Weight Control Product Market Synopsis

Weight Control Product Market Size Was Valued at USD 188.23 Billion in 2023, and is Projected to Reach USD 347.22 Billion by 2032, Growing at a CAGR of 7.04% From 2024-2032.

Weight control products are items designed to aid individuals in managing their weight by either promoting weight loss, weight maintenance, or weight gain, depending on the specific goals of the consumer. These products can include dietary supplements, meal replacement shakes, appetite suppressants, fat burners, metabolism boosters, and low-calorie foods or beverages. They often contain ingredients such as vitamins, minerals, fiber, protein, caffeine, or herbal extracts that are believed to support weight management efforts.

- Weight control products are designed to help individuals manage their weight effectively. They come in various forms and serve different purposes, catering to diverse consumer needs. Common applications include dietary supplements, meal replacement shakes, low-calorie snacks, fitness equipment, meal planning and tracking tools, and behavioral support programs. Supplements contain ingredients like vitamins, minerals, and herbal extracts that support weight loss or management. Meal replacement shakes are convenient alternatives to traditional meals, providing essential nutrients while controlling calorie intake.

- Low-calorie snacks are portion-controlled and formulated to satisfy cravings without contributing to excessive calorie intake. Fitness equipment, such as treadmills, stationary bikes, resistance bands, and exercise DVDs, helps individuals incorporate exercise into their daily routines. Meal planning and tracking tools promote accountability and awareness, while behavioral support programs address psychological and emotional factors influencing eating behaviors and weight loss success. The obesity epidemic and the desire for aesthetic appearance have led to a surge in demand for weight control products.

- The Weight control products offer convenience, as they can be easily integrated into daily routines without extensive meal planning or exercise routines. They also cater to busy lifestyles, where time is limited for meal preparation or exercise. Social media and cultural trends on platforms like Instagram and TikTok also influence consumer behavior, increasing the demand for weight management products. Furthermore, advances in scientific research and product development have led to the introduction of new and improved weight control products with enhanced efficacy and safety profiles, further fueling consumer interest and demand.

Weight Control Product Market Trend Analysis

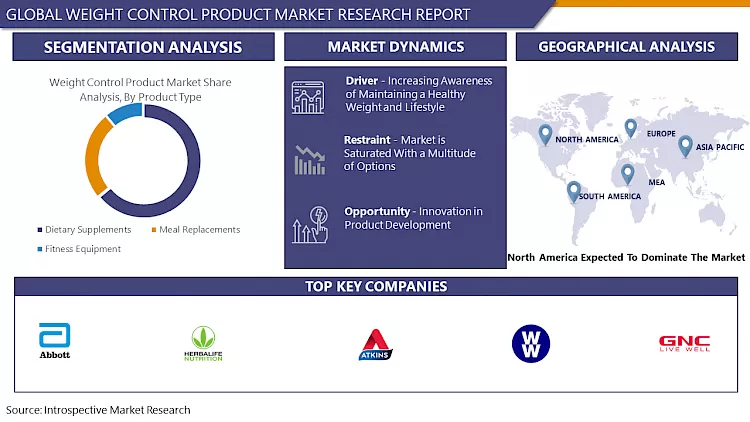

Increasing Awareness of Maintaining a Healthy Weight and Lifestyle

- The awareness is driven by growing concerns about obesity rates, diabetes, heart disease, and hypertension. The proliferation of health-related information through various media channels has contributed to increased awareness about weight control, with consumers exposed to messages about healthy eating habits, exercise routines, and the risks associated with being overweight or obese.

- Healthcare professionals, including doctors, nutritionists, and dietitians, play a crucial role in educating individuals about the importance of weight management for overall health and well-being. The increasing awareness of maintaining a healthy weight and lifestyle is a significant driver for weight control products.

- Celebrity endorsements and influencers who advocate for healthy living and weight management can significantly impact consumer perceptions and behaviors. Government initiatives and policies often launch campaigns to raise public awareness about the importance of maintaining a healthy weight, including educational programs, public service announcements, and policy interventions.

