Workplace Services Market Synopsis

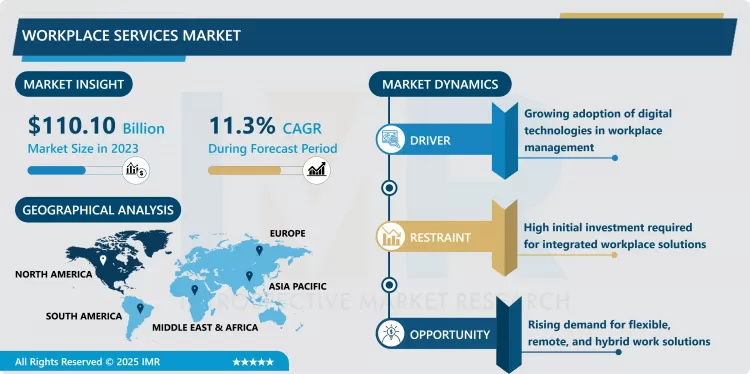

Workplace Services Market Size Was Valued at USD 110.10 Billion in 2023, and is Projected to Reach USD 288.57 Billion by 2032, Growing at a CAGR of 11.3% From 2024-2032.

Workplace services is a broad category of consumables aimed at enhancing the physical, IT, and operational workspace for people. This market comprises of efficiency enhancing solutions and management of workforce including technology solutions and conventional facility management services. They range from managed workplaces services such as cleaning and maintenance, information technology services, security services, facility and office administration and employee wellness programs. Workplace services employed by organizations make it easy to maintain employee satisfaction and productivity as the management of the workplace and corporate technology is handled by service providers. This market is still developing understandably because many companies seek to meet the emerging demands of the employees, technology and business models. Besides, the increase in the popularity of remote work, effective work spaces with no closed office space and changes in relation to the digital transformation of many industries also helped to increase demand for adequate solutions.

The workplace services market is experiencing a solid growth rate due to the increasing number of factors including the digital transformation, cloud computing, and the emergence of the new economic models as the remote and the hybrid workplace. The management of organizations is concerned with ways of increasing the output of its workforce and optimizing organizational performance through service provision that has led to the evolution of workplace services. Such services are useful in minimizing the costs of operation, improving the standards of employees, and supporting environmental conservation. Continued focus on the employee experience has seen more requirements of IT management, desk management, facility management, and security service providers as essentials for offices today. The evolution of AI, machine learning, and IoT devices also go hand in hand with the advancement of the market and helps the business to offer intelligent solutions to look after its work force and machineries in a more efficient manner.

However, the current market in the workplace services segment is rapidly growing competitive with several players all offering complex solutions which encompass different aspects of workplace management. There has also be increasing use of outsourcing services as it aid an organization to concentrate on its major activities while employees take care of other issues in the workplace. Because of the demand for better collaboration, increased work output and improved employee health in the workplace, this market is anticipated to continue its positive growth trend in the years ahead. They do not only help to design productive spaces, but they also address the importance of human capital health, safety, and security to organizations – a factor that is receiving attention in organizations around the world.

Workplace Services Market Trend Analysis:

Shift Toward Integrated Workplace Management Solutions

- Integrated workplace management solutions are some of the trends that contribute to the growth of the workplace services market. IWMS is gaining much importance and is being integrating into the companies to redesign or manage its physical and virtual workplaces for delivering a consistent employee experience. These solutions provide information in real time, the control of various business processes at the workplace, and the effective internal communication between various divisions and employees who work from home. IWMS can be used by businesses to gain maximum efficiency of the available space, minimize overall cost and enhance the productivity of the workplace. Several application integration such as IoT, AI, and data analytics feature is driving the need for dynamic, flexibility, and responsiveness to the workers in IWMS, a factor that is also impacting the market growth.

