficiency. Renewable energy sources such as solar panels or wind turbines can also be combined with them in order to lower energy expenses and environmental footprint.

- Electric water heaters are a secure and dependable choice since they do not present a fire hazard similar to gas water heaters. They also provide reliable functioning and need minimal upkeep. This makes them a budget-friendly option for customers, particularly in regions with minimal gas resources. Electric water heaters must comply with rigorous safety and efficiency regulations established by governmental agencies in different countries to guarantee consumer safety and trust. Manufacturers subject their products to testing and certification in order to comply with industry standards regarding safety and reliability.

By Application, Residential Segment Held the Largest Share in 2023

- Residential properties worldwide have a constant and significant demand for reliable hot water supply, as access to hot water is an everyday necessity for bathing, cooking, and cleaning. This enhances residents' quality of life, especially during colder months, making residential water heaters crucial for comfort in chilly climates. The increasing world population and urbanization are fuelling the need for water heaters in newly built houses and renovated existing homes. Increased numbers of homes in urban areas are continuing to drive up the need for essential services in densely populated regions.

- Homeowners prioritize convenience and comfort by choosing fundamental conveniences, such as having hot water accessible in their home. They appreciate the ability to personalize and regulate their hot water preferences. Residential water heaters fulfil these requirements by offering instant hot water supply and the ability to adjust temperature and timing as needed. Residential water heaters are cheaper and easier to obtain compared to commercial or industrial heaters, with lower initial expenses and simple installation, making them ideal for homeowners with tight budgets or in established residences.

- Continuous technological developments in home water heaters involve energy-saving heating components, intelligent controls, and improved insulation materials, which boost efficiency and lower operational expenses. Integration of smart home technology allows for monitoring and controlling devices from a distance using smartphones or other gadgets. House owners are progressively turning to solar water heating systems to cut down on energy expenses and minimize their environmental footprint. Government incentives also encourage the use of renewable energy-powered water heaters in homes, which stimulates sustainable behaviours and contributes to the expansion of the market.

Water Heater Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is heavily populated, especially in countries like China and India. This results in increased urbanization levels, creating a need for housing and infrastructure. The increase in population drives the demand for water heating solutions in homes, hotels, hospitals, and offices. The increase in economic development in countries such as China, India, Indonesia, and Vietnam have caused a growth in the middle class, leading to higher levels of disposable income. This has in turn increased the affordability and demand for household appliances such as water heaters.

- Metropolitan areas in the Asia Pacific region also display elevated levels of living standards, leading to an increased need for water heaters that offer enhanced features and efficiency. The varied climates in Asia Pacific, ranging from tropical to temperate, affect the demand for hot water supply. Cultural standards in the area emphasize the importance of using hot water for bathing, cooking, and cleaning, resulting in a constant need for water heaters to satisfy these choices.

- Countries in the Asia Pacific region is at the lead of water heater production, developing cutting-edge products with advanced functionalities for domestic and international markets. Through the use of local manufacturing capacities, businesses are able to create products rapidly, tailor them to specific needs, and manufacture them in a cost-efficient manner, thereby enhancing market expansion and competitiveness. Infrastructure development and construction activities drive the need for reliable water heating solutions in ongoing residential, commercial, and industrial projects. The booming real estate sector in Asia Pacific countries further increases the demand for water heaters in new constructions and renovations.

- From this graph, it is shown that the size of the online water heater in China from 2019 to 2020. In 2023 their highest growth about 4120 billion yaun.

Water Heater Market Active Players

- Rheem Manufacturing Company (United States)

- A.O. Smith Corporation (United States)

- Bradford White Corporation (United States)

- Bosch Thermotechnology Corp. (Germany)

- Ariston Thermo Group (Italy)

- Rinnai Corporation (Japan)

- State Industries, Inc. (United States)

- Noritz Corporation (Japan)

- Ferroli S.p.A. (Italy)

- Whirlpool Corporation (United States)

- Eemax, Inc. (United States)

- Navien, Inc. (South Korea)

- Vaillant Group (Germany)

- Haier Group Corporation (China)

- Atmor Industries Ltd. (Israel)

- Stiebel Eltron GmbH & Co. KG (Germany)