- Social norms and peer influence also play a role in driving demand for weight control products as people seek to align with perceived norms and expectations. The desire for self-improvement is another driving factor, as many consumers aspire to improve their overall quality of life, which often includes efforts to achieve and maintain a healthy weight.

Restraint

Market is Saturated With a Multitude of Options

- The market for weight control products is saturated, with numerous options available for various needs and goals. This can lead to confusion and dissatisfaction among consumers. Trust and credibility issues arise due to consumers questioning the efficacy and safety of certain products. Competition among brands intensifies, with established brands facing new entrants offering innovative products and alternative approaches.

- Quality control and regulatory compliance become increasingly challenging, as some products may not meet safety standards or contain undisclosed ingredients, posing health risks. This lack of oversight can undermine consumer trust and lead to regulatory crackdowns. Brand loyalty and switching costs can result from consumers struggling to find consistent results or meet their expectations. Market fragmentation can result from various niche segments targeting specific demographics, preferences, or dietary requirements.

- Market fragmentation can complicate market analysis, distribution strategies, and product positioning for businesses. Limited innovation and product differentiation are essential for standing out in a saturated market, but the abundance of options can stifle innovation, as businesses may prioritize replicating existing products or following trends rather than investing in groundbreaking solutions.

Opportunity

Innovation in Product Development

- Innovative weight control products can provide a competitive advantage by offering unique features, formulations, and delivery methods. These products can be tailored to specific consumer needs, such as age groups, dietary preferences, or lifestyle factors, expanding the market reach.

- Advances in formulation and ingredient technology can enhance product efficacy and safety, while personalization and customization can be enabled through personalized nutrition plans, meal replacements, or wearable devices. Technology integration can enhance user experience and provide valuable data insights for continuous product improvement.

- Expanding into adjacent markets can be achieved by combining weight management with other health benefits, such as energy support, immune support, or cognitive enhancement. However, addressing environmental sustainability concerns can be achieved by exploring eco-friendly packaging solutions, plant-based ingredients, or sustainable sourcing practices. Furthermore, innovative product development can help weight control companies stand out in the market.

Challenge

Regulations Govern the Marketing and Sale of Weight Control Products

- Weight control product marketing and sales face numerous challenges, including strict labeling requirements, rigorous safety and efficacy testing, ingredient restrictions and bans, advertising restrictions, monitoring and enforcement, international compliance, and legal liability. Regulatory agencies often impose strict labeling requirements to ensure accurate information about ingredients, dosage instructions, and potential side effects.

- Meeting these requirements can be complex and costly for manufacturers, especially those operating in multiple jurisdictions with varying regulations. Some regulatory agencies may impose restrictions or bans on certain ingredients due to safety concerns or lack of evidence supporting their efficacy. Advertising restrictions are also a challenge, as companies must ensure their marketing materials comply with these regulations to avoid penalties and maintain consumer trust.

- Monitoring and enforcement can be time-consuming and resource-intensive, especially for businesses expanding their global presence. Non-compliance with regulatory requirements can expose companies to legal liability and damage their reputation, making it essential to ensure weight control products meet all applicable regulations for consumer safety and business long-term viability.

Weight Control Product Market Segment Analysis:

Weight Control Product Market is Segmented on the basis of product type, Ingredient, age, gender, and distribution channel.

By Product Type, Dietary Supplements segment is expected to dominate the market during the forecast period

- Dietary supplements are popular for weight control due to their convenience and flexibility, available in various forms like capsules, tablets, powders, and liquids. They are marketed for their perceived health benefits, such as boosting metabolism and supporting overall well-being. The market offers a wide array of products, catering to individual preferences and needs. Dietary supplements are widely available in pharmacies, grocery stores, health food stores, and online retailers, making them easily accessible.

- Companies invest in marketing and promotional strategies to raise awareness and educate consumers about their products. Regulatory requirements for dietary supplements are generally less stringent than those for pharmaceutical drugs, allowing for faster and more cost-effective product development. Dietary supplements are also a convenient solution for busy lifestyles, as they allow consumers to supplement their diet with key nutrients and bioactive compounds without significant changes to their daily routines.