Expansion of Outsourced Workplace Services

- This is a vast opportunity of for outsourced workplace services because organizations are now outsourcing most of the workplace functions to service providers who have specialized in offering such services. Subcontracting enables organisations to directly manage key change factors while leaving complementary specialism in fields like facility management, IT services, security among others to experts and specialists. It has been observed more often among SMEs due to their limited capacity to coordinate the operations in their workplace. Increasing availability in cost effective and effective methods that are used to obtain outsourcing services together with the need to improve the operation productivity levels are the key factors that are fueling the demand. With the increasing trend of adopting the hybrid work model and remote-work arrangements for employees, several service providers have opened avenues to align themselves with changeful company-associated needs by focusing on flexibly designed and oriented workplace services.

Workplace Services Market Segment Analysis:

Workplace Services Market is Segmented on the basis of Service Type, Organisation Size, Vertical, and Region

By Service Type, End-User Outsourcing Services segment is expected to dominate the market during the forecast period

- The services market is expected to be led by outsourcing services during forecast period. Many of the services in this segment are IT outsourcing, facility management outsourcing, security services outsourcing and employee wellness outsourcing. Since companies aim at achieving operational efficiency and controlling costs, they have shifted towards dealing with outsourcing services of non-strategic processes. Outsourcing is beneficial to the organizations since it means getting the services of third parties to handle various workplace functions while at the same time guaranteeing effective delivery of workplace functions. We expect the outsourcing services segment to have a strong Compound Annual Growth Rate for the same reason, owing to increased reliance by businesses on external services providers for specific activities, particularly in a world that may become more hybrid, and contain remote work forces, in a post COVID-19 world.

- Outsourcing services are especially appealing to organizations as the overall value of service can be increased by achieving higher economies of scale, scopes needed skills or knowledge that may not exist within the organization may be gained and overall costs of providing can often be reduced. As for the main focuses in terms of the delivery of workplace solutions, IT service providers especially expect growing customer interest in cloud services, cybersecurity, and data management. Similarly, outsourcing facility management services has become rampant to guarantee workplace is suitable for physical and virtual employees. With organisations adopting the use of technology in running their operations, there is going to be ever increasing demand for outsourcing services in the workplace services market.

By Organisation Size, Large Enterprises segment expected to held the largest share

- In the workplace services market, it is also segregated on the basis of the size of the organization; large enterprises are expected to dominate this market throughout the coming years. Such organizations may have complicated operational requirements and a significantly big staff, and thus, require intricate workplace services. These organizations need modem IT support system that can handle several aspects of their large operation; they also need adequate security features and proper facility management systems. Moreover, the large enterprises have the financial muscles to procure IWMS and other sophisticated solutions that will improve productivity and effectiveness of business operations.

Workplace Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The analysis of the geographic spread of the workplace services market for the year 2023 depicts North America as the largest consumer. There are factors that are determined to have contributed to dominance in this region; the first one is the high usage of superior workplace technologies, there are also a number of leading service providers in this region, as well as a rising demand for workplace management solutions. Concisely, many big-sized organizations especially from the USA are spending a large amount on IT solutions business space management and corporate wellness programs.

- Also, the growth of the remote and hybrid work models as a result of COVID-19 pandemic has greatly enhanced the growth of the workplace services market in the region. According to the market research, North American market will account to nearly 40-45% in 2023, fueled by the industries including IT, finance, health, and manufacturing sectors’ demand of workplace services. Having experienced the highest growth rates of digitalization and innovative solutions to innovative work organization, North America will remain the leading market for workplace services over the coming years.

