Wireless Audio Devices Market Synopsis:

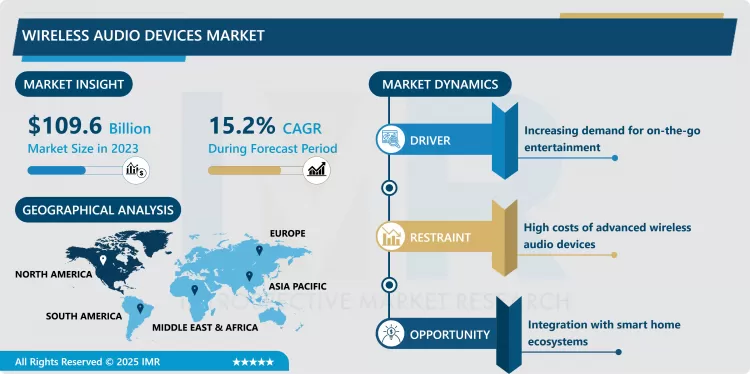

Wireless Audio Devices Market Size Was Valued at USD 109.6 Billion in 2023, and is Projected to Reach USD 391.5 Billion by 2032, Growing at a CAGR of 15.2% From 2024-2032.

The market of wireless audio devices includes the devices which transmit audio signals with the help of wireless technologies such as Bluetooth, Wi-Fi, or radiofrequency, rather than a cable. These are earphones, headphones, speakers, sound bars, and microphones that reflect portability, convenience, and better experiences. Wireless communication has continued to expand at a very fast pace, and this pace is expected to increase in future due to the emergence of new wireless applications in personal entertainment, communication, automobiles, and business. These solutions have gained popularity in both smart home systems and the portable entertainment market as a result.

Global wireless audio devices market has been grown rapidly in the past few years due to technology enhancement and shift in customer taste. The availability of portable devices like smart phones, social pads, smart TVs’ has encouraged market to look for wireless speakers that have better and improved sound quality. Further, wireless lifestyle, with contributions made by TWS earbuds, has changed the ways consumers or users listen to audio contents. The specific requirements of these customers are shorter battery time, better noise cancellation, and better voice assistant integration that the major players are investing in through R&D.

Also, the market is backed by the emergence of new streaming services, as well as the need for working from home that leads to the consumption of high-quality wireless headphones and speakers. Another industry to have gaining importance is the automotive industry with wireless audio systems becoming essential for great in car entertainment. Wireless audio devices’ market is slowly advancing in the various segments of housing such as residential, commercial, and industrial segments, so market has bright future in the next few years.

Wireless Audio Devices Market Trend Analysis:

Rise of True Wireless Stereo (TWS) Technology

- True Wireless Stereo or TWS is now one of the most impactful trends visible in the wireless market for audio devices. There is now numerous TWS earphones and earbuds in the market because of their convenience in use, small form factor, and ANCs and touch controls. High-profile players in smartphone industry like Apple, Samsung, Sony etc. have been setting the pace in this regard by providing customers trends that create far superior sound quality and improved usership experience. The increase in the use of TWS earbuds by fitness lovers, daily travelers, and gamers has also contributed to deep market penetration more so with established brands. They thus predict that due to increased manufacturer emphasis on battery optimization and the incorporation of artificial intelligence elements in this segment, TWS is well placed to be the segment that leads the wireless audio market.

Growing Demand in Smart Home Integration

- Integration of wireless audio devices with smart home systems is likely to major market opportunity due to higher usage rate across houses. Some of the best examples include wireless speakers and soundbars which form part of smart home devices intended to harmonize with voice assistants including Alexa, Google Assistant, and Siri. With smart living solutions steadily becoming the new norm consumers are likely to increasingly look for wireless audio systems that support multi-room and smart capabilities. This trend is even more so with increasing disposable income in the pockets of the consumers suitable for premium home entertainment and willingness to spend on such a system places the market in a position of strength moving forward.

Wireless Audio Devices Market Segment Analysis:

Wireless Audio Devices Market is Segmented on the basis of Product, Technology, Application, and Region

By Product, Earphone segment is expected to dominate the market during the forecast period

- The research also highlights that earphone segment is expected to dominate the wireless audio devices market over the forecast period because of the rapidly increasing demand for portable sound delivery systems. Mobile phone users are shifting towards wireless earphones due to ease of use, necessary connectivity, fluidity of functions, noise cancellation, and water proofing and many more. Highly combined working variants have also contributed to the burgeoning of earphones needs since it forms a major equipment for informal communication as well as entertainment.

- Further, technological changes in bluetooth and technology advancements in design have seen manufacturer deliver earphones with enhanced sound quality and increased battery life. Of all the electronic accessories, there is a relatively high popularity of TWS earphones, which have a large share of the earphone market among tech-savvy consumers. Enhancements such as wearable technology including heart rate tracking and water proofing fitness focused earphones has also boosted the segment.