By Ingredient, Natural segment held the largest share of 35% in 2022

- Consumers are increasingly choosing natural ingredients in weight control products due to concerns about synthetic additives and chemicals. Natural ingredients are perceived as safer and healthier, aligning with clean label preferences. They are also perceived as more effective and gentler on the body compared to synthetic alternatives. Consumers are also seeking transparency and authenticity in ingredient sourcing and processing methods.

- Natural ingredients may enjoy lenient regulatory treatment, making it easier for companies to formulate products using these ingredients. Companies can leverage the natural segment to differentiate their products and create a unique selling proposition in the competitive weight control market. Additionally, consumers are becoming more aware of sustainable and ethical practices, as natural ingredients are perceived as more sustainable and environmentally friendly.

Weight Control Product Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, particularly the United States, has high obesity rates, leading to a significant market demand for weight control products. This is driven by a strong health-conscious culture, advanced healthcare infrastructure, consumer awareness, and robust marketing and distribution channels. Consumers are well-informed about the importance of maintaining a healthy weight and lifestyle, making them more likely to adopt weight management strategies.

- The regulatory environment in North America is generally well-established and transparent, providing confidence to consumers and investors. The cultural influence of physical appearance, fitness, and wellness in North America also drives consumer interest in weight management solutions. Overall, the North American market is a significant player in the global weight control product market, driven by a combination of factors.

Weight Control Product Market Top Key Players:

- Herbalife Nutrition Ltd. (US)

- Nutrisystem, Inc. (US)

- Weight Watchers International, Inc. (US)

- Abbott Laboratories (US)

- Atkins Nutritionals, Inc. (US)

- GNC Holdings, Inc. (US)

- Amway Corporation (US)

- SlimFast (US)

- USANA Health Sciences, Inc. (US)

- General Nutrition Centers, Inc. (GNC) (US)

- MuscleTech (US)

- The Coca-Cola Company (US)

- PepsiCo, Inc. (US)

- The Nature's Bounty Co. (US)

- Kellogg Company (US)

- Procter & Gamble Co. (US)

- Johnson & Johnson (US)

- Pfizer Inc. (US)

- Bayer AG (Germany)

- GlaxoSmithKline plc (UK)

- Unilever (UK)

- Danone S.A. (France)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Nestlé S.A. (Switzerland)

- Glanbia plc (Ireland), and other major players

Key Industry Developments in the Weight Control Product Market:

- In February 2024, Herbalife, a premier health and wellness company and community, announced the launch of the Herbalife® GLP-1 Nutrition Companion, a new range of food and supplement product combos fueled by the #1 Protein Shake in the World* and intended to support the nutritional needs of individuals on GLP-1 and other weight-loss medications. Herbalife’s Classic and Vegan options are now available in the United States and Puerto Rico in a variety of flavors.

- In December 2023, Nutrisystem®, a division of Wellful, Inc. and a leading provider of health and wellness and weight loss solutions, launched Nutrisystem 7 in 7 program. Nutrisystem 7 in 7 is a new program that includes a one-week, high-protein jumpstart that allows customers to lose up to seven pounds in their first seven days. The plan is designed to help control hunger between meals and is specially created to prime the body for steady weight loss.

|

Global Weight Control Product Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

188.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.04% |

Market Size in 2032: |

347.22 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Ingredient |

|

||

|

By Age |

|

||

|

By Gender |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Weight Control Product Market by By Product Type (2018-2032)

4.1 Weight Control Product Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dietary Supplements

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Meal Replacements

4.5 Fitness Equipment

Chapter 5: Weight Control Product Market by By Ingredient (2018-2032)

5.1 Weight Control Product Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Natural

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Organic

5.5 Low-Calorie

Chapter 6: Weight Control Product Market by By Age (2018-2032)

6.1 Weight Control Product Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Teenagers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Adults

Chapter 7: Weight Control Product Market by By Gender (2018-2032)