- Nihon Itomic Co., Ltd. (Japan)

- Hubbell Incorporated (United States)

- Kenmore Appliances (United States)

- Lochinvar, LLC (United States)

- Eccotemp Systems, LLC (United States)

- HTP Comfort Solutions LLC (United States)

- Heat Transfer Products Group, LLC (United States)

- Marey Heater Corp. (United States)

- Whisen (South Korea)

-

Global Water Heater Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 29752.72 Million

Forecast Period 2024-32 CAGR:

4.98 %

Market Size in 2032:

USD 46077.17 Million

Segments Covered:

By Type

- Electric

- Solar

- Gas

- Hybrid

By Technology

- Tankless

- Storage

- Heat Pump

By Application

- Residential

- Commercial

- Industrial

By Capacity

- Below 30 Liters

- 30-100 Liters

- 100-250 Liters

- 250-400 Liters

- Above 400 Liters

By Distribution Channel

- Supermarket and Hypermarket

- Electric Stores

- Speciality Stores

- E-commerce Platforms

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Rising Demand for Energy-Efficient Water Heating Systems

Key Market Restraints:

- Technological Limitations

Key Opportunities:

- Integration Of Smart Water Heater with Adoption of Renewable Resources

Companies Covered in the report:

- Rheem Manufacturing Company (United States), A.O. Smith Corporation (United States), Bradford White Corporation (United States), Bosch Thermotechnology Corp. (Germany), and Other Active Players.

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Water Heater Market by By Type (2018-2032)

4.1 Water Heater Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Electric

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Solar

4.5 Gas

4.6 Hybrid

Chapter 5: Water Heater Market by By Technology (2018-2032)

5.1 Water Heater Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tankless

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Storage

5.5 Heat Pump

Chapter 6: Water Heater Market by By Application (2018-2032)

6.1 Water Heater Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Industrial

Chapter 7: Water Heater Market by By Capacity (2018-2032)

7.1 Water Heater Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Below 30 Liters

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 30-100 Liters

7.5 100-250 Liters

7.6 250-400 Liters

7.7 Above 400 Liters

Chapter 8: Water Heater Market by By Distribution Channel (2018-2032)

8.1 Water Heater Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Supermarket and Hypermarket

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Electric Stores

8.5 Speciality Stores

8.6 E-commerce Platforms

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Water Heater Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 RHEEM MANUFACTURING COMPANY (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 A.O. SMITH CORPORATION (UNITED STATES)