By Technology, Bluetooth segment expected to held the largest share

- Among the wireless audio devices, the Bluetooth segment is expected to hold the largest market share due to the high usage and availability with immense types of products. Bluetooth connectivity is smooth, consumes less power and has a better audio quality in wireless audio. The growth of the segment has been helped by the availability of new Bluetooth codecs including aptX and LDAC.

- Mobile phones accessories that support Bluetooth connectivity including earphones, headphones and speakers are on high demand due to their flexibility and operational simplicity. The segment has also been opened by the availability of smartphones, mp3 players and all devices which use Bluetooth connection. The blessings of technology are persistent especially that it yields continual innovation in Bluetooth where Bluetooth Low Energy (BLE) have been developed for more battery efficiency, it is for these reasons that segment is expected to sustain its dominance in the market.

Wireless Audio Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America emerged as the leading region for wireless audio devices market in 2023 in terms of market share. The region has more smart devices connected, most technology players and the emerging need for better end-to-end audio solutions. Market share In North America was reaching approximately 35 % in 2023 due to a higher tendency of consumers’ expenditure towards wireless technologies and home entertainment networks. Chief among these countries include the United States that has registered high demand for the firm’s wireless earphones, speakers, and soundbars products. A young tech-savvy privatized population and the ease of access to enhance products have done much more to cement the region’s position as the leading in the global market.

Active Key Players in the Wireless Audio Devices Market:

- Apple Inc. (USA)

- Bose Corporation (USA)

- Creative Technology Ltd. (Singapore)

- Google LLC (USA)

- Harman International Industries (USA)

- Jabra (Denmark)

- JBL (USA)

- Logitech International S.A. (Switzerland)

- Panasonic Corporation (Japan)

- Plantronics, Inc. (USA)

- Samsung Electronics Co., Ltd. (South Korea)

- Sennheiser Electronic GmbH & Co. KG (Germany)

- Sony Corporation (Japan)

- V-Moda (USA)

- Yamaha Corporation (Japan)

- Other Active Players

|

Wireless Audio Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 109.6 Billion |

|

Forecast Period 2024-32 CAGR: |

15.2% |

Market Size in 2032: |

USD 391.5 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wireless Audio Devices Market by By Product (2018-2032)

4.1 Wireless Audio Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Earphone

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Headphone

4.5 True Wireless Hearables/Earbuds

4.6 Speaker Systems

4.7 Soundbars

4.8 Headsets

4.9 Microphones

Chapter 5: Wireless Audio Devices Market by By Technology (2018-2032)

5.1 Wireless Audio Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bluetooth

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Wi-Fi

5.5 Bluetooth + Wi-Fi

5.6 Airplay

5.7 Others

Chapter 6: Wireless Audio Devices Market by By Application (2018-2032)

6.1 Wireless Audio Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential/Individual

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Automotive

6.6 Government

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Wireless Audio Devices Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 APPLE INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOSE CORPORATION (USA)

7.4 CREATIVE TECHNOLOGY LTD. (SINGAPORE)

7.5 GOOGLE LLC (USA)

7.6 HARMAN INTERNATIONAL INDUSTRIES (USA)

7.7 JABRA (DENMARK)

7.8 JBL (USA)

7.9 LOGITECH INTERNATIONAL S.A. (SWITZERLAND)

7.10 PANASONIC CORPORATION (JAPAN)

7.11 PLANTRONICS INC. (USA)

7.12 SAMSUNG ELECTRONICS CO. LTD. (SOUTH KOREA)

7.13 SENNHEISER ELECTRONIC GMBH & CO. KG (GERMANY)

7.14 SONY CORPORATION (JAPAN)

7.15 V-MODA (USA)

7.16 YAMAHA CORPORATION (JAPAN)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Wireless Audio Devices Market By Region

8.1 Overview

8.2. North America Wireless Audio Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product

8.2.4.1 Earphone

8.2.4.2 Headphone

8.2.4.3 True Wireless Hearables/Earbuds

8.2.4.4 Speaker Systems

8.2.4.5 Soundbars

8.2.4.6 Headsets

8.2.4.7 Microphones

8.2.5 Historic and Forecasted Market Size By By Technology

8.2.5.1 Bluetooth

8.2.5.2 Wi-Fi

8.2.5.3 Bluetooth + Wi-Fi

8.2.5.4 Airplay

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Residential/Individual

8.2.6.2 Commercial

8.2.6.3 Automotive

8.2.6.4 Government

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Wireless Audio Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product