7.1 Weight Control Product Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Men

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Women

Chapter 8: Weight Control Product Market by By Distribution Channel (2018-2032)

8.1 Weight Control Product Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Online

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Offline

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Weight Control Product Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 CARGILL INCORPORATED (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ARCHER DANIELS MIDLAND COMPANY (US)

9.4 BUNGE LIMITED (US)

9.5 UNITED SUGARS CORPORATION (US)

9.6 AMERICAN CRYSTAL SUGAR COMPANY (US)

9.7 SUDZUCKER AG (GERMANY)

9.8 NORDZUCKER AG (GERMANY)

9.9 ASSOCIATED BRITISH FOODS PLC (UK)

9.10 TEREOS (FRANCE)

9.11 LOUIS DREYFUS COMPANY (NETHERLANDS)

9.12 COFCO INTERNATIONAL (CHINA)

9.13 GUANGXI NANNING SUGAR INDUSTRY COLTD. (CHINA)

9.14 E.I.D. PARRY (INDIA) LIMITED (INDIA)

9.15 SHREE RENUKA SUGARS LIMITED (INDIA)

9.16 DHAMPUR SUGAR MILLS LTD. (INDIA)

9.17 TULLY SUGAR LIMITED (AUSTRALIA)

9.18 COSAN LIMITED (BRAZIL)

9.19 RAÍZEN (BRAZIL)

9.20 BIOSEV (BRAZIL)

9.21 TONGAAT HULETT (SOUTH AFRICA)

9.22 ILLOVO SUGAR AFRICA (SOUTH AFRICA)

9.23

Chapter 10: Global Weight Control Product Market By Region

10.1 Overview

10.2. North America Weight Control Product Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Product Type

10.2.4.1 Dietary Supplements

10.2.4.2 Meal Replacements

10.2.4.3 Fitness Equipment

10.2.5 Historic and Forecasted Market Size By By Ingredient

10.2.5.1 Natural

10.2.5.2 Organic

10.2.5.3 Low-Calorie

10.2.6 Historic and Forecasted Market Size By By Age

10.2.6.1 Teenagers

10.2.6.2 Adults

10.2.7 Historic and Forecasted Market Size By By Gender

10.2.7.1 Men

10.2.7.2 Women

10.2.8 Historic and Forecasted Market Size By By Distribution Channel

10.2.8.1 Online

10.2.8.2 Offline

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Weight Control Product Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Product Type

10.3.4.1 Dietary Supplements

10.3.4.2 Meal Replacements

10.3.4.3 Fitness Equipment

10.3.5 Historic and Forecasted Market Size By By Ingredient

10.3.5.1 Natural

10.3.5.2 Organic

10.3.5.3 Low-Calorie

10.3.6 Historic and Forecasted Market Size By By Age

10.3.6.1 Teenagers

10.3.6.2 Adults

10.3.7 Historic and Forecasted Market Size By By Gender

10.3.7.1 Men

10.3.7.2 Women

10.3.8 Historic and Forecasted Market Size By By Distribution Channel

10.3.8.1 Online

10.3.8.2 Offline

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Weight Control Product Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Product Type

10.4.4.1 Dietary Supplements

10.4.4.2 Meal Replacements

10.4.4.3 Fitness Equipment

10.4.5 Historic and Forecasted Market Size By By Ingredient

10.4.5.1 Natural

10.4.5.2 Organic

10.4.5.3 Low-Calorie

10.4.6 Historic and Forecasted Market Size By By Age

10.4.6.1 Teenagers

10.4.6.2 Adults

10.4.7 Historic and Forecasted Market Size By By Gender

10.4.7.1 Men

10.4.7.2 Women

10.4.8 Historic and Forecasted Market Size By By Distribution Channel

10.4.8.1 Online

10.4.8.2 Offline

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Weight Control Product Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Product Type