Active Key Players in the Workplace Services Market:

- Accenture (Ireland)

- CBRE Group (USA)

- Compass Group (UK)

- Cushman & Wakefield (USA)

- DXC Technology (USA)

- G4S (UK)

- IBM (USA)

- ISS Facility Services (Denmark)

- JLL (USA)

- Kelly Services (USA)

- ManpowerGroup (USA)

- Sodexo (France)

- TCS (India)

- Xerox (USA)

- Zoom Video Communications (USA), and Other Active Players.

|

Global Workplace Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 110.10 Billion |

|

Forecast Period 2024-32 CAGR: |

11.3% |

Market Size in 2032: |

USD 288.57 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Organisation Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Workplace Services Market by By Service Type (2018-2032)

4.1 Workplace Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 End-User Outsourcing Services

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Tech Support Services

Chapter 5: Workplace Services Market by By Organisation Size (2018-2032)

5.1 Workplace Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Large Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Small and Medium-sized Enterprises

Chapter 6: Workplace Services Market by By Vertical (2018-2032)

6.1 Workplace Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Media and Entertainment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 BFSI

6.5 Consumer Goods and Retail

6.6 Manufacturing

6.7 Healthcare and Life Sciences

6.8 Education

6.9 Telecom

6.10 IT

6.11 and ITES

6.12 Energy and Utilities

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Workplace Services Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACCENTURE (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CBRE GROUP (USA)

7.4 COMPASS GROUP (UK)

7.5 CUSHMAN & WAKEFIELD (USA)

7.6 DXC TECHNOLOGY (USA)

7.7 G4S (UK)

7.8 IBM (USA)

7.9 ISS FACILITY SERVICES (DENMARK)

7.10 JLL (USA)

7.11 KELLY SERVICES (USA)

7.12 MANPOWERGROUP (USA)

7.13 SODEXO (FRANCE)

7.14 TCS (INDIA)

7.15 XEROX (USA)

7.16 ZOOM VIDEO COMMUNICATIONS (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Workplace Services Market By Region

8.1 Overview

8.2. North America Workplace Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Service Type

8.2.4.1 End-User Outsourcing Services

8.2.4.2 Tech Support Services

8.2.5 Historic and Forecasted Market Size By By Organisation Size

8.2.5.1 Large Enterprises

8.2.5.2 Small and Medium-sized Enterprises

8.2.6 Historic and Forecasted Market Size By By Vertical

8.2.6.1 Media and Entertainment

8.2.6.2 BFSI

8.2.6.3 Consumer Goods and Retail

8.2.6.4 Manufacturing

8.2.6.5 Healthcare and Life Sciences

8.2.6.6 Education

8.2.6.7 Telecom

8.2.6.8 IT

8.2.6.9 and ITES

8.2.6.10 Energy and Utilities

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Workplace Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Service Type

8.3.4.1 End-User Outsourcing Services

8.3.4.2 Tech Support Services

8.3.5 Historic and Forecasted Market Size By By Organisation Size

8.3.5.1 Large Enterprises

8.3.5.2 Small and Medium-sized Enterprises

8.3.6 Historic and Forecasted Market Size By By Vertical

8.3.6.1 Media and Entertainment

8.3.6.2 BFSI

8.3.6.3 Consumer Goods and Retail

8.3.6.4 Manufacturing

8.3.6.5 Healthcare and Life Sciences

8.3.6.6 Education

8.3.6.7 Telecom

8.3.6.8 IT

8.3.6.9 and ITES

8.3.6.10 Energy and Utilities

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Workplace Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Service Type

8.4.4.1 End-User Outsourcing Services

8.4.4.2 Tech Support Services

8.4.5 Historic and Forecasted Market Size By By Organisation Size

8.4.5.1 Large Enterprises

8.4.5.2 Small and Medium-sized Enterprises

8.4.6 Historic and Forecasted Market Size By By Vertical

8.4.6.1 Media and Entertainment

8.4.6.2 BFSI

8.4.6.3 Consumer Goods and Retail

8.4.6.4 Manufacturing

8.4.6.5 Healthcare and Life Sciences

8.4.6.6 Education

8.4.6.7 Telecom

8.4.6.8 IT

8.4.6.9 and ITES

8.4.6.10 Energy and Utilities

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Workplace Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Service Type