9.4 BRADFORD WHITE CORPORATION (UNITED STATES)

9.5 BOSCH THERMOTECHNOLOGY CORP. (GERMANY)

9.6 ARISTON THERMO GROUP (ITALY)

9.7 RINNAI CORPORATION (JAPAN)

9.8 STATE INDUSTRIES INC. (UNITED STATES)

9.9 NORITZ CORPORATION (JAPAN)

9.10 FERROLI S.P.A. (ITALY)

9.11 WHIRLPOOL CORPORATION (UNITED STATES)

9.12 EEMAX INC. (UNITED STATES)

9.13 NAVIEN INC. (SOUTH KOREA)

9.14 VAILLANT GROUP (GERMANY)

9.15 HAIER GROUP CORPORATION (CHINA)

9.16 ATMOR INDUSTRIES LTD. (ISRAEL)

9.17 STIEBEL ELTRON GMBH & CO. KG (GERMANY)

9.18 NIHON ITOMIC COLTD. (JAPAN)

9.19 HUBBELL INCORPORATED (UNITED STATES)

9.20 KENMORE APPLIANCES (UNITED STATES)

9.21 LOCHINVAR

9.22 LLC (UNITED STATES)

9.23 ECCOTEMP SYSTEMS

9.24 LLC (UNITED STATES)

9.25 HTP COMFORT SOLUTIONS LLC (UNITED STATES)

9.26 HEAT TRANSFER PRODUCTS GROUP

9.27 LLC (UNITED STATES)

9.28 MAREY HEATER CORP. (UNITED STATES)

9.29 WHISEN (SOUTH KOREA)

9.30 GROUPE ATLANTIC (FRANCE)

9.31 US CRAFTMASTER WATER HEATERS (UNITED STATES) OTHER MAJOR KEY PLAYERS.

Chapter 10: Global Water Heater Market By Region

10.1 Overview

10.2. North America Water Heater Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Electric

10.2.4.2 Solar

10.2.4.3 Gas

10.2.4.4 Hybrid

10.2.5 Historic and Forecasted Market Size By By Technology

10.2.5.1 Tankless

10.2.5.2 Storage

10.2.5.3 Heat Pump

10.2.6 Historic and Forecasted Market Size By By Application

10.2.6.1 Residential

10.2.6.2 Commercial

10.2.6.3 Industrial

10.2.7 Historic and Forecasted Market Size By By Capacity

10.2.7.1 Below 30 Liters

10.2.7.2 30-100 Liters

10.2.7.3 100-250 Liters

10.2.7.4 250-400 Liters

10.2.7.5 Above 400 Liters

10.2.8 Historic and Forecasted Market Size By By Distribution Channel

10.2.8.1 Supermarket and Hypermarket

10.2.8.2 Electric Stores

10.2.8.3 Speciality Stores

10.2.8.4 E-commerce Platforms

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Water Heater Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Electric

10.3.4.2 Solar

10.3.4.3 Gas

10.3.4.4 Hybrid

10.3.5 Historic and Forecasted Market Size By By Technology

10.3.5.1 Tankless

10.3.5.2 Storage

10.3.5.3 Heat Pump

10.3.6 Historic and Forecasted Market Size By By Application

10.3.6.1 Residential

10.3.6.2 Commercial

10.3.6.3 Industrial

10.3.7 Historic and Forecasted Market Size By By Capacity

10.3.7.1 Below 30 Liters

10.3.7.2 30-100 Liters

10.3.7.3 100-250 Liters

10.3.7.4 250-400 Liters

10.3.7.5 Above 400 Liters

10.3.8 Historic and Forecasted Market Size By By Distribution Channel

10.3.8.1 Supermarket and Hypermarket

10.3.8.2 Electric Stores

10.3.8.3 Speciality Stores

10.3.8.4 E-commerce Platforms

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Water Heater Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Electric

10.4.4.2 Solar

10.4.4.3 Gas

10.4.4.4 Hybrid

10.4.5 Historic and Forecasted Market Size By By Technology

10.4.5.1 Tankless

10.4.5.2 Storage

10.4.5.3 Heat Pump

10.4.6 Historic and Forecasted Market Size By By Application

10.4.6.1 Residential

10.4.6.2 Commercial

10.4.6.3 Industrial

10.4.7 Historic and Forecasted Market Size By By Capacity

10.4.7.1 Below 30 Liters

10.4.7.2 30-100 Liters

10.4.7.3 100-250 Liters

10.4.7.4 250-400 Liters

10.4.7.5 Above 400 Liters

10.4.8 Historic and Forecasted Market Size By By Distribution Channel

10.4.8.1 Supermarket and Hypermarket

10.4.8.2 Electric Stores

10.4.8.3 Speciality Stores

10.4.8.4 E-commerce Platforms

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Water Heater Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Electric

10.5.4.2 Solar

10.5.4.3 Gas

10.5.4.4 Hybrid

10.5.5 Historic and Forecasted Market Size By By Technology

10.5.5.1 Tankless

10.5.5.2 Storage

10.5.5.3 Heat Pump

10.5.6 Historic and Forecasted Market Size By By Application

10.5.6.1 Residential

10.5.6.2 Commercial

10.5.6.3 Industrial

10.5.7 Historic and Forecasted Market Size By By Capacity

10.5.7.1 Below 30 Liters

10.5.7.2 30-100 Liters

10.5.7.3 100-250 Liters

10.5.7.4 250-400 Liters

10.5.7.5 Above 400 Liters

10.5.8 Historic and Forecasted Market Size By By Distribution Channel

10.5.8.1 Supermarket and Hypermarket

10.5.8.2 Electric Stores

10.5.8.3 Speciality Stores

10.5.8.4 E-commerce Platforms

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Water Heater Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Electric