8.3.4.1 Earphone

8.3.4.2 Headphone

8.3.4.3 True Wireless Hearables/Earbuds

8.3.4.4 Speaker Systems

8.3.4.5 Soundbars

8.3.4.6 Headsets

8.3.4.7 Microphones

8.3.5 Historic and Forecasted Market Size By By Technology

8.3.5.1 Bluetooth

8.3.5.2 Wi-Fi

8.3.5.3 Bluetooth + Wi-Fi

8.3.5.4 Airplay

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Residential/Individual

8.3.6.2 Commercial

8.3.6.3 Automotive

8.3.6.4 Government

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Wireless Audio Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product

8.4.4.1 Earphone

8.4.4.2 Headphone

8.4.4.3 True Wireless Hearables/Earbuds

8.4.4.4 Speaker Systems

8.4.4.5 Soundbars

8.4.4.6 Headsets

8.4.4.7 Microphones

8.4.5 Historic and Forecasted Market Size By By Technology

8.4.5.1 Bluetooth

8.4.5.2 Wi-Fi

8.4.5.3 Bluetooth + Wi-Fi

8.4.5.4 Airplay

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Residential/Individual

8.4.6.2 Commercial

8.4.6.3 Automotive

8.4.6.4 Government

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Wireless Audio Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product

8.5.4.1 Earphone

8.5.4.2 Headphone

8.5.4.3 True Wireless Hearables/Earbuds

8.5.4.4 Speaker Systems

8.5.4.5 Soundbars

8.5.4.6 Headsets

8.5.4.7 Microphones

8.5.5 Historic and Forecasted Market Size By By Technology

8.5.5.1 Bluetooth

8.5.5.2 Wi-Fi

8.5.5.3 Bluetooth + Wi-Fi

8.5.5.4 Airplay

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Residential/Individual

8.5.6.2 Commercial

8.5.6.3 Automotive

8.5.6.4 Government

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Wireless Audio Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product

8.6.4.1 Earphone

8.6.4.2 Headphone

8.6.4.3 True Wireless Hearables/Earbuds

8.6.4.4 Speaker Systems

8.6.4.5 Soundbars

8.6.4.6 Headsets

8.6.4.7 Microphones

8.6.5 Historic and Forecasted Market Size By By Technology

8.6.5.1 Bluetooth

8.6.5.2 Wi-Fi

8.6.5.3 Bluetooth + Wi-Fi

8.6.5.4 Airplay

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Residential/Individual

8.6.6.2 Commercial

8.6.6.3 Automotive

8.6.6.4 Government

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Wireless Audio Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product

8.7.4.1 Earphone

8.7.4.2 Headphone

8.7.4.3 True Wireless Hearables/Earbuds

8.7.4.4 Speaker Systems

8.7.4.5 Soundbars

8.7.4.6 Headsets

8.7.4.7 Microphones

8.7.5 Historic and Forecasted Market Size By By Technology

8.7.5.1 Bluetooth

8.7.5.2 Wi-Fi

8.7.5.3 Bluetooth + Wi-Fi

8.7.5.4 Airplay

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Residential/Individual

8.7.6.2 Commercial

8.7.6.3 Automotive

8.7.6.4 Government

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Wireless Audio Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 109.6 Billion |

|

Forecast Period 2024-32 CAGR: |

15.2% |

Market Size in 2032: |

USD 391.5 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Wireless Audio Devices Market research report is 2024-2032.

Apple Inc. (USA), Bose Corporation (USA), Creative Technology Ltd. (Singapore), Google LLC (USA), Harman International Industries (USA), Jabra (Denmark), JBL (USA), Logitech International S.A. (Switzerland), Panasonic Corporation (Japan), Plantronics, Inc. (USA), Samsung Electronics Co., Ltd. (South Korea), Sennheiser Electronic GmbH & Co. KG (Germany), Sony Corporation (Japan), V-Moda (USA), Yamaha Corporation (Japan), and Other Active Players.

The Wireless Audio Devices Market is segmented into Product, Technology, Application and region. By Product, the market is categorized into Earphone, Headphone, True Wireless Hearables/Earbuds, Speaker Systems, Soundbars, Headsets, Microphones. By Technology, the market is categorized into Bluetooth, Wi-Fi, Bluetooth + Wi-Fi, Airplay, Others. By Application, the market is categorized into Residential/Individual, Commercial, Automotive, Government, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The market of wireless audio devices includes the devices which transmit audio signals with the help of wireless technologies such as Bluetooth, Wi-Fi, or radiofrequency, rather than a cable. These are earphones, headphones, speakers, sound bars, and microphones that reflect portability, convenience, and better experiences. Wireless communication has continued to expand at a very fast pace, and this pace is expected to increase in future due to the emergence of new wireless applications in personal entertainment, communication, automobiles, and business. These solutions have gained popularity in both smart home systems and the portable entertainment market as a result.

Wireless Audio Devices Market Size Was Valued at USD 109.6 Billion in 2023, and is Projected to Reach USD 391.5 Billion by 2032, Growing at a CAGR of 15.2% From 2024-2032.