Wealth Management Platform Market Synopsis

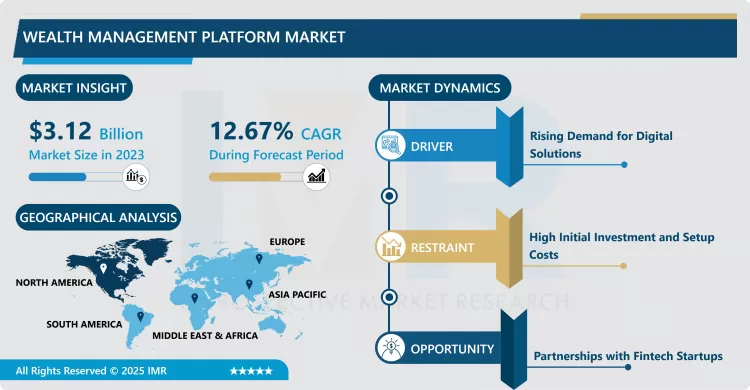

Wealth Management Platform Market Size Was Valued at USD 3.12 Billion in 2023, and is Projected to Reach USD 9.13 Billion by 2032, Growing at a CAGR of 12.67% from 2024-2032

The Wealth Management Platform Market means the industry which offers online services and software applications connected with the help of which financial consultants and wealth managers can analyze and enhance further their clients’ financial investments and portfolios. These platforms contain numerous services, encompassing financial planning, portfolio, risk assessment, performance measurement and client interaction services to support managers in the delivery of personalized wealth management services. This market is propelled by growing need for automation, analytical tools, and effective client interactions where the focus is made to deliver the solutions which can be easily implemented, automated, and tend to be less expensive to both private and institutional clients in wealth management industry.

Wealth management platforms are created to conquer the different requirements of economic advisors, private banking institutions, and wealth management solutions that enable professionals to supply complete solutions. They include portfolio management where the firm follows the management of an investment; investment tracking that involves tracking of assets; financial planning which is used in the management of an enterprise; and retirement planning that helps the clients in proper wealth management. There is increased competition for consumers as high net worth clients and sophistication of financial markets put pressure on wealth managers to find efficient solutions and platforms to manage their operations and offer prescriptive propose to their customers. But these platforms are also beneficial for wealth managers to deliver more effective operations for the clients and really help the clients to be offered with individualized recommendations based on analysis of their data.

The usage of such platforms has risen recently due to the total digitalisation process happening in the field of financial services. The use of artificial intelligence AI in conjunction with big data and analytic cloud proves to boost the scale, automation, and even personalization of wealth management. BlackRock’s AI and machine learning technologies are applied for automation of the processes in portfolios and for providing the clients with the individual recommendations based on the data of the present moment. Wealth managers can use the results of Big data analytics to get more understanding of the tendencies on the market and clients’ behavior to improved decision-makings. These technologies remain prominent factors aiding growth in wealth management platforms and are therefore a necessity that cannot be overlooked by any financial advisor determined to compete in today’s market space .

Wealth Management Platform Market Trend Analysis

The Growing Complexity of Investment Portfolios

- Whether referred to as complete wealth platforms or integrated staggering providers, these are also playing a significant role in the growth of wealth management since they offer a range of services including portfolio management, financial planning and reporting within one application. It allows wealth managers to think bigger, to offer clients the full package in terms of services and portfolio management, and more importantly, to help investors understand the increasingly complicated world of investment portfolios. Even as investment strategies become more elaborative, WM firms feel the need to embrace technologies that intensify management procedures. These platforms are also becoming indispensable in the competitive wealth management industry as the requirement of higher efficiency, accuracy, and individualization of investment management is growing.

- To adapt to these complexities some wealth management firms are applying artificial intelligence (AI), machine learning (ML), and big data analytics. These innovating help firms in the wealth management industry to deliver a much better approach to client services, coming up with recommendations of investment opportunities that best suit the clients’ needs as a result of data mining. AI and ML in turn assist in analyzing opportunities, asset distribution and movements to existing and potential wealth managers, as well as their clients. Big data analytics on the other hand makes it possible to analyze huge amount of client and market data to get improved insights to the wealth managers and the overall client advantage. In addition to doing so these technologies also deliver greater and more accurate wealth management solutions to clients.