10.5.4.1 Dietary Supplements

10.5.4.2 Meal Replacements

10.5.4.3 Fitness Equipment

10.5.5 Historic and Forecasted Market Size By By Ingredient

10.5.5.1 Natural

10.5.5.2 Organic

10.5.5.3 Low-Calorie

10.5.6 Historic and Forecasted Market Size By By Age

10.5.6.1 Teenagers

10.5.6.2 Adults

10.5.7 Historic and Forecasted Market Size By By Gender

10.5.7.1 Men

10.5.7.2 Women

10.5.8 Historic and Forecasted Market Size By By Distribution Channel

10.5.8.1 Online

10.5.8.2 Offline

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Weight Control Product Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Product Type

10.6.4.1 Dietary Supplements

10.6.4.2 Meal Replacements

10.6.4.3 Fitness Equipment

10.6.5 Historic and Forecasted Market Size By By Ingredient

10.6.5.1 Natural

10.6.5.2 Organic

10.6.5.3 Low-Calorie

10.6.6 Historic and Forecasted Market Size By By Age

10.6.6.1 Teenagers

10.6.6.2 Adults

10.6.7 Historic and Forecasted Market Size By By Gender

10.6.7.1 Men

10.6.7.2 Women

10.6.8 Historic and Forecasted Market Size By By Distribution Channel

10.6.8.1 Online

10.6.8.2 Offline

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Weight Control Product Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Product Type

10.7.4.1 Dietary Supplements

10.7.4.2 Meal Replacements

10.7.4.3 Fitness Equipment

10.7.5 Historic and Forecasted Market Size By By Ingredient

10.7.5.1 Natural

10.7.5.2 Organic

10.7.5.3 Low-Calorie

10.7.6 Historic and Forecasted Market Size By By Age

10.7.6.1 Teenagers

10.7.6.2 Adults

10.7.7 Historic and Forecasted Market Size By By Gender

10.7.7.1 Men

10.7.7.2 Women

10.7.8 Historic and Forecasted Market Size By By Distribution Channel

10.7.8.1 Online

10.7.8.2 Offline

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Weight Control Product Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

188.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.04% |

Market Size in 2032: |

347.22 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Ingredient |

|

||

|

By Age |

|

||

|

By Gender |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Weight Control Product Market research report is 2024-2032.

Herbalife Nutrition Ltd. (US), Nutrisystem, Inc. (US), Weight Watchers International, Inc. (US), Abbott Laboratories (US), Atkins Nutritionals, Inc. (US), GNC Holdings, Inc. (US), Amway Corporation (US), SlimFast (US), USANA Health Sciences, Inc. (US), General Nutrition Centers, Inc. (GNC) (US), MuscleTech (US), The Coca-Cola Company (US),PepsiCo, Inc. (US), The Nature's Bounty Co. (US),Kellogg Company (US),Procter & Gamble Co. (US),Johnson & Johnson (US), Pfizer Inc. (US), Bayer AG (Germany), GlaxoSmithKline plc (UK), Unilever (UK), Danone S.A. (France), Otsuka Pharmaceutical Co., Ltd. (Japan), Nestlé S.A. (Switzerland), Glanbia plc (Ireland), and Other Major Players.

The Weight Control Product Market is segmented into Product Type, Ingredient, Age, Gender, Distribution Channel, and region. By Product Type, the market is categorized into Dietary Supplements, Meal Replacements, and Fitness Equipment. By Ingredient, the market is categorized into Natural, Organic, and Low-Calorie. By Age, the market is categorized into Teenagers and adults. By Gender, the market is categorized into Men and women. By Distribution Channel, the market is categorized into Online and offline. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The weight control product market refers to the industry focused on products and services designed to help individuals manage their weight. This includes a wide range of offerings such as dietary supplements, meal replacements, fitness equipment, weight loss programs, and other related solutions aimed at promoting weight loss, weight maintenance, and overall wellness. The market caters to consumers looking to achieve their weight goals through various approaches, including diet modification, exercise, lifestyle changes, and supplementation.

Weight Control Product Market Size Was Valued at USD 188.23 Billion in 2023, and is Projected to Reach USD 347.22 Billion by 2032, Growing at a CAGR of 7.04% From 2024-2032.