8.5.4.1 End-User Outsourcing Services

8.5.4.2 Tech Support Services

8.5.5 Historic and Forecasted Market Size By By Organisation Size

8.5.5.1 Large Enterprises

8.5.5.2 Small and Medium-sized Enterprises

8.5.6 Historic and Forecasted Market Size By By Vertical

8.5.6.1 Media and Entertainment

8.5.6.2 BFSI

8.5.6.3 Consumer Goods and Retail

8.5.6.4 Manufacturing

8.5.6.5 Healthcare and Life Sciences

8.5.6.6 Education

8.5.6.7 Telecom

8.5.6.8 IT

8.5.6.9 and ITES

8.5.6.10 Energy and Utilities

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Workplace Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Service Type

8.6.4.1 End-User Outsourcing Services

8.6.4.2 Tech Support Services

8.6.5 Historic and Forecasted Market Size By By Organisation Size

8.6.5.1 Large Enterprises

8.6.5.2 Small and Medium-sized Enterprises

8.6.6 Historic and Forecasted Market Size By By Vertical

8.6.6.1 Media and Entertainment

8.6.6.2 BFSI

8.6.6.3 Consumer Goods and Retail

8.6.6.4 Manufacturing

8.6.6.5 Healthcare and Life Sciences

8.6.6.6 Education

8.6.6.7 Telecom

8.6.6.8 IT

8.6.6.9 and ITES

8.6.6.10 Energy and Utilities

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Workplace Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Service Type

8.7.4.1 End-User Outsourcing Services

8.7.4.2 Tech Support Services

8.7.5 Historic and Forecasted Market Size By By Organisation Size

8.7.5.1 Large Enterprises

8.7.5.2 Small and Medium-sized Enterprises

8.7.6 Historic and Forecasted Market Size By By Vertical

8.7.6.1 Media and Entertainment

8.7.6.2 BFSI

8.7.6.3 Consumer Goods and Retail

8.7.6.4 Manufacturing

8.7.6.5 Healthcare and Life Sciences

8.7.6.6 Education

8.7.6.7 Telecom

8.7.6.8 IT

8.7.6.9 and ITES

8.7.6.10 Energy and Utilities

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Workplace Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 110.10 Billion |

|

Forecast Period 2024-32 CAGR: |

11.3% |

Market Size in 2032: |

USD 288.57 Billion |

|

Segments Covered: |

By Service Type |

|

|

|

By Organisation Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Workplace Services Market research report is 2024-2032.

Accenture (Ireland), CBRE Group (USA), Compass Group (UK), Cushman & Wakefield (USA), DXC Technology (USA), G4S (UK), IBM (USA), ISS Facility Services (Denmark), JLL (USA), Kelly Services (USA), ManpowerGroup (USA), Sodexo (France), TCS (India), Xerox (USA), Zoom Video Communications (USA), and Other Active Players.

The Workplace Services Market is segmented into Service Type, Organization Size, Vertical and region. By Service Type, the market is categorized into End-User Outsourcing Services, Tech Support Services. By Organization Size, the market is categorized into Large Enterprises, Small and Medium-sized Enterprises. By Vertical, the market is categorized into Media and Entertainment, BFSI, Consumer Goods and Retail, Manufacturing, Healthcare and Life Sciences, Education, Telecom, IT, and ITES, Energy and Utilities. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Workplace services is a broad category of consumables aimed at enhancing the physical, IT, and operational workspace for people. This market comprises of efficiency enhancing solutions and management of workforce including technology solutions and conventional facility management services. They range from managed workplaces services such as cleaning and maintenance, information technology services, security services, facility and office administration and employee wellness programs. Workplace services employed by organizations make it easy to maintain employee satisfaction and productivity as the management of the workplace and corporate technology is handled by service providers. This market is still developing understandably because many companies seek to meet the emerging demands of the employees, technology and business models. Besides, the increase in the popularity of remote work, effective work spaces with no closed office space and changes in relation to the digital transformation of many industries also helped to increase demand for adequate solutions.

Workplace Services Market Size Was Valued at USD 110.10 Billion in 2023, and is Projected to Reach USD 288.57 Billion by 2032, Growing at a CAGR of 11.3% From 2024-2032.