10.6.4.2 Solar

10.6.4.3 Gas

10.6.4.4 Hybrid

10.6.5 Historic and Forecasted Market Size By By Technology

10.6.5.1 Tankless

10.6.5.2 Storage

10.6.5.3 Heat Pump

10.6.6 Historic and Forecasted Market Size By By Application

10.6.6.1 Residential

10.6.6.2 Commercial

10.6.6.3 Industrial

10.6.7 Historic and Forecasted Market Size By By Capacity

10.6.7.1 Below 30 Liters

10.6.7.2 30-100 Liters

10.6.7.3 100-250 Liters

10.6.7.4 250-400 Liters

10.6.7.5 Above 400 Liters

10.6.8 Historic and Forecasted Market Size By By Distribution Channel

10.6.8.1 Supermarket and Hypermarket

10.6.8.2 Electric Stores

10.6.8.3 Speciality Stores

10.6.8.4 E-commerce Platforms

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Water Heater Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Electric

10.7.4.2 Solar

10.7.4.3 Gas

10.7.4.4 Hybrid

10.7.5 Historic and Forecasted Market Size By By Technology

10.7.5.1 Tankless

10.7.5.2 Storage

10.7.5.3 Heat Pump

10.7.6 Historic and Forecasted Market Size By By Application

10.7.6.1 Residential

10.7.6.2 Commercial

10.7.6.3 Industrial

10.7.7 Historic and Forecasted Market Size By By Capacity

10.7.7.1 Below 30 Liters

10.7.7.2 30-100 Liters

10.7.7.3 100-250 Liters

10.7.7.4 250-400 Liters

10.7.7.5 Above 400 Liters

10.7.8 Historic and Forecasted Market Size By By Distribution Channel

10.7.8.1 Supermarket and Hypermarket

10.7.8.2 Electric Stores

10.7.8.3 Speciality Stores

10.7.8.4 E-commerce Platforms

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Water Heater Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 29752.72 Million |

|

Forecast Period 2024-32 CAGR: |

4.98 % |

Market Size in 2032: |

USD 46077.17 Million |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Capacity |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Water Heater Market research report is 2024-2032.

Rheem Manufacturing Company (United States), A.O. Smith Corporation (United States), Bradford White Corporation (United States), Bosch Thermotechnology Corp. (Germany), Ariston Thermo Group (Italy), Rinnai Corporation (Japan), State Industries, Inc. (United States), Noritz Corporation (Japan), Ferroli S.p.A. (Italy), Whirlpool Corporation (United States), Eemax, Inc. (United States), Navien, Inc. (South Korea), Vaillant Group (Germany), Haier Group Corporation (China), Atmor Industries Ltd. (Israel), Stiebel Eltron GmbH & Co. KG (Germany), Nihon Itomic Co., Ltd. (Japan), Hubbell Incorporated (United States), Kenmore Appliances (United States), Lochinvar, LLC (United States), Eccotemp Systems, LLC (United States), HTP Comfort Solutions LLC (United States), Heat Transfer Products Group, LLC (United States), Marey Heater Corp. (United States), Whisen (South Korea), Groupe Atlantic (France), US Craftmaster Water Heaters (United States) and Other Active Players.

The Water Heater Market is segmented into Type, Technology, Application, Capacity, Distribution Channel, Segment6, and region. By Type, the market is categorized into Electric, Solar, Gas, Hybrid. By Technology, the market is categorized into Tankless, Storage, Heat Pump. By Application, the market is categorized into Residential, Commercial, Industrial. By Capacity, the market is categorized into Below 30 Liters, 30-100 Liters, 100-250 Liters, 250-400 Liters, above 400 Liters. By Distribution Channel, The Market Is Categorized into Supermarket and Hypermarket, Electric Stores, Specialty Stores, E-commerce Platforms. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The water heater market involves manufacturing, distributing, and selling devices that heat water for residential, commercial, and industrial purposes. These appliances are vital for providing hot water for bathing, cleaning, cooking, and space heating, utilizing various technologies and energy sources like tank-based, tankless, electric, gas, and solar-powered units.

Water Heater Market Size Was Valued at USD 29752.72 Million in 2023, and is Projected to Reach USD 46077.17 Million by 2032, Growing at a CAGR of 4.98% From 2024-2032.