Opportunity

Rising Demand for Personalized, Digital Solutions

- With investors wanting more of self-directed and online solutions for their investments, there is a need for wealth management platforms with sophisticated analytical tools, AI integrated investment solutions and rich user interfaces. These platforms enable FI’s to provide their clients with unique services, such as portfolio selection, real time market data as well as future trends and performance forecasts on the selected portfolio. The move to digital also enhances client satisfaction while at the same time making it easier for financial firms to hold on to, and attract new clients as investors expect to be served with applications that can quickly and easily solve their problems. While more people embrace advancements in technology to help them in their financial affairs, that ability to give a personal touch to clients via the digital interactions channel becomes an edge.

- In addition, the growing generation interested in and having more access to the technological bases of digital financial platforms is inclined to use digital wealth management services. This demographic is most times more technically inclined than the previous generations and as such is receptive to flexibility, accessibility and automation offered by such platforms. When such people are searching for the most efficient ways of managing their funds, they are fostering a constantly advancing customer base for the wealth management platforms. This shift is again enlarging the market and encouraging the change in men’s traditional advisory services and going completely online. The demand this group of consumers is relatively new hence, wealth management firms are adjusting their services to capture this group.

Wealth Management Platform Market Segment Analysis:

Wealth Management Platform Market is Segmented on the basis of By Advisory Mode, Deployment Model, Application, End-use, and Region

By Advisory Mode, Human Advisory segment is expected to dominate the market during the forecast period

- Human advisory is a conventional model of interaction between a client and a financial advisor. The passive management of investment schemes where specialists who understand the customer’s financial position, his attitude toward risk, and his long-term objectives make recommendations backed by extensive research into the market. HNWIs are its biggest users since it provides tailored services based on the customers’ unique requirements of financial services. Investment advisors provide social intelligence into obtaining fixed outlooks, industry patterns, and investment plans while considering specific client traits. It is personal because advisors can develop positive contracts with their customers, thus able to adjust their plans according to goals and markets.

- Despite growing reliance on algorithms, the human advisory segment remains popular since clients trust their actions to experienced professionals who offer much more than the contains of a financial robot. Complex aspects of our personal and business lives like wealth management, wills and taxes, and creating a legacy all require a personal touch. Some of the benefits include a client-tailored approach, access to smart people, empathy, and an ability to consider client emotions during volatile times. This segment is continuing to expand over time owing to the need for specialized face-to-face financial planning rather than relying on automated/algorithmic returns that may not be tailored to a customer’s specific needs while at the same time offering value-added advice from specialized market professionals, therefore producing devoted customer returns.

By End-use, Banking Investment Management Firms segment expected to held the largest share

- Companies that engage in banking investment management are very important in the financial service industry since they provide various needs to customer and clients. These firms deal in portfolio management, wealth management and investment advisory and help each client to realize their financial targets by managing their financial resources effectively in the best possible way. Specializing in investment advisory, tax, and wealth planning, these firms serve HNWIs, endowments, and foundations, and help them to generate more and minimize the losses to their assets. It provides a combination of high service, with face-to-face and remote services and technological aids that cater with clients’ needs.

- Robo-advisory has gained popularity and use in banking investment management and better performance management systems to support and meet the customers’ demands are on the rise. These firms utilize robo-advisors to offer an efficient and affordable level of advisory, at the same time guarantee the high level of individual approach and accessibility for clients. Also, performance management tools assist in monitoring investment and progress, managing return and guaranteeing portfolio meets the goal of the client. The new trend for firms has been to transform hybrid advisory models with the help of people and IT systems; these changes have become the key business strategy that lets these firms address more and more clients and respond to the market demand for efficient data use in the financial sector.

Wealth Management Platform Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Currently, North America is a region displaying impressive growth in the WM space, mainly due to a higher level of adoption of such novelties as robo-advisors and AI-based platforms. The reason in favour of this trend is the region’s economic power, high net worth population and growing consciousness about the digital investment prospects. The U.S. and Canadian wealth management firms are incorporating the use of technology to meet the needs of savvy investors who want efficient solutions to meet their financial needs. The increased usage of robo-advisors for portfolio management is another pointer to this realization because it is affordable and more accessible across the region.

- Further, the favourable regulation change and improvement has contributed significantly towards expansion of the market through enhanced transparency and investors’ protection. Increased number of high net worth individuals (HNWI) in North America has also helped to boost demand for wealth management platforms as the individuals looked for personalize investment solutions. US and Canada dominate this market where wealth management firms are now engaging high stake investments aimed at integrating more digital platforms to unlock the new market needs of the investors. Given that the region is now increasingly opening itself up to innovations and the digital age at an even faster rate, North America is set to retain its market leadership in the future global wealth management platform market.

Active Key Players in the Wealth Management Platform Market:

- SS & C Technologies, Inc.

- Fiserv Inc.

- FIS

- Profile Software

- Broadridge Financial Solutions, Inc.

- InvestEdge, Inc.

- Temenos Headquarters SA

- InvestCloud

- SEI Investments Company

- Comarch SA

- Dorsum Limited

- Avaloq Group AG

- Other Active Players

|

Wealth Management Platform Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.12 Billion |

|

Forecast Period 2024-32 CAGR: |

12.67% |

Market Size in 2032: |

USD 9.13 Billion |

|

|

By Advisory Mode |

|

|

|

By Deployment Model |

|

||

|

By Application |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wealth Management Platform Market by By Advisory Mode (2018-2032)

4.1 Wealth Management Platform Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Human Advisory

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Robo Advisory

4.5 Hybrid

Chapter 5: Wealth Management Platform Market by By Deployment Model (2018-2032)

5.1 Wealth Management Platform Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-premise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud

Chapter 6: Wealth Management Platform Market by By Application (2018-2032)

6.1 Wealth Management Platform Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Financial Advice & Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Portfolio

6.5 Accounting & Trading Management

6.6 Performance Management

6.7 Risk & Compliance Management

6.8 Reporting

Chapter 7: Wealth Management Platform Market by By End-use (2018-2032)

7.1 Wealth Management Platform Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Banking Investment Management Firms

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Trading & Exchange Firms

7.5 Brokerage Firms

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Wealth Management Platform Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SS & C TECHNOLOGIES INC.

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 FISERV INC.

8.4 FIS

8.5 PROFILE SOFTWARE

8.6 BROADRIDGE FINANCIAL SOLUTIONS INC.

8.7 INVESTEDGE INC.

8.8 TEMENOS HEADQUARTERS SA

8.9 INVESTCLOUD

8.10 SEI INVESTMENTS COMPANY

8.11 COMARCH SA

8.12 DORSUM LIMITED

8.13 AVALOQ GROUP AG

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Wealth Management Platform Market By Region

9.1 Overview

9.2. North America Wealth Management Platform Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Advisory Mode

9.2.4.1 Human Advisory

9.2.4.2 Robo Advisory

9.2.4.3 Hybrid

9.2.5 Historic and Forecasted Market Size By By Deployment Model

9.2.5.1 On-premise

9.2.5.2 Cloud

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Financial Advice & Management

9.2.6.2 Portfolio

9.2.6.3 Accounting & Trading Management

9.2.6.4 Performance Management

9.2.6.5 Risk & Compliance Management

9.2.6.6 Reporting

9.2.7 Historic and Forecasted Market Size By By End-use

9.2.7.1 Banking Investment Management Firms

9.2.7.2 Trading & Exchange Firms

9.2.7.3 Brokerage Firms

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Wealth Management Platform Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Advisory Mode

9.3.4.1 Human Advisory

9.3.4.2 Robo Advisory

9.3.4.3 Hybrid

9.3.5 Historic and Forecasted Market Size By By Deployment Model

9.3.5.1 On-premise

9.3.5.2 Cloud

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Financial Advice & Management

9.3.6.2 Portfolio

9.3.6.3 Accounting & Trading Management

9.3.6.4 Performance Management

9.3.6.5 Risk & Compliance Management

9.3.6.6 Reporting

9.3.7 Historic and Forecasted Market Size By By End-use

9.3.7.1 Banking Investment Management Firms

9.3.7.2 Trading & Exchange Firms

9.3.7.3 Brokerage Firms

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Wealth Management Platform Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Advisory Mode

9.4.4.1 Human Advisory

9.4.4.2 Robo Advisory

9.4.4.3 Hybrid

9.4.5 Historic and Forecasted Market Size By By Deployment Model

9.4.5.1 On-premise

9.4.5.2 Cloud

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Financial Advice & Management

9.4.6.2 Portfolio

9.4.6.3 Accounting & Trading Management

9.4.6.4 Performance Management

9.4.6.5 Risk & Compliance Management

9.4.6.6 Reporting

9.4.7 Historic and Forecasted Market Size By By End-use

9.4.7.1 Banking Investment Management Firms

9.4.7.2 Trading & Exchange Firms

9.4.7.3 Brokerage Firms

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Wealth Management Platform Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Advisory Mode

9.5.4.1 Human Advisory

9.5.4.2 Robo Advisory

9.5.4.3 Hybrid

9.5.5 Historic and Forecasted Market Size By By Deployment Model

9.5.5.1 On-premise

9.5.5.2 Cloud

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Financial Advice & Management

9.5.6.2 Portfolio

9.5.6.3 Accounting & Trading Management

9.5.6.4 Performance Management

9.5.6.5 Risk & Compliance Management

9.5.6.6 Reporting

9.5.7 Historic and Forecasted Market Size By By End-use

9.5.7.1 Banking Investment Management Firms

9.5.7.2 Trading & Exchange Firms

9.5.7.3 Brokerage Firms

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Wealth Management Platform Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Advisory Mode

9.6.4.1 Human Advisory

9.6.4.2 Robo Advisory

9.6.4.3 Hybrid

9.6.5 Historic and Forecasted Market Size By By Deployment Model

9.6.5.1 On-premise

9.6.5.2 Cloud

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Financial Advice & Management

9.6.6.2 Portfolio

9.6.6.3 Accounting & Trading Management

9.6.6.4 Performance Management

9.6.6.5 Risk & Compliance Management

9.6.6.6 Reporting

9.6.7 Historic and Forecasted Market Size By By End-use

9.6.7.1 Banking Investment Management Firms

9.6.7.2 Trading & Exchange Firms

9.6.7.3 Brokerage Firms

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Wealth Management Platform Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Advisory Mode

9.7.4.1 Human Advisory

9.7.4.2 Robo Advisory

9.7.4.3 Hybrid

9.7.5 Historic and Forecasted Market Size By By Deployment Model

9.7.5.1 On-premise

9.7.5.2 Cloud

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Financial Advice & Management

9.7.6.2 Portfolio

9.7.6.3 Accounting & Trading Management

9.7.6.4 Performance Management

9.7.6.5 Risk & Compliance Management

9.7.6.6 Reporting

9.7.7 Historic and Forecasted Market Size By By End-use

9.7.7.1 Banking Investment Management Firms

9.7.7.2 Trading & Exchange Firms

9.7.7.3 Brokerage Firms

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Wealth Management Platform Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.12 Billion |

|

Forecast Period 2024-32 CAGR: |

12.67% |

Market Size in 2032: |

USD 9.13 Billion |

|

|

By Advisory Mode |

|

|

|

By Deployment Model |

|

||

|

By Application |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Market research report is 2024-2032.

SS&C Technologies, Inc., Fiserv Inc., FIS, Profile Software, Broadridge Financial Solutions, Inc., InvestEdge, Inc., Temenos Headquarters SA, InvestCloud, SEI Investments Company, Comarch SA, Dorsum Limited, Avaloq Group AG, and Other Active Players.

The Wealth Management Platform Market is segmented into By Advisory Mode, By Deployment Model, By Application, By End-use and region. By Advisory Mode, the market is categorized into Human Advisory, Robo Advisory, Hybrid. By Deployment Model, the market is categorized into On-premise, Cloud. By Application, the market is categorized into Financial Advice & Management, Portfolio, Accounting & Trading Management, Performance Management, Risk & Compliance Management, Reporting. By End-use, the market is categorized into Banking Investment Management Firms, Trading & Exchange Firms, Brokerage Firms. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Wealth Management Platform Market refers to the sector that provides digital solutions and software tools designed to support financial advisors and wealth managers in managing and optimizing their clients' investments and financial portfolios. These platforms integrate various functionalities, including financial planning, portfolio management, risk assessment, performance tracking, and client communication, helping wealth managers deliver personalized services. The market is driven by the increasing demand for automation, data-driven insights, and seamless client engagement, with an emphasis on providing more efficient and scalable solutions for both individuals and institutions in the wealth management industry.

Wealth Management Platform Market Size Was Valued at USD 3.12 Billion in 2023, and is Projected to Reach USD 9.13 Billion by 2032, Growing at a CAGR of 12.67% from 2024-2032